|

市場調查報告書

商品編碼

1273394

醫用插管市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Medical Cannula Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,醫用插管市場預計將以 6.5% 的複合年增長率增長。

在大流行開始時,醫療保健系統因手術取消、預約延遲和漫長的等待時間而受到重創。 手術數量的下降和手術數量的下降對醫用插管市場的增長速度產生了重大影響。 例如,2021 年 12 月發表在 PubMed 上的一項研究發現,與大流行後同期相比,美國首次停工期間手術和其他擇期手術的數量減少了 48%。對醫用插管的需求。 然而,隨著大流行後期慢性病患者入院人數的增加,所研究的市場預計會增長。

例如,根據 AIHW 擇期手術活動報告,2020-21 年新增的擇期手術患者人數 (893,200) 比上一年增長了 6.6%。 因此,預計手術數量的增加將產生對手術期間使用的醫用插管的需求,從而促進市場增長。

此外,隨著技術的進步和研究表明醫用插管在各種環境中都有用,市場預計會增長。 例如,2022 年 10 月在 ScienceDirect 上發表的一篇論文顯示了使用 Berlin Heart EXCOR 靜脈插管對兒科患者進行終末期心力衰竭的植入和支持。 因此,此類調查和案例介紹有望增加對醫用插管的需求,並有助於市場的增長。

此外,微插管常用於整形和整容手術,因為它們更容易在整容手術中去除更多脂肪。 隨著世界各地的人們開始對自己的外表感興趣,對整容和整形手術的需求也隨之增加。 例如,根據 2022 年 1 月發布的一份 ISAPS 報告,2020 年全球進行的前五名整容手術分別是隆胸手術(1,624,281 次)、吸脂手術(1,525,197 次)、雙眼皮手術(1,225,540 次)、隆鼻手術(852,554 次)、腹肌手術(765,248)。 隨著美容領域的外科手術越來越多,可以預料,美容插管會越來越受歡迎。

由於外科手術的增加以及證明醫用插管優勢的大量研究,預計未來幾年市場將以健康的速度增長。 然而,由於插管的不當穩定而導致的神經損傷和其他並發症的風險預計會阻礙市場需求。

醫用插管市場趨勢

鼻插管細分市場預計在預測期內實現顯著增長

鼻插管是一種通過輸送氧氣或改善通過鼻子的氣流來幫助需要呼吸幫助的人的設備。 該裝置由一根一端有兩個尖頭的輕質管組成,可以插入鼻孔,讓空氣和氧氣的混合物流動。 鼻插管使用時間可短可長,適合各年齡段人群使用。 這使您可以通過嘴巴或鼻子呼吸。 需要鼻塞的人數正在增加,因為越來越多的人患有呼吸系統疾病並因受傷和心臟問題而去醫院。 例如,根據美國哮喘和過敏基金會 (AAFA) 的數據,截至 2022 年 4 月,大約三分之一的美國人將患有哮喘病,即約 2500 萬人。 據同一消息來源稱,約有 500 萬美國兒童患有哮喘病。

此外,根據 PubMed 2021 年 12 月的一篇論文,通過鼻插管 (HFNC) 輸送的高流量氧療通過充分潤濕氣道來幫助呼吸,並且在臨床環境中安全且有用。 因此,在呼吸支持中越來越多地使用鼻插管有助於增加對高流量鼻插管的需求,從而導致預測期內的市場增長。 同樣,根據 2022 年 12 月發表在 BMC 期刊上的一篇論文,使用高流量鼻插管 (HFNC) 作為一線通氣支持可降低重症 COVID-19 患者插管的發生率。超過一半的患者經歷HFNC 故障。

因此,隨著越來越多的人使用鼻插管來幫助呼吸,以及越來越多的人患有呼吸系統疾病,研究部門有望在未來幾年以健康的方式發展。

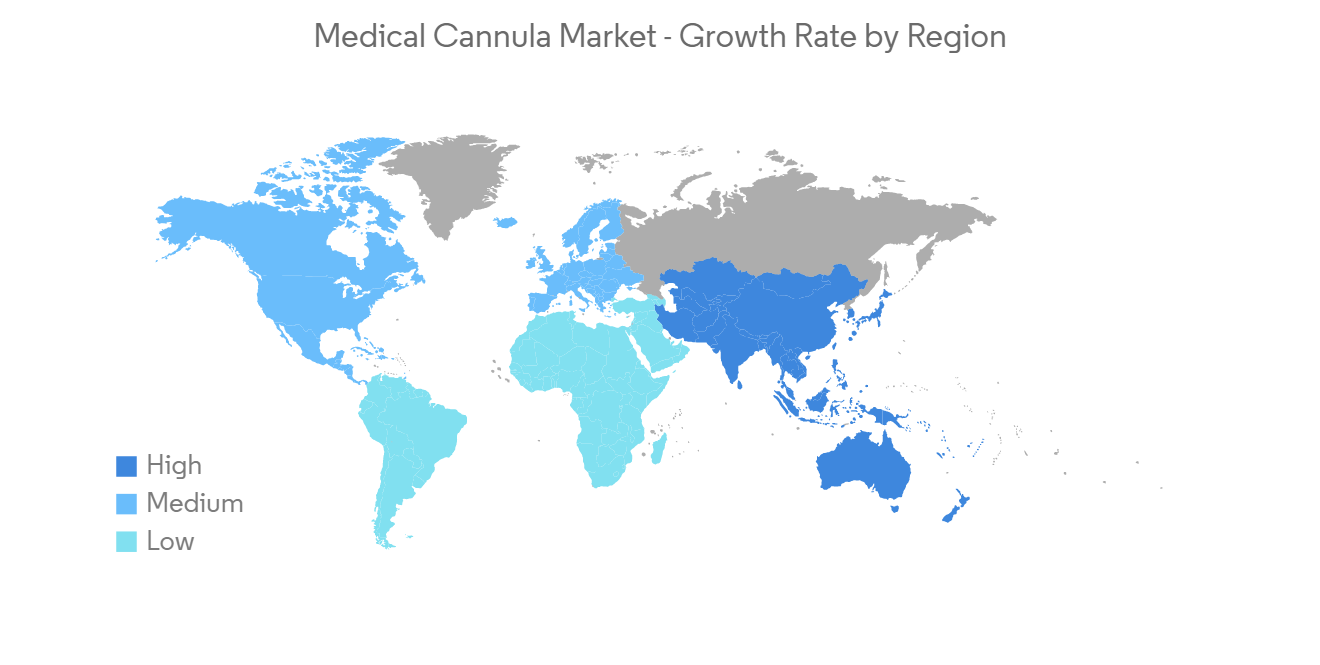

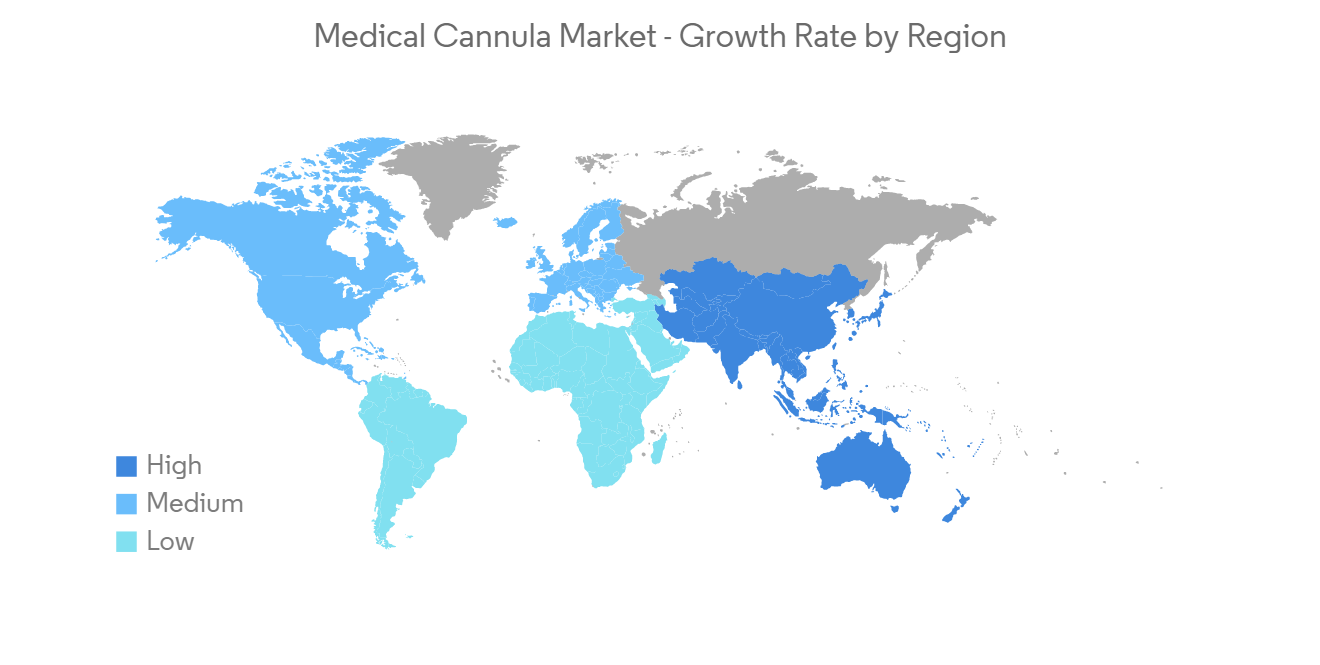

預計在預測期內北美將佔據很大的市場份額

北美是市場的主要貢獻者之一,原因是手術和微創手術的增加、傷害事件的增加、減肥手術的增加以及住院人數的增加。 例如,根據美國勞工統計局的數據,2021 年美國私營行業將發生 260.79 萬起非致命傷害事故。 出於這個原因,更多的傷害可能需要手術,從而增加了對插管的需求。

使用關節鏡插管還可以減少滲出到軟組織中的液體量。 因此,它在骨科手術中使用。 因此,該地區國家的骨科手術數量正在增加,預計這將在分析期間推動市場增長。 例如,根據加拿大健康信息研究所(CIHI)2021 年 6 月發布的一份報告,2019 年至 2020 年間,加拿大完成了 63,496 例髖關節置換術和 75,073 例膝關節置換術。 此外,如上述消息來源所述,該國近年來膝關節和髖關節置換術的平均增長率約為 5%。 因此,預計手術病例的增加將刺激醫用插管的採用,這有望在預測期內推動市場增長。

隨著越來越多的插管被用於治療損傷和進行的手術越來越多,預計北美在未來幾年內將以健康的速度增長。

醫用插管行業概況

醫用插管市場競爭適中,有許多市場參與者積極參與研發。 全球和區域市場參與者正專注於併購和產品發布,以增加他們的市場佔有率。 市場上的主要參與者包括波士頓科學公司、康美德公司、美敦力、施樂輝、百合醫療等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 手術數量增加,微創手術增加

- 患者數量不斷增加,技術進步不斷加快

- 市場製約因素

- 因插管固定不當而導致神經損傷和其他並發症的風險

- 波特的五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 按產品分類

- 心

- 血管

- 關節鏡

- 用於鼻腔

- 其他產品

- 按類型

- 新生兒

- 直型

- 翼型

- 其他類型

- 通過使用

- 心血管

- 氧療

- 骨科

- 神經學

- 其他用途

- 按材料

- 矽膠

- 塑料

- 金屬

- 最終用戶

- 醫院

- 門診手術中心

- 其他最終用戶

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章競爭格局

- 公司簡介

- Medtronic

- LivaNova PLC

- Edwards Lifesciences Corporation

- ICU Medical, Inc(Smiths Medical)

- Becton, Dickinson and Company

- Terumo Corporation

- Teleflex Incorporated

- CONMED Corporation

- Smith+Nephew

- Boston Scientific Corporation

- Gilde Healthcare(Jecture)

- Baihe Medical

第7章 市場機會與將來動向

During the time frame of the forecast, the medical cannula market is expected to grow at a CAGR of 6.5%.

At the start of the pandemic, the health care system was severely affected by things like surgeries being canceled, appointments being late, and long wait times.The surgeries were put off, and the number of surgeries went down, which had a big effect on how fast the medical cannula market grew.For example, a study published in December 2021 in PubMed found that the number of surgeries and other elective procedures in the US dropped by 48% during the first shutdown compared to the same time period after the pandemic.This decline in surgical procedures notably impacted the demand for medical cannulas. However, as hospital admissions of chronic disease patients increased in the later stages of the pandemic, the market studied is likely to grow.

The main things that drive the studied market are things like the growing number of patients, the growing number of surgeries and minimally invasive procedures, and the growing number of technological advances.For instance, as per the AIHW Elective Surgery Activity Report, the number of patients for elective surgeries added in 2020-21 (893,200) was a 6.6% increase from the previous year. Hence, an increase in the number of surgeries is likely to create a demand for medical cannulas used during surgeries, thereby contributing to market growth.

Also, the market is likely to grow because of improvements in technology and research studies that show how the medical cannula can be useful in different situations. For instance, as per the article published in October 2022 in ScienceDirect, the study showed the implantation and support for terminal heart failure in pediatric patients using the Berlin Heart EXCOR Venous Cannula. Because of this, these kinds of research studies and case presentations are likely to increase the demand for medical cannulas and help the market grow.

Also, microcannulas make it easier to remove more fat during cosmetic surgeries, so they are used a lot in plastic surgery and cosmetic surgery.As the target population around the world became more interested in how they looked, so did the demand for cosmetic and plastic surgery.For example, the ISAPS report, which came out in January 2022, said that breast augmentation (1,624,281), liposuction (1,525,197), eyelid surgery (1,225,540), rhinoplasty (852,554), and abdominoplasty (765,248) were the top 5 cosmetic surgeries done around the world in 2020.Cannulas used in aesthetic procedures are likely to become more popular because there are so many surgeries in the field of aesthetics.

Due to the rise in surgical procedures and the number of studies showing the benefits of medical cannulas, the market is expected to grow at a healthy rate over the next few years. However, the risk of injury to the nerves and other complications due to improper stabilization of the cannula is predicted to hinder market demand.

Medical Cannula Market Trends

Nasal Cannula Segment is Expected to Witness a Significant Growth in the Market Over the Forecast Period

A nasal cannula is a device that helps people who need help breathing by giving them extra oxygen or more airflow through their nose. This device is made up of a lightweight tube that splits at one end into two prongs that are put in the nostrils and through which a mixture of air and oxygen flows. The nasal cannula can be used for short or long periods of time and is available for people of all ages. It lets you breathe through your mouth or nose. The number of people who need nasal cannulas is going up because more people are getting respiratory diseases and going to the hospital because of injuries or heart problems. For instance, according to the Asthma and Allergy Foundation of America (AAFA), in April 2022, roughly 1 in 13 Americans had asthma, which is about 25 million people. As per the same source, about 5 million American children have asthma.

Also, the December 2021 article in PubMed said that high-flow oxygen therapy given through a nasal cannula (HFNC) helps with breathing by keeping the airways moist enough and has been shown to be safe and helpful in clinical practice. Thus, the growing utilization of nasal cannulas in respiratory support is contributing to the increasing demand for high-flow nasal cannulas, leading to market growth over the forecast period. Similarly, as per the article published in December 2022 in the BMC journal, while using a high-flow nasal cannula (HFNC) as first-line ventilatory support was associated with a decreased incidence of intubation in critically ill COVID-19 patients, more than half of patients had HFNC failure.

Thus, because more people are using nasal cannulas to help with breathing and more people are getting respiratory diseases, the studied segment is expected to grow in a healthy way over the next few years.

North America Anticipated to Hold a Significant Share in the Market Over the Forecast Period

North America is one of the significant contributors to the studied market owing to the rise in surgeries and minimally invasive procedures, growing cases of injuries, increasing bariatric surgeries, and increasing hospital admissions in the region. For example, the US Bureau of Labor Statistics says that in 2021, there were 2,607,900 injuries that did not lead to death in private industries in the US.Because of this, more injuries are likely to need surgery, which will increase the need for cannulas.

Moreover, the amount of fluid extravasation into soft tissues is reduced with arthroscopic cannulas. Thus, these cannulas are used during orthopedic surgeries. Hence, the increasing number of orthopedic surgical procedures in the countries of the region is projected to drive market growth over the analysis period. For instance, as per the report of the Canadian Institute of Health Information (CIHI) published in June 2021, 63,496 hip replacements and 75,073 knee replacements were performed in Canada in the period 2019-2020. Also, as per the source above, there has been an average increase of about 5% in recent years in knee and hip replacement procedures in the country. Thus, a rise in surgery cases is likely to spur adoption of medical cannulas, which will thereby drive market growth over the forecast period.

Since more cannulas are being used to treat injuries and more surgeries are being done, North America is expected to grow at a healthy rate over the next few years.

Medical Cannula Industry Overview

The market for medical cannulas is moderately competitive, and there are a number of market players who are actively working on research and development. The market players globally and regionally are focused on mergers, acquisitions, and product launches to enhance their market presence. Some of the major players in the market are Boston Scientific Corporation, CONMED Corporation, Medtronic, Smith & Nephew, and Baihe Medical, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Number of Surgeries and Minimally Invasive Procedures

- 4.2.2 Rising Patient Pool and Increasing Technological Advancements

- 4.3 Market Restraints

- 4.3.1 Risk of Injury to Nerve and Other Complications Due to Improper Stabilization of Cannula

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Product

- 5.1.1 Cardiac

- 5.1.2 Vascular

- 5.1.3 Arthroscopy

- 5.1.4 Nasal

- 5.1.5 Other Products

- 5.2 By Type

- 5.2.1 Neonatal

- 5.2.2 Straight

- 5.2.3 Winged

- 5.2.4 Other Types

- 5.3 By Application

- 5.3.1 Cardiovascular

- 5.3.2 Oxygen Therapy

- 5.3.3 Orthopaedic

- 5.3.4 Neurology

- 5.3.5 Other Applications

- 5.4 By Material

- 5.4.1 Silicone

- 5.4.2 Plastic

- 5.4.3 Metal

- 5.5 By End-User

- 5.5.1 Hospital

- 5.5.2 Ambulatory Surgical Centers

- 5.5.3 Other End-Users

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United states

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Medtronic

- 6.1.2 LivaNova PLC

- 6.1.3 Edwards Lifesciences Corporation

- 6.1.4 ICU Medical, Inc (Smiths Medical)

- 6.1.5 Becton, Dickinson and Company

- 6.1.6 Terumo Corporation

- 6.1.7 Teleflex Incorporated

- 6.1.8 CONMED Corporation

- 6.1.9 Smith + Nephew

- 6.1.10 Boston Scientific Corporation

- 6.1.11 Gilde Healthcare (Jecture)

- 6.1.12 Baihe Medical