|

市場調查報告書

商品編碼

1433886

工業電腦斷層掃描 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Industrial Computed Tomography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

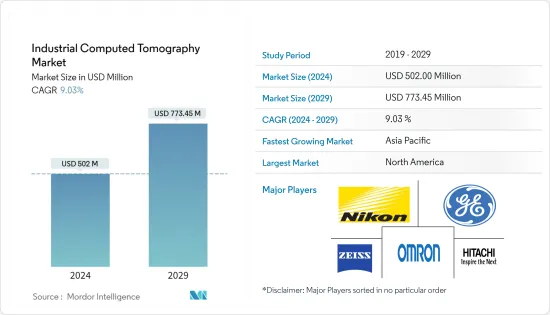

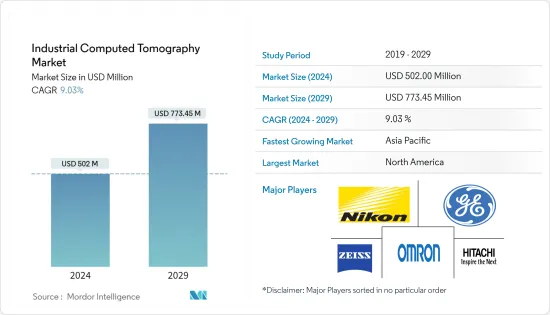

工業電腦斷層掃描市場規模預計到2024年為 5.02 億美元,到2029年將達到 7.7345 億美元,在預測期內(2024-2029年)CAGR為 9.03%。

大流行病毒透過自動偵測和監控系統取代了生產線的員工,限制了他們的工作。這增加了工業領域對電腦斷層掃描的需求。例如,韓國政府提供高達200 億韓元(1,680 萬美元)的資助為搬遷至首都以外地區的企業支付搬遷和設施費用,並為搬遷至首爾首都地區的科技企業支付高達 150 億韓元的費用。 預計這將增加對工業測試、檢測和監控系統的需求,擴大電腦斷層掃描的市場。

主要亮點

- 人們越來越有興趣將 CT 掃描技術應用於食品生產設施中進行異物檢測。主要促進因素包括零售商要求更高的品質檢驗制度,而僅靠金屬檢測技術無法提供這種制度,以及提高產品品質、開拓新客戶群或透過提供高品質產品來維持現有客戶利潤的願望。

- 航空航太與國防(A&D)產業預計將實現全球強勁成長,其中亞太地區處於領先地位,交付量達 16,930 架,約佔需求的 40%。這使得 A&D 服務市場達到 33.65 億美元(資料來源:Cyient,2019年)。新興地區對商用飛機的需求不斷成長(過去兩年空中巴士等主要供應商的交付訂單增加就證明了這一點)預計將為航空航太業帶來新的機會。

- 此外,Collins Aerospace Systems於2019年 6月在新加坡進行了戰略投資,開發了積層製造和 MRO 流程的航空航太創新中心。此類投資為航空航太和國防領域的工業 CT 帶來了市場機會。

- 因此,隨著航空航太和國防工業的不斷發展,用於無損檢測的工業X光(DR)和電腦斷層掃描(CT)系統可以滿足最關鍵的航空航太/國防標準,並確保對飛機零件和設備進行安全可靠的檢查。材料,在檢查過程中為操作員提供支持,並促進原型的生產以及抽查樣品檢查,為該領域工業 CT 市場的成長鋪平道路。

工業電腦斷層掃描市場趨勢

航太將推動工業電腦斷層掃描市場

- 航太產業整合了一些對品質最關鍵的產品,從小型電子感測器到整個複合材料直升機旋翼槳葉,大多數公司都擁有專為提高效率和可重複性而設計的X 光和CT 系統,以確保設備每次都能安全、正確地運作。

- 飛機製造商選擇可用於一次性檢查渦輪機和活塞引擎等大型零件的 CT 設備,以節省時間和金錢。這些高溫合金成分的密度和一致性可以透過工業CT設備進行測試和檢查。這些企業或行業的這些機器的高銷售量可以推動市場成長。

- Trending 介紹了用於航空航太領域尺寸計量的 X光電腦斷層掃描,用於對工業零件進行尺寸測量,具有多種優勢並可執行任何其他測量技術通常無法完成的無損測量任務。

- 例如,以高資訊密度檢查複雜和高價值的積層製造產品,而無需切割或破壞組件。在飛機製造過程中,各種材料和設計概念都要經過 CT 測試程序。此外,由於 CT 可以定量測量材料密度和尺寸,因此可以建立正確的零件模型。透過定量地了解零件在零件座標系中的特徵,可以判斷是否適合使用。

歐洲將佔據主要市場佔有率

- 由於多個政府嚴格的安全法規和工業設備的預防性維護,汽車和航空航太產業不斷成長的需求鼓勵了歐洲工業CT市場的發展。英國、德國、法國和俄羅斯被認為是歐洲工業CT市場最重要的市場之一。英國是歐洲主要的航空航太業,其航空航太收入幾乎佔全球的17%,僅次於美國。

- 英國航空航太和國防工業規模龐大,擁有世界著名國防承包商之一的BAE Systems、McLaren、Rolls Royce等公司。政府對健康和環境的擔憂導致實施和實施執行目的是提高該部門在管理輻射防護方面的績效的舉措,導致政府制定了嚴格的法規。德國在離岸風電計畫上投入了大量資金。工業4.0起源於德國,投資數位化的企業需要高水準的測試實驗室。

- 法國政府在2019年國防預算中撥出7.58億歐元用於研發研究,42億歐元用於服務支持,主要用於飛機維修。該計畫的成長帶動了該地區對 CT 系統的需求。

- 航空航太和汽車產業對具有詳細 3D 視圖的大體積掃描需求預計將推動該領域電腦斷層掃描的銷售。法國是核電的巨大投資者,也是核能的全球領導者。該國擁有許多全球能源產業巨頭,例如GDF Suez、EDF和Areva。不過,減少對非再生能源依賴的努力可能會改變未來幾年的市場動態。

工業電腦斷層掃描產業概述

工業電腦斷層掃描市場競爭相當激烈,由多家參與者組成。就市場佔有率而言,目前很少有主要參與者佔據市場領先地位。這些在市場上佔有相當佔有率的主要參與者的目標是擴大其在其他國家的客戶群。這些公司利用策略合作計劃來擴大市場佔有率並提高獲利能力。隨著行業績效的日益重要和競爭水準的不斷提高,市場有望在預測期內實現強勁成長。

- 2020年 12月 - 蔡司宣布吸收義大利工業 X光系統解決方案供應商 BOSELLO HIGH TECHNOLOGY(BOSELLO),並以 Carl Zeiss X-ray Technologies Srl 的名義運作。憑藉 BOSELLO 的客戶客製化解決方案,蔡司朝著成為工業和研究無損測量和測試技術整合解決方案提供者的目標邁出了重要一步。

- 2020年 12月 - 尼康推出了一款新的監控套件,該套件將根據全球公認的標準 ASTM E2737 提供功能性和簡單性。 ASTM E2737 偵測器評估套件適用於該公司的整個 X 光 CT 偵測、計量和大型 CT 系統。除了全系列領先業界的探測器之外,還支援製造商的所有 X光源,包括旋轉靶技術和 450kV 微焦點源。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素與限制簡介

- 市場促進因素

- 解析度和影像處理方面的技術改進

- 對攜帶式放射成像設備的需求不斷增加

- 市場限制

- 工業 CT 系統的購買和維護成本高昂

- 產業吸引力 - 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- COVID-19 工業電腦斷層掃描市場影響的評估

第5章 市場細分

- 應用

- 缺陷檢測與檢驗

- 故障分析

- 裝配分析

- 其他應用

- 最終用戶產業

- 航太

- 汽車

- 電子產品

- 石油和天然氣

- 其他最終用戶產業

- 地理

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Waygate Technologies

- Nikon Corporation

- Omron Corporation

- Zeiss International

- Hitachi Ltd.

- Bruker Corporation

- Thermo Fisher Scientific Inc.

- Shimadzu Corporation

- Comet Group Limited

- 3DX-Ray Limited

第7章 投資分析

第8章 未來的市場機會

The Industrial Computed Tomography Market size is estimated at USD 502 million in 2024, and is expected to reach USD 773.45 million by 2029, growing at a CAGR of 9.03% during the forecast period (2024-2029).

The pandemic virus has limited employees working on the production lines by replacing them with automated detection and monitoring systems. This has been increasing the demand for the computed tomography in the industrial sector. For instance, the South Korean government is offering an impetus up to KRW 20 billion (USD 16.8 million) to cover relocation and facility costs for firms relocating to regions outside the capital and up to KRW 15 billion to tech firms relocating to the capital region of Seoul. This is expected to boost the demand for industrial testing, detection, and monitoring systems, thereby augmenting the market for the computed tomography.

Key Highlights

- There is an increasing interest in applying CT scanning technology into food production facilities for foreign body detection. The primary drivers include retailers demanding higher quality inspection regimes that cannot be provided by metal detection technology alone and a desire for improved product quality, opening up new customer bases, or maintaining margins with existing customers by delivering high-quality products.

- The aerospace and defense (A&D) industry is positioned for strong global growth, with Asia-Pacific leading the way, with around 40% of the demand accounting for 16,930 deliveries. This makes for an A&D service market of USD 3.365 billion (source: Cyient, 2019). The growing demand for commercial jets from emerging regions (as witnessed in the increase in the delivery orders by key vendors such as Airbus over the last two years) is expected to open up new opportunities in the aerospace industry.

- Also, Collins Aerospace Systems, in June 2019, made a strategic investment in Singapore by developing an aerospace innovation hub for additive manufacturing and MRO processes. Such investments prompt the market opportunity for industrial CT in the aerospace and defense sector.

- Consequently, with the intensification of growth of the A&D industry, industrial X-ray (DR) and computed tomography (CT) systems for non-destructive testing can meet the most critical aerospace/defense standards and ensure safe and reliable inspection of aircraft parts and materials, thereby supporting the operator at the inspection process, and also boosting the production of prototypes, as well as for spot-check sample inspection, paving the way for the growth of industrial CT market in the domain.

Industrial Computed Tomography Market Trends

Aerospace Industry to Drive the Industrial Computed Tomography Market

- The Aerospace industry integrates some of the most quality critical products ranging from a small electronic sensor or an entire composite helicopter rotor blade, most of the companies have X-ray and CT Systems designed for efficiency and repeatability to ensure equipment functions safely and correctly each time.

- Aircraft manufacturers opt for CT equipment that can be used for the inspection of large components such as turbines and piston engines in a single run in order to save time and money. The density and consistency of these superalloys components can be tested and inspected by means of industrial CT equipment. The high sales volume of these machines from such businesses or industries can drive market growth.

- Trending is an introduction to x-ray computed tomography for dimensional metrology in aerospace for performing dimensional measurements on industrial parts, providing several advantages and performing non-destructive measurement tasks that are often impossible with any other measurement technologies.

- For instance, the inspection of complex and high-value additive manufacturing products with a high density of information and without any need to cut or destroy the components. During the manufacturing of an aircraft, various materials and design concepts undergo the testing procedure through CT. Also, because CT allows for quantitative measures of material density and dimensions, it is possible to build a correct model of the part. By knowing quantitatively the features of a component in the part coordinate system, its suitability for service can be judged.

Europe to Hold a Major Market Share

- The development of the industrial CT market in Europe is encouraged by the intensifying demand from the automotive and aerospace industry, because of the strict safety regulations by several governments and preventive maintenance of industrial equipment. The United Kingdom, Germany, France, and Russia have been identified as one of the foremost markets for Industrial CT market in Europe. The United Kingdom is the chief aerospace industry in Europe, with almost 17% of the worldwide revenues in aerospace, second only to the United States.

- The British aerospace and defense industry is vast, with the presence of firms, like BAE Systems, which is one of the world's prominent defense contractors, and McLaren, Rolls Royce, etc. Health and environmental worries by the government is leading to the implementation and execution of initiatives meant at improving the sector's performance at managing radiation protection, leading to stern regulations set by the government. Germany is spending substantially on offshore wind power projects. Industry 4.0 has its roots in Germany, and the businesses investing in digitalization will need a high level of testing labs.

- The French government set EUR 758 million for R&D studies from the defense budget 2019, and EUR 4.2 billion is allocated for service support, majorly dedicated to aircraft maintenance. This project's growth in the region's demand for CT systems.

- Big volume scan requirements in the aerospace and automotive industry with a detailed 3D view are anticipated to drive the sale of computed tomography in the area. France is a massive investor in nuclear power and the global leader in nuclear energy. The country houses numerous global giants in the energy business, such as GDF Suez, EDF, and Areva. Though, attempts are made to decrease dependence on non-renewable sources of energy might amend the dynamics of the market in the future years.

Industrial Computed Tomography Industry Overview

The industrial computed tomography market is reasonably competitive and consists of several players. In terms of market share, few of the key players presently lead the market. These chief players with a substantial share in the market are aiming to expand their customer base across other countries. These companies are leveraging on strategic collaborative initiatives to augment their market share and increase their profitability. With the increasing importance on performance and rising levels of competition in the industry, the market is poised to witness strong growth over and beyond the forecast period.

- December 2020 - ZEISS announced the absorption of BOSELLO HIGH TECHNOLOGY (BOSELLO), an Italian supplier of solutions for industrial X-ray systems to operate under the name of Carl Zeiss X-ray Technologies Srl. With BOSELLO's customer-specific solutions, ZEISS took a significant step towards its goal of becoming an integrated solution provider in non-destructive measurement and testing technology for industry and research.

- December 2020 - Nikon launched a new monitoring kit that will provide functionality and simplicity in accordance with the globally accepted standard, ASTM E2737. The ASTM E2737 Detector Evaluation Package was made available to suit the entire range of the company's X-ray CT inspection, metrology, and large CT systems. All of the manufacturer's X-ray sources are also supported including the rotating target technology and the 450kV microfocus source, in addition to a full range of industry-leading detectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Technology Improvements in Resolution and Image Processing

- 4.3.2 Intensifying Demand for Portable Radiography Equipment

- 4.4 Market Restraints

- 4.4.1 High Acquisition and Maintenace Cost of Industrial CT systems

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the COVID-19 Impact on the Industrial Computed Tomography Market

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Flaw Detection and Inspection

- 5.1.2 Failure Analysis

- 5.1.3 Assembly Analysis

- 5.1.4 Other Applications

- 5.2 End User Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Electronics

- 5.2.4 Oil and Gas

- 5.2.5 Other End User Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Waygate Technologies

- 6.1.2 Nikon Corporation

- 6.1.3 Omron Corporation

- 6.1.4 Zeiss International

- 6.1.5 Hitachi Ltd.

- 6.1.6 Bruker Corporation

- 6.1.7 Thermo Fisher Scientific Inc.

- 6.1.8 Shimadzu Corporation

- 6.1.9 Comet Group Limited

- 6.1.10 3DX-Ray Limited