|

市場調查報告書

商品編碼

1332537

移動數據保護市場規模和份額分析 - 增長趨勢和預測(2023-2028)Mobile Data Protection Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

移動數據保護市場規模預計將從2023年的81.3億美元增長到2028年的209億美元,預測期內(2023-2028年)複合年增長率為20.78%。

移動數據保護 (MDP) 產品和服務是軟件安全技術,可保護對最終用戶工作站大容量存儲系統上存儲的加密數據的訪問並執行保密標準。

隨著全球移動設備的興起和數據可訪問策略的進步,訪問數據變得前所未有的簡單。由於智能設備現在允許對企業數據進行無處不在的訪問,企業可以從更快地做出業務決策的能力中受益。

移動數據可訪問性的顯著增加也提高了企業盈利能力和企業效率。然而,駐留在組織內並定期通過網絡傳遞的大量數據始終面臨被篡改或濫用的風險。企業正在認真探索使用移動數據保護解決方案來統一保護這些數據。

為了提高移動數據的安全性,移動數據保護行業在各個終端用戶領域快速發展。該市場呈現出強勁的趨勢,包括企業越來越接受 BYOD 以及移動數據使用量的增加。

此外,由於未經授權的數據處理,數據傳輸增加了數據丟失和被盜的風險,而移動生產以及尋找保護數據的策略也可能阻礙市場增長。

COVID-19 已將商業和社會活動轉向在線數據隱私,加強保護並對市場增長產生積極影響。

移動數據保護市場趨勢

移動支付解決方案的採用增加推動了移動數據保護市場

移動支付的興起導致移動數據洩露事件急劇增加,對移動數據保護市場產生了重大影響。在所有支付方式中,移動支付是增長最快的。由於這種增長,移動數據也在增加。

此外,Apple Pay、Android Pay 和 Walmart Pay 等移動錢包的滲透預計將推動移動數據保護市場的進一步增長。隨著智能手機支付使用量的增加,預計在預測期內,移動數據保護的需求將會增加。

隨著移動錢包的興起,零售業正在向移動功能發展。數字錢包的安全問題肯定會推動移動保護市場的發展。因為5G的到來將加速零售技術的創新,讓顧客受益。

“自帶設備”、“雲計算”、“在線媒體”等趨勢以及對移動數據保護的嚴格監管預計將支持各種規模企業的移動數據保護行業的增長,這是一樣的。

此外,智能手機在全球的普及以及移動支付數據保護市場中電子商務領域的增長也是推動移動數據保護行業興起的主要因素。

預計北美將主導移動數據保護市場

由於美國公司較早採用數據安全技術,並且存在大量移動數據保護供應商,這些供應商幫助聚合了移動數據保護市場的大部分收入,預計北美將主導全球移動數據保護市場.馬蘇。該地區對雲技術的接受率也相對較高。

北美是全球 IT BFSI 市場的最大貢獻者,也是移動數據保護的主要市場。此外,嚴格的政府法規鼓勵公司提供保安服務。由於智能手機使用率在所有行業中最高,該地區還引領移動數據保護市場。

此外,北美行業的一個主要趨勢是越來越多地使用 BYOD 等物聯網設備來訪問銀行和醫療保健服務,這為移動數據保護提供了巨大的市場機會。

此外,移動數據保護方面的重大發展正在提高整個地區的盈利能力和企業生產力。隨著企業利用移動數據保護解決方案以統一的方式保護其數據,對移動數據保護解決方案的需求不斷增長。

移動數據保護行業概況

移動數據保護解決方案市場是一個高度分散的利基市場,供應商數量有限。行業主要參與者主要通過聯盟和收購來開發創新產品。該市場高度分散、競爭激烈,並具有不斷發展的技術格局和標準。越來越多的製造商正在利用其資源和能力來提供數據信息管理解決方案。我們還通過併購進一步擴大我們的產品組合。

2023 年 2 月,Hewlett Packard Enterprise Development LP 宣布將通過收購 Athonet 來擴展其連接的邊緣到雲產品。這家專用蜂窩網絡技術提供商為企業和通信服務提供商提供移動核心網絡。與 HPE 電信和 Aruba 網絡產品組合相結合。企業在大型和偏遠地點面臨著複雜的連接挑戰,而專用 5G 可以在園區和工業環境中提供高覆蓋範圍、可靠性和移動性。

2022 年 11 月,趨勢科技宣布推出新的保護部署模型,為安全和開發團隊提供卓越的價值。這款新產品是對安全團隊經常難以跟上公共雲環境中應用程序變化速度的聲音的直接回應。隨著開發人員快速部署新應用程序和更新的應用程序資源,他們必須跨所有資源有效地部署安全控制。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 調查範圍

第二章研究方法論

第三章執行摘要

第四章市場洞察

- 市場概況

- 行業價值鏈分析

- 行業吸引力——波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第五章市場動態

- 市場驅動力

- 移動支付解決方案的日益普及推動了移動數據保護市場

- 組織中日益增長的 BYOD 趨勢

- 市場製約因素

- 由於多平台設備的存在而導致的功能互操作性問題限制了市場增長

第六章市場細分

- 按類型

- 軟件

- 服務

- 通過部署

- 本地

- 雲

- 按公司

- 大公司

- 中小企業

- 按終端用戶行業

- BFSI

- 衛生保健

- 零售

- 款待

- 航運

- 按地區

- 北美

- 歐洲

- 亞太地區

- 南美洲

- 中東/非洲

第七章 競爭格局

- 公司簡介

- Dell Inc.

- Microsoft Corporation

- Hewlett Packard Enterprise Development LP

- Broadcom Inc.(Symantec Corporation)

- Trend Micro Incorporated

- McAfee LLC

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Thales Group(Gemalto N.V.)

- CipherCloud, Inc.

第八章投資分析

第 9 章 市場機會和未來趨勢

The Mobile Data Protection Market size is expected to grow from USD 8.13 billion in 2023 to USD 20.90 billion by 2028, at a CAGR of 20.78% during the forecast period (2023-2028).

Mobile data protection (MDP) products and services are software security techniques that protect access to encrypted data stored on end-user workstation mass storage systems to enforce confidentiality standards.

Data has become more accessible than ever due to the rise of mobile devices worldwide and the advancement of data accessibility strategies. Businesses have benefited by making quick business judgments thanks to the permission to utilize smart devices for accessing corporate data anywhere.

Also, these significant improvements in mobile data accessibility have increased company profitability and boosted their corporate efficiency. However, this large amount of data that resides within the organizations and regularly goes over the network runs the continual danger of being altered and exploited. Enterprises have been seriously exploring using mobile data protection solutions to safeguard this data uniformly.

To improve mobile data security, the mobile data protection industry is gaining pace across various end-user sectors. The market is observing a strong trend that includes growing BYOD acceptance among enterprises and increasing the volume of mobile data being used, among other factors.

Furthermore, data transfer has increased the risk of data loss and unauthorized data processing theft, along with discovering strategies to protect data, as mobile production might hamper the market growth.

Due to COVID-19, commercial and social activities moved to online data privacy, and protection was increased, positively impacting the market's growth.

Mobile Data Protection Market Trends

Increasing Adoption of Mobile Payment Solutions will Drive the Mobile Data Protection Market

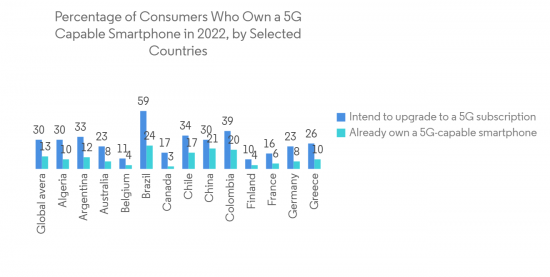

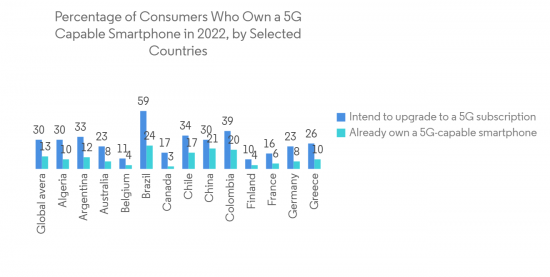

Mobile data breaches have dramatically increased due to the rise in mobile payments, which has significantly impacted the mobile data protection market. Among all payment options, mobile payments are growing the fastest. Mobile data has increased as a result of this growth.

Additionally, the market for mobile data protection is anticipated to grow further due to the proliferation of mobile wallets like Apple pay, Android pay, and Walmart pay. Over the projection period, there will likely be a rise in demand for mobile data protection due to the increasing use of smartphones for making payments.

Retail has evolved into a mobile function with the rise in mobile e-wallets. Security problems in digital wallets must drive the mobile protection market because the arrival of 5G will accelerate retail technology innovation, benefiting customers.

Similar to how trends like "bring your device," "cloud computing," and "online media," as well as strict legislation for mobile data protection, are expected to support the growth of the mobile data protection industry across enterprises of all sizes.

Also, the proliferation of smartphones worldwide and the growth of the e-commerce sector in the developing mobile payments data protection market are the main factors driving the industry's rise.

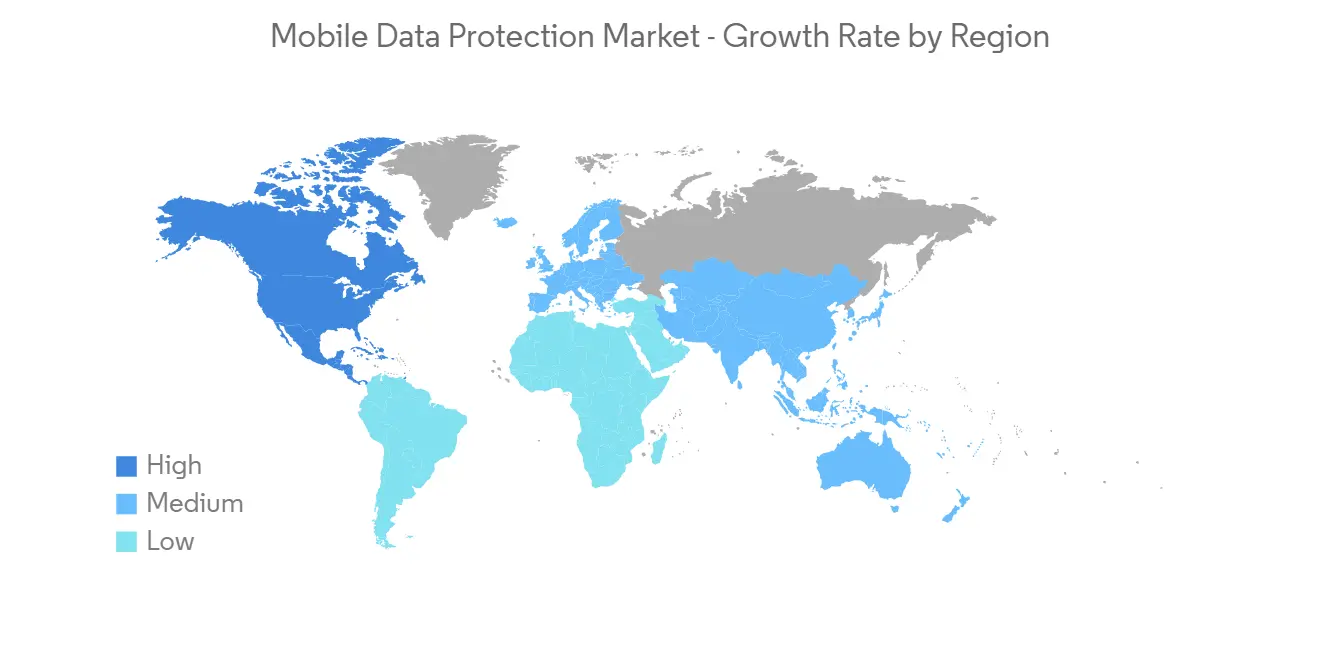

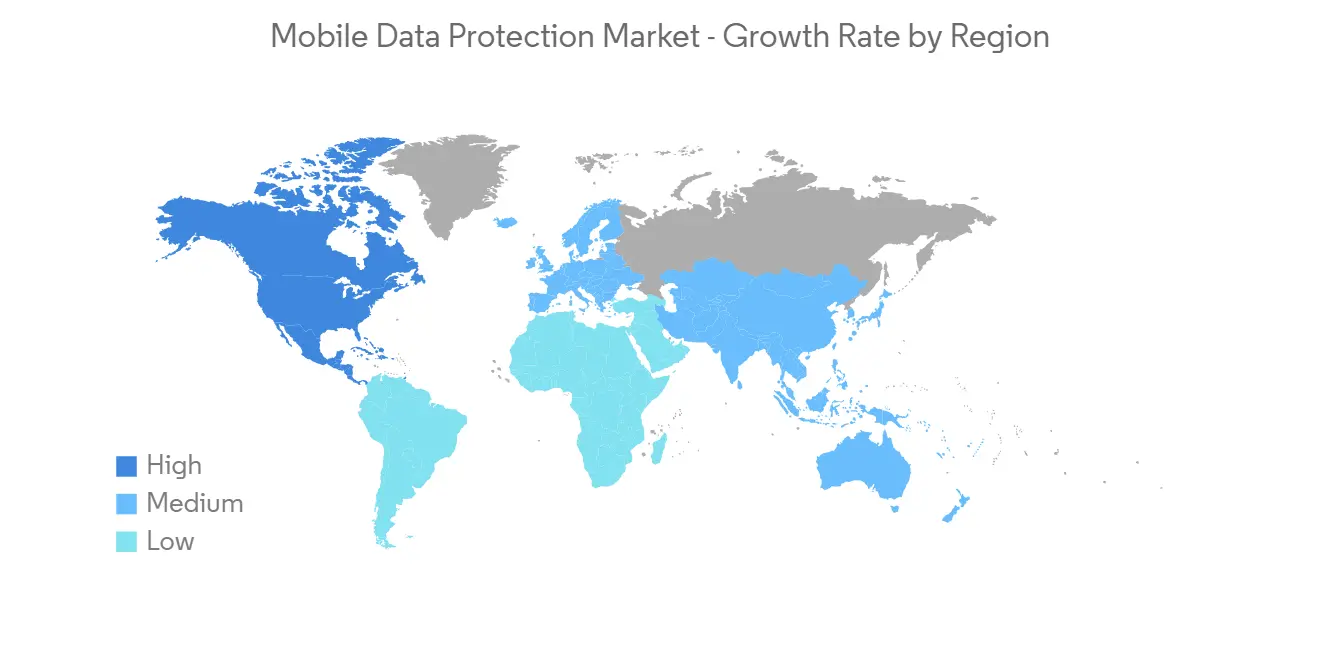

North America Anticipated to Dominate the Mobile Data Protection Market

Due to the early adoption of data security by American businesses and the presence of numerous mobile data protection vendors in the region, which would help to consolidate the majority of revenues in the mobile data protection market, North America is predicted to dominate the global market for mobile data protection. Also, this region has a relatively high acceptance rate for cloud technology.

North America is the most significant contributor to the global IT BFSI market, which is the primary market for mobile data protection. Furthermore, businesses that offer security services are working due to strict government rules. Also, the area leads the market for mobile data protection because it has one of the highest smartphone usage rates among all industries.

Also, a significant trend for the North American industry is the growing use of IoT devices, such as BYOD, to access banking and healthcare services, which indicates a significant market opportunity for mobile data protection.

Moreover, these significant developments in mobile data protection have increased their profitability and corporate productivity across the region. The demand for mobile data protection solutions is growing as enterprises utilize mobile data protection solutions to protect data in a unified manner.

Mobile Data Protection Industry Overview

The Mobile Data Protection Solutions Market is a highly fragmented, niche market with a limited number of vendors. The key industry players primarily engage in partnerships and acquisitions to develop innovative products. The market is highly fragmented and intensely competitive, marked by a constantly-evolving technological landscape and standards. There has been a rise in manufacturers offering data and information management solutions using their resources and capabilities. They are further extending their product portfolios by undertaking mergers & acquisitions.

In February 2023, Hewlett Packard Enterprise Development LP announced the expansion of its connected edge-to-cloud offering with the acquisition of Athonet. This private cellular network technology provider delivers mobile core networks to enterprises and communication service providers. They are combined with the HPE telco and Aruba networking portfolios. With enterprises facing complex connectivity challenges across large and remote sites, private 5G offers high coverage, reliability, and mobility across campus and industrial environments.

In November 2022, Trend Micro Incorporated has announced a new protection deployment model that delivers excellent value to security and development teams. The new offering directly responds to security teams sharing how they often battle to keep pace with the speed of application change in public cloud environments. Developers rapidly deploy new and updated application resources, and security controls must be effectively deployed for all resources.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Mobile Payment Solutions will Drive the Mobile Data Protection Market

- 5.1.2 Increasing Bring Your Own Devices (BYOD) Trend among Organisations

- 5.2 Market Restraints

- 5.2.1 Issues of Functional Interoperability due to the Presence of Multiple Platform Devices will Restrain the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-Premises

- 6.2.2 Cloud

- 6.3 By Enterprise

- 6.3.1 Large Enterprise

- 6.3.2 Small & Medium Enterprise

- 6.4 By End-user Industry

- 6.4.1 BFSI

- 6.4.2 Healthcare

- 6.4.3 Retail

- 6.4.4 Hospitality

- 6.4.5 Transport

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 South America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dell Inc.

- 7.1.2 Microsoft Corporation

- 7.1.3 Hewlett Packard Enterprise Development LP

- 7.1.4 Broadcom Inc. (Symantec Corporation)

- 7.1.5 Trend Micro Incorporated

- 7.1.6 McAfee LLC

- 7.1.7 Check Point Software Technologies Ltd.

- 7.1.8 Cisco Systems, Inc.

- 7.1.9 Thales Group (Gemalto N.V.)

- 7.1.10 CipherCloud, Inc.