|

市場調查報告書

商品編碼

1433860

行為生物辨識:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Behavioral Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

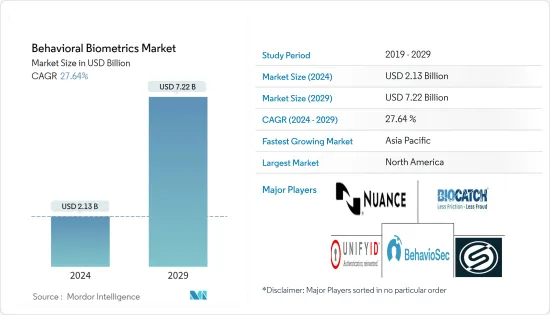

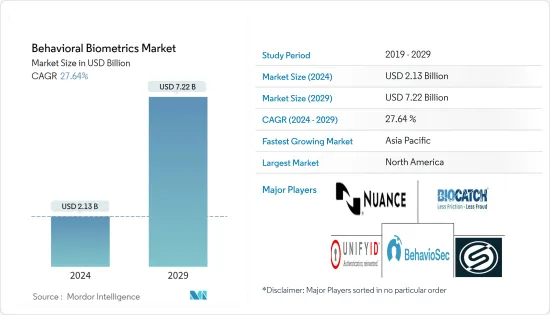

行為生物辨識市場規模預計到 2024 年將達到 21.3 億美元,到 2029 年將達到 72.2 億美元,在預測期內(2024-2029 年)複合年成長率為 27.64%。

最近爆發的 COVID-19 大流行迫使世界各地的組織主動應對大流行期間網路威脅的擴散。因此,網路彈性——一個部門或組織應對網路攻擊、做好準備並從網路攻擊中恢復的能力——在當前情況下不再是一種選擇,而是絕對必要的。

主要亮點

- 行為生物辨識技術提供了新一代的使用者安全解決方案,可根據個人與智慧型手機、平板電腦、滑鼠螢幕和鍵盤等計算設備的獨特互動來識別個人。

- 透過測量從你如何握持行動電話、如何在螢幕上滑動以及如何使用鍵盤和手勢快捷鍵等一切內容,軟體演算法開發出獨特的功能,可用於建立用戶個人資料並在後續互動中驗證用戶的身份。

- 行為生物辨識技術不會取代密碼或其他傳統的身份驗證,但它們確實減輕了密碼保護敏感資料的負擔。無論您的密碼有多強,只要它是秘密的,它就是安全的。行為生物辨識技術透過提供持續的身份保證來防止密碼成為單點安全。

- 與資料外洩相關的威脅數量正在增加。這給組織帶來了巨大損失,用戶憑證洩露已被視為世界網路威脅的主要原因之一。

- 同樣,根據 2020 年 IBM 報告,重大惡意破壞是由憑證外洩造成的。此外,2020 年,約 19% 的惡意違規行為是惡意攻擊背後的原因。

行為生物辨識市場趨勢

BFSI資料外洩事件的增加推動了市場成長

- 隨著詐騙和網路犯罪的增加,改善客戶體驗並保護客戶免受風險已成為銀行的首要任務。隨著幾乎每天都會出現新的威脅,必須在不影響消費者體驗的情況下保護最終用戶免受駭客攻擊和詐騙。

- 隨著這一領域競爭的加劇、付款新創公司的Start-Ups以及即將訂定的 PSD2 監管,客戶體驗變得越來越重要,需要採取更細緻的方法。

- 金雅拓最近委託的一項研究發現,如果發生安全漏洞,44% 的消費者會離開他們的銀行,38% 的消費者會轉向提供更好服務的競爭對手。在此背景下,銀行和其他金融機構對使用生物辨識技術感興趣,並正在與具有安全和技術專長的合作夥伴進行策略合作,以確保鏈條中的所有環節都受到保護。

- 大多數 BFSI 部門都採用了這種行為生物辨識技術來提高客戶資料的安全性。 2019年,澳洲國民銀行(NAB)引進了行為生物辨識技術來防止詐騙。此外,富國銀行公司正在開發使用客戶語音進行交易驗證和服務存取的付款解決方案。此外,該公司正在探索如何利用人工智慧來實現類似於 iPhone 上的 Sir 或亞馬遜 Alexa 的對話式銀行業務。

- 美國五大銀行之一的財政部最近實施了 Biocatch 的行為生物辨識模式。行為生物辨識系統採用率的不斷提高正在推動該市場的成長。

北美地區佔比最高

- 在北美,由於 BFSI 和 ICT 中擴大採用行為生物識別技術,該地區預計將在市場研究中佔據很大佔有率。該地區安全解決方案的支出正在增加。 2019年,美國宣布將在網路安全方面投入150億美元,比2018年增加5.834億美元(4.1%)。

- Cybersecurity Ventures 預測,到 2021 年,網路犯罪將繼續增加,每年對全球企業造成的損失將超過 6 兆美元。這項估計是基於歷史網路犯罪數據,包括最近與前一年同期比較成長、敵對民族國家贊助的駭客活動的急劇增加以及有組織犯罪集團的駭客活動。這可能會增加預測期內的網路安全支出。

- 此外,該地區各國政府對生物辨識應用表現出濃厚的興趣。我們積極資助多個研究計畫和新創企業,以在關鍵公共新興企業開發先進的行為生物辨識應用。根據 CIRA(加拿大網路註冊局)最近的一項研究,71% 的組織在 2019 年遭受資料外洩。此外,這些組織中近 43% 不知道《個人資訊保護和電子文檔法》(PIPEDA) 強制違規要求。因此,這些政府減少網路竊盜的宣傳活動將推動該地區的行為生物辨識市場。

行為生物辨識產業概述

行為生物辨識市場競爭適中,由策略上專注於技術創新和推出新解決方案的公司組成。兩家公司也專注於策略聯盟、協作計劃和資金籌措活動,以擴大其服務範圍並增加市場佔有率。

- 2020 年 2 月 - Biocatch Ltd 完成了對 AimBrain 的策略性收購,鞏固了其在全球數位身分領域的地位。 Biocatch表示,此次收購將透過增強其詐欺檢測能力並為用戶提供更好的體驗來進一步深化其解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 擴大生物辨識技術在商業和政府部門的應用

- 線上交易和詐欺增加

- 市場限制因素

- 對侵犯隱私的擔憂

- COVID-19 對行為生物辨識產業的影響

第5章市場區隔

- 類型

- 特徵分析

- 按鍵認證

- 語音辨識

- 步態分析

- 部署

- 本地

- 在雲端

- 應用

- 身份驗證

- 持續認證

- 風險與合規性

- 詐騙偵測/預防

- 最終用戶

- BFSI

- 零售/電子商務

- 衛生保健

- 政府/公共部門

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- BioCatch Ltd

- Nuance Communications Inc.

- SecureAuth Corporation

- Mastercard Incorporated(NuData Security)

- BehavioSec Inc.

- Threat Mark SRO

- UnifyID Inc.

- Zighra Inc.

- Plurilock Security Solutions Inc.

- SecuredTouch Inc.

第7章 投資分析

第8章市場的未來

The Behavioral Biometrics Market size is estimated at USD 2.13 billion in 2024, and is expected to reach USD 7.22 billion by 2029, growing at a CAGR of 27.64% during the forecast period (2024-2029).

With the recent outbreak of the COVID-19 pandemic, organizations across the world must respond proactively to cyber threats that have witnessed a spike during the pandemic. Owing to this, cyber resilience, which refers to a sector or organization's ability to respond to, prepare for, and recover from cyberattacks, has become an absolute necessity rather than an option in the current scenario.

Key Highlights

- Behavioral biometrics provides a new generation of user security solutions that identify individuals based on the unique way they interact with computer devices, such as smartphones, tablets, or mouse-screen-and-keyboard.

- By measuring everything from how the user holds the phone or how they swipe the screen, to which keyboard or gestural shortcuts they use, software algorithms build a unique user profile, which can then be used to confirm the user's identity on subsequent interactions.

- Behavioral biometrics does not replace the password or other legacy forms of identity authentication, but it does reduce the burden placed on them to protect sensitive data. Even the strongest password is only secure so long as it is secret. By offering an additional, continuous layer of identity assurance, behavioral biometrics prevents the password from being a single point of security failure.

- A growing number of threats are associated with the data compromising. This is resulting in significant loss to organizations, and compromising user credentials being highlighted as one of the major causes of global cyber threat.

- Similarly, according to the IBM report in 2020, major malicious breaches were caused by compromised credentials. Moreover, about 19% of all the malicious breaches were the cause behind malicious attacks in 2020.

Behavioral Biometrics Market Trends

Increasing Data Breaches in BFSI will Drive the Growth of this Market

- With the increasing fraud and cybercrime, along with improving the customer experience, preventing customers from being exposed to risk has become a top concern of banks' agendas. With new threats emerging almost daily, measures to protect end-users from hacking and fraud have to be delivered without jeopardizing the consumer experience.

- With the rise of fintech start-ups and the imminent PSD2 (Revised Payment Service Directive) regulations set to increase competition in the sector, the customer experience is becoming an increasingly important differential, so a more nuanced approach is necessary.

- A recent study commissioned by Gemalto showed that 44% of consumers would leave their bank in the event of a security breach, and 38% would switch to a competitor offering a better service. It has driven the interest of banks and other financial institutions in using biometric technology for which they are strategically working with partners who have the security and technology expertise to ensure every link in the chain is protected.

- Most of BFSI sectors are implementing this behavioral biometric market to increase the security of their customer's data. In 2019, National Australian Bank(NAB) implemented behavioral biometrics for fraud prevention. Additionally, Wells Fargo Company is working on a payment solution that will make use of the voice of its customers to authenticate transactions and access services. Further, the company is exploring how it can leverage artificial intelligence to make it able to perform conversational banking, much like iPhone's Sir or Amazon's Alexa.

- The Treasury arm, One of the top five banks of the United States, recently deployed Biocatch's behavioral biometric modality, which can able to detect 95% of all malware cases with a false positive rate of less than 0.05%. This increasing adoption rate of behavioral biometric systems is driving the growth of this market.

North America to Hold Highest Share

- Owing to the significant adoption of behavioral biometrics in BFSI and ICT in North America, the region is anticipated to hold a substantial share in the market studied. The area is witnessing an increase in spending on security solutions. In 2019, the United States announced to spend USD 15 billion for cybersecurity, a USD 583.4 million (4.1 %) increase over 2018.

- Cybersecurity Ventures predicts cybercrime would continue rising and cost businesses globally more than USD 6 trillion annually by 2021. The estimate is based on historical cybercrime figures, including recent year-over-year growth, a dramatic increase in the hostile nation state-sponsored, and organized crime gang hacking activities. This would increase cybersecurity spending over the forecast period.

- Furthermore, the government across the region has taken a keen interest in biometric applications. It is aggressively funding multiple research programs and startups to develop advanced behavioral biometrics applications in crucial public sector departments. According to a recent survey by CIRA (Canadian Internet Registration Authority), 71 percent of organizations are suffered from data breach activities in 2019. Additionally, almost 43 % of those organizations were unaware of the mandatory breach requirements of the Personal Information Protection and Electronic Documents Act (PIPEDA). Hence the government campaigns to reduce these cyber thefts will drive the market of behavioral biometrics for this region.

Behavioral Biometrics Industry Overview

The behavioral biometrics market is moderately competitive, consisting of players strategically focusing on innovation and new solution launches. The companies are also focusing on strategic partnership & collaboration initiatives and fund-raising activities to expand their offerings and increase their market share.

- Feb 2020 - Biocatch Ltd completed its strategic acquisition with AimBrain to enhance its digital identity position in all over the world. According to the Biocatch, this acquisition will deepen its solution by enhancing its fraud detection capabilities and by also providing a better experience to its users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters 5 Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Growth in Applications of Biometric Technology in the Commercial and Government Sectors

- 4.3.2 Increase in Online Transactions and Fraudulent Activities

- 4.4 Market Restraints

- 4.4.1 Privacy Intrusion Concerns

- 4.5 Impact of COVID-19 on the Behavioral Biometrics Industry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Signature Analysis

- 5.1.2 Keystroke Dynamics

- 5.1.3 Voice Recognition

- 5.1.4 Gait Analysis

- 5.2 Deployment

- 5.2.1 On-premise

- 5.2.2 On-cloud

- 5.3 Application

- 5.3.1 Identity Proofing

- 5.3.2 Continuous Authentication

- 5.3.3 Risk and Compliance

- 5.3.4 Fraud Detection and Prevention

- 5.4 End-User

- 5.4.1 BFSI

- 5.4.2 Retail and E-commerce

- 5.4.3 Healthcare

- 5.4.4 Government and Public Sector

- 5.4.5 Other End-user Verticals

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 BioCatch Ltd

- 6.1.2 Nuance Communications Inc.

- 6.1.3 SecureAuth Corporation

- 6.1.4 Mastercard Incorporated (NuData Security)

- 6.1.5 BehavioSec Inc.

- 6.1.6 Threat Mark SRO

- 6.1.7 UnifyID Inc.

- 6.1.8 Zighra Inc.

- 6.1.9 Plurilock Security Solutions Inc.

- 6.1.10 SecuredTouch Inc.