|

市場調查報告書

商品編碼

1433841

電腦輔助製造:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Computer Aided Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

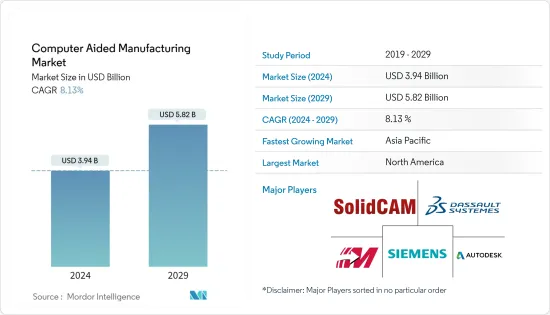

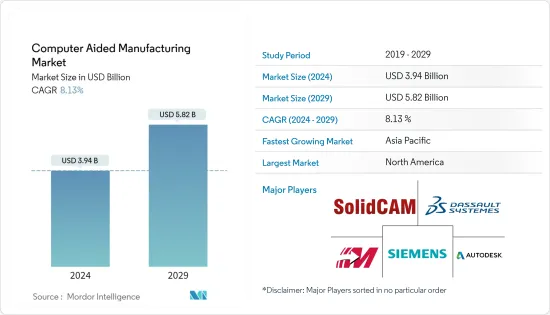

全球電腦輔助製造市場規模預計將在2024年達到39.4億美元,並在2024-2029年預測期內以8.13%的複合年成長率成長,到2029年將達到58.2億美元。

電腦輔助製造 (CAM) 有助於減少能源和廢棄物,透過提高生產速度、原料一致性和提高模具精度,使製造更強大、更有效率。快速的工業化和工業自動化趨勢正在推動電腦輔助製造市場的成長。

主要亮點

- 各種製造設備的技術進步正在推動電腦輔助製造 (CAM) 的採用。此外,工業 4.0 和物聯網 (IIoT) 使製造商更容易使機器智慧化和連網型設備,使市場更容易進入。現在可以透過單一控制中心或穿戴式裝置存取製造流程,從而改善操作流程和可用性。

- 在預測期內,製造業中物聯網連接設備的數量可能會增加。根據思科年度視覺網路指數,上年度機器對機器 (M2M) 連接佔全球 285 億連網型設備的一半以上。

- CAM 技術顯著減少了快速設計和原型製作所需的時間,而無需重建生產線。因此,CAM 解決方案擴大在各個行業中實施。 CAM 解決方案還有助於確保關鍵任務機械的維護、提高效率並生產高品質的產品。

- 隨著科技的進步,CAM也被應用於醫療領域。減材銑床是牙科領域使用最廣泛的 CAM通訊協定,因為它提供了製造口腔和臉部修復體的替代方案。聯合國開發計畫署 (UNDP) 駐盧安達辦事處最近開始與 Swiss Limbs 和 Vierge des Pauvres (HVP) Gatagara 合作,進行 3D 電腦輔助設計和製造矯正器具和義肢。

- COVID-19 也阻礙了市場成長。由於相關成本較高,較小的製造商無法採用,市場採用率顯著降低。航太和汽車業的供應商因疫情期間的支出削減而受到沉重打擊。然而,從專有軟體到雲端基礎的訂閱的轉變預計將為疫情後時代的市場成長提供利潤豐厚的機會。

電腦輔助製造市場趨勢

汽車預計將佔據較大市場佔有率

- 汽車生產涉及工程、設計、製造和第三方供應商的全球化。這增加了對使用電腦輔助製造 (CAM) 支援車輛生產的資訊系統的需求。

- 汽車 CAM 正在被廣泛採用來解決間隙、應變、應力、熱和振動等機械設計問題。 CAM 系統擴大被部署來處理汽車設計中通常使用的大量零件文件。

- 汽車領域的 CAM 系統簡化了生產線上的缺陷檢測,並且可以立即消除缺陷。 CAM模擬可協助電腦在3D模型上模擬真實場景,包括嚴重衝擊、惡劣天氣、高速場景、磨損問題和碰撞等測試。

- 量子運算等技術進步將把 GPU 和 CPU 整合到一個元件中,從而不再需要額外的介面。因此,運算完成得更快,這對汽車領域設計過程的速度有重大影響。

- 此外,市場上的供應商正在利用 3D 列印和 CAM 等技術來顛覆產品建模流程,並在未來的汽車產業中發揮不可或缺的作用。

預計北美將佔據最高的市場佔有率

- 由於美國地區工業機器人和 CAM 的採用率不斷提高,預計北美將佔據螺柱市場的最高市場佔有率。在工業機器人中,CAM 正在幫助改善機器人功能並推動市場成長。

- 由於汽車製造商面臨前所未有的競爭,該地區正在大力投資以保持競爭優勢。由於排放和安全法規尚未訂定,最終用戶正在投資 CAM 解決方案。例如,根據OICA的數據,由於生產成本上升和供應鏈變化,上一年北美生產了約1343萬輛汽車。

- 工業 4.0 和智慧工廠正在迫使製造商實現流程自動化以提高效率。例如,去年,德勤在美國堪薩斯州威奇托開設了一家新的智慧工廠,匯集了創新者的生態系統,以實現工業4.0。

- 智慧工廠成長匯集了世界知名的解決方案供應商和技術創新者的生態系統,幫助您解決最複雜的製造課題。全面運作的生產線利用機器學習、人工智慧、巨量資料、機器人、視覺解決方案等。

- 此外,美國高昂的人事費用迫使製造商引入自動化以減少支出。例如,根據 FXTM Academy 的數據,去年第四季美國的單位勞動成本每年成長 3.2%。因此,CAM 的引入降低了與人力相關的風險,並進一步促進了市場成長。

電腦輔助製造業概述

電腦輔助製造市場有多位參與者。市場是分散的,有許多相互競爭的公司在運作。該供應商不斷創新產品系列以滿足當前需求,同時跟上最新的行業要求。

- 2023 年 9 月 - 海克斯康安全基礎設施地理空間部門宣布 2023 年電力組合。海克斯康的製造智慧部門發布了 HxGN Production Machining,該軟體旨在實現從醫療到航太行業的離散零件、工具和組件的工具機製造的卓越運作。該軟體包括用於製造和設計審查的 CAD(電腦輔助設計)、用於 CNC(電腦數值控制)的CAM(電腦輔助製造)以及其他自動化和創新技術,以幫助承包商最有效地利用材料、切削工具、和CNC設備。

- 2023 年 6 月 - 達梭系統和 ISAE 集團合作開發供航太產業使用的現代數位方法。透過與達梭系統的合作,ISAE Group 將把 3DEXPERIENCE 平台與達梭系統的應用程式整合。 3DEXPERIENCE 平台及其應用程式創建產品的虛擬雙胞胎並管理其生命週期。這包括電腦輔助製造、系統工程、流體模擬、複雜系統、多物理場系統、製造流程、組裝和工業 4.0 工廠規劃等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 工業 4.0 的採用率提高

- 擴大CAM軟體在包裝器材領域的使用

- 市場限制因素

- 開源CAM軟體的普及

- COVID-19 對電腦輔助製造 (CAM) 市場的影響

第5章技術概況

- 2D設計

- 3D設計

- 5D設計

第6章市場區隔

- 最終用戶產業

- 航太/國防

- 車

- 醫療保健

- 能源/公共產業

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Autodesk Inc.

- Siemens AG

- SolidCAM Ltd.

- CNC Software, LLC.(Mastercam)

- Hexagon AB

- 3D Systems, Inc.

- HCL Technologies Limited

- NTT DATA Corporation

- OPEN MIND Technologies AG

- BobCAD-CAM

- MecSoft Corporation

- Dassault Systems

- PTC

- ZWSOFTCO., LTD.(Guangzhou)

- SmartCAMcnc.

第8章供應商市場佔有率分析

第9章投資分析

第10章 市場未來性

The Computer Aided Manufacturing Market size is estimated at USD 3.94 billion in 2024, and is expected to reach USD 5.82 billion by 2029, growing at a CAGR of 8.13% during the forecast period (2024-2029).

Computer-aided manufacturing (CAM) helps reduce energy and waste for enhanced manufacturing and efficiency in production via increased production speed, consistency of raw material, and tooling accuracy. Rapid industrialization and the trend of industrial automation are propelling the computer-aided manufacturing market growth.

Key Highlights

- Technological advancements across various manufacturing units have aided computer-aided manufacturing (CAM) adoption. Furthermore, Industry 4.0 and the Industrial Internet of Things (IIoT) have made the market accessible, as it has become easier to convert machines into intelligent and connected devices in the manufacturing industry. Manufacturing processes have become accessible via a single control center and wearables, improving operational processes and usability.

- The number of IoT-connected devices in the manufacturing sector will increase during the forecast period. Cisco's annual Visual Networking Index states that machine-to-machine (M2M) connections accounted for over half of the world's 28.5 billion connected devices in the previous year.

- CAM technology significantly reduces the time required to design and prototype quickly without reconfiguring the manufacturing line. This is increasing the deployment of CAM solutions across various industry verticals. CAM solutions further ensure that mission-critical machines are maintained, which helps to increase efficiency, resulting in high-quality products.

- CAM is also used in the medical field with technological advancement. Subtractive milling is the most widely used CAM protocol in dentistry, as it offers an alternative method of fabricating oral and facial prostheses. The United Nations Development Programme (UNDP) in Rwanda recently collaborated with Swiss Limbs and the Home de la Vierge des Pauvres (HVP) Gatagara to launch a 3D computer-aided design and the manufacturing of orthotics and prosthetics.

- COVID-19 also discouraged market growth. Because of the high associated costs, small manufacturers could not adopt it, lowering the market adoption rate significantly. Vendors operating in the aerospace, and automotive verticals have suffered significantly due to reduced spending during the pandemic. However, the shift from proprietary software to cloud-based subscriptions is anticipated to provide profitable opportunities for market growth in the post-pandemic era.

Computer Aided Manufacturing Market Trends

Automotive is Expected to Hold a Major Market Share

- Automobile production includes the globalization of engineering, design, manufacturing, and third-party suppliers. This increased the need for information systems to assist automobiles production using computer-aided manufacturing (CAM).

- Automotive CAM is gaining widespread adoption as it addresses mechanical design issues such as clearances, strain, stress, heat, and vibration. CAM systems are increasingly being deployed in handling the large part files standard in automotive designing.

- CAM systems in the automotive sector simplify fault detection on the production line and enable it to be eliminated immediately. CAM simulations assist computers in simulating real-life scenarios on 3D models, which includes testing for a violent impact, harsh weather, high-speed scenarios, wear and tear issues, and crashes.

- Technological advancements, such as quantum computing, combine GPUs and CPUs into a single element to eliminate the need for additional interfaces. Therefore, operations can be completed faster, significantly impacting the speed of the design process in the automobile sector.

- Furthermore, vendors operating in the market are leveraging 3D printing and other technologies, such as CAM to disrupt product modeling processes and play an essential role in the automotive industry in the future.

North America is Expected to have Highest Market Share

- North America is expected to hold the highest market share in the studid market owing to the increased adoption rate of industrial robotics and CAM in the United States region. With industrial robots, CAM has helped improve the robotics' functioning, propelling market growth.

- Due to unprecedented competition from automakers, the region invests heavily in its efforts to compete. End-users are investing in CAM solutions due to pending emission control and safety regulations. For instance, as per OICA, around 13.43 million motor vehicles were produced in North America in the previous year due to increased production costs and changes in the supply chain.

- Industry 4.0 and smart factories have compelled manufacturers to automate the process to improve efficiencies. For instance, Deloitte opened a new smart factory in Wichita, Kansas, United States, in the previous year, bringing together an ecosystem of innovators to make Industry 4.0 a reality.

- The growth of smart factories is bringing together an ecosystem of world-renowned solution providers and technology innovators to help solve the most complex manufacturing challenges. A fully operational manufacturing line utilizes machine learning, artificial intelligence, big data, robotics, vision solutions, and others.

- Furthermore, the high labor cost in the United States has compelled manufacturers to adopt automation to reduce expenditures. For instance, unit labor costs in the United States increased by 3.2 percent annually in the fourth quarter last year, according to FXTM Academy. Thus, CAM deployments have reduced the risks associated with human labor, further propelling market growth.

Computer Aided Manufacturing Industry Overview

There are several players in the computer-aided manufacturing market. The market is fragmented in nature, with a large number of competitors operating in the market. The providers are constantly innovating their product portfolio to meet the current demand while catering to recent industry requirements.

- September 2023 - Hexagon's Safety, Infrastructure & Geospatial division launched its Power Portfolio 2023. Hexagon's Manufacturing Intelligence division released HxGN Production Machining, a software developed to empower machine shops to achieve operational excellence in manufacturing discrete parts, tools, and components with machine tools across industries ranging from medical to aerospace. Capabilities of the suite include CAD (computer-aided design) for manufacturing and design review, CAM (computer-aided manufacturing) for CNC (computer numerical control), and other automation and innovative technologies that help manufacturers achieve highly efficient utilization of material, cutting tools and CNC equipment.

- June 2023 - Dassault Systemes and ISAE Group partnered to develop the latest digital practices the aerospace industry uses. Through its partnership with Dassault Systemes, ISAE Group will integrate the 3DEXPERIENCE platform with Dassault Systemes' applications. The 3DEXPERIENCE platform and its applications create virtual twins of products and manage their life cycle. It includes computer-aided manufacturing, systems engineering, the simulation of fluids, complex systems, multi-physics systems, manufacturing processes, and the planning of assembly lines and industry 4.0 factories.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Increasing Adoption of Industry 4.0

- 4.3.2 Growing Utilization of CAM Software in the Packaging Machinery Sector

- 4.4 Market Restraints

- 4.4.1 Wide Availability of Open Source CAM Software

- 4.5 Impact of COVID-19 on the Computer Aided Manufacturing (CAM) Market

5 TECHNOLOGY SNAPSHOT

- 5.1 2D Design

- 5.2 3D Design

- 5.3 5D Design

6 MARKET SEGMENTATION

- 6.1 End-User Industry (Revenue in USD million and Market Share as a part of the study)

- 6.1.1 Aerospace & Defense

- 6.1.2 Automotive

- 6.1.3 Medical

- 6.1.4 Energy & Utilities

- 6.1.5 Other End-User Industries

- 6.2 Geography (Revenue in USD million and Market share as a part of the study)

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Autodesk Inc.

- 7.1.2 Siemens AG

- 7.1.3 SolidCAM Ltd.

- 7.1.4 CNC Software, LLC. (Mastercam)

- 7.1.5 Hexagon AB

- 7.1.6 3D Systems, Inc.

- 7.1.7 HCL Technologies Limited

- 7.1.8 NTT DATA Corporation

- 7.1.9 OPEN MIND Technologies AG

- 7.1.10 BobCAD-CAM

- 7.1.11 MecSoft Corporation

- 7.1.12 Dassault Systems

- 7.1.13 PTC

- 7.1.14 ZWSOFTCO., LTD. (Guangzhou)

- 7.1.15 SmartCAMcnc.