|

市場調查報告書

商品編碼

1273471

軟件定義廣域網市場——增長、趨勢和預測 (2023-2028)Software-Defined Wide Area Network Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,軟件定義的廣域網市場預計將以 31.2% 的複合年增長率增長。

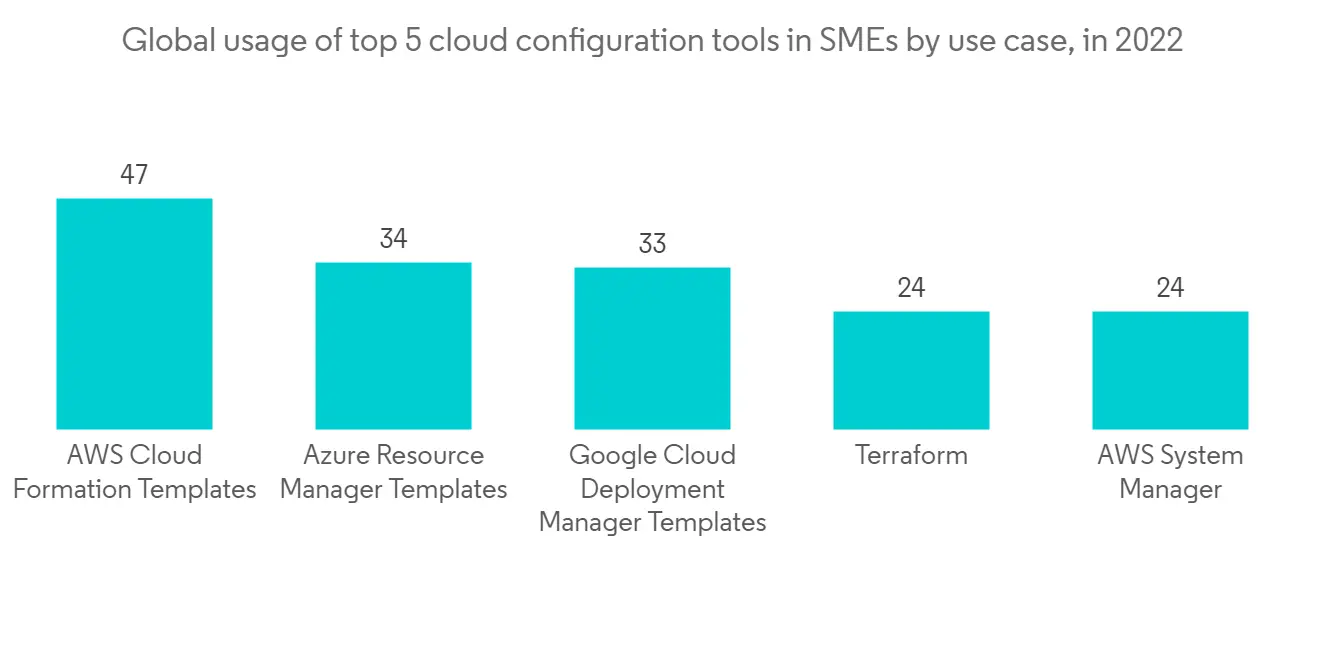

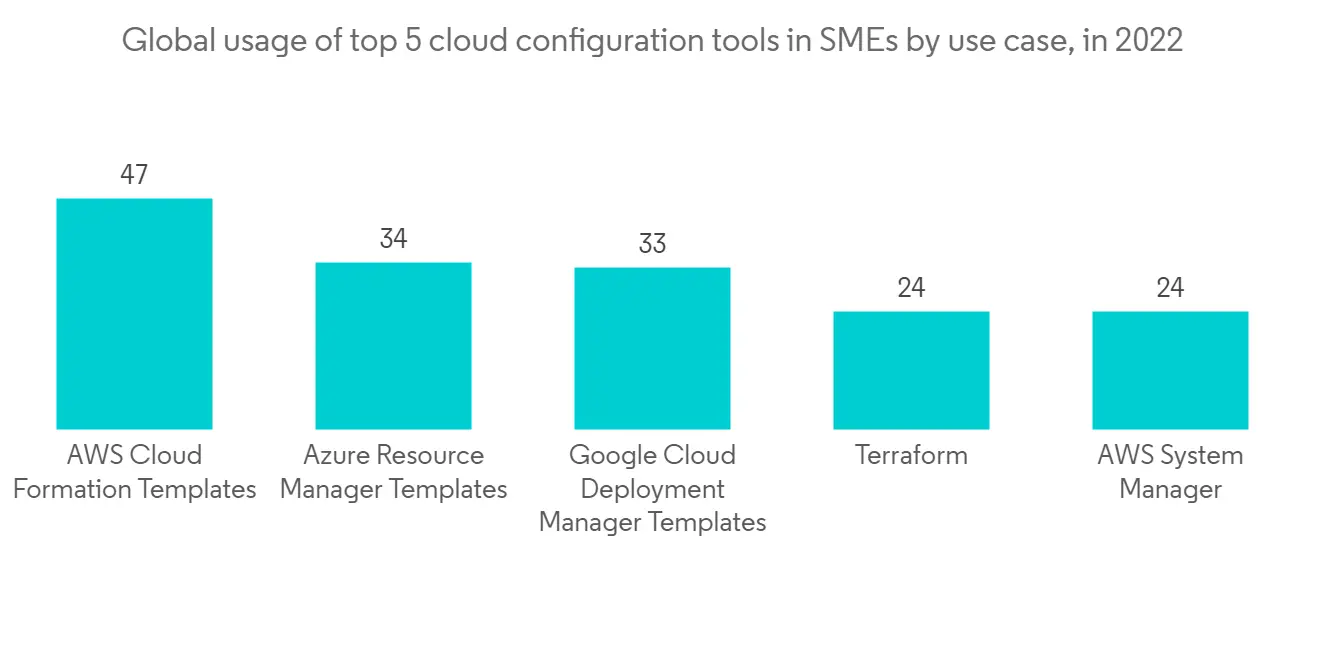

越來越多地採用基於雲的解決方案增加了組織層面的複雜性。 簡化流程的需求正在推動 SD-WAN 的採用。

主要亮點

- 由於智能手機普及率的提高,移動數據流量也在增加。 因此,服務提供商面臨著與流程簡化相關的重大挑戰。

- 此外,對互聯網寬帶連接的需求正在飆升,導致從更昂貴的解決方案轉向簡化的網絡解決方案。

- 公司現在正在將重點轉移到減少運營費用上。 製造商之間的競爭如此激烈,要想盈利,唯一的辦法就是盡量減少運營費用。

- 出現了對 SD-WAN 網絡安全性的擔憂,限制了增長和採用率。

軟件定義廣域網市場趨勢

企業部門對 SD-WAN 市場增長的貢獻

隨著世界加速邁向數字化,大型和小型企業都希望確保安全、無縫的連接以管理其業務運營。 這促使企業選擇 SD-WAN 架構。 SD-WAN 還有助於為企業內的內容消費維護高質量流。

- Edgecore Networks 宣佈了其 SD-WAN 產品組合的兩個新系列。 這將改善您的遠程工作者網絡,並允許您解決遠程用戶的應用程序性能問題。 它專為連鎖店和中小企業設計,支持按需交付穩健、安全和適應性強的網絡服務。 鈺登科技是一家開放網絡解決方案提供商,為企業、數據中心和通信服務提供商提供NOS和SDN軟件。

- Aryaka 是完全託管的 SD-WAN 和 SASE 解決方案的領導者,已在法國巴黎開設了服務接入點 (PoP)。 Aryaka 的新設施意味著無論未來工作環境的不確定性如何,您的企業都可以得到保護。

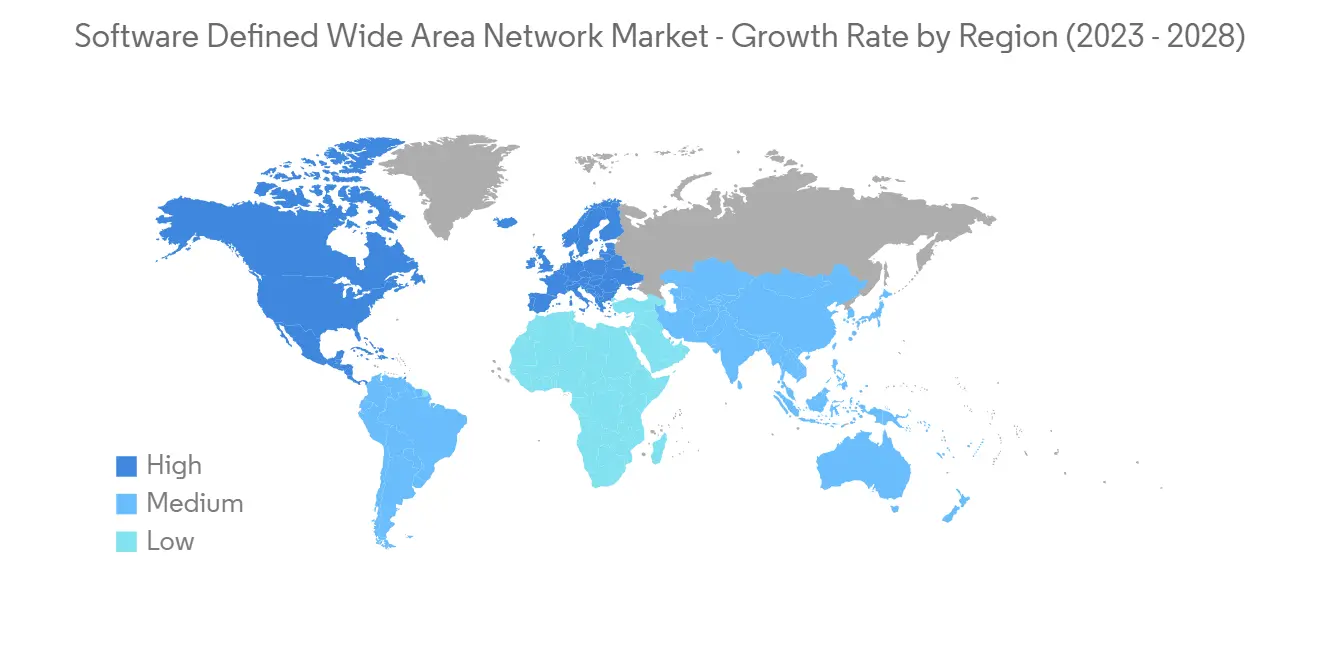

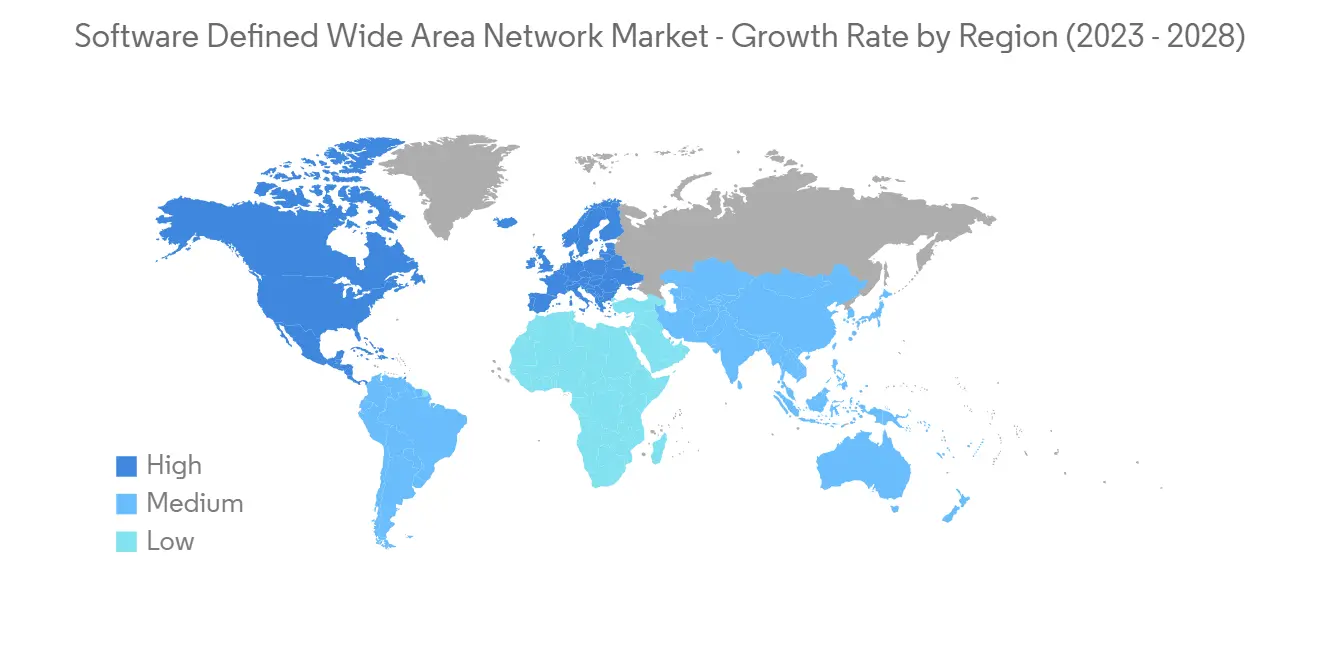

北美有望佔據主要市場份額

SD-WAN 解決方案在北美地區的企業和服務提供商中越來越受歡迎。 由於多個試點項目的成功和企業的全面引進,它已成為世界範圍內的熱門話題。 在 SD-WAN 解決方案的意識不斷增強和已證明的優勢的推動下,北美這個主要市場有望推動顯著增長。

SD-WAN 市場的長期趨勢表明,北美市場為 SD-WAN 供應商貢獻的商機最多。 美國不斷增長的零售業增加了組織的複雜性,而這可以通過 SD-WAN 解決方案進行簡化。

北美地區的大多數國家經濟實力雄厚。 這一優勢使該地區比其他地區更具優勢,並被用於投資 5G、RAN、網絡安全和其他物聯網服務等尖端技術。

軟件定義廣域網行業概況

軟件定義的廣域網市場競爭激烈,由幾家大型企業組成。 就市場份額而言,目前幾家主要參與者主導著市場。 服務提供商正在進行併購 (M&A),以獲得競爭優勢並推動業務擴張。

2022 年 2 月,思科與 Microsoft Teams 和 Office 365 合作解決不一致的軟件即服務 (SaaS) 性能問題。 思科發佈了其 SD-WAN 軟件的更新版本,以支持通過 SD-WAN 優化 Microsoft SaaS 應用程序(例如 Microsoft SharePoint、OneDrive 和 Teams)的路由。 思科 SD-WAN 客戶可以利用思科的 Cloud OnRamp 智能路由 Microsoft 365 流量,以提供最快、最安全和最可靠的最終用戶體驗。

2022 年 3 月,Verizon 將與 VMware 合作,幫助將這家軟件巨頭的 VeloCloud SD-WAN 平台部署到 Verizon 的託管服務產品組合中。 該服務包括一個集中式 SD-WAN 編排器、一個全球分佈式 SD-WAN 網關網絡,以及一些用於分支機構連接的邊緣設備。

2022 年 11 月,技術服務分銷商 TVI 將與 Aryaka 達成協議,允許 TBI 代理商銷售安全網絡服務提供商提供的服務。 它還將提供統一的安全訪問服務邊緣 (SASE)。 憑藉其先進的技術,Aryaka 將高級網絡和網絡安全功能完全融合在同一個基於雲的平台上,而不是在單獨的孤島中運行它們。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第 1 章目錄

第 2 章介紹

- 調查假設和市場定義

- 調查範圍

第 3 章研究方法論

第 4 章執行摘要

第 5 章市場動態

- 市場概覽

- 市場促進因素

- 增加基於雲端的解決方案

- 簡化網路解決方案

- 對出行服務的需求不斷增長

- 市場抑制因素

- 數據安全

- 缺乏合格的培訓師

- 行業價值鏈分析

- 波特的五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 6 章市場細分

- 按安裝類型

- 前提

- 雲端

- 混合型

- 按組件類型

- 解決方案

- 服務

- 按組織規模

- 大企業

- 中小企業

- 按最終用戶行業

- 醫療保健

- 銀行和金融服務

- 零售和消費者服務

- 製造業

- 運輸/物流

- IT/電信

- 其他最終用戶行業

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 英國

- 法國

- 德國

- 其他歐洲

- 亞太地區

- 中國

- 印度

- 日本

- 澳大利亞和新西蘭

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲地區

- 北美

第 7 章競爭格局

- 供應商市場份額

- 併購

- 公司簡介

- Aryaka

- Cisco

- vmware

- Nokia

- Hewlett Packard Enterprise

- Huawei

- Tata Communications

- MCM Telecom

- Fortinet

- Ericsson

第 8 章投資分析

第 9 章市場機會與未來趨勢

The Software-defined Wide Area Network Market is expected to register a CAGR of 31.2% over the forecast period. The increased adoption of cloud-based solutions has led to a rise in the number of complexities at the organizational level. The need to streamline the processes has boosted the adoption of SD-WAN.

Key Highlights

- The increase in smartphone penetration rates has led to an increase in mobile data traffic. This has exposed the service providers to huge problems related to the streamlining of the processes.

- There is also an upsurge in the demand for internet broadband connections to replace more expensive solutions with simplified network solutions.

- The enterprises have now shifted their focus to the reduction of operational expenditure. Due to huge competition among the manufacturers, the only way to increase profits is to minimize operational expenditure.

- Certain concerns over the security of the SD-WAN network have come into the picture, which is restricting its growth and adoption rates.

Software-Defined Wide Area Network Market Trends

Enterprise Sector will Add to the SD-WAN Market Growth

As the world accelerates towards digitization, enterprises, either small or large, want to have secure and seamless connectivity to manage business operations. This directs them to opt for SD-WAN architecture. SD-WAN also helps in maintaining high-quality streams for content consumption within businesses.

- Edgecore Networks launched two new series in the SD-WAN portfolio. This will help in better networking for remote workers and will address application performance issues for remote users. Specifically designed for chain stores and small to medium-sized enterprises, it will provide robust, secure, and adaptive network services on demand. Edgecore Networks is a provider of open networking solutions which offers NOS and SDN software for enterprises, data centers, and telecommunication service providers.

- Aryaka, the leader in fully managed SD-WAN and SASE solutions, launched a service Point of Presence (PoP) in Paris, France. Aryaka's new facilities mean it can protect its businesses, regardless of any future uncertainty concerning the working environments.

North America is Expected to Hold the Major Market Share

SD-WAN solutions have gained popularity amongst enterprise and service providers in the North American region. Multiple successful pilot projects and full-fledged deployments performed by enterprises are creating a significant market buzz across the world. Driven by growing awareness and proven benefits of SD-WAN solutions, critical markets of North America are expecting a massive boost in growth.

The long-term trend for the SD-WAN market indicates that the North American market has contributed the highest business opportunities for SD-WAN vendors. The growing retail business in the United States has led to more organizational complexities, which can be simplified with SD-WAN solutions.

Most of the countries in the North American region are economically robust. This advantage keeps the region ahead of other geographies and leverages them to invest in the latest technologies like 5G, RAN, cyber security, and other IoT services.

Software-Defined Wide Area Network Industry Overview

The Software-defined Wide Area Network Market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. The service providers are engaging themselves in mergers and acquisitions in order to gain a competitive advantage and trigger expansion.

In February 2022, Cisco joined hands with Microsoft Teams and Office 365 to address inconsistent software-as-a-service (SaaS) performance. Cisco released an updated version of their SD-WAN software which supports the optimal routing of Microsoft SaaS apps, including Microsoft SharePoint, OneDrive, and Teams on their SD-WAN. Cisco SD-WAN customers can leverage Cisco's Cloud OnRamp to intelligently route Microsoft 365 traffic to provide the fastest, most secure, and most reliable end-user experience.

In March 2022, Verizon collaborated with VMware, which will help Verizon roll the software giant's VeloCloud SD-WAN platform into its managed services portfolio. The service includes a centralized SD-WAN orchestrator, a network of globally distributed SD-WAN gateways, and a bevy of edge appliances for branch connectivity.

In November 2022, TVI, the technology services distributor, signed a deal with Aryaka that will allow TBI agents to sell the secure network services provider's offering. It will also offer a unified, secure access service edge (SASE). With its advanced technology, Aryaka fully converges advanced networking and cybersecurity features onto the same cloud-based platform rather than running them in separate silos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 TOC

2 INTRODUCTION

- 2.1 Study Assumption and Market Definition

- 2.2 Scope of the Study

3 RESEARCH METHODOLOGY

4 EXECUTIVE SUMMARY

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Increased Number of Cloud-based Solution

- 5.2.2 Simplified Network Solution

- 5.2.3 Growing Demand for Mobility Services

- 5.3 Market Restraints

- 5.3.1 Data Security

- 5.3.2 Lack of Qualified Trainers

- 5.4 Industry Value Chain Analysis

- 5.5 Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers/Consumers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitute Products

- 5.5.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Deployment Mode

- 6.1.1 Premise

- 6.1.2 Cloud

- 6.1.3 Hybrid

- 6.2 By Component Type

- 6.2.1 Solutions

- 6.2.2 Services

- 6.3 By Organisation Size

- 6.3.1 Large Enterprises

- 6.3.2 Small-Medium Enterprises

- 6.4 By End-user Industry

- 6.4.1 Healthcare

- 6.4.2 Banking and Financial Services

- 6.4.3 Retail and Consumer Services

- 6.4.4 Manufacturing

- 6.4.5 Transport and Logistics

- 6.4.6 IT and Telecom

- 6.4.7 Other End-user Industries

- 6.5 Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.1.4 Rest of North America

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 France

- 6.5.2.3 Germany

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Australia & New Zealand

- 6.5.3.5 Rest of Asia-Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Mexico

- 6.5.4.3 Rest of Latin America

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share

- 7.2 Mergers and Acquisitions

- 7.3 Company Profiles

- 7.3.1 Aryaka

- 7.3.2 Cisco

- 7.3.3 vmware

- 7.3.4 Nokia

- 7.3.5 Hewlett Packard Enterprise

- 7.3.6 Huawei

- 7.3.7 Tata Communications

- 7.3.8 MCM Telecom

- 7.3.9 Fortinet

- 7.3.10 Ericsson

![軟體定義廣域網路 (SD-WAN) 市場規模 - 按元件(解決方案 [實體設備、虛擬設備]、服務 [培訓和諮詢、整合和維護、託管])、按部署模型、按應用程式和預測,2024 年- 2032](/sample/img/cover/42/1465590.png)