|

市場調查報告書

商品編碼

1432407

全球安全儀器系統:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Safety Instrumented System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

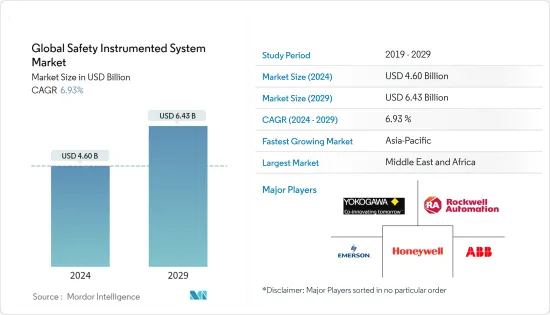

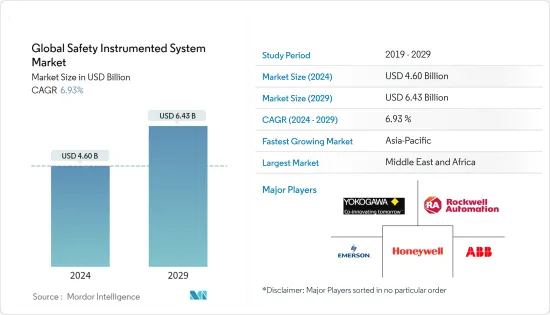

預計2024年全球安全儀器系統市場規模為46億美元,預計到2029年將達到64.3億美元,在預測期內(2024-2029年)將成長69.3億美元,複合年成長率為%。

廣泛採用安全法規和標準,提高個人和組織層面對職業安全管理和能力需求的認知,並在製造業中快速引入安全開關以防止事故發生。現在看起來是這樣的。

主要亮點

- 2020年,印度Raigarh附近Tetla村Shakti造紙廠的大約7名工人因吸入有毒煙霧而患病,納西克市附近Satpur區的一家藥品包裝廠也發生火災。這種令人震驚的情況強調了該國各個最終用戶產業採用高可靠性壓力保護系統的必要性。 HIMA 是石油和天然氣行業安全解決方案供應商,專門為馬來西亞石油和天然氣生產商提供關鍵的工業安全解決方案。據該公司稱,海上石油和天然氣公司因意外停機而面臨巨大損失,該公司提供安全且經濟高效的渦輪機械操作來解決此類問題。我們提供帶有HiMax 的HIMA Flex SILon TMC,這是一種整合解決方案

- 此外,化學、石化、發電、製藥、食品和飲料、石油和天然氣以及其他最終用戶的工業流程受到各個治理機構的嚴格監管,以防止突然故障和事故。法規環境正在加強,以促進採用 SIS 作為預防措施。廣泛採用安全法規和標準,提高個人和組織層面對職業安全管理和能力需求的認知,並在製造業中快速引入安全開關以防止事故發生。現在看起來是這樣的。

- SIS 在石油和天然氣行業的實施受到嚴格的法律法規的推動,這些法律法規旨在限制災難性洩漏並避免環境污染。例如,美國制定了石油污染法以及石油洩漏預防和準備法規來防止此類事件。一些合規計劃,例如第 13892 號行政命令第 7 條「確保合理的行政檢查」中考慮的地方私人檢查程序規定,檢查設施是否符合環境法。各行業不斷擴大的法規環境正在促進市場成長。

- 冠狀病毒感染疾病(COVID-19)在全球爆發,由於各國政府為遏制病毒傳播而實施的多項限制,迫使大多數企業完全停止或限制生產,對各行業的成長產生了重大影響。因此,疫情對安全儀器系統(SIS)的成長產生了顯著影響。例如,作為SIS最大終端用戶之一的石油和天然氣行業,受到原油市場崩壞(美國原油基準價格暫時創歷史新低)以及全球感染疾病大流行的影響。 COVID-19 病毒。我們遭受了前所未有的經濟放緩雙重打擊。

- 根據國際能源總署的數據,2020 年許多主要生產商的石油和天然氣收入下降了 50-85%。與2019年相比,根據未來市場發展情況,損失可能會更大。此外,對於許多新興石油生產國來說,影響更大,因為石油占這些國家出口和政府收入的很大一部分,限制了它們應對 COVID-19 造成的多方面國內壓力的能力。我做到了。

安全儀器系統的市場趨勢

化學和石化行業預計將佔據重要的市場佔有率

- 安全儀器系統包括感測器、邏輯控制器和最終控制元件,其目的只有一個:如果違反指定條件,則使製程進入安全狀態。安全儀器系統相對於傳統安全系統的優勢不斷增加,市場需求不斷增加。化學和石化行業被認為是一個不斷發展的行業,安全問題日益突出,基礎設施擴建和升級的需求也至關重要。傳統的安全系統是透過電氣控制系統實施和硬連線的,導致可能發生影響人員、財產和環境的事故。

- 這導致石化行業對安全儀器系統的需求激增,延長現場壽命,減少計劃外停機時間,降低年度維護成本,消除計劃外維修成本,並滿足現行法規和標準。它提供了多種好處,包括提高合規性。因此,安全儀器系統相對於傳統安全系統日益增加的優勢將推動產業成長。

- 2020年9月,橫河電機宣布開發了OpreX Managed Service,支援化工廠設備的遠端監控和維護。該服務透過在工廠器材與設備發生故障之前識別和糾正問題,幫助防止工廠意外停機。可以根據客戶要求以多種方式存取和使用它。

- 化學工業的環境充滿氣體、油和灰塵,在機械內部和周圍形成爆炸性環境。此外,與監管、地緣政治風險、自然資源使用的法律限制、股東激進主義和加強公眾監督相關的行業問題也帶來了進一步的挑戰。因此,火災和氣體監測和偵測、SCADA 和 HIPPS 裝置等安全設備至關重要。

- 此外,許多公司還提供用於石化廠複雜設備的商務用以及維護的控制器。例如,智慧安全公司 HIMA 提供的控制器可以執行傳統的緊急關閉業務並處理複雜的設備功能。 SafeEthernet通訊協定可確保安全完整性等級 3 (SIL 3) 的控制器之間的安全通訊。此外,安全停車期間的快速反應時間和安全關鍵生產過程中的高操作安全性 (SIL 3) 有助於乙炔工廠的高可用性和生產率。

亞太地區預計將出現高成長率

- 在許多工業製程和自動化系統中,安全儀器系統在提供保護層功能方面發揮重要作用。 「安全系統工程」一詞是指在工廠的整個生命週期內進行危險識別、安全要求規範、系統維護和操作的嚴格且系統化的方法。石化和能源產業的崛起對於安全儀器系統產業的成長至關重要。此外,隨著製程產業逐漸採用更高的安全標準,他們需要能夠管理蒸氣渦輪、壓縮機、變速驅動器等的變化的控制系統,以滿足敏捷需求,同時保持盈利能力。

- 已開發國家工業成長停滯已經減緩了對閥門和致動器的需求。政府對新興產業的支持力道加大,政治條件有利於產業擴張。因此,外國公司正在尋求投資該行業。此外,正在努力並計劃在該地區建立水和廢水處理設施。例如,柬埔寨政府與日本國際協力機構簽署協議,在Dangkor地區建造污水處理設施。這個耗資2500萬美元的計劃旨在改善該地區的排水基礎設施,讓污水直接流入工廠而不是流入河流。此類計劃預計將推動亞太地區安全儀器系統市場的發展。

- 食品和飲料行業有保護其員工的道德和法律責任。重型設備、危險化學物質和光滑表面是最直接的問題,而吸入灰塵、聽力損失和重複性勞損是更漸進的威脅。全球最大的飲料公司可口可樂注意到東南亞對無糖和低糖飲料的需求激增。這在 COVID-19感染疾病後變得更加明顯。

- 由於工業活動的快速擴張、成本壓力和生產率的上升以及中國和印度等新興國家的有利政府政策,預計亞太地區將成為成長最快的地區。製造商透過開發針對特定應用的新產品來應對不斷變化的特定應用需求。此外,安全儀器系統數量的增加導致了更複雜的系統的創建。此外,這些系統在石油和天然氣、化學和電力行業中的應用越來越廣泛,因為它們有助於監控使用時間、鍋爐管理的各個方面、煙囪溫度、鍋爐和燃料效率。所有這些系統在此業務中都很重要。

- 此外,在2020年全國人民代表大會上,中國共產黨宣布,除了將「中國製造2025」和「中國標準2035」的力度加倍之外,中國共產黨還可能在數位基礎設施公共支出計劃上支出約1.4兆美元。中國的新基礎設施舉措為全球企業提供了令人興奮的機會。這預計將增加新能源汽車、石油天然氣、5G設備、物流、能源電力等各領域採用SIS設備的公司數量,進而推動市場成長。地區。

安全儀器系統產業概述

全球安全儀器系統市場與西門子公司、ABB 有限公司和施耐德電氣公司等幾家主要企業的競爭中等。從市場佔有率來看,目前幾乎沒有主要參與者佔據市場主導地位。這些擁有主導市場佔有率的領先公司正致力於擴大海外客戶群。這些公司正在利用策略合作舉措來提高市場佔有率和盈利。競爭、快速的技術進步和消費者偏好的頻繁變化預計將威脅該公司在預測期內的市場成長。

- 2021 年 1 月 - ABB Ltd. 推出適用於起吊裝置的 ABBability Safety Plus,這是首款經過完全 SIL 3 認證、具有最高安全等級的礦井起吊裝置解決方案。這包括 Safety Plus 煞車系統 (SPBS),其中包括 Safety Plus起吊裝置監視器 (SPHM)、Safety Plus起吊裝置保護器 (SPHP) 和安全煞車液壓系統 (SBH)。根據國際「機械安全」標準IEC62061設計。

- 2021年2月-橫河電機公司宣佈在產品系列中增加新的濁度檢測器、氯感測器單元和液體分析儀。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 產業法規環境的成長

- 存在強大的 SIS 服務生態系統

- 市場限制因素

- 操作複雜、維修成本高

第6章市場區隔

- 按用途

- 緊急關閉系統(ESD)

- 火災與氣體監測與控制系統(F&GC)

- 高可靠性壓力保護系統(HIPPS)

- 燃燒器管理系統 (BMS)

- 渦輪機械控制

- 其他

- 按最終用戶

- 化工/石化

- 發電

- 製藥

- 食品與飲品

- 油和氣

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Rockwell Automation Inc.

- Emerson Electric Company

- Honeywell International Inc.

- Yokogawa Electric Corporation

- ABB Ltd

- Schneider Electric SE

- Siemens AG

- HIMA Paul Hildebrandt GmbH

- SIS-TECH Solutions LP

- Schlumberger Limited

第8章投資分析

第9章市場的未來

The Global Safety Instrumented System Market size is estimated at USD 4.60 billion in 2024, and is expected to reach USD 6.43 billion by 2029, growing at a CAGR of 6.93% during the forecast period (2024-2029).

The widespread adoption of safety regulations and standards, coupled with increased awareness about the need for industrial safety management and competency at both individual and organizational levels, has led to the rapid adoption of safety switches in manufacturing units to prevent any accidents.

Key Highlights

- Around seven employees fell ill after inhaling poisonous gas at Shakti paper mills in Tetla village near Raigarh, and a fire broke out at a pharmaceutical packaging factory in the Satpur area near Nashik city all in one day, in 2020 in India. Such an alarming situation has emphasized the need for the adoption of high integrity pressure protection systems by various end-user industries in the country. HIMA, a vendor of safety solutions for the oil and gas industry, offers pivotal solutions for industrial safety specific to Malaysian oil and gas producers. According to the company, the offshore oil and gas companies face huge losses due to unplanned downtime, and the company offers its HIMA Flex SILon TMC with HiMax, an integrated solution that provides safe and cost-effective turbomachinery operation, to tackle such issues.

- Further, the industrial processes across chemicals and petrochemicals, power generation, pharmaceutical, food and beverage, oil and gas, and other end users are closely regulated by various governing bodies to prevent sudden breakdowns and mishaps. The regulatory environment has tightened to encourage the deployment of SIS as a precautionary measure. The widespread adoption of safety regulations and standards, coupled with increased awareness about the need for industrial safety management and competency at both individual and organizational levels, has led to the rapid adoption of safety switches in manufacturing units to prevent any accidents.

- The deployment of the SIS in the oil and gas industry is driven by the strict laws and acts that are formulated to restrict catastrophic spillage and avoid environmental pollution. For instance, the US Oil Pollution Act, alongside Oil Spills Prevention and Preparedness Regulations, is placed to prevent such accidents. Several compliance programs like the On-Site Civil Inspection Procedures Rule, as contemplated by section 7 of EO 13892, Ensuring Reasonable Administrative Inspections check if the facilities are complying with the environmental laws. The growing regulatory environment in various industries contributes to market growth.

- The global outbreak of COVID-19 has significantly impacted the growth of various industries as most companies had to put a complete stop or limit their production owing to several restrictions put by the government to curb the spread of the virus. As a result, the pandemic had a notable impact on the growth of the Safety Instrumented Systems (SIS). For instance, the oil and gas industry, which is among the largest end-user for the SIS, is experiencing an unprecedented double blow, owing to the oil market collapse with the benchmark price for US crude oil, briefly touching a record low and a global economic slowdown driven by the COVID-19 pandemic.

- According to International Energy Agency, the oil and gas revenues for a number of key producers fell between 50 to 85% in 2020; compared with 2019, the losses could even be larger depending on future market developments. Furthermore, for many oil-producing developing countries, wherein oil contributes the majority of their exports and government revenues, the impact was even higher, limiting the ability of these countries to respond to the multidimensional domestic pressures produced by COVID-19.

Safety Instrumented System Market Trends

The Chemical and Petrochemical Industry is expected to Hold a Major Market Share

- A Safety Instrumented System is encompassed of sensors, logic solvers, and final control elements for the single purpose of taking the process to a safe state when predetermined conditions are violated. The growing benefits of safety instrumented systems over traditional safety systems are fueling the market demand. The chemicals & petrochemicals industries are identified as continuously developing industries, wherein the need for expansion and upgrading of aging safety problems and infrastructures is essential. Traditional safety systems are deployed through an electrical control system and are hardwired, leading to potential accidents affecting people, assets, and the environment.

- This will surge the demand for safety instrumented systems in petrochemical industries that deliver several advantages such as prolonged field life, reduction in unplanned downtime, reduction in annual maintenance cost, elimination of unexpected repair expenses, and adherence to current codes and standards. Thus, the increasing advantages of safety instrumented systems over traditional safety systems will drive industry growth.

- In September 2020, Yokogawa Electric Corporation announced that it had developed the OpreX Managed Service, which supports the remote monitoring and maintenance of chemical plant equipment. This service can prevent unexpected plant shutdowns by identifying and correcting issues with plant equipment and devices before breaking down. It can be accessed and utilized in various ways, depending on customer requirements.

- Chemical industries have hazardous environments due to gas, oil, or dust, creating an explosive atmosphere in and around the machines. Moreover, the industry issues related to regulation, geopolitical risk, legal limits on using natural resources, shareholder activism, and increasing public scrutiny have created additional challenges. Thus, safety equipment such as fire and gas monitoring and detection, SCADA, and HIPPS installation is of utmost importance.

- Further, many companies offer controllers for emergency and safety shutdown duties and handle complex equipment maintenance in the petrochemical plant. For instance, HIMA, a smart safety company, offers controllers that perform classic emergency shutdown duties and handle complex equipment functions. The SafeEthernet protocol ensures safe cross-communication between controllers at safety integrity level 3 (SIL 3). It also offers fast response times in a safety shutdown, and the high operational safety (SIL 3) within safety-critical production processes contribute to the acetylene plant's high availability and productivity.

Asia Pacific is Expected to Witness High Growth Rate

- In many industrial processes and automation systems, safety instrumented systems play an important role in delivering protective layer functions. The term "safety system engineering" refers to a disciplined and methodical approach to hazard identification, safety requirement specifications, and system maintenance and operation throughout the life of a plant. The rise of the petrochemical and energy sectors is critical to the growth of the safety instrumented system industry. Furthermore, as the process sector advances toward embracing greater safety standards, control systems that can manage changes, such as steam turbines, compressors, and variable speed drives, may become necessary to maintain profitability while meeting agile needs.

- Because of stagnating industrial growth in industrialized countries, demand for valves and actuators has slowed. The government's increasing support for new industries, as well as political conditions, make the country conducive to industrial expansion. As a result, foreign corporations are looking to invest in this industry. In addition, there are ongoing and planned initiatives for establishing water and wastewater treatment plants in the region. For example, the Cambodian government and the Japanese International Cooperation Agency struck an agreement to construct a wastewater treatment plant in the Dangkor area. With a USD 25 million investment, the project aims to improve the drainage infrastructure in the district so that wastewater can flow directly to the plant rather than into the river. Such projects are expected to fuel the market for safety instrumentation systems in the Asia Pacific region.

- The food and beverage sector has a moral and legal responsibility to protect its employees. Heavy machinery, hazardous chemicals, and slick surfaces are among the immediate concerns, while dust inhalation, hearing loss, and repetitive strain injuries are among the more gradual threats. Coca-Cola, the world's largest beverage company, has noticed a surge in demand for sugar-free and low-sugar beverages in Southeast Asia. After the COVID-19 epidemic, this became more prominent.

- Due to rapidly increasing industrial activity, rising cost pressures and production rates, and favorable government policies in developing countries like China and India, the Asia Pacific area is predicted to grow the fastest. Manufacturers have responded by developing new goods for specific uses in response to changing demands based on usage. Furthermore, an increase in the number of safety instrumented systems has resulted in the creation of more complex systems. Furthermore, the use of these systems has increased in the oil and gas, chemicals, and power industries because they help monitor usage hours, different aspects of boiler management, stack temperature, boiler, and fuel efficiency, all of which are important in this business.

- Moreover, at the 2020 National People's Congress, the CCP announced that in addition to doubling down on its Made in China 2025 and China Standards 2035 initiatives, it might spend approximately USD 1.4 trillion on a digital infrastructure public spending program. China's New Infrastructure initiative presents exciting opportunities for global companies. Owing to the same, the number of SIS equipment adopters in different sectors, such as new energy vehicles, oil and gas, 5G equipment, logistics, and energy and power, is expected to grow, providing a boost to the growth of the market in the region.

Safety Instrumented System Industry Overview

The Global Safety Instrumented Systems Market is moderately competitive with several major players like Siemens AG, ABB Ltd., Schneider Electric SE, etc. In terms of market share, few significant players currently dominate the market. With a prominent share in the market, these major players are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. The competition, rapid technological advancements, and frequent changes in consumer preferences are expected to threaten the market's growth of the companies during the forecast period.

- January 2021 - ABB Ltd. Launched ABB Ability Safety Plus for hoists, the first fully SIL 3 certified mine hoist solutions with the highest level of safety. It includes include Safety Plus Hoist Monitor (SPHM), Safety Plus Hoist Protector (SPHP), and Safety Plus Brake System (SPBS), including Safety Brake Hydraulics (SBH). It has been designed in accordance with the international 'safety of machinery' standard IEC62061.

- February 2021 - Yokogawa Electric Corporation announced the addition of new turbidity detectors, chlorine sensor units, and liquid analyzers lineup in its product portfolio for water treatment facilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.1.1 Threat of New Entrants

- 4.1.2 Bargaining Power of Buyers

- 4.1.3 Bargaining Power of Suppliers

- 4.1.4 Threat of Substitute Products

- 4.1.5 Intensity of Competitive Rivalry

- 4.2 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Regulatory Environment in the Industry

- 5.1.2 Presence of Robust SIS Service Ecosystem

- 5.2 Market Restraints

- 5.2.1 Operational Complexity Coupled with High Maintenance Costs

6 Market SEGMENTATION

- 6.1 By Application

- 6.1.1 Emergency Shutdown Systems (ESD)

- 6.1.2 Fire and Gas Monitoring and Control (F&GC)

- 6.1.3 High Integrity Pressure Protection Systems (HIPPS)

- 6.1.4 Burner Management Systems (BMS)

- 6.1.5 Turbo Machinery Control

- 6.1.6 Other Applications

- 6.2 By End-User

- 6.2.1 Chemicals and Petrochemicals

- 6.2.2 Power Generation

- 6.2.3 Pharmaceutical

- 6.2.4 Food and Beverage

- 6.2.5 Oil and Gas

- 6.2.6 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Emerson Electric Company

- 7.1.3 Honeywell International Inc.

- 7.1.4 Yokogawa Electric Corporation

- 7.1.5 ABB Ltd

- 7.1.6 Schneider Electric SE

- 7.1.7 Siemens AG

- 7.1.8 HIMA Paul Hildebrandt GmbH

- 7.1.9 SIS-TECH Solutions LP

- 7.1.10 Schlumberger Limited