|

市場調查報告書

商品編碼

1433475

陶瓷墨水:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Ceramic Inks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

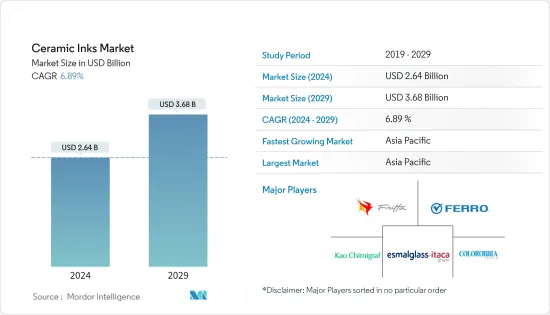

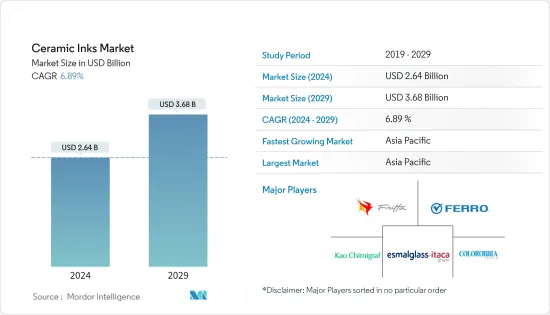

陶瓷墨水市場規模預計2024年為26.4億美元,預計到2029年將達到36.8億美元,在預測期內(2024-2029年)成長6.89%,預計將以複合年成長率成長。

COVID-19 大流行對市場產生了負面影響。這是由於封鎖和限制措施導致製造設施和工廠關閉。供應鏈和運輸中斷造成了進一步的市場瓶頸。然而,隨著所研究市場的需求復甦,該產業在 2021 年出現復甦。

主要亮點

- 從短期來看,對裝飾玻璃和瓷磚的需求不斷增加是推動所研究市場成長的一些因素。

- 相反,從類比技術過渡到數位技術的高成本可能會阻礙市場成長。

- 然而,數位印刷的技術進步預計很快就會成為市場機會。

- 預計亞太地區在預測期內將主導全球陶瓷油墨市場。

陶瓷油墨市場趨勢

瓷磚是成長最快的細分市場

- 陶瓷油墨市場中成長最快的應用是瓷磚。為了滿足客戶的功能需求,必須提高建築的美觀。

- 瓷磚因其高耐用性、耐磨性和色彩持久性等特性而成為最受歡迎的材料。

- 過去幾年,世界各地對瓷磚的需求不斷成長,導致住宅建築支出大幅增加。例如,根據土木工程師協會(ICE)的一項研究,到2030年,全球建築業預計將達到8兆美元,主要由中國、印度和美國推動。因此,不斷成長的建設產業包括對瓷磚的需求上升,預計未來幾年將進一步增加對陶瓷油墨市場的需求。

- 預計印度仍將是亞太地區成長最快的二十國集團經濟體。印度政府宣布三年(2023-2025年)基礎建設投資目標為3,765億美元,其中1,205億美元用於發展27個產業叢集,753億美元用於公路、鐵路和港口互聯互通計劃。

- 此外,沙烏地阿拉伯正在進行許多商業計劃,這可能會導致建造更多商業建築。紅海計劃的第一階段,耗資5000億美元的未來特大城市Neom計劃,預計於2025年完工,將建設14家豪華和超豪華酒店,共3000間客房,分佈在五個島嶼和兩個內陸度假村。 。度假村包括 Qiddiya 娛樂城、超豪華健康目的地 Amara 以及位於埃爾奧拉的 Jean Nouvel 的 Sharan 度假村。因此,商業建設投資的增加預計將為陶瓷油墨市場創造上行需求。

- 由於生活方式趨勢的改變和人口收入的增加,這些瓷磚在市場上獲得了巨大的需求,特別是在新興經濟體。因此,與其他地板材料和牆壁裝飾選擇相比,消費者現在更喜歡瓷磚。

- 預計這將在預測期內推動陶瓷油墨的需求。

亞太地區可望引領陶瓷油墨市場

- 亞太地區主導了全球市場佔有率。由於印度、中國、菲律賓、越南和印尼等國家對住宅和商業建築的投資不斷增加,陶瓷油墨市場預計在未來幾年將成長。

- 中國龐大的建築業創造了對陶瓷油墨的巨大需求。此外,過去幾年,中國一直是全球基礎設施建設的主要投資者和重要貢獻者之一。例如,根據國家統計局(NBS)的數據,2022年中國建築業產值將達到27.63兆元人民幣(41.08581億美元),比2021年增加6.6%。

- 此外,由於政府的支持和舉措,印度的住宅產業正在崛起,需求進一步增加。據印度品牌股權基金會(IBEF)稱,住房與城市發展部(MoHUA)已在2022-2023年預算中撥出98億日元用於建造住宅並設立基金以完成停滯的計劃。我們已撥款5000萬美元。

- 印度的食品印刷業擁有一個巨大的市場,其中包括食品儲存和運輸的包裝。陶瓷油墨廣泛應用於食品容器印刷、玻璃印刷等。例如,根據印度品牌資產基金會(IBEF)的數據,印度食品加工業在過去五年中成長迅速,年平均成長率為8.3%。

- 此外,食品加工市場預計到2023年將產生9,630億美元的收益,預計2023-2027年市場複合年成長率為7.23%。因此,這預計將為食品包裝陶瓷油墨市場創造向上的需求。

- 因此,隨著各個應用領域的需求不斷增加,預計該地區陶瓷油墨市場在預測期內將進一步成長。

陶瓷油墨產業概況

陶瓷油墨市場本質上是分散的。市場的主要企業(排名不分先後)包括 Ferro Corporation、FRITTA、Colorobbia Italia SpA、Kao Chimigraf 和 Esmalglass-Itaca Grupo。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 裝飾玻璃和瓷磚的需求增加

- 建築業快速成長

- 市場限制因素

- 從類比技術過渡到數位技術帶來的高成本

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:以金額為準)

- 產品類別

- 功能性油墨

- 裝飾油墨

- 印刷技術

- 數位印刷

- 類比印刷

- 目的

- 磁磚

- 住宅

- 非住宅

- 玻璃印刷

- 食品容器印刷

- 其他用途

- 磁磚

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- Colorobbia Italia SpA

- Esmalglass-Itaca Grupo

- Ferro Corporation

- FRITTA

- INKCID

- Kao Chimigraf

- Rex-Tone Industries Ltd

- Sicer SPA

- Sun Chemical

- TECGLASS

- Torrecid

- ZSCHIMMER & SCHWARZ CHEMIE GMBH

第7章 市場機會及未來趨勢

- 數位印刷方法的技術進步

- 其他機會

The Ceramic Inks Market size is estimated at USD 2.64 billion in 2024, and is expected to reach USD 3.68 billion by 2029, growing at a CAGR of 6.89% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. It was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increasing demand for decorative glass and tiles are some factors driving the studied market's growth.

- Conversely, high-cost involvement in shifting from analog to digital technology will likely hinder the market's growth.

- However, technological advancements in digital printing are projected to act as an opportunity for the market shortly.

- Asia-Pacific is expected to dominate the global ceramic ink market during the forecast period.

Ceramic Inks Market Trends

Ceramic Tiles is the Fastest Growing Segment

- The fastest-growing application of the ceramic ink market is ceramic tiles. There is a need to improve the aesthetics of buildings to address the functional requirement of the customers.

- Ceramic tiles became the most popular materials that are being used, owing to properties such as high durability, resistance to wear, color permanence, etc.

- Over the past few years, there is a significant increase in residential construction spending, owing to which there is a rise in the demand for ceramic tiles across the globe. For instance, according to a study by the Institution of Civil Engineers (ICE), the global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by China, India, and the United States. Therefore, the growing construction industry is expected to include an upside demand for ceramic tiles which further will boost the demand for ceramic inks market in the coming years.

- India is anticipated to remain the fastest-growing G20 economy in the Asia-Pacific region. The Indian government announced a target of USD 376.5 billion in infrastructure investment over three years (2023-2025), including USD 120.5 billion for developing 27 industrial clusters and USD 75.3 billion for road, railway, and port connectivity projects.

- Furthermore, Saudi Arabia is working on many commercial projects, likely leading to more commercial buildings. The USD 500 billion futuristic mega-city "Neom" project, the Red Sea Project - Phase 1, is expected to be completed by 2025 and includes 14 luxury and hyper-luxury hotels with 3,000 rooms spread across five islands and two inland resorts. The resorts include Qiddiya Entertainment City, Amaala - the uber-luxury wellness tourism destination, and Jean Nouvel's Sharaan resort in Al-Ula. Therefore, increasing investments in commercial constructions is expected to create an upside demand for the ceramic inks market.

- These ceramic tiles gained huge demand in the market, especially in developing economies with the changing lifestyle trend and increasing population income. As a result of this, consumers are preferring ceramic tiles over other flooring and wall decoration options.

- It, in turn, is expected to drive the demand for ceramic inks over the forecast period.

The Asia-Pacific Region is Expected to Lead the Ceramic Inks Market

- The Asia-Pacific region dominated the global market share. With growing investments in residential and commercial construction in the countries such as India, China, the Philippines, Vietnam, and Indonesia, the market for ceramic inks is expected to grow in the coming years.

- China's massive construction sector generated significant demand for ceramic inks. Moreover, China is a huge contributor, as it is one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to CNY 27.63 trillion (USD 4108.581 billion), an increase of 6.6% compared with 2021.

- Moreover, the residential sector in India is on an increasing trend, with government support and initiatives further boosting the demand. According to the India Brand Equity Foundation (IBEF), the Ministry of Housing and Urban Development (MoHUA) allocated USD 9.85 billion in the 2022-2023 budget to construct houses and create funds to complete the halted projects.

- The food printing sector in India includes a large market that involves packaging for the storage and transportation of food. Ceramic inks are widely used in food container printing, glass printing, etc. For instance, according to India Brand Equity Foundation (IBEF), the Indian food processing industry grew rapidly, with an average annual growth rate of 8.3% in the past 5 years.

- Moreover, in 2023, the food-processing market will generate USD 963 billion in revenue, and the market is anticipated to expand at a CAGR of 7.23% between 2023-2027. Therefore, this is expected to create an upside demand for the Ceramic inks market from food packaging.

- Hence, with the increasing demand from the various application segments, the ceramic inks market is expected to grow more in the region during the forecast period.

Ceramic Inks Industry Overview

The Ceramic Inks Market is fragmented in nature. The major players in this market (not in a particular order) include Ferro Corporation, FRITTA, Colorobbia Italia SpA, Kao Chimigraf, and Esmalglass-Itaca Grupo.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Decorative Glass and Tiles

- 4.1.2 Rapid Growth in the Construction Sector

- 4.2 Market Restraints

- 4.2.1 High-cost Involvement in Shifting of Analog Technology to Digital Technology

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Functional Inks

- 5.1.2 Decorative Inks

- 5.2 Printing Technology

- 5.2.1 Digital Printing

- 5.2.2 Analog Printing

- 5.3 Application

- 5.3.1 Ceramic Tiles

- 5.3.1.1 Residential

- 5.3.1.2 Non-residential

- 5.3.2 Glass Printing

- 5.3.3 Food Container Printing

- 5.3.4 Other Applications

- 5.3.1 Ceramic Tiles

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Colorobbia Italia SpA

- 6.4.2 Esmalglass - Itaca Grupo

- 6.4.3 Ferro Corporation

- 6.4.4 FRITTA

- 6.4.5 INKCID

- 6.4.6 Kao Chimigraf

- 6.4.7 Rex-Tone Industries Ltd

- 6.4.8 Sicer S.P.A.

- 6.4.9 Sun Chemical

- 6.4.10 TECGLASS

- 6.4.11 Torrecid

- 6.4.12 ZSCHIMMER & SCHWARZ CHEMIE GMBH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Digital Printing Methods

- 7.2 Other Opportunities