|

市場調查報告書

商品編碼

1433010

小袋包裝:市場佔有率分析、產業趨勢、資料、成長預測(2024-2029)Pouch Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

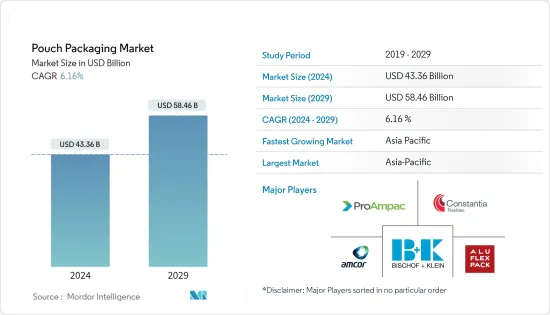

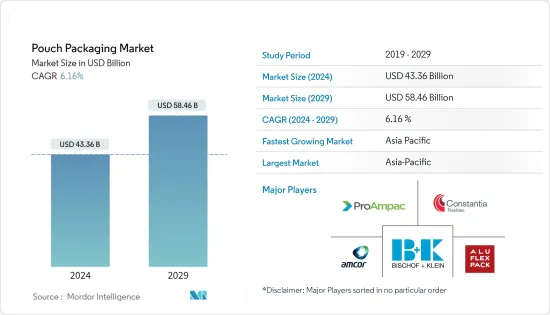

預計2024年小袋包裝市場規模為433.6億美元,預計2029年將達到584.6億美元,在預測期內(2024-2029年)複合年成長率為6.16%。

主要亮點

- 袋是食品和飲料行業中使用最廣泛的包裝產品之一,包括寵物食品、嬰兒食品和液體包裝(茶、咖啡、果汁)。這是因為它們具有多種特性,包括易於打開(例如撕裂凹口和雷射穿孔)、易於使用(拉鍊和形狀)和可重新密封性。此外,它具有化學惰性,使其廣泛應用於多種行業,包括藥物、寵物食品和化妝品。

- 西方國家冷凍包裝產業的成長預計將對市場產生積極影響。例如,根據歐洲冷凍食品的數據,德國、法國和英國佔了歐洲冷凍食品市場50%以上的佔有率。政府因 COVID-19 大流行而實施的封鎖對市場產生了積極影響,有助於許多地區的冷凍食品銷售。

- 市場擴張的關鍵因素包括對包裝食品和食品和飲料的需求不斷成長、對即食 (RTE)食品日益成長的興趣、袋裝食品的易用性和可負擔性。此外,對隨身攜帶零食的需求不斷增加,也增加了對為消費者提供便利的可重新封閉的自立袋的需求。消費者生活方式和食品偏好的變化以及食品技術的變化也在推動市場需求。

- 然而,消費者對環境問題意識的增強、不斷變化的監管標準、對永續性的持續推動(包括用生物分解性材料取代塑膠包裝產品)以及缺乏先進的回收設施促使回收率提高。這些都是阻礙回收率提高的因素。市場成長。

- 袋包裝比硬質運輸包裝便宜得多,重量也輕。據軟包裝協會 (FPA) 稱,製造方法的進步和材料創新使一些軟包裝的重量減輕了近 50%。此外,袋包裝可以節省空間,這意味著可以使用更少的燃料和能源來運輸更多的產品。

- COVID-19 大流行對小袋包裝銷售產生了多種影響。疫情導致全球許多地區的袋包裝製造商面臨供應鏈中斷和產量減少的情況。然而,對醫療和保健用品的需求不斷成長預計將對袋包裝市場產生積極影響。

自立袋包裝市場趨勢

對簡便食品和已調理食品的需求增加

- 滿足消費者對便利性的需求是現有和新型包裝技術的關鍵驅動力。包裝產業正在經歷一場根本性的轉變,開始注重品牌體驗。舒適性的需求也是改變的關鍵驅動力。軟包裝,尤其是袋包裝,由於其對消費者和製造商的便利性而得到大力推廣。因此,軟包裝形式被認為是建立品牌忠誠度的資產。消費者喜歡將產品從軟質包裝中擠壓出來以節省空間並重新密封產品以依照自己的步調調整產品消費的能力。

- 從剛性包裝轉向軟質包裝以利用便利包裝並適應不斷變化的生活方式的總體趨勢是由越來越多的小家庭和日益成長的單一服務選擇推動的。隨著單身家庭數量的增加,大多數消費者(尤其是年輕人)傾向於頻繁購買少量食品雜貨,以便隨身攜帶自己喜歡的產品。派對大小的食品袋現在已成為過去。

- 美洲和歐洲地區消費者生活方式的變化也增加了對已調理食品的需求。已調理食品的需求從未如此強烈。全天候工作的新時代勞動力和尋找簡便食品的一代已經成為已調理食品的最佳解決方案。

- 世界日益都市化強調了包裝的便利性和永續性。需要便利包裝的最終用戶(例如生鮮食品、已調理食品、即食食品、咖啡等)的健康成長預計將推動袋包裝的製造需求。據印度經濟顧問辦公室稱,2022會計年度,印度加工和已調理食品批發價格指數突破137。過去十年,印度的物價指數普遍上漲。

- 零嘴零食、肉品、泡麵、米等簡便食品的需求量大。食品和飲料支出的增加、對健康食品的認知提高、用餐模式和飲食習慣的變化以及社會和經濟變量的變化都促使了對快餐的渴望增加。據韓國產業通商資源部稱,2023年1月韓國便利商店即時加工食品月銷售額與去年同月相比成長了14.6%。

亞太地區將經歷最快的成長

- 該市場是由越來越多的中國客戶推動的,他們主要喜歡蒸餾包裝的產品以保持貨架穩定性,例如魚、肉和蔬菜。此外,中國消費者也越來越習慣家常小菜。

- 由於食品、藥品/醫療、個人護理和家庭護理等最終用戶行業的需求快速成長,中國在預測期內可能會對軟包裝產品產生巨大需求。儘管該國擁有龐大的包裝基地,但由於其低成本和眾多的產品優勢,軟包裝在所有型態的包裝中經歷了最快和最顯著的成長。

- 此外,印度對乳製品產業也做出了巨大貢獻。由於一次性塑膠受到嚴格限制,市場相關人員在開發生物分解性和可重複使用的袋子方面具有巨大潛力。永續包裝還包括可重複使用的材料,例如由生質乙醇製成的聚乙烯、聚乳酸、微纖化纖維素和生物分解性材料。

- 軟包裝袋,特別自立袋,是在該國不斷擴大的食品行業中迅速發展的包裝類型。客戶和供應商都立即喜歡這種類型的包裝。現今忙碌的消費者正在尋找簡單、輕巧、便於攜帶的零食包裝。因此,從食品包裝的趨勢來看,更緊湊、更小的包裝尺寸很快就變得流行,尤其是那些具有可重新閉合功能(如拉鍊)的包裝。

- 越來越多使用袋包裝的替代包裝選項限制了產品在市場上的擴張。由於包裝食品需求激增、可支配收入增加以及職業女性數量增加,預計印度將在亞太地區包裝行業中佔據重要佔有率。

- 2022 年 8 月,致力於提高人們對塑膠廢棄物危險性認知的印度青年協會 (IYFS) 發起了一項收集奶袋的新措施。 VS Krishna 學院特別重視收集奶袋。該組織表示,該組織收集並回收了這些袋子。 IYFS 與大剪切機市政公司合作,在垃圾場建立了回收站。 IYFS 辦公室可以輕鬆處理不需要的奶袋和塑膠。

自袋包裝產業概況

由於全球存在多個市場參與者,小袋包裝市場呈現零碎化。主要參與者包括 Bischof+Klein SE &Co.KG、Amcor Limited、Aluflexpack Group、ProAmpac Intermediate 和 Constantia Flexibles Group GmbH。市場參與者預計將採取創新措施,利用多個最終用戶垂直領域成長所帶來的機遇,並擴大其在市場中的影響力。

2022年9月,Amcor對基於數位化的ePacFlexible Packaging(自稱在印刷技術方面具有優勢的自立袋、平鋪袋和捲材製造商)進行了4500萬美元的戰略投資,並收購了ePacHoldings LLC的少數股權.宣布增持持股比率.

2022 年 7 月,Mondi 宣布投資擴大其永續寵物食品包裝解決方案。 Mondi 宣布計劃投資約 6,500 萬歐元(7,142 萬美元)在歐洲建造三個消費性軟包裝工廠,以提高產能並滿足客戶對永續寵物食品包裝解決方案的需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 對具有成本效益的包裝解決方案和品牌提升的需求不斷成長

- 對方便即食食品的需求不斷成長

- 市場限制因素

- 日益嚴重的環境問題與回收

第6章市場區隔

- 依類型

- 標準

- 無菌的

- 蒸餾

- 熱填充

- 依閉合類型

- 拉鍊

- 噴口

- 撕裂缺口

- 依最終用戶產業

- 食品和飲料

- 個人護理

- 衛生保健

- 其他最終用戶產業

- 依地區

- 北美洲

- 美國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Amcor PLC

- Bischof+Klein SE & Co. KG

- Aluflexpack AG

- ProAmpac Intermediate Inc.

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- FLAIR Flexible Packaging Corporation

- Gualapack SpA

- Hood Packaging Corporation

- Mondi PLC

- Scholle IPN

- Sealed Air Corporation

- Sonoco Products Company

- Toppan Inc.

- TOYO SEIHAN CO LTD(Toyo Seikan Group Holdings Ltd.)

- Huhtamaki Flexible Packaging

- Glenroy Inc.

- Uflex Limited

- KM Packaging Services Ltd.

- Eagle Flexible Packaging

第8章投資分析

第9章市場的未來

The Pouch Packaging Market size is estimated at USD 43.36 billion in 2024, and is expected to reach USD 58.46 billion by 2029, growing at a CAGR of 6.16% during the forecast period (2024-2029).

Key Highlights

- Pouches are among the most widely used packaging products in the food and beverage industry, including pet food, baby food, and liquid packaging (tea, coffee, and juices) owing to their different features, including an easy opening (like a tear notch and laser perforation), easy to use (with zippers and shapes) and being reclosable. Moreover, as they are chemically inert, they are widely used in different industries, such as pharmaceuticals, pet food, and cosmetics.

- The growth of the frozen packaged industry across European and American countries is expected to impact the market positively. For instance, according to Frozen Food Europe, Germany, France, and the United Kingdom account for more than 50% of the frozen food market in Europe. The government-mandated lockdown due to the COVID-19 pandemic aided the sales of frozen foods in many regions and impacted the market positively.

- The key market expansion drivers include increased demand for packaged foods and beverages, expanding interest in ready-to-eat (RTE) food, ease of use, and affordability of pouches. In addition, the rise in the demand for on-the-go snacks led to the need for re-closable stand-up pouches as they offer convenience to consumers. The changing lifestyle and food preferences among consumers and changing food technology also boost the market demand.

- However, the growing consumer awareness about environmental concerns, dynamic regulatory standards, the ongoing drive for sustainability that includes replacing plastic-based packaging products with biodegradable materials, and poor recycling rate due to the lack of advanced recycling facilities are some factors challenging the market's growth.

- Pouch packing is significantly less expensive and lower in weight than rigid packaging for transportation. According to the Flexible Packaging Association (FPA), advancements in manufacturing methods and material innovation have reduced the weight of some flexible packaging by nearly 50%. Furthermore, pouch packaging allows for space savings, which implies that large quantities of products can be shipped with less fuel and energy.

- The COVID-19 pandemic had a mixed influence on pouch packaging sales. Due to the outbreak, pouch packaging manufacturers faced supply chain disruptions and decreased manufacturing in many parts of the world. However, the increasing demand for medical and healthcare supplies was expected to positively affect the pouch packaging market.

Pouch Packaging Market Trends

Increasing Demand for Convenience and Ready-to-eat Food

- Meeting consumer demands for convenience is a significant driver for existing and new packaging technologies. The packaging industry has been experiencing fundamental shifts focused on brand experience. Demand for comfort is also a key driver of change. There is a considerable push for flexible packaging, especially pouches, owing to its convenience for consumers and manufacturers. Therefore, flexible packaging formats are recognized as an asset in building brand loyalty. Consumers like the ability to squish or squeeze out products from a flexible package to save space and prefer resealing products to regulate product consumption at their own pace.

- The general trend of shifting from rigid to flexible packaging to avail the benefits of convenience packaging and fit the changing lifestyles, along with the growing number of smaller households, is increasing the need for single-serve options. In line with the growth in the number of single-person households, most consumers (especially the youth) are inclined to frequent shopping for groceries in smaller quantities as they can carry their favorite products with them wherever they move to convenience. Party-size bags of food items have been an old norm as smaller or individual-sized pouches allow consumers to feel more likely in control of portion sizes.

- The changing lifestyle of the consumer in the American and European regions also increased demand for ready-to-eat foods. The need for ready-to-eat food is at an all-time high. With the new age working population working round the clock and the gen-z looking for everything handy, ready-to-eat foods have emerged as the best solution.

- The increasing rate of urbanization worldwide has resulted in a higher focus on convenience and sustainability in packaging. The healthy growth of end users, such as fresh food, ready-to-eat food, ready-to-food, and coffee that require convenient packaging, is projected to drive the need for producing pouch packaging. According to the Office of Economic Adviser (India), during the fiscal year 2022, India's Wholesale Price Index of processed ready-to-eat meals exceeded 137. Since the past decade, the country has witnessed an overall increase in the price index.

- Convenience meals such as snacks, meat products, quick noodles, rice, and other items are in high demand. Higher food and beverage expenditure, more awareness of healthier foods, changes in meal patterns and eating habits, and shifting social and economic variables are all contributing causes to the increased desire for quick foods. According to the South Korean Ministry of Trade, Industry, and Energy, the year-on-year growth of processed instant food sales at convenience stores each month in South Korea increased by 14.6% in January 2023 compared to the previous month.

Asia-Pacific to Witness the Fastest Growth

- The market is being driven by Chinese customers' growing preference for mostly retort-packed goods to maintain their shelf stability, including fish, meat, and vegetables. Additionally, the nation's customers are becoming increasingly accustomed to ready-made meals.

- China will likely experience a considerable demand for flexible packaging goods during the forecast period due to the rapid development in demand from end-user sectors like food, pharmaceutical and medical, personal care, and domestic care. Despite the country having a sizable basis for packaging, flexible packaging had the quickest and most significant growth among all forms of packaging due to its low cost and numerous product benefits.

- Moreover, India made a significant contribution to the dairy industry. Due to strict limits on single-use plastics, market players have considerable potential to develop biodegradable and reusable pouches. Reusable materials such as polyethylene made from bioethanol, polylactic acid, micro-fibrillated cellulose, and biodegradable materials are also included in sustainable packaging.

- Flexible pouches, particularly stand-up pouches, are the packaging types expanding rapidly in the expanding food business in the country. Customers and suppliers alike love this kind of packaging right away. Consumers nowadays who lead hectic lives seek simple, lightweight snack packaging that is portable. Because of this, trends in food packaging show that more compact, smaller package sizes are popular right away, especially when they have recloseable features like zippers.

- A rise in the use of alternative packaging options for pouch packaging is constraining the market's expansion of products. Due to the rapidly increasing demand for packaged food goods, an increase in disposable income, and the number of working women in the country, India is predicted to hold a significant share of the Asia-Pacific packing industry.

- In August 2022, the India Youth For Society (IYFS), a committed group raising awareness about plastic waste's dangers, launched a new initiative to collect milk pouches. At Dr. V.S. Krishna Degree College, a particular push to collect these pouches got underway. According to the organization, the group gathers pouch bags for recycling. In collaboration with the Greater Visakhapatnam Municipal Corporation, the IYFS set up a recycling operation at the dump. The IYFS office is convenient for disposing of unwanted milk pouches and plastic.

Pouch Packaging Industry Overview

The Pouch Packaging market is fragmented due to the presence of several market players globally. Some major players are Bischof + Klein SE & Co. KG, Amcor Limited, Aluflexpack Group, ProAmpac Intermediate, and Constantia Flexibles Group GmbH. The market players are expected to leverage the opportunity posed by the growth of several end-user verticals and are innovating to expand their market presence.

In September 2022, Amcor announced a strategic investment of USD 45 million in the digitally-based ePacFlexible Packaging (manufacturers of stand-up pouches, lay flat pouches, and roll stock, with a self-claimed advantage in print technology) to increase its minority shareholding in ePacHoldings LLC.

In July 2022, Mondi announced an investment to expand sustainable pet food packaging solutions. Mondi announced plans to invest nearly EUR 65 million (USD 71.42 million) in three consumer flexible packaging plants in Europe to increase production capacity and meet customer demand for sustainable pet food packaging solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Requirements for Cost-effective Packaging Solutions and Brand Enhancement

- 5.1.2 Increasing Demand for Convenience and Ready-to-eat Food

- 5.2 Market Restraints

- 5.2.1 Growing Environmental Concerns and Recycling

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Standard

- 6.1.2 Aseptic

- 6.1.3 Retort

- 6.1.4 Hot-fill

- 6.2 By Closure Type

- 6.2.1 Zipper

- 6.2.2 Spout

- 6.2.3 Tear Notch

- 6.3 By End-user Industry

- 6.3.1 Food and Beverage

- 6.3.2 Personal Care

- 6.3.3 Health Care

- 6.3.4 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Bischof + Klein SE & Co. KG

- 7.1.3 Aluflexpack AG

- 7.1.4 ProAmpac Intermediate Inc.

- 7.1.5 Constantia Flexibles Group GmbH

- 7.1.6 Coveris Management GmbH

- 7.1.7 FLAIR Flexible Packaging Corporation

- 7.1.8 Gualapack SpA

- 7.1.9 Hood Packaging Corporation

- 7.1.10 Mondi PLC

- 7.1.11 Scholle IPN

- 7.1.12 Sealed Air Corporation

- 7.1.13 Sonoco Products Company

- 7.1.14 Toppan Inc.

- 7.1.15 TOYO SEIHAN CO LTD (Toyo Seikan Group Holdings Ltd.)

- 7.1.16 Huhtamaki Flexible Packaging

- 7.1.17 Glenroy Inc.

- 7.1.18 Uflex Limited

- 7.1.19 KM Packaging Services Ltd.

- 7.1.20 Eagle Flexible Packaging