|

市場調查報告書

商品編碼

1273510

金槍魚和藻類 Omega-3 成分市場 - 增長、趨勢和預測 (2023-2028)Tuna and Algae Omega-3 Ingredient Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

未來五年,金槍魚和藻類 omega-3 成分市場預計將以 14.03% 的複合年增長率增長。

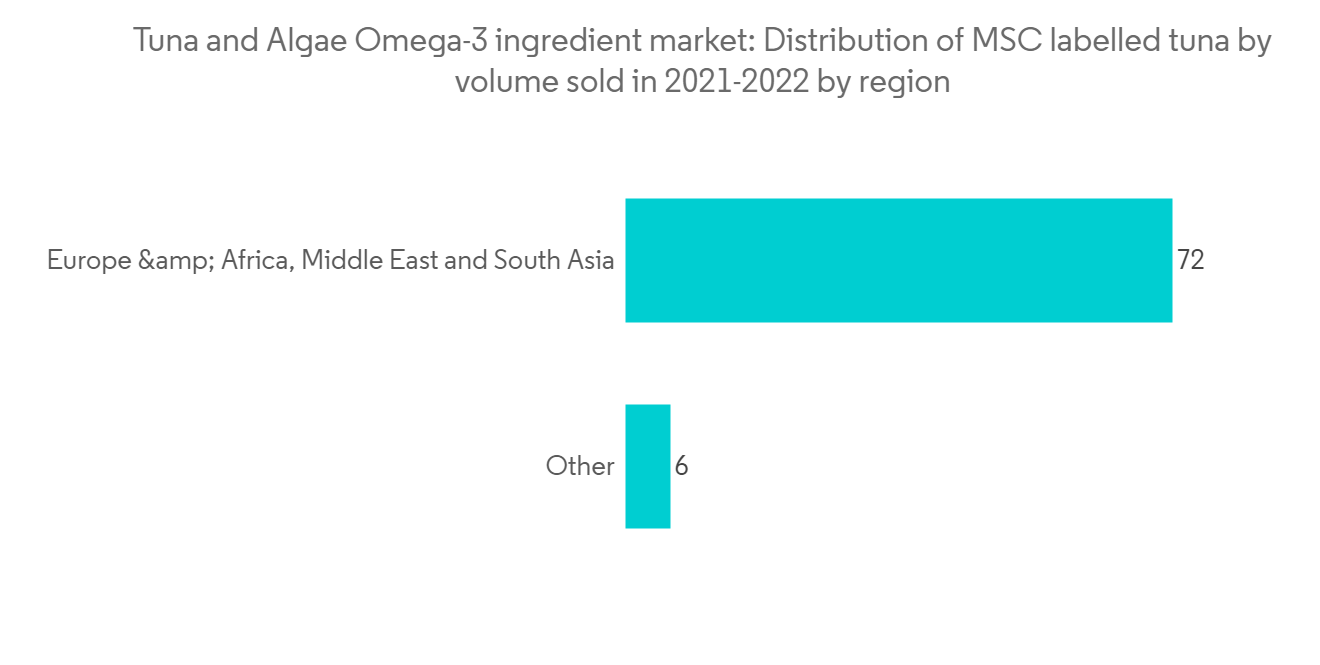

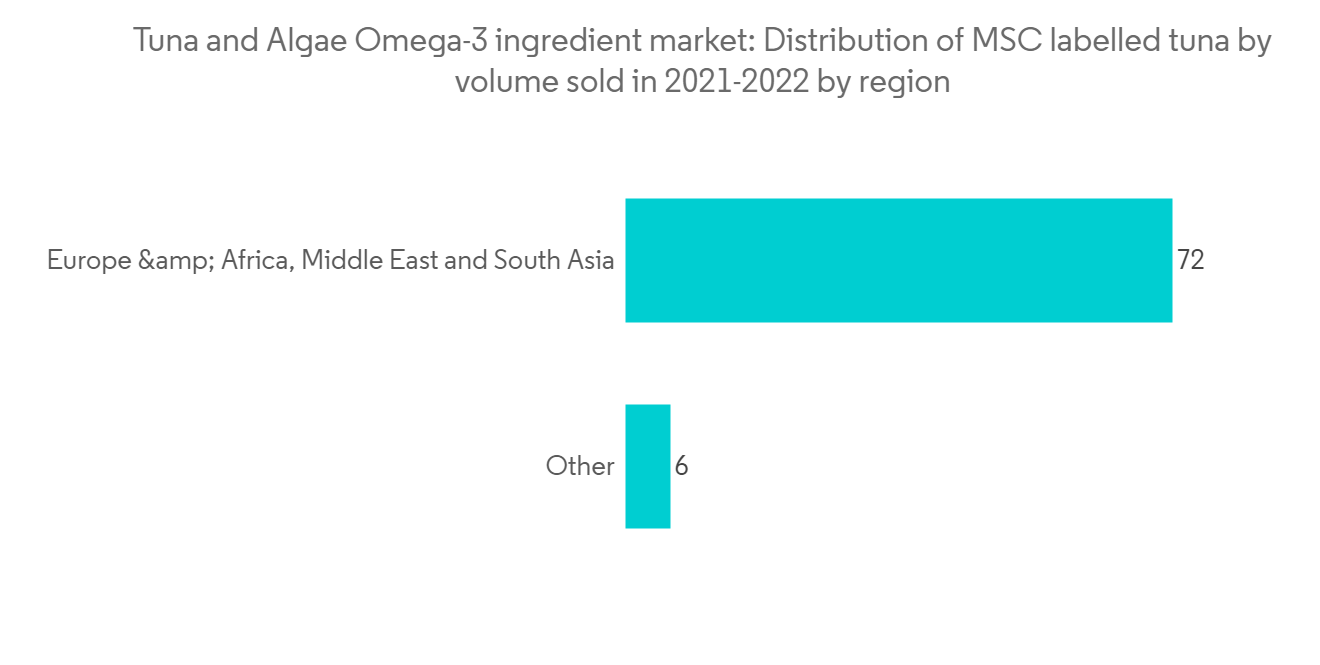

人們認識到 omega-3 脂肪酸(魚油是其中的主要來源)對健康的益處,這推動了對金槍魚 omega-3 成分的需求。 金槍魚魚油 omega-3 市場正在中國、日本、西班牙和意大利等新興的全球原料熱點地區。 水產養殖業在世界各地蓬勃發展,預計這一推動力將進一步推動魚油 omega-3 產業的整體增長。 據海洋管理委員會稱,2021年和2022年MSC認證的漁獲量和MSC認證的金槍魚漁業數量將繼續增加。 到 2022 年 9 月初,將有 19 個金槍魚漁業獲得 MSC 認證,使總數達到 91 個。

因此,MSC 認證的金槍魚捕撈量從 2021 年 9 月的 198.2 萬噸增加到 2022 年 9 月的 246 萬噸,增長了 24%。 世界上近 50% 的商業金槍魚漁獲物通過了 MSC 認證,進一步推動了市場的發展。 海藻 omega-3 成分具有與魚油相似的功效,且無異味和異味,因此海藻 omega-3 在嬰兒食品強化中的需求不斷增長,對推動整個市場的增長發揮著重要作用。在這裡。 此外,全球各個年齡段對強化食品的需求激增也推動了金槍魚和 omega-3 成分的市場。

金槍魚和藻類 omega-3 成分的市場趨勢

消費者在 Omega-3 補充劑產品上的支出增加

在亞太地區、拉丁美洲和非洲等地區,消費者的健康意識和對健康生活方式的興趣不斷增強,導致對 EPA 和 DHA 等成分的需求增加。 此外,吸煙人口比例的增加、心臟相關並發症的發生率和其他與健康相關的問題正在刺激 omega-3 脂肪酸的增長,包括金槍魚和藻類 omega-3 脂肪酸,尤其是在新興經濟體。 製造商和供應商積極參與各個地區的 omega-3 供應鏈。 我們還在戰略上努力減緩與富含 omega-3 的飲食相關的健康益處的信息傳播,這將對發展中地區 omega-3 成分的銷售產生重大而積極的影響。我正在給予

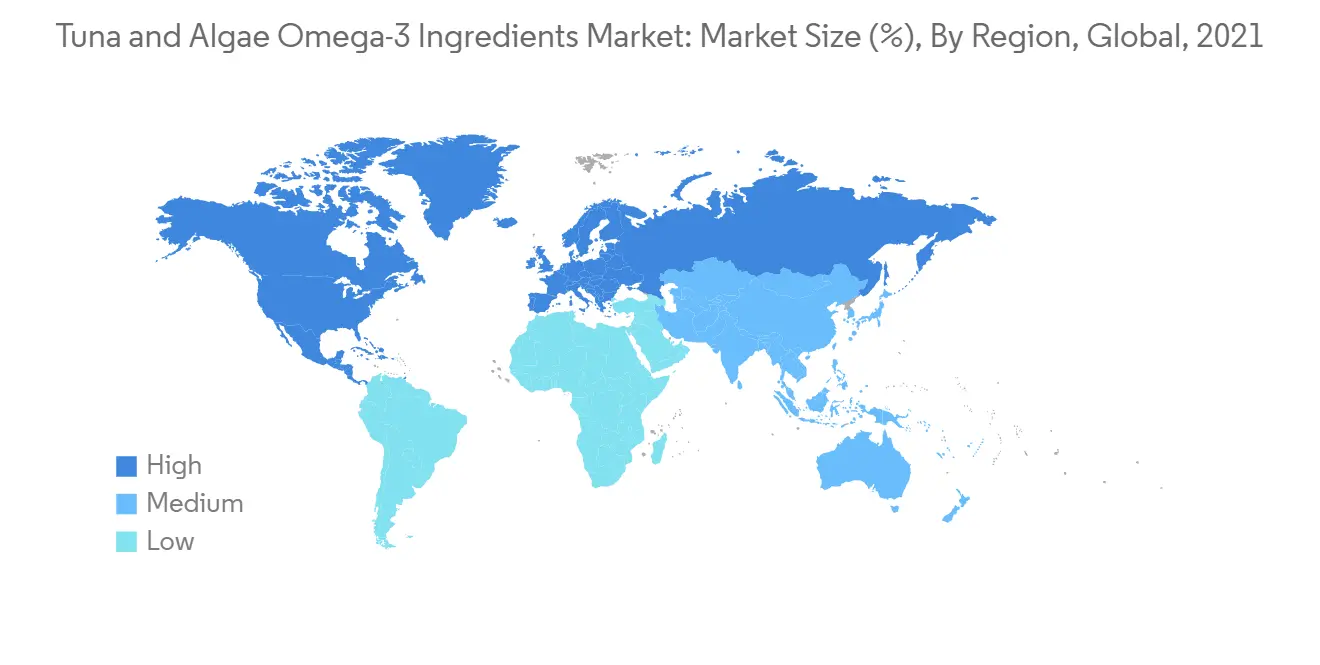

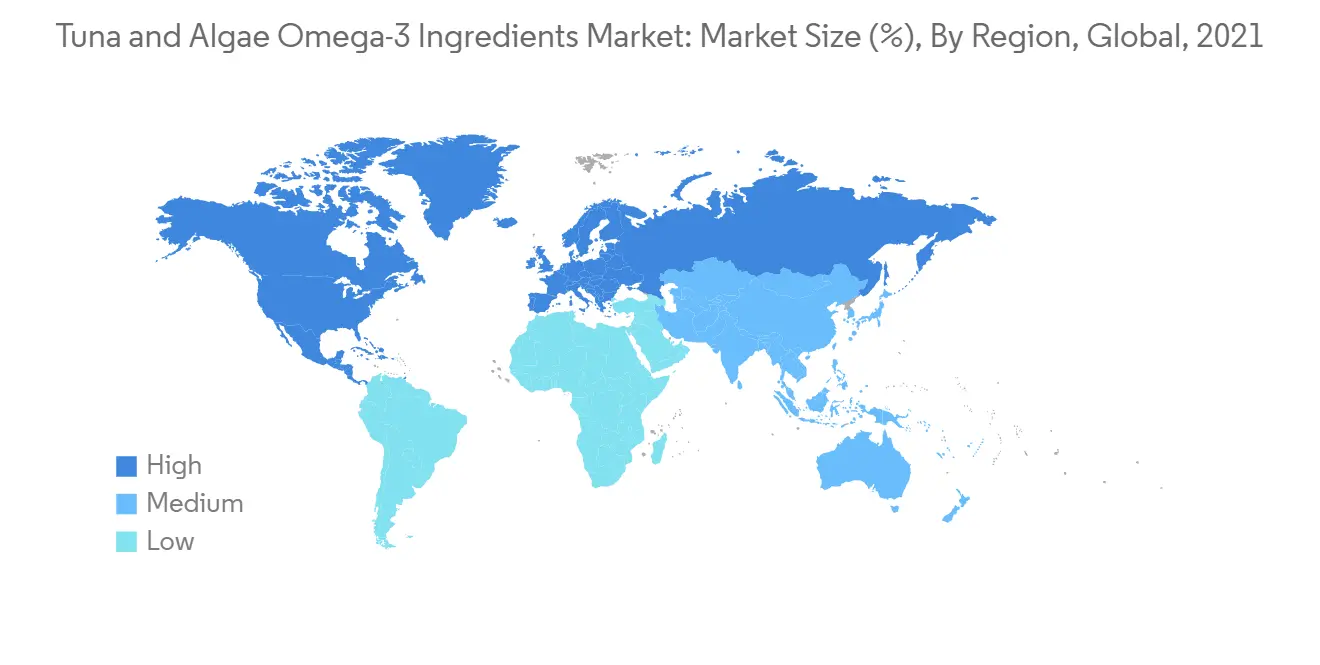

亞太地區成為全球最大的市場

對運動營養的需求不斷增長,個性化營養的機會越來越多,這使得 omega-3 成分在亞太地區成為一個前景廣闊的市場。 此外,隨著中國和日本等國家的老齡化和總人口的增加,對有助於保持大腦健康的補充劑的需求也在增加。 高生育率和中國最近取消的獨生子女政策將推動嬰兒食品行業的發展。 許多公司,如 Pathway International,都與主要成分製造商建立戰略合作夥伴關係,以擴大生產水平和產品線。

金槍魚和藻類 Omega-3 成分行業概覽

全球金槍魚和藻類 omega-3 市場高度分散。 巴斯夫、Neptune Wellness Solutions Inc. 和 Omega Protein Corporation 是全球金槍魚和藻類 omega-3 成分市場上最活躍的參與者。 Neptune Wellness Solutions Inc. 和 Cellana Inc. 等主要參與者正專注於合作夥伴關係和合資企業,以提高各自地區的生產能力和消費者基礎。 此外,參與者正專注於各種研發活動以及技術投資以提高效率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 三個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場驅動因素

- 市場製約因素

- 波特的五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 類型

- 藻類類型

- 濃縮型

- 高濃度

- 中濃度

- 低濃度

- 金槍魚類型

- 生金槍魚油

- 精製金槍魚油

- 藻類類型

- 用法

- 食品和飲料

- 嬰兒配方奶粉

- 強化食品和飲料

- 膳食補充劑

- 醫藥

- 動物營養

- 臨床營養學

- 食品和飲料

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 西班牙

- 英國

- 德國

- 法國

- 意大利

- 俄羅斯

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 南非

- 阿拉伯聯合酋長國

- 其他中東/非洲

- 北美

第六章競爭格局

- 最常採用的策略

- 市場份額分析

- 公司簡介

- Archer Daniels Midland Company

- Koninklijke DSM NV

- Corbion NV

- Lonza

- Bioprocess Algae LLC

- Neptune Wellness Solutions Inc.

- Polaris SA

- BASF SE

- Source-Omega LLC

- AlgaeCytes

第七章市場機會與未來趨勢

第 8 章免責聲明

The tuna and algae omega-3 ingredient market is projected to grow at a CAGR of 14.03% in the next five years.

The perceived health benefits of omega-3 fatty acids, for which fish oil is the primary extraction source, drives the demand for tuna omega-3 ingredients. The tuna fish oil omega-3 market has witnessed emerging global raw material hotspots in China, Japan, Spain, and Italy. There has been a surge in the aquaculture sector around the world, and this boost is expected to provide further impetus to the overall growth of the fish oil omega-3 industry. According to the Marine Stewardship Council, the quantity of MSC-certified catch and the number of MSC-certified tuna fisheries continued to increase in 2021 and 2022. Nineteen tuna fisheries received MSC accreditation at the beginning of September 2022, bringing the total to 91.

This resulted in a 24% rise in the amount of MSC-certified tuna catch, from 1,982,000 tonnes in September 2021 to 2,460,000 in September 2022. Nearly 50% of the commercial tuna catch worldwide has MSC certification, boosting the market further. Algae omega-3 ingredients play a key role in driving the overall market growth due to the growing demand for algae omega-3 in infant food fortification, as it provides benefits similar to fish oil and has no off-odor or taste. Additionally, the surge in demand for fortified foods among various age groups across the globe is driving the tuna and omega-3 ingredients market.

Tuna and Algae Omega-3 Ingredient Market Trends

Increasing Consumer Expenditure on Omega-3 Supplements Products

Growing consumer health awareness and concerns toward a healthy lifestyle, majorly in regions like Asia-Pacific, Latin America, and Africa, are leading to an increased demand for ingredients such as EPA and DHA. Moreover, the increase in the percentage of the smoking population, incidences of heart-related complications, and other health-related issues across the world are fueling the growth of omega-3 ingredients, including tuna and algae omega-3 ingredients, especially in developing economies. Manufacturers and suppliers are actively involved in the supply chain of omega-3 in various regions. They are also making strategic efforts to ensure a gradual flow of information regarding the health benefits associated with omega-3 enriched diets, which has largely and positively affected the sales of omega-3 ingredients in developing regions.

Asia-Pacific Emerges as the Largest Market Globally

Driven by the growing demand for sports nutrition and the increase in opportunities for personalized nutrition, omega-3 ingredients hold a promising future market in Asia-Pacific. Moreover, the increasing aging population in the countries such as China and Japan, with a proportionate rise in the general population, is emerging as one of the key factors leading to the demand for brain health supplements, which, in turn, has led many key players to invest on their research and development activities regarding new innovations in omega-3 supplements. The high birth rate and the recent abolition of the one-child policy in China are slated to boost the infant food industry. Many players, such as Pathway International, are strategically partnering with key ingredient manufacturers to expand the production level or product line.

Tuna and Algae Omega-3 Ingredient Industry Overview

The global tuna and algae omega-3 ingredient market is highly fragmented. BASF, Neptune Wellness Solutions Inc., and Omega Protein Corporation are the most active companies in the global tuna and algae omega-3 ingredients market. Key players, like Neptune Wellness Solutions Inc. and Cellana Inc., are focusing on partnerships and joint ventures to increase their production capabilities and consumer base across various regions. Moreover, players are focusing on investing in technology to increase efficiency as well as various research and development activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Algae Type

- 5.1.1.1 Concentration type

- 5.1.1.1.1 High Concentration

- 5.1.1.1.2 Medium Concentration

- 5.1.1.1.3 Low Concentration

- 5.1.2 Tuna Type

- 5.1.2.1 Crude Tuna Oil

- 5.1.2.2 Refined Tuna Oil

- 5.1.1 Algae Type

- 5.2 Application

- 5.2.1 Food and Beverage

- 5.2.1.1 Infant Formula

- 5.2.1.2 Fortified Food and Beverages

- 5.2.2 Dietary Supplements

- 5.2.3 Pharmaceutical

- 5.2.4 Animal Nutrition

- 5.2.5 Clinical Nutrition

- 5.2.1 Food and Beverage

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Archer Daniels Midland Company

- 6.3.2 Koninklijke DSM NV

- 6.3.3 Corbion NV

- 6.3.4 Lonza

- 6.3.5 Bioprocess Algae LLC

- 6.3.6 Neptune Wellness Solutions Inc.

- 6.3.7 Polaris SA

- 6.3.8 BASF SE

- 6.3.9 Source-Omega LLC

- 6.3.10 AlgaeCytes