|

市場調查報告書

商品編碼

1273417

海上石油和天然氣通信市場 - 增長、趨勢和預測 (2023-2028)Offshore Oil and Gas Communications Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,隨著石油和天然氣行業增加對新技術和數字技術的投資,海上石油和天然氣電信市場的複合年增長率預計為 7.6%。

主要亮點

- 從石油鑽井平台到海上平台,擁有優質的石油和天然氣通信設備對於安全和效率至關重要。良好的通信系統不僅僅是在離岸和在岸企業之間傳輸數據。

- 海上鑽井平台是相對難以設置、操作和維護的設施。必須解決強水流和偏遠地區等環境因素。此外,許多鑽井平台是在深海作業的深水鑽井平台。在這樣的偏遠地區,通信在監控多個組件、與陸上設施通信、報告和提供緊急援助方面發揮著重要作用。

- 今天,各種通信技術單獨或作為一個系統來解決海上通信問題。衛星通信需要 VSAT 用於離岸站點,用於偏遠地區和移動的船隻,並且是與離岸人員交談的最常見方式。海上油田正在使用蜂窩網絡,因為基礎設施需要花錢。

- 然而,數據保護不足、數據傳輸風險、資產安全、網絡攻擊難度等問題將滯後於油氣海事通信行業。油價的波動可能會進一步減緩油田通信行業的增長。維護該程序的高成本將進一步限製油田電信業務的擴展。

- COVID-19 還影響了石油和天然氣行業。每個人都必須適應,無論是被迫休假的人還是必須從根本上重新考慮其長期計劃的公司。公司必須重新考慮他們的長期戰略。對於海上石油鑽井平台,影響更為明顯。COVID-19 大流行擾亂了海上石油鑽井平台的開發和維護。大流行後,隨著公司適應這些新條件、採用新技術和新工作方式,該行業正在擴大。

海上石油和天然氣通信市場趨勢

基於電信的技術進步推動市場增長

- 多年前,海上設施和陸上站點之間的通信僅限於雙向無線電頻道和每日報告。駐紮在海上的油田工人實際上與世界其他地方隔絕了。然而,通信技術的進步改變了離岸行業的工作。

- 微波通信是一種以一米或更短的波長傳輸數據並放置在很近的位置的技術。光纖通信安裝在交通繁忙的地區,例如北海和美國墨西哥灣。

- 技術進步正在改進通信系統,改變海底開採的數量以及偏遠、無人值守的離岸工業的工作方式。石油和天然氣行業越來越容易受到網絡安全威脅,這是油田通信市場的主要增長因素。對基於雲的服務的需求不斷增長以及對採用有效通信技術的更加關注將加劇對油田通信的需求。增加對網絡基礎設施的投資、石油和天然氣行業的擴張和增長將為油田通信市場創造更有利可圖的增長前景。

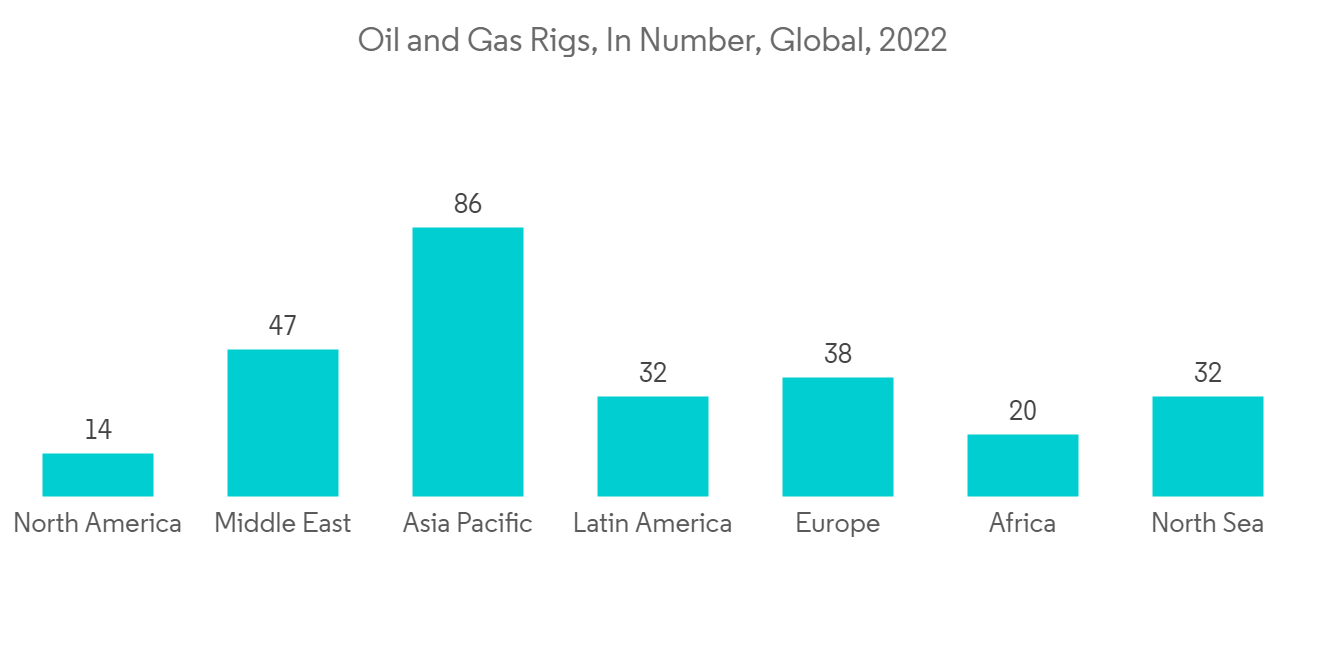

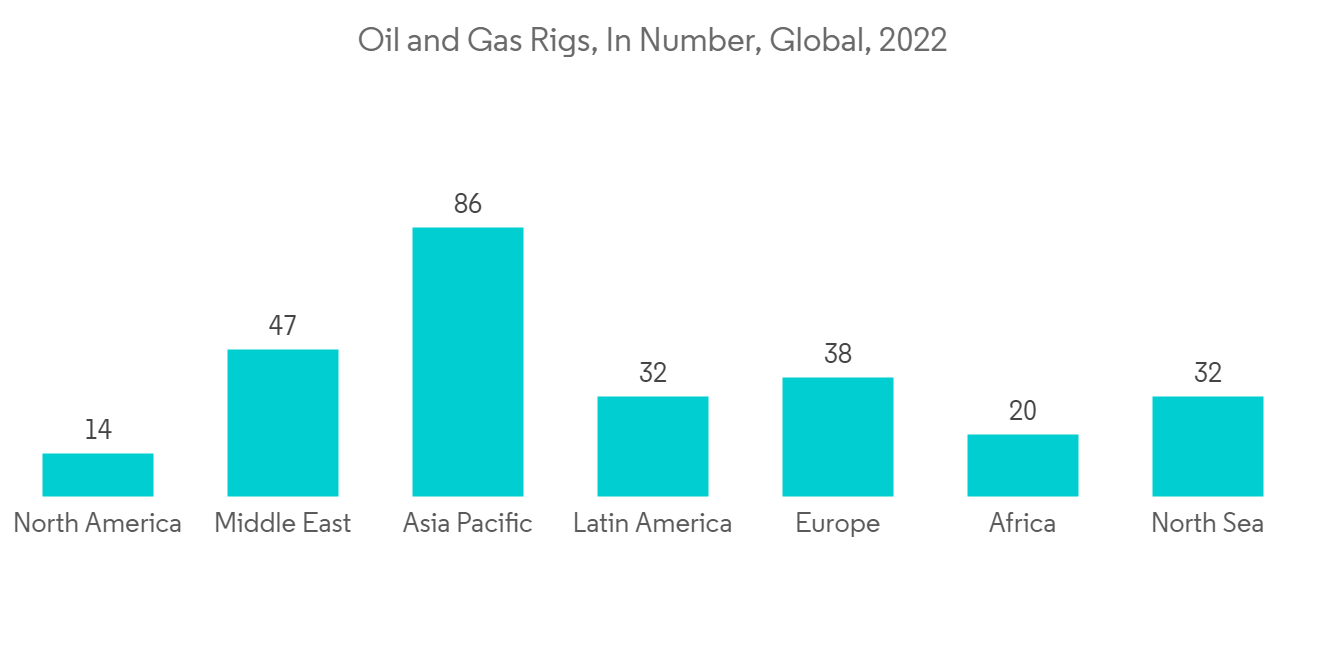

- 隨著世界各地建設更多的石油和天然氣項目,海上石油和天然氣的電信市場有望增長。貝克休斯表示,截至去年,亞太地區擁有最多的海上石油和天然氣鑽井平台。

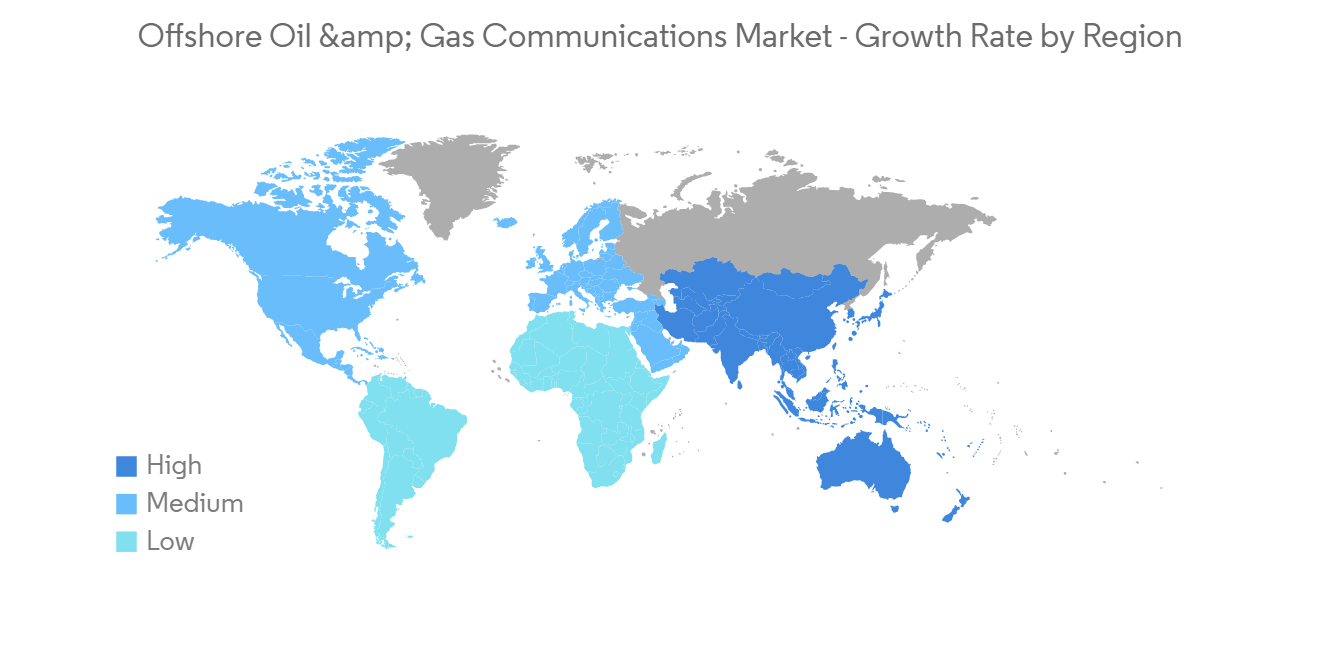

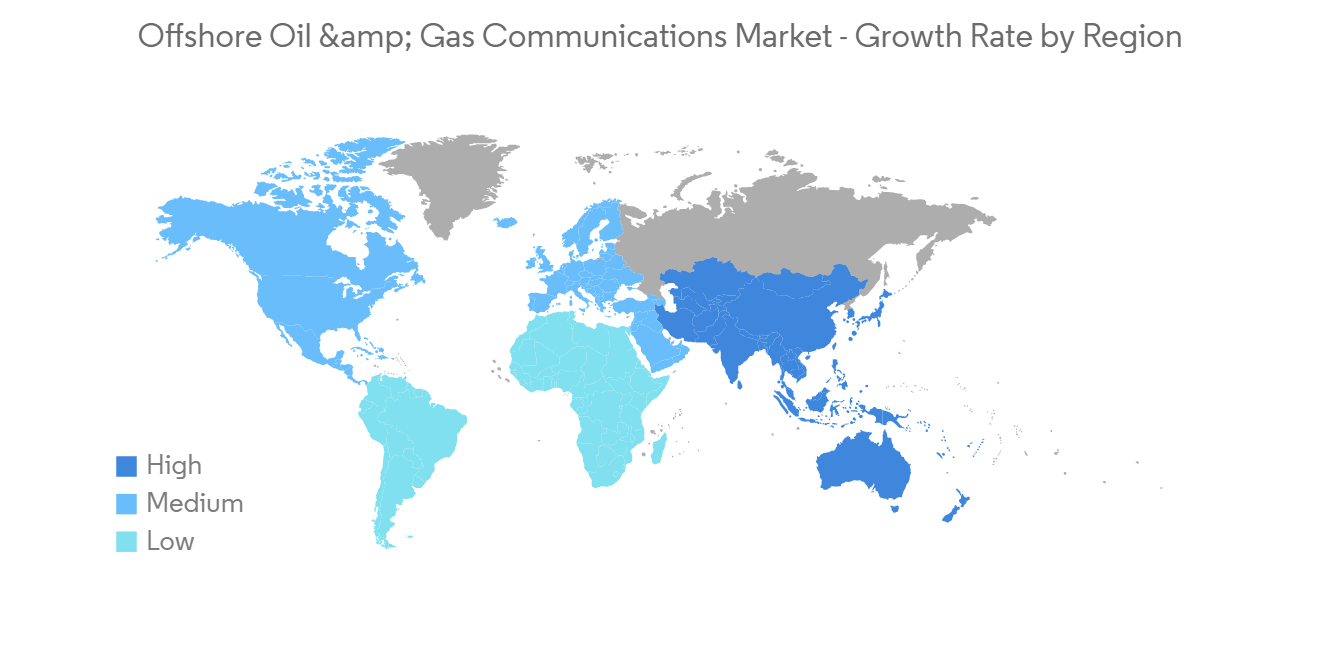

預計北美將佔據最大的市場份額

- 美國新頁岩資源的發現以及加拿大石油和天然氣項目的擴張預計將推動該地區對電信設備的需求。

- 該地區還是最大的石油和天然氣生產國,據說是該市場的先驅。據Baker Hughes稱,北美擁有世界上最多的石油和天然氣鑽井平台,擁有 14 座海上石油和天然氣鑽井平台。此外,越來越多的公司正在為其海上油氣田作業尋找先進的數字解決方案,並且市場有望增長。

- 全球油價上漲預計將在預測期內達到危機前水平,預計將刺激上游石油和天然氣活動,導致石油和天然氣行業對離岸通信的需求增加。

- 由於更先進技術的使用、大型石油和海上油田的需求增加以及該地區石油和天然氣鑽探活動的快速增長,預計該市場在預測期內將會增長。

海上石油和天然氣電信行業概述

海上石油和天然氣通信市場有幾家大型企業,包括 ABB Ltd.、Alcatel Lucent SA、Baker Hughes Incorporated、CommScope Inc. 和 AT&T Inc.。市場參與者正在利用合作夥伴關係、合併、投資和收購來改進他們的產品並獲得持久的競爭優勢。

2022 年 7 月,Baker Hughes宣佈將收購 AccessESP,後者是先進人工舉升解決方案的領先技術提供商之一。這樣做是為了實現石油和天然氣業務的現代化,並通過降低運營成本和減少停機時間來提高效率。AccessESP 的 "GoRigless ESP 系統" 能夠使用標準的輕型介入設備(電纜、盤管、油井拖拉機等)而不是起重鑽機或油井生產管來安裝和拆卸電動潛水泵 (ESP),這是一種獨特的解決方案。這些解決方案顯著降低了 ESP 更換過勞的成本和停機時間,這在離岸和孤立環境中變得更加重要。

Alcatel-Lucent Enterprise是為特定行業提供電信、雲和網絡解決方案的領先供應商之一,於 2022 年 11 月宣佈推出 Purple on Demand。Purple On Demand 是一種新的基於訂閱的產品,專注於在私人環境中為最終用戶提供安全的業務通信。著手數字化轉型的企業尋求簡單性、靈活性、安全性和數字主權。Purple On Demand 提供商業通信服務,包括訂閱模式可用的軟件和電話、會議設備和外圍設備等設備,以滿足這些需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 本次調查範圍

第二章研究方法論

第三章執行摘要

第四章市場洞察

- 市場概況

- 工業吸引力——波特五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 行業價值鏈分析

- COVID-19 對市場的影響

第五章市場動態

- 市場驅動力

- 對海上油田通信解決方案的需求不斷增長

- 基於電信的技術增長

- 市場製約因素

- 數據傳輸風險

第六章市場細分

- 按溶液

- 上游通訊系統

- 中流通訊系統

- 下游通訊系統

- 通過通信網絡技術

- 蜂窩網絡

- VSAT通信網絡

- 光纖網絡

- 微波通信網絡

- 按地區

- 北美

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第七章競爭格局

- 公司簡介

- ABB Ltd

- Alcatel Lucent SA

- Baker Hughes Incorporated

- CommScope Inc.

- AT&T Inc.

- Redline Communications Inc.

- Harris CapRock Communications Inc.

- Hughes Network Systems LLC

- Huawei Technologies Co. Ltd.

- Siemens AG

第八章投資分析

第 9 章 市場機會和未來趨勢

During the time frame of the forecast, the offshore oil and gas communications market is anticipated to register a CAGR of 7.6%.During the forecast period, the market is expected to grow because the oil and gas industry is investing more in new technologies and digital technologies.

Key Highlights

- From the oil rig to the offshore platforms, it's important to have good oil and gas communication equipment for safety and efficiency. A good communication system does more than just send data between businesses that are offshore and those that are onshore.

- Offshore rigs are comparatively hard to establish, operate, and maintain. They must deal with environmental factors, including strong ocean currents and highly remote environments. Most of them are deep-water rigs that operate at great depths. In such remote locations, communications play a major role in monitoring several components and staying in contact with onshore establishments for reporting and assistance in emergencies.

- Several different communication technologies can now work alone or as a system to solve communication problems offshore. Satellite communications, which require a VSAT at the offshore site and are used by ships in remote places or that are moving, are the most common way to talk to people while offshore. Cellular networks are now being used in offshore oil fields because more money is being put into infrastructure there.

- Still, the offshore oil and gas field communications industry will be slowed down by worries about not enough data protection, risks in data transfer, asset security, and the difficulty of cyberattacks. Oil price volatility would even further slow the oil field communications sector's growth. The high expenses of maintaining this procedure will further limit the expansion of the oil field communications business.

- COVID-19 had an impact on the oil and gas industry as well. Everyone has had to adjust, from people being placed on leave to businesses having to radically rethink their long-term plans. Businesses must rethink their long-term strategies. When it comes to offshore oil rigs, the effect is more evident. The COVID-19 pandemic hindered offshore oil rig development and maintenance. Post-epidemic, the industry is expanding as it adopts new technology and new working methods, with companies adjusting to these new circumstances.

Offshore Oil and Gas Communications Market Trends

Telecom-based Technological Advancements to Drive the Market Growth

- A few years ago, communications between offshore facilities and onshore locations were limited to a two-way radio channel and daily reports. Oilfield workers stationed offshore were virtually cut off from the rest of the world. However, with the technological advancements in communication technologies, offshore industry work has been transformed.

- With the help of microwave communications technology, data is sent over wavelengths that are less than one meter long.These microwave solutions are chosen for locations that are close to each other. Fiber-optic telecommunications are chosen for locations in high-traffic areas, such as the North Sea or the US Gulf of Mexico.

- Technological advancements have allowed improved communication systems that have transformed total subsea developments and the way the remote, unmanned offshore industry works. The increasing vulnerability to cyber security threats in the oil and gas sector is a significant growth driver for the oil field communications market. The growing need for cloud-based services and a greater emphasis on adopting effective communication technology will exacerbate the demand for oil field communications. Increasing investments in network infrastructure and the expansion and growth of the oil and gas sector will generate more profitable growth prospects for the oil field communications market.

- With more oil and gas projects being built around the world, the offshore oil and gas communications market is expected to grow. Baker Hughes says that as of last year, Asia Pacific had the most offshore oil and gas rigs.

North America is Expected to Hold the Largest Market Share

- One of the biggest markets for offshore oil and gas communications is North America.The demand for communication equipment in this area is likely to be driven by the discovery of new shale resources in the United States and the growth of oil and gas projects in Canada.

- This region is said to be the pioneer in this market because it is also the largest oil and gas producer. According to Baker Hughes, North America hosts the most oil and gas rigs globally and has 14 offshore oil and gas rigs. Moreover, the market is expected to grow, with companies seeking advanced digital solutions for offshore field operations.

- Globally increasing crude oil prices that are expected to reach pre-crisis levels over the forecast period are expected to increase upstream oil and gas activity, leading to an increase in demand for offshore communications in the oil and gas industry.

- During the time frame of the projection, the market would grow because more advanced technologies would be used, there would be more demand for these technologies in large oilfields and offshore locations, and oil and gas field excavation activities in the region would grow quickly.

Offshore Oil and Gas Communications Industry Overview

There are a few big players in the offshore oil and gas communications market, such as ABB Ltd., Alcatel Lucent SA, Baker Hughes Incorporated, CommScope Inc., and AT&T Inc.Players in the market are using partnerships, mergers, investments, and acquisitions to improve their products and gain a competitive edge that will last.

In July 2022, Baker Hughes announced that it was buying AccessESP, which was one of the leading providers of advanced technology for artificial lift solutions. This was done to modernize oil and gas operations by lowering operating costs and downtime, which would make them much more efficient.AccessESP's "GoRigless ESP System" has its own solutions that make it possible to set up and take down an electrical submersible pump (ESP) with standard, light-duty intervention equipment (like a wireline, coiled tubing, or well tractor) instead of a rig or pulling well production tubing.These solutions greatly reduce the cost and downtime of ESP replacement workovers, which are becoming more important in offshore and isolated settings.

Alcatel-Lucent Enterprise, one of the top providers of communications, cloud, and networking solutions for specific industries, announced Purple on Demand in November 2022. Purple on Demand is a new commercial product that is sold on a subscription basis and focuses on offering secure business communications to end users in a private setting. Businesses that start on a digital transition seek simplicity, flexibility, security, and digital sovereignty. Purple on Demand provides business communication services, including software available through a subscription model and gear, such as phone sets, conferencing devices, and peripherals, to satisfy these demands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Offshore Oilfield Communication Solutions

- 5.1.2 Telecom-based Technological Growth

- 5.2 Market Restraints

- 5.2.1 Risk in Data Transfer

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Upstream Communication Systems

- 6.1.2 Midstream Communication Systems

- 6.1.3 Downstream Communication Systems

- 6.2 By Communication Network Technology

- 6.2.1 Cellular Communication Network

- 6.2.2 VSAT Communication Network

- 6.2.3 Fiber Optic-based Communication Network

- 6.2.4 Microwave Communication Network

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Alcatel Lucent SA

- 7.1.3 Baker Hughes Incorporated

- 7.1.4 CommScope Inc.

- 7.1.5 AT&T Inc.

- 7.1.6 Redline Communications Inc.

- 7.1.7 Harris CapRock Communications Inc.

- 7.1.8 Hughes Network Systems LLC

- 7.1.9 Huawei Technologies Co. Ltd.

- 7.1.10 Siemens AG