|

市場調查報告書

商品編碼

1432826

化學噴射泵和閥門:市場佔有率分析、行業趨勢和成長預測(2024-2029)Chemical Injection Metering Pumps And Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

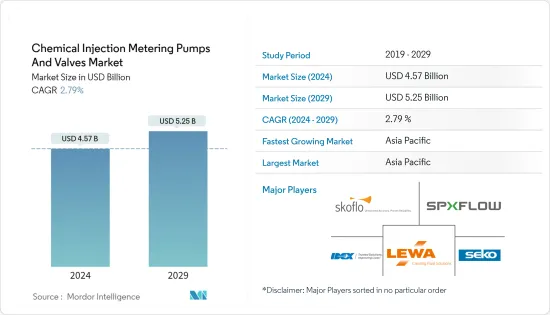

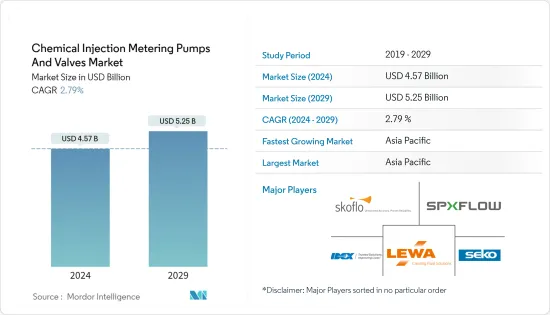

化學計量幫浦和閥門市場規模預計到2024年為45.7億美元,預計到2029年將達到52.5億美元,複合年成長率預計為2.79%。

2020 年,COVID-19 爆發導致全國封鎖、製造活動和供應鏈中斷以及全球生產停頓,對市場產生了負面影響。然而,到了2021年,情況開始好轉,市場恢復了成長軌跡。

主要亮點

- 市場研究的主要驅動力之一是污水處理應用需求的不斷成長。

- 然而,某些應用的高維護和更換成本預計將阻礙市場成長。

- 能源、電力和化學產業在市場中佔據主導地位,預計在預測期內將成長。用水和污水處理產業預計在未來幾年仍將保持最高的複合年成長率。

- 亞太地區佔市場主導地位,其次是北美和歐洲,中國、日本和印度等國家的消費量最高。

- 製藥業不斷成長的需求可能會提供未來的機會。

化工計量幫浦和閥門市場趨勢

能源、電力和化學品主導市場

- 能源、電力和化學是噴射計量泵和閥門市場的主要最終用戶領域。紙漿和造紙工業也包含在該細分市場中。

- 化學工業包括最終產品的合成。計量泵和閥門可用於在不同溫度和化學處理壓力下處理各種有毒化學物質。

- 化學注入系統也用於發電。硫酸鐵和硫酸等化學物質需要精確測量,才能將水轉化為鍋爐用超純水。

- 在法國,從美國和中東國家的進口滿足了大部分石油產品的需求。在法國,大約有60%的能源被用作化石資源。能源來源主要是石油產品、天然氣和煤炭。因此,能源產出依賴從沙烏地阿拉伯、俄羅斯、哈薩克、阿爾及利亞和奈及利亞進口原油,以及從俄羅斯、挪威、奈及利亞和荷蘭進口天然氣。

- 法國消耗的石油95%以上是從其他國家進口的。大部分石油是從俄羅斯進口以滿足法國的需求。然而,自從俄羅斯和烏克蘭戰爭爆發以來,歐盟一直在尋找將俄羅斯石油趕出歐洲市場的方法。由於法國是歐盟最大的石油進口國之一,法國政府已經在加緊與阿拉伯聯合大公國的談判,以取代購買俄羅斯石油。

- 大多數石化設施利用產生的熱量來運作鍋爐並滿足現場電力需求。

- 根據美國人口普查局的數據,2022 年採礦和採石業收益達到 143.9 億美元,而 2021 年為 136.8 億美元。預計 2023 年該產業收益將達到 152.5 億美元。

- 採礦和冶金是加拿大的主要工業。加拿大向世界各國供應 60 多種金屬和礦物。採礦業正在投資創新和新技術,迅速重塑這個產業。採礦業也出現了整合,引發了對該行業未來幾年成長前景的猜測。

- 在電力工業中,例如火力發電廠和核能發電廠,通常需要化學物質來向鍋爐系統供水。

- 能源、電力和化學產業的成長以及投資的增加可能會推動預測期內對調查市場的需求。

中國在亞太地區市場佔據主導地位

- 預計亞太地區將主導化學計量泵和閥門的需求。光是中國就佔了亞太市場的約35%。

- 石油和天然氣計量泵和閥門消耗量較高,國家正在增加下游生產和石化產能。

- 中國其他突出的最終用戶產業是化工廠,市場上許多大公司在中國設有化工廠,它們進一步增加了所生產的化學品噴射計量泵和閥門的消耗量和產能。其他主要行業是生活水處理設施,用於各個行業。

- 污水處理主要是因為煤炭、鋼鐵和鋼鐵業的日常活動需要淡水。中國北方地區擁有全國約90%的煤炭相關產業。

- 中國政府頒布了用水和排放法規,以改善該地區寶貴的水資源。最近,政府加強了對華北地區煤炭和化工廠的監管,要求實現零液體排放(ZLD)。

- 中國食品和飲料產業規模龐大,在國家經濟中扮演重要角色。由於具有購買力的中產階級人口不斷成長以及對食品安全和品質的日益關注,食品和飲料行業預計將繼續成長。

- 在上游石油和天然氣行業,製造商不斷尋求提高產能、整體流程效率和機器停機時間。石油和天然氣公司使用化學注入計量泵和閥門來提高產量、減少腐蝕、分離石油、天然氣和水,並提高所有探勘和採收活動的盈利。

- 儘管中國是世界第二大石油和天然氣消費國,但僅是第六大生產國。中國作為石油消費量大國,石油消費量逐年增加,成長速度不一。但由於石油供應仍無法滿足需求,中國主要依賴進口。

- 在預測期內,上述各種最終用戶產業的成長預計將推動該國對化學噴射計量幫浦和閥門的需求。

化學品注入泵和閥門行業概述

全球化學品計量泵和閥門市場高度分散,五家主要企業的市場佔有率非常小。主要公司包括 Idex Corporation、SPX Flow、Lewa GmbH、SkoFlo Industries Inc. 和 Seco SpA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 污水處理應用的需求不斷增加

- 健全的環境監管操作程序

- 其他司機

- 抑制因素

- 維護和更換成本很高,取決於應用

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(金額:市場規模)

- 泵浦類型

- 隔膜

- 活塞/柱塞

- 其他泵浦類型

- 最終用戶產業

- 能源、動力、化學

- 油和氣

- 水和污水處理

- 食品和飲料

- 製藥

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 澳洲和紐西蘭

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- Market Ranking/Share(%)Analysis

- 主要企業策略

- 公司簡介

- Cameron(Schlumberger)

- Hunting PLC

- Idex Corporation

- ITC Dosing Pumps

- Lewa GmbH

- McFarland-Tritan LLC

- Milton Roy

- ProMinent

- Seepex GmbH

- Seko SpA

- SkoFlo Industries Inc.

- SPX FLOW Inc.

- Swelore Engineering Pvt Ltd.

第7章 市場機會及未來趨勢

- 製藥業需求不斷成長

- 開發技術先進的化學注入系統

The Chemical Injection Metering Pumps And Valves Market size is estimated at USD 4.57 billion in 2024, and is expected to reach USD 5.25 billion by 2029, growing at a CAGR of 2.79% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- One of the major factors driving the market study is the accelerating demand for wastewater treatment applications.

- However, high maintenance and replacement costs in some applications are expected to hinder the market's growth.

- The energy, power, and chemicals industry dominated the market and is expected to grow during the forecast period. The water and wastewater treatment industry is expected to register the highest CAGR in the coming years.

- Asia-Pacific dominated the market, followed by North America and Europe, with the largest consumption from countries such as China, Japan, and India.

- Growing demand from the pharmaceutical industry will likely act as an opportunity in the future.

Chemical Injection Metering Pumps & Valves Market Trends

Energy, Power, and Chemicals to Dominate the Market

- Energy, power, and chemicals are major end-user segments in the injection metering pumps and valves market. Even the pulp and paper industry is considered in this segment.

- The chemical industry consists of the synthesis of finished or intermediate products. Metering pumps and valves help handle various toxic chemicals at different temperatures and chemical processing pressures.

- Chemical injection systems also find major use in power generation. Chemicals, such as ferric sulfate and sulphuric acid, are needed in precise measurements to transform water into ultra-pure water for boilers.

- In France, imports from the United States and Middle Eastern countries meet most of the demand for petroleum products. Around 60% of the energy is utilized in the form of fossil resources in France. Energy is primarily derived from petroleum products, natural gas, and coal. Hence energy generation depends on imports from Saudi Arabia, Russia, Kazakhstan, Algeria, and Nigeria for crude oil while upon Russia, Norway, Nigeria, and the Netherlands for gas.

- Over 95% of the oil consumed in France is imported from other nations. A large share of oil is imported from Russia to fulfill the country's demand. However, since the onset of the Russia-Ukraine war, European Union has been finding ways to push out Russian oil from the European market. Since France is one of the largest oil importers in the European Union, the French government has already strengthened talks with United Arab Emirates (UAE) to replace Russian oil purchases.

- Most petrochemical facilities use generated heat to run boilers to meet site power requirements.

- As per the United States Census Bureau, revenue in mining and quarrying amounted to USD 14.39 billion in 2022, compared to USD 13.68 billion in 2021. The revenue from this sector is projected to amount to USD 15.25 billion in 2023.

- Mining and metallurgy are key industries in the country. Canada supplies over 60 metals and minerals to different countries worldwide. The mining industry invests in innovation and new technologies, rapidly reshaping the sector. The mining industry also witnessed consolidations, which led to speculations regarding the growth prospects for the industry in the coming years.

- Power industries, such as thermal and nuclear plants, often require chemicals to inject the feed water into the boiler system.

- The growth in the energy, power, and chemicals sectors with increasing investments is likely to drive the demand in the market studied during the forecast period.

China to Dominate the Market in Asia-Pacific Region

- Asia-Pacific region is expected to dominate the demand for chemical injection metering pumps and valves. China alone accounts for about 35% of the market in the Asia-Pacific region.

- The consumption of metering pumps and valves is high in oil and gas; the downstream production has increased in the country, which has also increased the production capacities of petrochemicals; therefore, it will augment the consumption of chemical injection metering pumps and valves in the country.

- The other end-user industry prominent in China is the chemical plants, many big companies in the market have their chemical plants in China, and they have even increased their production capacities, which will increase the consumption of chemical injection metering pumps and valves. The other major industry is a water treatment facility in the country, used in different industries.

- Wastewater treatment is mainly because the coal, steel, and iron industries require fresh water for daily activities. North China has approximately 90% of the country's coal-based industries.

- The Chinese government has enacted water use and discharge regulations to improve the region's precious water resources. Recently, the government has tightened the rules for coal and chemical plants in North China, which require zero-liquid discharge (ZLD).

- China's food and beverage industry is enormous and plays an important role in the country's economy. The food and beverages industry is expected to continue growing because of the increasing middle-class population with more purchase power and growing attention to food safety and quality.

- In the upstream Oil & Gas industry, manufacturers constantly seek to improve their production capacities, overall process efficiency, and machinery downtime. Oil and gas companies use chemical Injection metering pumps and valves to increase production, reduce corrosion, separate oil/gas/water, and improve the profitability of all exploration and recovery efforts.

- China is the world's second-largest consumer of oil and gas but only the sixth-largest producer of the same. As a big oil consumer, China's oil consumption is increasing yearly with fluctuating growth rates. However, China mainly relies on imports because the oil supply still cannot meet the demand.

- The growth in those mentioned above various end-user industries in the forecast period is expected to boost the demand for chemical injection metering pumps and valves in the country.

Chemical Injection Metering Pumps & Valves Industry Overview

The global chemical injection metering pumps and valves market is highly fragmented, with the top 5 players accounting for a very small market share. The major companies include Idex Corporation, SPX Flow, Lewa GmbH, SkoFlo Industries Inc., and Seko SpA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Accelerating Demand from Wastewater Treatment Applications

- 4.1.2 Robust Operational Procedures for Regulating Environmental Concerns

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Maintenance and Replacement Costs in Some Applications

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Pump Type

- 5.1.1 Diaphragm

- 5.1.2 Piston/Plunger

- 5.1.3 Other Pump Types

- 5.2 End-user Industry

- 5.2.1 Energy, Power, and Chemicals

- 5.2.2 Oil and Gas

- 5.2.3 Water and Wastewater Treatment

- 5.2.4 Food and Beverage

- 5.2.5 Pharmaceutical

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Australia and New Zealand

- 5.3.1.7 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Spain

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking/Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Cameron (Schlumberger)

- 6.4.2 Hunting PLC

- 6.4.3 Idex Corporation

- 6.4.4 ITC Dosing Pumps

- 6.4.5 Lewa GmbH

- 6.4.6 McFarland-Tritan LLC

- 6.4.7 Milton Roy

- 6.4.8 ProMinent

- 6.4.9 Seepex GmbH

- 6.4.10 Seko SpA

- 6.4.11 SkoFlo Industries Inc.

- 6.4.12 SPX FLOW Inc.

- 6.4.13 Swelore Engineering Pvt Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand in the Pharmaceutical Industry

- 7.2 Development of Technologically Advanced Chemical Injection Systems