|

市場調查報告書

商品編碼

1273431

顏料市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)Pigments Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,全球顏料市場預計將以超過 6% 的複合年增長率增長。

COVID-19 對 2020 年的市場產生了負面影響。 顏料需求受到全球供應鏈中斷以及油漆和塗料、塑料和紡織品等許多終端用戶行業需求減少的拖累。 然而,隨著消費者在家的時間增加、對房屋裝修的關注度增加以及住宅建築行業的複蘇,市場出現反彈。 由於人們對清潔和衛生的關注度越來越高,防護和消毒塗料的需求量很大。

主要亮點

- 從中期來看,亞太地區油漆和塗料行業不斷增長的需求以及中東和亞太地區持續的工業發展是推動市場發展的關鍵因素。

- 另一方面,嚴格的政府法規和 COVID-19 大流行的不利影響等因素預計會阻礙市場增長。

- 對可靠的商業產品(例如 3D 打印材料)的需求不斷增長可能會成為未來的機遇。

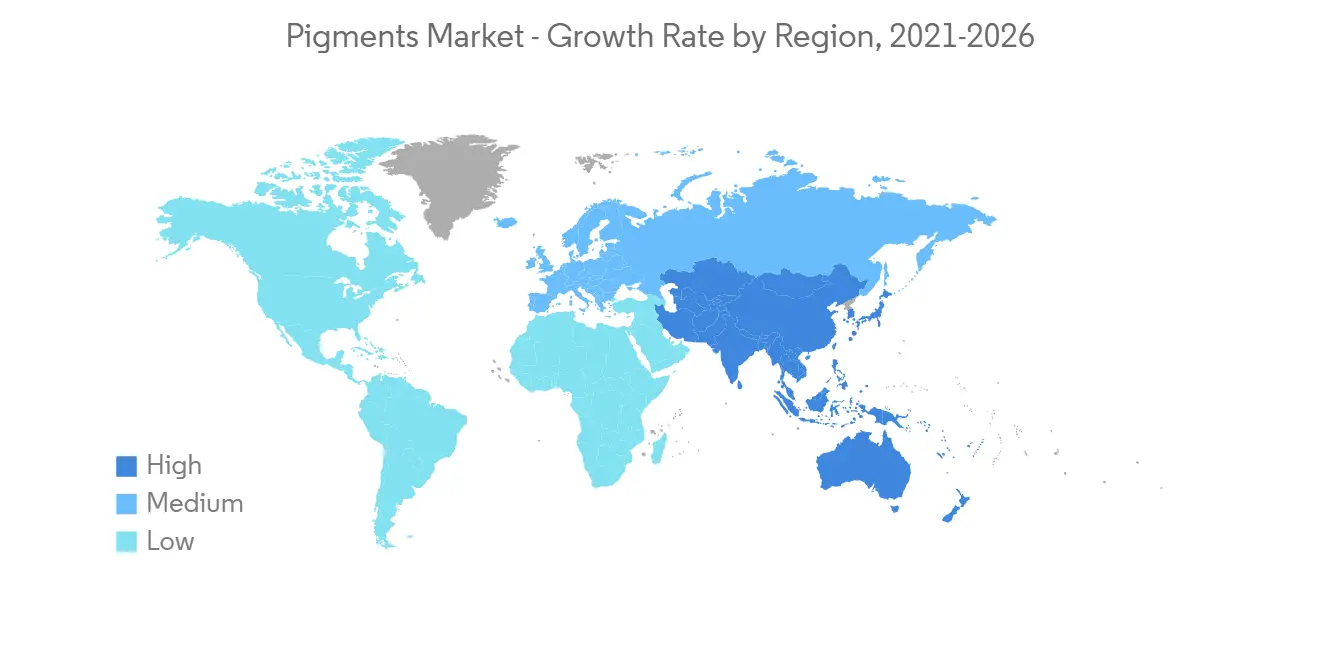

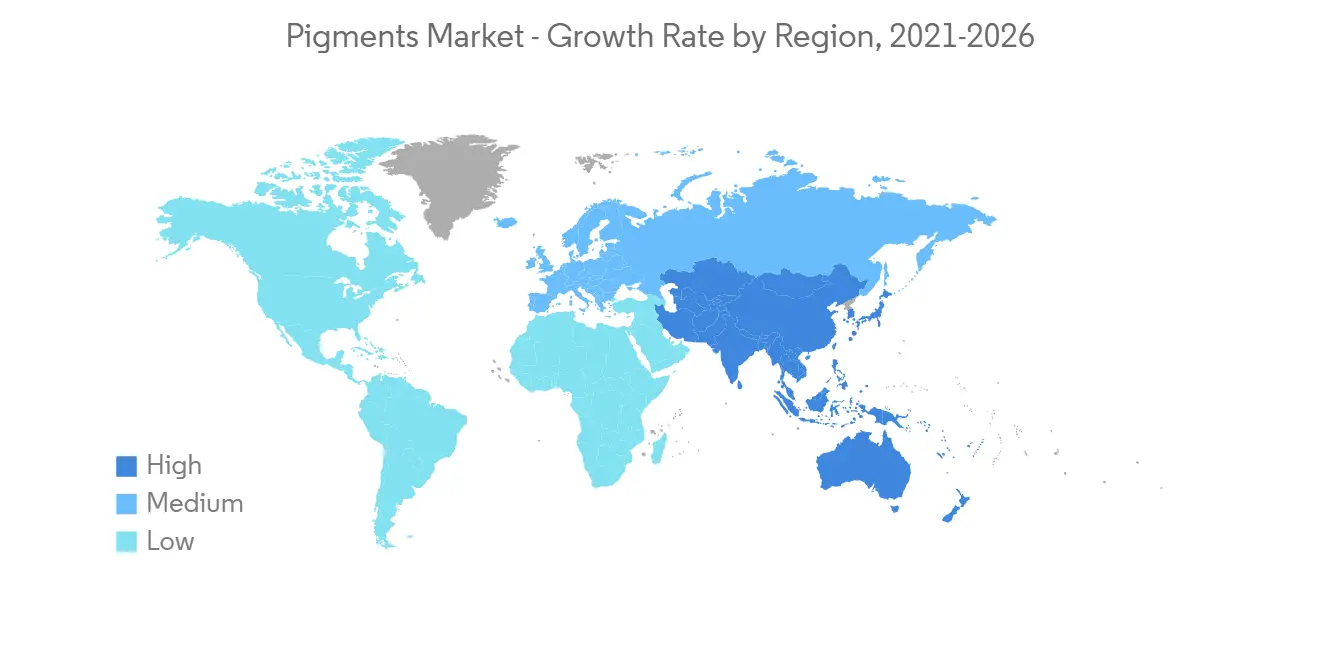

- 亞太地區主導著全球市場,其中中國、印度和日本等國家/地區的消費最為突出。

顏料市場趨勢

油漆和塗料行業的需求增加

- 顏料主要用於油漆和塗料的生產。 這些顏料旨在滿足最嚴苛的要求,同時不會影響塗層性能。

- 在建築行業,建築和裝飾塗料在其生產過程中消耗了大量顏料。 因此,亞太地區建築和基礎設施活動的增加是顏料市場的主要驅動力。

- 此外,汽車行業在汽車的內部和外部部件上使用油漆和塗料來賦予它們保護和吸引力。 用於汽車金屬零件和塑料車輛零件。

- 使用汽車漆的主要原因是為了避免各種侵蝕性環境因素,如陽光、腐蝕性物質、酸雨、高/低溫衝擊、石頭、紫外線、洗車、飛沙等,以保護汽車零件。 這些塗料用於汽車車身修理廠和維修中心,為車輛重新噴漆。

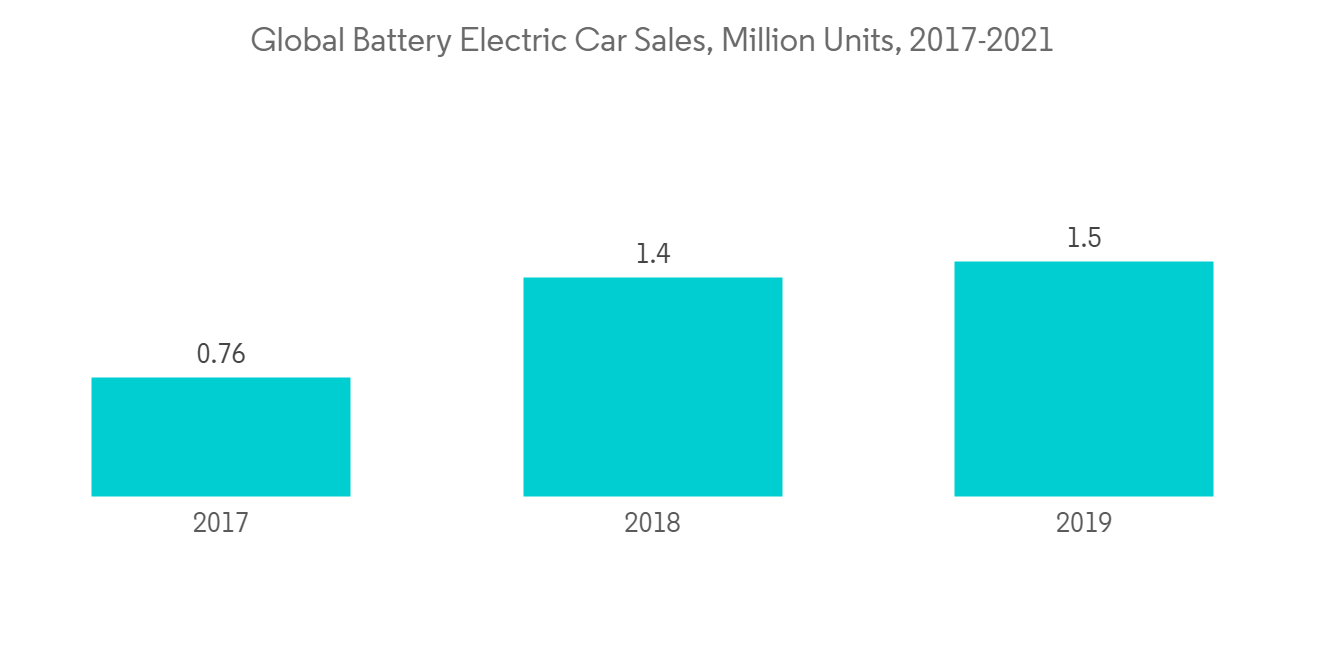

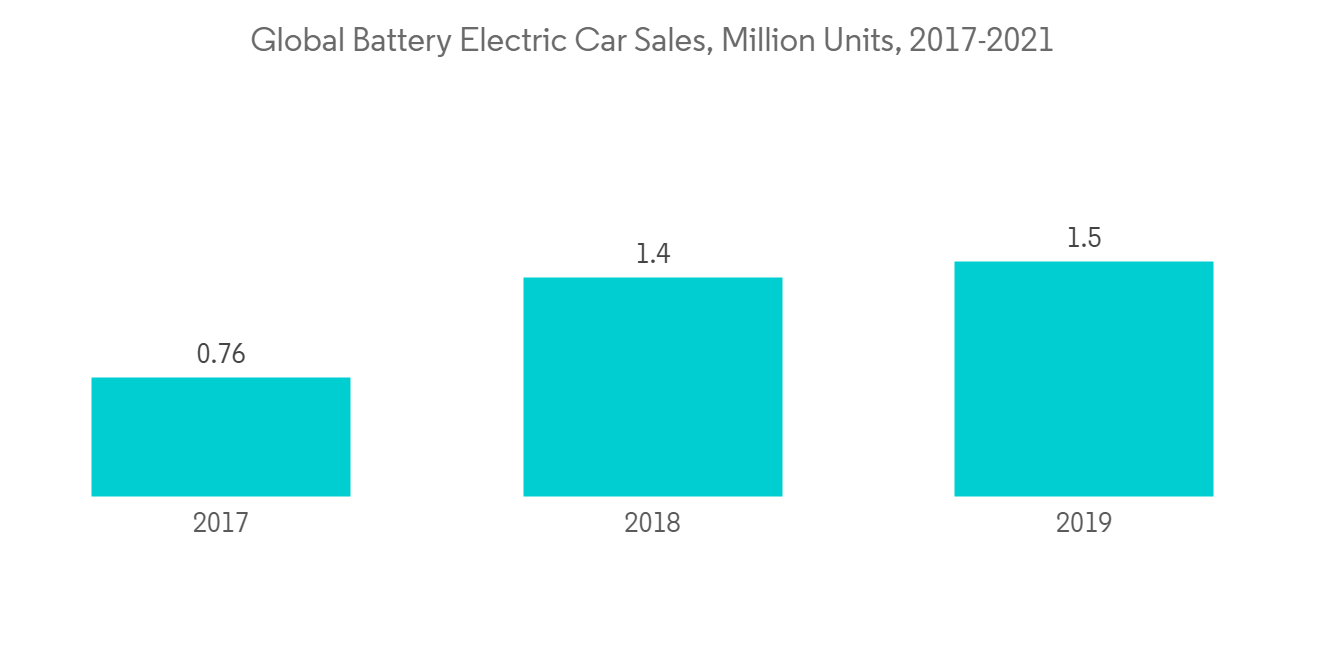

- 在電動汽車領域,正在開發專門用於電動汽車的新型塗料和塗層劑。 這些油漆和塗料必須能夠承受電動機產生的高溫,並提供腐蝕和其他環境保護。 它還需要很高的審美。 據國際能源署(IEA)預測,2021年純電動汽車銷量有望達到470萬輛,同比增長135%。

- 然而,隨著人們對汽油和柴油汽車造成的環境污染的擔憂日益加劇,預計電動汽車生產將在未來五年內恢復,這可能會提振預測期內所研究市場的需求。

- 預計這些因素將對未來幾年的市場增長產生重大影響。

亞太地區主導市場

- 亞太地區主導著市場,這主要是由於中國和印度的建築需求增加。

- 在中國,政府正在增加用於建設保障性住房設施以滿足住房需求的支出。 在印度,基礎設施領域已成為政府重點關注的領域之一。

- 在到 2025 年的未來五年內,中國將在重大建設項目上投資 1.43 萬億美元。 根據國家發改委 (NDRC) 的數據,上海計劃在未來三年內投資 387 億美元。 同時,廣州新簽基建項目16個,投資額80.9億美元。

- 在中國,人口趨勢預計將繼續刺激住房建設的增長。 家庭收入水平的提高和農村向城市的遷移預計將繼續推動該國住房建築行業的需求。

- 印度仍是一個新興經濟體,建築業是該國蓬勃發展的行業之一。 基礎設施部門是印度經濟增長的重要支柱。 政府正在作出各種努力,適時發展優良的基礎設施。

- 在印度,政府將在未來幾年推動住房領域的一些項目。 政府的“人人有房”計劃旨在到 2022 年為城市貧困人口建造超過 2000 萬套經濟適用房,這將大大推動住房建設。 智慧城市使命是政府承擔的又一重大工程,將在全國建設100多個智慧城市,實現國家快速城鎮化。 2021-22 財年預算包括 7.784 億美元(6,450 印度盧比)的智慧城市任務,而 2020-21 財年的修訂預算為 4.103 億美元(3,400 印度盧比)。

- 2021 年 3 月,印度議會通過立法成立國家基礎設施和發展融資銀行 (NaBFID),這是一家規模 25 億美元的發展金融機構,旨在為印度的基礎設施項目提供資金。

- 因此,所有此類建築活動和適當的政府措施預計將促進該地區的建築活動,進一步增加對油漆和塗料的需求,從而增加對顏料的需求。我來了。

顏料行業概覽

顏料市場整合,前五名佔據較大份額。 主要公司有 DIC Corporation、The Chemours Company、Venator Materials PLC、KRONOS Worldwide Inc. 和 Clariant。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 亞太地區油漆和塗料行業的需求不斷擴大

- 中東和亞太地區持續的工業發展

- 紡織行業的穩定需求

- 約束因素

- 嚴格的政府法規

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 專利分析

第 5 章市場細分

- 產品類型

- 無機物

- 氧化鈦

- 氧化鋅

- 其他產品類型

- 有機

- 特種顏料和其他產品類型

- 無機物

- 用法

- 油漆和塗料

- 紡織品

- 油墨

- 塑料

- 皮革

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 西班牙

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 阿拉伯聯合酋長國

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場排名分析

- 主要公司採用的策略

- 公司簡介

- ALTANA AG

- Clariant

- DIC Corporation

- KRONOS Worldwide Inc.

- LANXESS

- Lomon Billions

- Merck KGaA

- Pidilite Industries Ltd

- Sudarshan Chemical Industries Limited

- The Chemours Company

- Tronox Holdings plc

- Venator Materials PLC

第七章市場機會與未來趨勢

- 轉向環保產品

- 對 3D 打印材料等高可靠性產品的需求不斷增加

The global pigments market is projected to register a CAGR of over 6% during the forecast period.

COVID-19 had a negative impact on the market in 2020. The disruption in the worldwide supply chain, combined with lower demand from numerous end-user industries such as paints and coatings, plastics, textiles, and others, hampered pigment demand. However, the market recovered as consumers spent more time at home and focused on home remodeling projects, and the residential construction sector recovered. Protective and sanitizing coatings are in high demand due to growing concerns about cleanliness and hygiene.

Key Highlights

- In the medium term, the significant factors driving the market studied are rising demand from the paints and coatings industry in Asia-Pacific and consistent industrial developments in the Middle East and Asia-Pacific regions.

- On the flip side, factors such as stringent government regulations and the negative impact of the COVID-19 pandemic are expected to hinder the growth of the market studied.

- Rising demand for reliable commercial products, like 3d printing material, will likely act as an opportunity in the future.

- Asia-Pacific dominated the market worldwide, with the most significant consumption from countries such as China, India, and Japan.

Pigments Market Trends

Increasing Demand from the Paints and Coatings Industry

- Pigments are majorly used in paints and coatings production. These are engineered, enabling them to withstand challenging demands without compromising the coating performance.

- In the construction industry, architectural and decorative coatings account for the enormous consumption of pigments in their production. Thus, rising construction and infrastructure activities in Asia-Pacific are significant drivers for the pigment market.

- Furthermore, in the automotive sector, paints and coatings are used in the interior and exterior parts of the vehicle, as they impart protection and appeal to the cars. They are used on metallic pieces and plastic vehicle components of automobiles.

- The primary reason for using automotive coatings is to protect the vehicle parts against various aggressive environmental agents, such as sunlight, corrosive materials, and environmental effects, such as acid rain, hot-cold shocks, stone chips, UV radiation can washing, and blowing sand. These coatings are used in automotive body shops and repair centers for vehicle refinishing.

- The electric car sector is driving the development of new paints and coatings explicitly intended for electric vehicles. These paints and coatings must endure the high temperatures electric motors produce while providing corrosion and other environmental protection. They must also be able to deliver a high level of aesthetic appeal. According to the International Energy Agency, battery electric vehicle sales will reach 4.7 million units in 2021, representing a 135% increase over the previous year.

- However, with growing concerns about environmental pollution from petrol and diesel-based vehicles, the production of electric cars is expected to pick up over the next five years, likely driving the demand for the market studied over the forecast period.

- All the above factors are expected to impact market growth in the coming years significantly.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the market, primarily due to the increasing demand for construction activities in China and India.

- In China, government spending is increasing on constructing affordable housing facilities to cater to the housing demand. In India, the infrastructure sector is one of the major focus areas for the government.

- China is investing USD 1.43 trillion in significant construction projects in the next five years till 2025. According to National Development and Reform Commission (NDRC), the Shanghai plan includes an investment of USD 38.7 billion in the next three years. In contrast, Guangzhou signed 16 new infrastructure projects with an investment of USD 8.09 billion.

- In China, demographics in the country are expected to continue to spur the growth in residential construction. Rising household income levels and the population migrating from rural to urban areas are expected to continue to drive demand for the residential construction sector in the country.

- India is still a developing economy; the construction sector is one of the booming industries in the country. The infrastructure sector is an essential pillar for the growth of the Indian economy. The government is taking various initiatives to ensure the country's time-bound creation of excellent infrastructure.

- In India, the government is pushing numerous projects in the next few years in the residential segment. The government's 'Housing for All' initiative aims to build more than 20 million affordable homes for the urban poor by 2022, which will significantly boost residential construction. The smart cities mission is another major project undertaken by the government, which will construct more than 100 smart cities all over the country to achieve rapid urbanization in the country. In the 2021-22 budget, the smart cities mission includes USD 778.4 million (INR 6,450 crore) against USD 410.3 million (INR 3,400 crore) in the 2020-21 revised estimates.

- In March 2021, the Indian Parliament passed legislation to establish the National Bank for Financing Infrastructure and Development (NaBFID), a USD 2.5 billion development finance institution to fund infrastructure projects in India.

- Thus, all such construction activities and suitable government measures are expected to boost the construction activities in the region, which is further projected to grow the demand for paint and coating, thereby increasing the demand for pigments.

Pigments Industry Overview

The pigment market is consolidated with the top five players accounting for significant market share. The major companies include DIC Corporation, The Chemours Company, Venator Materials PLC, KRONOS Worldwide Inc., and Clariant.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Paints and Coatings Industry in Asia-Pacific

- 4.1.2 Consistent Industrial Developments in Middle-East and Asia-Pacific Regions

- 4.1.3 Consistent Demand from the Textile Industry

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Inorganic

- 5.1.1.1 Titanium Dioxide

- 5.1.1.2 Zinc Oxide

- 5.1.1.3 Other Product Types

- 5.1.2 Organic

- 5.1.3 Specialty Pigments and Other Product Types

- 5.1.1 Inorganic

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Textiles

- 5.2.3 Printing Inks

- 5.2.4 Plastics

- 5.2.5 Leather

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALTANA AG

- 6.4.2 Clariant

- 6.4.3 DIC Corporation

- 6.4.4 KRONOS Worldwide Inc.

- 6.4.5 LANXESS

- 6.4.6 Lomon Billions

- 6.4.7 Merck KGaA

- 6.4.8 Pidilite Industries Ltd

- 6.4.9 Sudarshan Chemical Industries Limited

- 6.4.10 The Chemours Company

- 6.4.11 Tronox Holdings plc

- 6.4.12 Venator Materials PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus toward Eco-friendly Products

- 7.2 Rising Demand for Reliable Commercial Products, like 3D Printing Material