|

市場調查報告書

商品編碼

1432378

工業物聯網 (IIoT) -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Industrial Internet Of Things (IIoT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

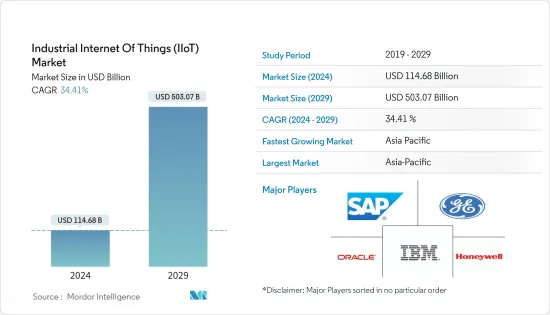

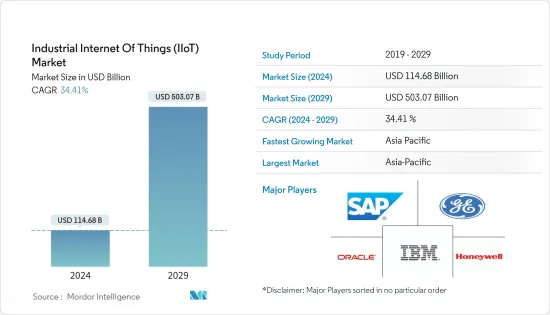

預計2024年工業物聯網(IIoT)市場規模為1,146.8億美元,2029年預計將達到5,030.7億美元,複合年成長率預計為34.41%。

主要亮點

- 巨量資料和機器學習 (ML) 等技術將擴大用於利用連網設備產生的資料來改善機器對機器 (M2M)通訊並簡化工作流程。此外,物聯網製造中製造和感測器成本的下降進一步刺激了需求。

- 由於該市場具有顯著的優勢,包括由於提高電源效率而增加的報酬率,各公司正在積極投資該市場。根據微軟的研究,物聯網對於製造業變得越來越重要。其行業中 87% 的物聯網決策者已採用物聯網,其中大多數人表示這對其組織的成功至關重要,並對這項技術感到滿意。

- 此外,由於其下一代功能,工業IoT中邊緣運算的使用和需求正在迅速增加。例如,今年義大利高科技公司SECO宣布與高通技術國際有限公司建立策略夥伴關係。此次合作的目的是推出與工業物聯網 (IIoT) 一致的創新邊緣運算產品和解決方案。根據協議,SECO 將被任命為 Qualcomm Technologies 的 IIoT 設計中心合作夥伴,並將負責為主要針對OEM客戶的即用型硬體解決方案創建特定的參考設計。

- 谷歌、亞馬遜網路服務和微軟等市場巨頭旨在加強與邊緣運算公司的合作,為產業用戶提供一站式解決方案。此外,隨著全球安裝的工業機器人數量的增加,對低延遲、低抖動通訊的需求預計將大幅增加,對工業物聯網解決方案的需求預計將大幅增加。

- AWS IoT TwinMeker 引入了三種新的實體建模功能,以簡化現實系統數位雙胞胎的建立、部署和擴充性:首先,批次元資料操作(包括匯入、匯出和更新)現在可以促進裝置模型和元資料的無縫遷移來自外部來源和不同的 AWS 帳戶。這簡化了大規模實體模型的建立。其次,AWS IoT TwinMaker 服務配額已增加,以支援具有更多實體和組件的數位雙胞胎。第三,複合組件類型的引入在建構複雜組件時提供了更大的彈性和效率。

- 此外,AWS IoT SiteWise 現在可以在 AWS IoT TwinMaker 普遍可用的所有區域中提供對元資料操作和複合組件的存取(批次元資料操作除外,這些操作在 AWS GovCloud 中無法存取)。世界各地的客戶。此類發展預計將影響未來和正在進行的工業物聯網計劃,這些項目暫時可能被認為沒有必要,並可能被推遲或取消。

工業物聯網 (IIoT) 市場趨勢

製造業佔較大市場佔有率佔有率

在產業內,製造業在投資和市場佔有率方面佔據最大佔有率,離散製造商和流程製造商都積極投資於物聯網的採用。此外,人們也關注將物聯網整合到工業中,尤其是隨著工業 4.0 的出現。物聯網提供了一種最佳化營運、減少停機時間、提高效率、促進資料主導決策的方法,並最終幫助提高報酬率,同時最大限度地降低成本。在離散和流程製造行業取得了重大進展,確保了快速的投資收益(ROI) 物聯網部署。

例如,Ubisense 追蹤事物的精確位置、移動和互動的研究發現,該研究提供了 2023 年製造業狀況的清晰簡介,62% 的製造商組裝這表明該公司採用了物聯網技術。採用率的顯著增加凸顯了人們日益認知到物聯網在簡化業務和提高生產力方面具有巨大潛力。

未來幾年,公共產業、離散製造、流程製造和生命科學產業將在物聯網解決方案上投資最多。許多使用案例預計將繼續透過資產追蹤、資產壽命以及基於狀態的設備追蹤和維護來增強強制物理距離的能力。

隨著決策者擴大採用物聯網解決方案,該行業的採用率預計將高於其他行業。通用電氣的一項調查顯示,58%的製造商表示物聯網對於工業業務的數位轉型是必要的。

此外,Capgemini SA研究表明,製造業在高潛力用例的平均行業採用率僅次於通訊,其重點是資產維護、製造智慧和產品品質最佳化,高達 33%。

此外,預計未來幾年工業機器人在製造業的採用將進一步增加。例如,據 IFR 稱,全球製造業對先進機器人的需求預計將成長。隨著這些發展,製造業的許多其他方面,例如內部物流、庫存和倉儲,預計也將在未來幾年內實現自動化。

根據微軟研究,87% 的製造業決策者支援採用,關鍵使用案例包括工業自動化、品質和合規性、生產計畫和調度、供應鏈和物流以及工廠安全。

亞太地區佔最大市場佔有率

預計工業IoT將比消費物聯網佔據更大的市場佔有率。

隨著中美關係收緊,中國正在轉向日本的物聯網專業知識,以減少對美國的依賴。為此,中國多次邀請IVC成員代表參加中國物聯網主題研討會。中國也要求 IVC 支援建立一個國際組織,專注於在職場研究和實施更好的工業物聯網技術。

此外,政府在該地區實施工業物聯網使用案例發揮關鍵作用。數位印度和印度製造業等政府措施正在阻礙製造業。印度製造宣傳活動極大受益於物聯網,為製造業的永續提供創新方式。

智慧先進製造和快速轉型舉措(SAMARTH) Udyog Bharat 4.0 計畫旨在提高印度製造業對製造 4.0 的認知,並幫助相關人員應對智慧製造挑戰。

工業物聯網 (IIoT) 產業概覽

隨著工業 4.0 的發展,工業物聯網 (IIoT) 市場變得支離破碎,現在世界各地的大多數製造公司都在使用物聯網。因此,市場競爭非常激烈,每家公司都能夠利用物聯網提供服務。以下是市場的一些主要發展:

2023 年 4 月 - 西門子推出西門子 Xcelerator,這是一個全球開放數位業務平台,旨在為加拿大客戶快速、廣泛地釋放數位化的好處。該平台加速了工業、建築、電網和行動等各領域價值創造的數位轉型。西門子 Xcelerator 不斷擴大的市場促進了客戶、合作夥伴和開發人員之間的無縫互動和交易。以互通性、彈性和開放性的設計原則為指導,透過以服務形式提供的支援互通性聯網的硬體、軟體和數位服務的精選組合來簡化您的數位轉型。該平台與加拿大設施和營運管理公司 Dexterra Group 等關鍵參數合作。

2023 年 7 月 -Honeywell宣布收購 SCADAfence,該公司專注於監控各種操作技術(OT) 物聯網 (IoT) 網路的網路安全解決方案。 SCADAfence 以其在資產發現、威脅偵測和安全管治方面的專業知識而聞名,這些都是工業和建築管理網路安全工作的重要組成部分。

此外,SCADAfence 產品系列可無縫配置為 Honeywell Connected Enterprise 內 Honeywell Forge Cybersecurity+ 套件的一部分。這項策略性舉措符合Honeywell對數位化、永續性和 OT 網路安全 SaaS 解決方案的關注。此次整合將使Honeywell能夠為尋求增強情境察覺安全控制的現場經理、營運經理和 CISO 提供全面的企業 OT 網路安全解決方案。此外,此次收購還增強了Honeywell的網路安全能力,並強化了其快速擴張的 OT 網路安全產品組合,從而提高了營運安全性、可靠性和客戶效率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 對 IIoT 市場的影響

- 法律規範

- 市場促進因素

- 工廠中的數位化和感測器的普及

- 對自動化和高效流程的需求不斷成長

- 市場限制因素

- 資料安全和隱私、設備連接和互通性問題

第5章市場區隔

- 按類型

- 硬體

- 軟體

- 服務和連接

- 按最終用戶產業

- 製造業

- 運輸

- 油和氣

- 公共產業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭訊息

- 公司簡介

- Amazon Web Services Inc.

- Telefonaktiebolaget LM Ericsson

- Fujitsu Ltd

- Mitsubishi Electric Corporation

- SAP SE

- Siemens AG

- Honeywell International Inc.

- Emerson Electric Co.

- OMRON Corporation

- IBM Corporation

- Robert Bosch GmbH

- Oracle Corporation

- PTC Inc.

- Telit Communications Plc

- NXP Semiconductors NV

- Cisco Systems Inc.

- Cypress Semiconductor Corporation

- General Electric Company

第7章 廠商分類及主要廠商定位

第8章投資分析

第9章 市場機會及未來趨勢

The Industrial Internet Of Things Market size is estimated at USD 114.68 billion in 2024, and is expected to reach USD 503.07 billion by 2029, growing at a CAGR of 34.41% during the forecast period (2024-2029).

Key Highlights

- Technologies, such as big data and machine learning (ML), are being used increasingly to harness the data generated from connected devices to improve machine-to-machine (M2M) communication and streamline workflow. Also, declining manufacturing and sensor costs in producing IoTs further drive the demand.

- Significant advantages, such as large-scale profit margins through improvements in power efficiency, attract companies to invest in the market aggressively. According to a study by Microsoft, IoT is increasingly becoming indispensable to the manufacturing industry. 87% of IoT decision-makers in the industry have adopted IoT, and the vast majority say IoT is critical to the success of their company and that they are satisfied with the technology.

- Furthermore, the utilization and demand for edge computing in Industrial IoT are rapidly increasing due to its next-generation capabilities. For instance, in the current year, SECO, an Italian high-tech company, has announced a strategic partnership with Qualcomm Technologies International, Ltd-the goal of introducing innovative edge computing products and solutions tailored for the industrial Internet of Things (IIoT). Under the agreement, SECO is appointed Qualcomm Technologies IIoT design center partner, responsible for creating specific reference designs for readily available hardware solutions, primarily targeting OEM customers.

- Market incumbents like Google, Amazon Web Services, and Microsoft aim to establish more collaborative partnerships with edge-computing companies to provide one-stop solutions to industrial users. Further, the growing number of industrial robot installations globally is expected to create considerable demand for low latency and jitter communications, significantly improving the need for IIoT solutions.

- AWS IoT TwinMeker introduces three new entity modeling features to streamline the creation, deployment, and scalability of digital twins for real-world systems: Firstly, customers can now perform metadata bulk operations, including import, export, and update, facilitating the seamless migration of equipment models and metadata for external sources or different AWS accounts. This simplifies the creation of entity models at scale. Secondly, AWS IoT TwinMaker service quotas have been increased to support digital twins with higher entity and component counts. Third, introducing composite component types enhances flexibility and efficiency in constructing complex components.

- Moreover, metadata bulk operations and composite components are accessible in AWS IoT SiteWise, ensuring a consistent modeling experience for industrial customers across all regions where AWS IoT TwinMaker is generally available, except for metadata bulk operations, which are inaccessible in AWS GovCloud. Such developments were expected to influence future and current ongoing IIoT projects as they might be deemed non-essential and either postponed or canceled for the foreseeable future.

Industrial Internet of Things (IIoT) Market Trends

Manufacturing to Hold Major Market Share

Amongst the industries, the manufacturing industry holds a significant share of investment and market share, with both discrete and process manufacturing intensely investing in IoT adoption. Furthermore, there is a strong emphasis on integrating IoT within the industry, especially with the emergence of Industry 4.0. IoT is making significant strides in discrete and process manufacturing by providing avenues for operational optimization, downtime reduction, enhanced efficiency, facilitating data-driven decision-making, and ultimately contributing to increasing profit margins while minimizing costs, thus ensuring a swift return on investment (ROI) in IoT adoption.

For instance, according to the survey of Ubisense, a precise location, movement, and interaction of things tracker, the survey provides a clear snapshot of the 2023 manufacturing landscape, indicating that 62% of manufacturers have incorporated IoT technologies into their manufacturing or assembly processes. This significant increase in adoption highlights are growing acknowledgement of IoT's substantial potential to streamline operations and boost productivity.

In the upcoming years, utilities, discrete manufacturing, process manufacturing, and life sciences sectors will spend the most on IoT solutions. Most use cases are anticipated to continue enhancing asset tracking, asset life, and the ability to enforce physical distance through condition-based equipment tracking and maintenance.

The adoption rates from the industry are expected to be higher than any other industry due to the increased propensity of decision-makers to adopt IoT solutions. According to a study by General Electric, 58% of manufacturers mentioned IoT is required to transform industrial operations digitally.

In addition, a study by Capgemini found that industrial manufacturing held the second-highest average implementation percentage of high potential use cases by industries after telecom, which stood at 33%, focusing on production asset maintenance, manufacturing intelligence, and product quality optimization.

In addition, the adoption of industrial robots in manufacturing industries is expected to increase further over the coming years. For instance, according to IFR, the global demand for advanced robots in manufacturing is expected to grow; owing to such developments, various other aspects of the manufacturing industry, such as in-house logistics, inventory, and warehouse management etc., are also expected to be automated over the coming years.

According to a study by Microsoft, 87% of the manufacturing industry's decision-makers favored adoption, with industrial automation, quality & compliance, production planning & scheduling, supply chain and logistics, and plant safety & security being the primary use cases.

Asia Pacific To Hold Maximum Market Share

Industrial IoT is expected to represent a larger market share than consumer IoT.

Due to the straining US-China relationship, China is turning to Japanese IoT expertise to reduce dependency on the US. Thus, China has invited IVC member representatives to several Chinese symposiums addressing the IoT topic. China has also asked the IVC to help form an international organization focusing on researching and implementing better IIoT technology in the workplace.

Furthermore, the government plays a significant role in implementing the use cases of IIot in the region. Government initiatives like Digital India and Make in India are impeding the manufacturing industry. The make in India campaign immensely benefited from IoT for providing innovative ways for the sustainable development of manufacturing organizations.

The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aims to enhance awareness about manufacturing 4.0 within the Indian manufacturing industry and help stakeholders address the challenges related to smart manufacturing.

Industrial Internet of Things (IIoT) Industry Overview

The industrial internet of things market is fragmented as the majority of manufacturing companies across the world are using IoT after the current evolution of industry 4.0. This makes the market highly competitive and allows companies to provide services in IoT. Some of the key developments in the market are:

April 2023 - Siemens has introduced its global open digital business platform Siemens Xcelerator, aiming to rapidly and broadly unlock digitalisation benefits for its Canadian customers. This platform expedites digital transformation in value generation across various sectors such as industry, buildings, grids, and mobility. Siemens Xcelerator's expanding marketplace facilitates seamless interactions and transactions among customers, partners, and developers. It simplifies digital transformation by providing a curated portfolio of IoT-enabled hardware, software, and digital services adhering to design principles like interoperability, flexibility, and openness as a service. The platform collaborates with critical parameters, including Dexterra Group, are Canadian facilities and operations management company.

July 2023 - Honeywell has announced its acquisition of SCADAfence, which specializes in cyber security solutions for monitoring extensive operational technology (OT) Internet of Things (IoT) networks. SCADAfence is known for its expertise in asset discovery, threat detection, and security governance, crucial elements for cyber security initiatives in industrial and building management.

Moreover, the SCADAfence product lineup is set to seamlessly become part of the Honeywell Forge Cybersecurity+ suite within Honeywell Connected Enterprise. This strategic move aligns with Honeywell's emphasis on digitalization, sustainability, and OT cyber security SaaS solutions. The integration empowers Honeywell to deliver a comprehensive enterprise OT cyber security solution, catering to site managers, operations management, and CISOs in their quest for enhanced security management in situational awareness. Furthermore, this acquisition reinforces Honeywell's cyber security prowess and enhances its rapidly expanding OT cyber security portfolio, improving operational security, reliability, and customer efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 COVID-19 Impact on the IIoT market

- 4.5 Regulatory Framework

- 4.6 Market Drivers

- 4.6.1 Proliferation of digitization and adoption of sensors in plants

- 4.6.2 Growing demand for automated and efficient process

- 4.7 Market Restraints

- 4.7.1 Issues Related to Security and Privacy of Data and Connectivity of Devices and Interoperability

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services & Connectivity

- 5.2 End-user Vertical

- 5.2.1 Manufacturing

- 5.2.2 Transportation

- 5.2.3 Oil and Gas

- 5.2.4 Utility

- 5.2.5 Other End-user Verticals

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE INTELLIGENCE

- 6.1 Company Profiles

- 6.1.1 Amazon Web Services Inc.

- 6.1.2 Telefonaktiebolaget LM Ericsson

- 6.1.3 Fujitsu Ltd

- 6.1.4 Mitsubishi Electric Corporation

- 6.1.5 SAP SE

- 6.1.6 Siemens AG

- 6.1.7 Honeywell International Inc.

- 6.1.8 Emerson Electric Co.

- 6.1.9 OMRON Corporation

- 6.1.10 IBM Corporation

- 6.1.11 Robert Bosch GmbH

- 6.1.12 Oracle Corporation

- 6.1.13 PTC Inc.

- 6.1.14 Telit Communications Plc

- 6.1.15 NXP Semiconductors NV

- 6.1.16 Cisco Systems Inc.

- 6.1.17 Cypress Semiconductor Corporation

- 6.1.18 General Electric Company