|

市場調查報告書

商品編碼

1445975

紙杯 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Paper Cups - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

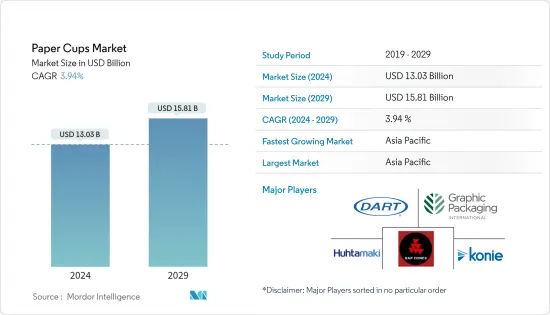

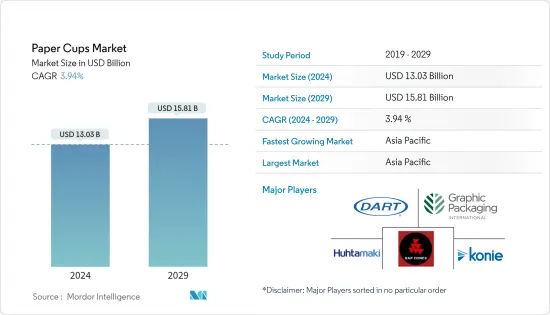

紙杯市場規模預計到2024年為130.3億美元,預計到2029年將達到158.1億美元,在預測期內(2024-2029年)CAGR為3.94%。

主要亮點

- 飲料業正在全球擴張,預計將對紙杯市場做出重大貢獻。隨著行業的發展並提供各種各樣的飲料,對合適載體的需求也隨之增加。訂購飲料外帶和外送上門的情況越來越受歡迎。這一趨勢進一步推動了對紙杯的需求,因為客戶需要安全、高效的包裝來運輸飲料。推動市場成長的主要因素之一是隨著行動飲料消費的成長趨勢,對紙杯的需求不斷成長。隨著城市化進程的加快,行動消費不斷增加,這與狂熱的習慣有關。

- 此外,星巴克、Dunkin' Donuts、Caribou等知名大型咖啡店品牌在美國都有存在。根據《每日咖啡新聞》報道,2022 年美國咖啡店市值達 458 億美元。

- 此外,消費者正在尋找一種不僅耐用而且美觀的杯子。這些品質使紙杯更受歡迎,並促使其高需求。需求的增加也是由於飲料消費的增加。這些因素促使製造商加強紙杯的阻隔和密封技術,以及整個供應鏈食品保鮮的技術突破。

- 透過在紙杯製造中使用可生物分解複合材料,該產品的保存期限將顯著延長,並將被各種最終用戶使用,這將推動市場。 JcFoodpack Bio 紙湯杯由可生物分解的牛皮紙、竹子或搪瓷紙板和 PE 內襯製成。典型用途包括熱湯、燕麥、義大利麵和冰淇淋或優格等冷凍食品。同樣,參與者專注於推出創新解決方案,以滿足不斷變化的市場需求和反收緊的限制。

- 2023 年 4 月,WinCup, Inc. 創造了 Phade,這是第一個內襯 PHA(聚羥基脂肪酸酯)的紙杯。它是一種由菜籽油發酵產生的新型生物聚合物,能夠在海洋和陸地環境中分解,使得使用紙杯盛裝熱飲成為可能,更加環保。 WinCup, Inc. 開發的革命性相紙杯取代了傳統紙杯。它們塗有由化石燃料製成的塑膠來容納飲料,因此無法回收或堆肥。

- 然而,大多數紙製品(紙杯)無法回收,因為它們塗有塑膠,每個杯子的塑膠含量只有 5%。這就是為什麼它們可以容納液體而不會將液體灑得到處都是。這也是它們不會分解成紙漿並回收成紙張的原因。大多數公司在其政策中實施了零浪費。儘管如此,他們仍無法執行這些操作。垃圾掩埋場排放的溫室氣體排放是導致氣候變遷的主要因素之一。

- COVID-19 大流行加劇了人們對衛生的擔憂,促使對一次性盤子、杯子和碗的需求增加。人們在共享個人物品(包括食物和飲料容器)時變得更加謹慎,以防止 COVID-19 的傳播。由於原料供應有限,紙杯的生產面臨課題。封鎖措施、供應鏈中斷和產能下降影響了製造紙杯所需材料的採購。向遠端工作的轉變和辦公室的關閉進一步影響了紙杯市場。隨著越來越多的人在家工作,對外帶或外帶飲料的需求減少,影響了辦公室環境中對紙杯的需求。

紙杯市場趨勢

QSR 預計將推動市場成長

- QSR 和永續性之間的關係需要更加一致。雖然快餐店注重速度和便利性,但他們在永續發展方面的做法各不相同。然而,業界越來越多的人意識到並努力採取更永續的做法,包括使用紙杯等環保材料。

- 已開發城市忙碌的生活方式以及外出用餐作為休閒活動一部分的趨勢催生了新的咖啡店和快餐店。特許經營模式是快餐連鎖店興起的新趨勢,預計將推動市場的成長。例如,地方當局開始激勵特許經營商和特許經營商,以吸引有興趣在經驗豐富的當地參與者的幫助下進入市場的國際品牌和投資者。

- 根據星巴克統計,2022年,全球星巴克門市數量為35,711家。該公司在過去十年中經歷了成長,星巴克的單位銷售額也有所增加。在過去的十年裡,由於全球擴張,這家咖啡公司的門市數量幾乎增加了四倍。這種消費模式正在發展中地區逐漸蔓延,促進了產業的成長並帶動了紙杯的需求。

- 此外,快餐店與不同食品鏈的投資和合作可能會增加對紙杯包裝的需求。 2022 年 3 月,A&W Restaurant 推出了首款無蓋、完全可堆肥的咖啡杯,不需要蓋子或吸管,不含塑膠內襯,並且完全可堆肥和可回收。來自英國的 ButterflyCup 的杯子設計創新完全由紙製成,具有獨特的水基塗層,可防止洩漏。此外,根據美國人口普查局的數據,2022年12月美國快餐店月銷售額達373.6億美元,2021年為336.8億美元。

亞太地區將成為紙杯成長最快的市場

- 亞太地區紙杯市場是全球最大、成長最快的市場之一。人口成長、都市化、生活方式的改變以及食品服務業的興起等因素促進了市場的擴張。

- 行動消費的成長趨勢,特別是在繁忙的城市地區,刺激了對紙杯的需求。紙杯提供的便利性符合消費者快節奏的生活方式,他們喜歡外帶和外送服務。該地區的食品服務業顯著擴張,包括快餐店、咖啡館和街頭食品攤販。這些場所嚴重依賴紙杯來提供飲料和外賣,推動了市場需求。

- QSR 致力於透過增加/開設新店來擴大其影響力,以滿足不斷成長的需求。星巴克是全球最大的咖啡連鎖店,在全球擁有近 36,000 家門市。截至2022年10月,全球星巴克門市最多的國家是美國,擁有超過1.5萬家門市。中國以 6,019 家門市排名第二。門市數量較2021年的5,358家增加,位居加拿大和日本之前。

- 此外,韓國等國家正在實施各種減少浪費的計畫。例如,2022 年 6 月,韓國對使用一次性咖啡杯實施強制可退還押金。此押金計畫旨在提高回收率,將由業者收取,並適用於擁有 100 家門市的飯店企業。

- 此外,在印度,政府宣布禁止使用一次性塑膠,並於2022 年7 月1 日起強制執行。消費者對塑膠對環境不利影響的認知不斷增強,這在購買行為中發揮著至關重要的作用。玉米澱粉是塑膠包裝最常見的替代品之一。領先的線上食品配送系統也改用玉米澱粉包裝,以宣傳環保的品牌形象。這些變化和快速發展預計將推動亞太地區紙杯市場的成長。

紙杯行業概況

全球紙杯市場的競爭格局正變得適度分散,這主要是由於新興市場中一些小型企業的進入。不過,與發展中經濟體相比,已開發經濟體的市場仍相對鞏固。市場近期的一些發展如下。

- 2022 年 7 月——Sonoco 位於南卡羅來納州哈茨維爾的紙板工廠表示,將增加混合紙包中紙杯的消費後回收和再循環前景,以用作製造新紙板的原料。作為頂級回收商、造紙廠所有者和紙包裝加工商,該公司處於鼓勵行業關注未來發展並擴大紙張價值鏈上的報廢選擇的理想位置。

- 2022 年 2 月 - Huhtamaki 擴大了對聯合利華 Carte D'Or 的支持,聯合利華將冰淇淋包裝改為可回收紙桶和紙蓋,轉而使用可回收紙,從而減少塑膠的使用。可回收的紙質包裝將使該品牌每年在英國減少 900 多噸原生塑膠。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- 評估 Covid-19 大流行對市場的影響

第 5 章:市場動態

- 市場促進因素

- 旅途中飲料消費的需求不斷成長

- 最近的創新有助於延長保存期限

- 市場課題

- 處置和高度碎片化等與可回收性相關的問題預計將影響利潤率

第 6 章:市場區隔

- 依罩杯類型

- 熱紙杯

- 冷紙杯

- 依最終用戶

- 速食店

- 制度性

- 其他最終用戶

- 依牆體類型

- 單層紙杯

- 雙層紙杯

- 三層壁紙杯

- 依地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 西班牙

- 歐洲其他地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 中東和非洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 亞太地區其他地區

- 北美洲

第 7 章:競爭格局

- 公司簡介

- Huhtamaki oyj

- Kap Cones Private Limited

- Graphic packaging international

- Dart container corporation

- Konie Cups International Inc.

- Go-Pak

- Benders Paper Cups

- International Paper

- Phoenix Packaging Operations, LLC.

- Eco-Products Inc.

第 8 章:投資分析

第 9 章:市場的未來

簡介目錄

Product Code: 68135

The Paper Cups Market size is estimated at USD 13.03 billion in 2024, and is expected to reach USD 15.81 billion by 2029, growing at a CAGR of 3.94% during the forecast period (2024-2029).

Key Highlights

- The beverage industry is expanding worldwide and is expected to contribute significantly to the market for paper cups. As the industry evolves and offers a wide range of beverages, the demand for suitable carriers also increases. The popularity of ordering beverages for takeaway and home delivery grew. This trend further drives the need for paper cups as customers require secure and efficient packaging for transporting their drinks. One of the major factors driving the market growth is the rising demand for paper cups in the increasing trend of consumption of on-the-go beverages. Consumption on the go continuously increased alongside rising urbanization, associated with frenetic habits.

- Further, Starbucks, Dunkin' Donuts, Caribou, and other well-known large coffee shop brands are present in the United States. The market value of the coffee shop in the United States reached USD 45.8 billion in 2022, according to Daily Coffee News.

- Additionally, consumers are looking for a cup that is not only durable but also visually appealing. These qualities make paper cups more desirable and contribute to their high demand. The increase in demand is also due to the rise in beverage consumption. Such factors propel manufacturers to enhance barrier and seal technologies for paper cups and technological breakthroughs for food preservation across the whole supply chain.

- The product's shelf life will be significantly extended by using biodegradable composite materials in paper cup manufacturing and will be utilized by various end users, which will drive the market. A biodegradable kraft, bamboo, or enamel paper board with PE liner makes up the JcFoodpack Bio paper Soup cup. Typical usage includes hot soups, oats, spaghetti, and frozen meals like ice cream or yogurt. In line with the same, players focus on launching innovative solutions to cater to the changing market needs and counter-tightening restrictions.

- In April 2023, WinCup, Inc. created Phade, the first paper cup lined with PHA (polyhydroxyalkanoate). It is a novel new biopolymer produced by the fermentation of canola oil and capable of decomposition in both marine and terrestrial environments, making it possible to use paper cups for hot beverages that are more environmentally friendly. The revolutionary phase paper cup, developed by WinCup, Inc., replaces conventional paper cups. These are coated in plastic made from fossil fuels to contain beverages and are, thus, unable to be recycled or composted.

- However, most paper products, paper cups, cannot be recycled because they are coated in plastic, as little as 5% of each cup. That's why they can hold liquid without spilling it everywhere. It's also why they don't decompose into a pulp and be recycled into paper. Most companies implemented zero waste in their policies. Still, they cannot execute those actions. One of the key contributors to climate change for greenhouse gas emissions emitted by landfills.

- The COVID-19 pandemic heightened hygiene concerns among people, leading to increased demand for disposable plates, cups, and bowls. Individuals became more cautious about sharing personal items, including food and drink containers, to prevent the spread of COVID-19. The production of paper cups faced challenges due to the limited availability of raw materials. Lockdown measures, disruptions in supply chains, and decreased production capacity affected the sourcing of materials necessary for manufacturing paper cups. The shift towards remote work and the closure of offices further impacted the paper cup market. With more people working from home, the demand for takeaway or to-go beverages decreased, affecting the need for paper cups in office settings.

Paper Cups Market Trends

QSR is Expected to Drive the Market Growth

- The relationship between QSRs and sustainability needs to be more consistent. While QSRs focus on speed and convenience, their practices regarding sustainability vary. However, there is an increasing awareness and effort within the industry to adopt more sustainable practices, including using environmentally friendly materials like paper cups.

- The busy lifestyle in developed cities and the trend of eating outside as part of leisure activities led to new coffee shops and QSRs. The franchise model is a new trend for the rise of QSR chains, which is expected to fuel the market's growth. For example, regional authorities started incentivizing franchisees and franchisers to attract international brands and investors interested in entering the market with the help of experienced local players.

- According to Starbucks, in 2022, there were 35,711 Starbucks stores globally. The company experienced growth over the past ten years, and Starbucks' unit sales increased. Over the past ten years, the coffee company practically quadrupled the number of stores thanks to global expansion. The consumption pattern is gradually spreading in the developing regions, contributing to the industry's growth and driving the demand for paper cups.

- Additionally, quick-service restaurants investing and collaborating with different food chains may raise demand for paper cup packaging. In March 2022, A&W Restaurant launched the first lidless, fully compostable coffee cup, which doesn't require a lid or straw, contains no plastic liner, and is fully compostable and recyclable. The cup design innovation from UK-based ButterflyCup is made entirely of paper, with a unique, water-based coating that prevents leaks. Moreover, according to the US Census Bureau, monthly quick-service restaurant sales in the United States reached USD 37.36 billion in December 2022, compared to USD 33.68 billion in 2021.

Asia-Pacific to be the Fastest Growing Market for Paper Cups

- The Asia-Pacific paper cups market is one of the largest and fastest-growing globally. Factors such as population growth, urbanization, changing lifestyles, and the rise of the food service industry contributed to the expansion of the market.

- The growing trend of on-the-go consumption, particularly in busy urban areas, fueled the demand for paper cups. The convenience offered by paper cups aligns with the fast-paced lifestyles of consumers who prefer takeaway and delivery services. The region witnessed a significant expansion of the food service sector, including quick-service restaurants, cafes, and street food vendors. These establishments rely heavily on paper cups for serving beverages and takeaways, driving the demand in the market.

- QSR focuses on expanding its presence by adding/opening new stores to cater to the increasing demand. Starbucks is the largest coffeehouse chain worldwide, with nearly 36 thousand stores across the globe. As of October 2022, the country with the most Starbucks stores worldwide was the United States, with over 15 thousand stores. China ranked second with 6,019 stores. The number of stores increased from 5,358 in 2021 and was ranked before Canada and Japan.

- Additionally, countries like South Korea are undertaking various programs to reduce waste. For instance, in June 2022, South Korea introduced a mandatory refundable deposit for disposable coffee cup use. The deposit scheme, intended to increase recycling rates, would be collected by operators and applied to hospitality businesses with 100 outlets.

- Further, in India, the government announced a ban on the application of single-use plastics that got enforced by July 1, 2022. Growing consumer awareness about the adverse effects of plastics on the environment plays a vital role in purchasing behavior. Corn starch is among the most common substitute for plastic packaging. Leading online food delivery systems also switch to corn starch packaging to promote an eco-friendly brand image. Such changes and rapid development are expected to boost market growth for paper cups in the Asia-Pacific.

Paper Cups Industry Overview

The competitive landscape of the Global Paper Cups Market is becoming moderately fragmented, leading due to the entry of several small players in the emerging markets. In the developed economies, though, the market remains relatively consolidated compared to developing economies. Some of the recent developments in the market are as follows.

- July 2022- The Hartsville, South Carolina, paperboard factory of Sonoco stated that it would increase post-consumer recovery and recycling prospects for paper cups in bales of mixed paper for use as raw material to make new paperboard. As a top recycler, paper mill owner, and paper packaging converter, the firm is ideally positioned to encourage the industry to focus on future developments and expand end-of-life options along the paper value chain.

- February 2022- Huhtamaki extended its support to Unilever's Carte D'Or as it slashes plastic use with a move to recyclable paper by shifting the packaging for their ice cream to recyclable paper tubs and lids. The recyclable paper-based packaging will enable the brand to eliminate more than 900 tonnes of virgin plastic in the UK annually.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment Of The Impact Of The Covid-19 Pandemic On The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for on-the-go Consumption of Beverages

- 5.1.2 Recent Innovations have aided Shelf-life

- 5.2 Market Challenges

- 5.2.1 Recyclability-related Concerns in the form of Disposal and High Levels of Fragmentation are Expected to Affect Profit Margins

6 MARKET SEGMENTATION

- 6.1 By Cup Type

- 6.1.1 Hot Paper Cups

- 6.1.2 Cold Paper Cups

- 6.2 By End-user

- 6.2.1 Quick Service Restaurants

- 6.2.2 Institutional

- 6.2.3 Other End-Users

- 6.3 By Wall Type

- 6.3.1 Single Wall Paper Cups

- 6.3.2 Double Wall Paper Cups

- 6.3.3 Triple Wall Paper Cups

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 France

- 6.4.2.3 Germany

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Rest of Europe

- 6.4.3 Latin America

- 6.4.3.1 Brazil

- 6.4.3.2 Argentina

- 6.4.3.3 Mexico

- 6.4.3.4 Rest of Latin America

- 6.4.4 Middle East and Africa

- 6.4.4.1 Saudi Arabia

- 6.4.4.2 South Africa

- 6.4.4.3 Egypt

- 6.4.4.4 Rest of Middle East and Africa

- 6.4.5 Asia Pacific

- 6.4.5.1 China

- 6.4.5.2 Japan

- 6.4.5.3 India

- 6.4.5.4 Australia

- 6.4.5.5 Rest of Asia Pacific

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huhtamaki oyj

- 7.1.2 Kap Cones Private Limited

- 7.1.3 Graphic packaging international

- 7.1.4 Dart container corporation

- 7.1.5 Konie Cups International Inc.

- 7.1.6 Go-Pak

- 7.1.7 Benders Paper Cups

- 7.1.8 International Paper

- 7.1.9 Phoenix Packaging Operations, LLC.

- 7.1.10 Eco-Products Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219

![紙杯市場:趨勢、機遇、競爭分析 [2023-2028]](/sample/img/cover/42/1297893.png)