|

市場調查報告書

商品編碼

1445960

電源設備 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Power Supply Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

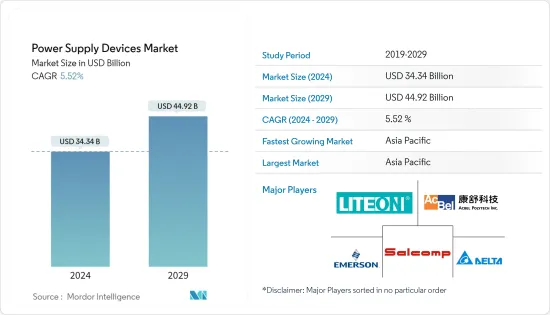

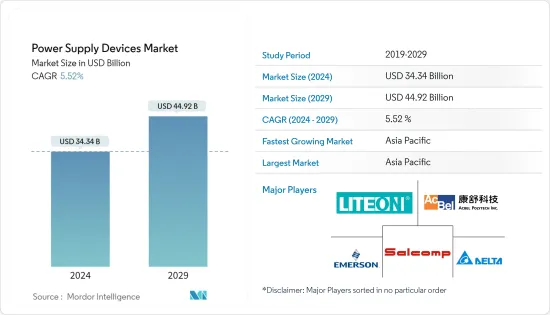

2024年電源設備市場規模預計為343.4億美元,預計到2029年將達到449.2億美元,在預測期內(2024-2029年)CAGR為5.52%。

由於對家庭和建築自動化系統的需求不斷成長,該市場經歷了顯著成長。消費性電子、醫療保健、軍事航太等各行業對電源的需求很高,為市場帶來了獲利機會。

主要亮點

- 電源是一種向電力負載輸送電力的電氣設備。電源的主要目標是將來自電源的電流轉換為負載供電所需的適當電壓、電流和頻率。

- 因此,電源有時被稱為電力轉換器。某些電源是獨立的單元,而其他電源則整合到它們供電的負載設備中。多年來電源技術的進步帶來了許多好處。透過利用複雜的電路和組件,電源可以提供穩定的電壓輸出,同時最大限度地減少能源浪費。

- 多年來,電源設備變得越來越受歡迎,因為它們在為電力負載提供能源以供消耗和運行方面發揮著至關重要的作用。各行業和工業設備對電力供應的需求不斷成長,預計將進一步推動其需求。

- 隨著物聯網 (IoT) 在智慧家庭、智慧城市、機器對機器 (M2M) 通訊和工業物聯網 (IIoT) 等各個領域的使用不斷增加,該市場正在加速發展。家庭和建築自動化系統的日益普及進一步推動了市場的發展。然而,由於區域和國家特定的監管和安全標準,預計市場成長將面臨障礙。此外,由於對輸入電源和非標準交流和直流輸入的嚴格設計考慮,預計電源市場在預測期內將面臨課題。

- 由於為遏制COVID-19傳播而實施的嚴格封鎖和社會疏遠措施,電力供應市場遭受了負面影響。經濟不確定性、部分企業停工以及消費者信心低迷導致對供電技術的需求下降。疫情也造成供應鏈中斷和物流活動延誤。不過,隨著限制的放鬆,預計疫情過後電力市場將會復甦。

電源裝置市場趨勢

消費者和行動領域將佔據重要市場佔有率

- 消費性電子產品需要電源才能正常運作。這些電源負責提供運作設備所需的電流。常見的家用電器和電子產品,例如手機、筆記型電腦、微波爐和燈泡,都使用直流電。然而,插座提供的電源是固定電壓為100V或200V的交流電。電源設備將交流電轉換為直流電並調節電壓以運行多種消費性電子設備。

- AC/DC電源廣泛用於各種電子設備,例如電腦、手機(例如壁式充電器)和電視。這些電源廣泛應用於各種環境和條件,其中消費性電子產品是重要的最終用戶。在這一領域,現在可以透過旨在最大限度地減少電力浪費的最新全球標準來顯著提高效率。

- 例如,遊戲機等家庭娛樂設備嚴重依賴直流電源。對遊戲機的需求不斷成長預計將推動市場的成長。遊戲產業的普及可歸因於年輕一代對遊戲的興趣日益濃厚。這一趨勢促使全球職業遊戲玩家數量的增加以及人們花在遊戲上的時間顯著增加。即使是休閒遊戲玩家也會在最新的遊戲機上投入大量資金。對遊戲機的需求增加促進了電源設備市場的成長。

- 智慧型手機和平板電腦是依賴穩定電源充電的電子設備。直流電源用於確保這些設備獲得穩定的能源供應,而不會出現任何可能損壞其敏感內部組件的波動。這是因為手機電池儲存的是直流電,與交流電相比,直流電更容易儲存。由於外部電源通常為交流電源,因此在為手機或其他可攜式裝置充電之前,需要使用整流器將交流電源轉換為直流電源。這些預期的市場機會是由於對這種轉換能力的需求不斷成長而產生的。

- 愛立信最新報告顯示,2022年全球智慧型手機行動網路用戶數接近64億,預計2028年將超過77億。中國、印度和美國的智慧型手機行動網路用戶數最多。儘管 2022 年銷量趨於平穩,但智慧型手機平均售價的上漲預計將推動未來幾年市場的成長。

- GSMA 預測,由於這些裝置的可負擔性不斷提高,到 2023 年,亞太地區、拉丁美洲和撒哈拉以南非洲地區的智慧型手機採用率預計將出現最大幅度的成長。智慧型手機的平均售價正在下降,事實證明,各種措施在推動普及方面取得了成功。到2030年,智慧型手機連線數將達到90億,佔總連線數的92%。網路普及率的不斷提高、智慧型手機供應商的行銷活動以及社交媒體訂閱量的增加預計將促進智慧型手機的銷售,從而促使對電源的需求大幅增加。

亞太地區預計將出現顯著成長

- 亞太地區是最大的生產和消費地區之一,擁有中國、印度、韓國等重要國家。工信部表示,中國創新能力和品牌建立能力不斷增強,消費性電子產銷售量穩居全球第一。隨著該地區不斷增加的投資以增強該地區的消費性電子產品生產能力,預計該市場將獲得牽引力。

- 中國資訊通訊研究院數據顯示,2021年中國支援5G網路的智慧型手機數量增加63.5%,達到2.66億部。中國資訊通訊研究院報告稱,2022年5G手機出貨量達到2.14億部,佔全國手機出貨量的78.8%。隨著市場需求的不斷成長,該地區的消費性電子市場預計將持續成長。引領這一成長的是智慧家電、創新高階產品和新型智慧型手機。

- 根據中國國家統計局的數據,中國電力產業經歷了顯著成長,成為一個價值數十億美元的產業。 2021年前10個月,中國家用電器市場規模達到約14億元(2億美元)。 2023年7月,中國家用電器和消費性電子產品零售額達近726億元人民幣(102.4億美元)。中國企業美的集團自2014年起穩居全球第一大家電企業地位,2022年銷售額約510億美元。家電產量的不斷增加預計將對電源設備產生巨大需求。

- 同樣,5G 網路和物聯網 (IoT) 等技術進步也推動了電子產品的快速普及。 「數位印度」和「智慧城市」計畫等措施進一步推動了電子設備市場對物聯網的需求,這些項目將徹底改變電子產品產業。這些非凡的舉措預計將成為市場成長的驅動力。

- 亞太地區是著名醫療器材製造商生產和採購醫療器材的理想目的地。市場的成長是由常規醫療檢查的日益普及和醫療設備技術的進步所推動的。該地區許多國家正在投資醫療設備市場,預計將推動AC/DC轉換器的應用。

電源元件行業概況

電源設備市場處於半整合狀態,主要參與者包括台達電子公司、艾默生電氣公司、光寶科技公司、Acbel Polytech Inc. 和 Salcomp PLC。市場參與者正在採取合作夥伴關係和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2023年8月,明緯推出全新超寬150~1500Vdc高壓輸入DC-DC小瓦數轉換器:DDRH-15/30/45系列。適用於5000公尺高海拔地區,已通過IEC62109-1光伏認證。可廣泛應用於光伏、儲能、充電樁或任何高低壓轉換相關的設備和系統。

- 2023年5月,台達電子宣布策略合作,將長期合作關係從工業應用擴展到汽車應用。兩家公司還簽署了一份合作備忘錄,以加強聯合創新活動,幫助為快速發展的電動車市場創造更有效、更密集的解決方案。該協議適用於廣泛的組件,包括用於電動車傳動系統應用(如牽引逆變器、TDI 轉換器或微控制器車載充電器產品)的 DCDC 轉換器和嵌入式模組。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- COVID-19 後遺症和其他宏觀經濟因素對市場的影響

第 5 章:市場動態

- 市場促進因素

- 家庭和建築自動化系統的日益普及

- 節能設備的需求不斷增加

- 市場限制

- 嚴格的監管合規性和安全標準

第 6 章:市場區隔

- 依設備類型

- 交流-直流電源

- 直流-直流轉換器

- 依最終用戶產業

- 溝通

- 工業的

- 消費者和行動裝置

- 汽車

- 運輸

- 燈光

- 其他最終用戶產業

- 依地理

- 美洲

- 歐洲、中東和非洲 (EMEA)

- 亞太

第 7 章:競爭格局

- 公司簡介

- Delta Electronics Inc.

- Emerson Electric Co.

- LITE-ON Technology Corporation

- Acbel Polytech Inc.

- Salcomp PLC

- Mean Well Enterprises Co. Ltd

- Siemens AG

- Murata Manufacturing Co. Ltd

- TDK-Lambda Corporation

第 8 章:投資分析

第 9 章:市場的未來

The Power Supply Devices Market size is estimated at USD 34.34 billion in 2024, and is expected to reach USD 44.92 billion by 2029, growing at a CAGR of 5.52% during the forecast period (2024-2029).

The market has experienced significant growth due to the increasing demand for home and building automation systems. There is a high demand for power supply in various industries, such as consumer electronics, medical and healthcare, and military and aerospace, which presents a profitable opportunity for the market.

Key Highlights

- A power supply is an electrical apparatus that delivers electric power to an electrical load. The primary objective of a power supply is to transform electric current from a source into the appropriate voltage, current, and frequency required to energize the load.

- Consequently, power supplies are occasionally denoted as electric power converters. Certain power supplies are independent units, whereas others are integrated into the load appliances they energize. The progressions in power supply technology throughout the years have yielded numerous benefits. Through the utilization of sophisticated circuitry and components, power supplies can furnish a steady voltage output while minimizing energy wastage.

- Power supply devices have become increasingly popular over the years, as they play a crucial role in providing energy to electric loads for consumption and operation. The growing demand for power supply in various industries and industrial equipment is anticipated to boost its demand further.

- The market is being accelerated by the increasing utilization of the Internet of Things (IoT) in various sectors, such as smart homes, smart cities, Machine-to-Machine (M2M) communications, and Industrial IoT (IIoT). The market is further driven by the growing adoption of home and building automation systems. However, the market growth is expected to face obstacles due to regional and country-specific regulatory and safety standards. Additionally, the power supply market is projected to face challenges during the forecast period due to stringent design considerations for input power and nonstandard AC and DC inputs.

- Due to the strict lockdowns and social distancing measures implemented to contain the spread of COVID-19, the power supply market suffered a negative impact. The economic uncertainty, partial shutdown of businesses, and low consumer confidence resulted in a decrease in demand for power supply technology. The pandemic also caused disruptions in the supply chain and delayed logistics activities. Nevertheless, as restrictions are eased, the power supply market is predicted to recover in the post-pandemic scenario.

Power Supply Devices Market Trends

Consumer and Mobile Segment to Hold Significant Market Share

- Consumer electronics require power supplies to function properly. These supplies are responsible for providing the necessary electrical current to run devices. Common household appliances and electronics, such as cellphones, laptops, microwaves, and light bulbs, use DC electricity. However, the power supplied from outlets is AC electricity with a fixed voltage of 100V or 200V. Power supply devices convert AC to DC and regulate voltages to operate several consumer electronic devices.

- AC/DC power supplies are extensively used in various electronic devices such as computers, cell phones (e.g., wall chargers), and televisions. These power supplies are widely employed in diverse settings and conditions, with consumer electronics being a prominent end user. In this realm, it is now feasible to attain remarkably elevated levels of efficiency by the latest global standards aimed at minimizing electrical power wastage.

- For instance, home entertainment devices such as game consoles rely heavily on DC power. The increasing demand for game consoles is expected to boost the growth of the market. The rise in popularity of the gaming industry can be attributed to the growing interest in gaming among the younger generation. This trend has led to an increase in the number of professional gamers worldwide and a significant rise in the amount of time people dedicate to gaming. Even casual gamers invest substantial amounts of money in the latest gaming consoles. The increased demand for gaming consoles has contributed to the growth of the power supply devices market.

- Smartphones and tablets are electronic devices that rely on a stable power source for charging. DC power supplies are utilized to ensure these gadgets receive a consistent energy supply without any fluctuations that could potentially harm their sensitive internal components. This is because cell phone batteries store DC power, which is easier to store compared to AC power. As the external power supply is typically AC, the conversion of AC to DC using a rectifier is necessary before charging cell phones or other portable devices. These anticipated market opportunities are due to the increasing demand for such conversion capabilities.

- Ericsson's latest report revealed that the number of smartphone mobile network subscriptions worldwide had almost hit 6.4 billion in 2022 and is expected to exceed 7.7 billion by 2028. China, India, and the United States have the highest number of smartphone mobile network subscriptions. Despite sales leveling off in 2022, the increasing average selling price of smartphones is predicted to drive the growth of the market in the coming years.

- GSMA predicts that the Asia-Pacific, Latin America, and Sub-Saharan Africa are expected to experience the largest surge in smartphone adoption by 2023 due to the growing affordability of these devices. The average selling prices of smartphones are decreasing, and various initiatives are proving successful in driving uptake. By 2030, there will be 9 billion smartphone connections, which will account for 92% of total connections. The increasing internet penetration, marketing activities by smartphone vendors, and increasing subscriptions in social media are expected to boost smartphone sales, leading to a significant increase in demand for power supplies.

Asia Pacific is Expected to Witness Significant Growth

- Asia-Pacific is one of the largest regions for production and consumption, with the presence of significant countries like China, India, Korea, and others. According to the Ministry of Industry and Information Technology, China's enhanced innovation and brand-building capacity have propelled the country to secure the top position worldwide in the production and sales of consumer electronics. The market is expected to gain traction with the increasing investments in the region to enhance the region's consumer electronics production capabilities.

- According to the China Academy of Information and Communications (CAICT), the number of smartphones in China that support 5G networks increased by 63.5%, reaching 266 million in 2021. CAICT reported that the shipment volume of 5G mobile phones reached 214 million in 2022, representing 78.8% of the total mobile phone shipments in the country. With the rising market demand, the consumer electronics market in the region is expected to experience consistent growth. Leading the way in this growth are smart appliances, innovative high-end products, and new smartphones.

- According to the National Bureau of Statistics of China, the Chinese household appliance industry has experienced significant growth, becoming a multi-billion dollar sector. In the initial ten months of 2021, the market volume of electrical household appliances in China reached approximately YUAN 1.4 billion (USD 0.20 billion). In July 2023, the retail sales of household appliances and consumer electronics in China reached nearly YUAN 72.6 billion (USD 10.24 billion). Midea Group, a Chinese company, has held the position of the world's largest household appliance company since 2014, with a sales value of around USD 51 billion in 2022. The increasing production of household appliances is expected to create immense demand for power supply devices.

- Similarly, the rapid adoption of electronic products is being propelled by technological advancements like the implementation of 5G networks and the Internet of Things (IoT). The demand for IoT in the electronics devices market has been further boosted by initiatives such as 'Digital India' and 'Smart City' projects, which are set to revolutionize the electronic products industry. These remarkable initiatives are anticipated to be the driving force behind market growth.

- The Asia-Pacific region is an ideal destination for prominent medical device manufacturers to produce and procure medical devices. The market's growth is driven by the increasing adoption of routine healthcare check-ups and advancements in medical device technology. Many countries in the region are investing in the medical devices market, which is anticipated to boost the applications of AC/DC converters.

Power Supply Devices Industry Overview

The power supply devices market is semi-consolidated with the presence of major players like Delta Electronics Inc., Emerson Electric Co., LITE-ON Technology Corporation, Acbel Polytech Inc., and Salcomp PLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In August 2023, Mean Well Enterprises Co. Ltd introduced a new ultra-wide 150~1500 Vdc high voltage input DC-DC small wattage converter: DDRH-15/30/45 series. It is suitable for high altitudes up to 5,000 meters and has passed IEC62109-1 photovoltaic certification. It can be widely used in photovoltaics, energy storage, charging piles, or any HV-LV conversion-related equipment and systems.

- In May 2023, Delta Electronics announced strategic collaborations to extend long-term partnerships from industrial to automotive applications. A memorandum of understanding was also signed between the two companies to strengthen their joint innovation activities to help create more effective and denser solutions for the rapidly developing EV market. This agreement shall apply to a broad range of components, including DCDC converters and embedded modules for use with EV drivetrain applications like traction inverters, TDI converters, or microcontrollers onboard charger products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Home and Building Automation Systems

- 5.1.2 Increasing Demand for Energy-efficient Devices

- 5.2 Market Restraints

- 5.2.1 Stringent Regulatory Compliance and Safety Standards

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 AC-DC Power Supplies

- 6.1.2 DC-DC Converters

- 6.2 By End-user Industry

- 6.2.1 Communication

- 6.2.2 Industrial

- 6.2.3 Consumer and Mobile

- 6.2.4 Automotive

- 6.2.5 Transportation

- 6.2.6 Lighting

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe, Middle East and Africa (EMEA)

- 6.3.3 Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Delta Electronics Inc.

- 7.1.2 Emerson Electric Co.

- 7.1.3 LITE-ON Technology Corporation

- 7.1.4 Acbel Polytech Inc.

- 7.1.5 Salcomp PLC

- 7.1.6 Mean Well Enterprises Co. Ltd

- 7.1.7 Siemens AG

- 7.1.8 Murata Manufacturing Co. Ltd

- 7.1.9 TDK-Lambda Corporation