|

市場調查報告書

商品編碼

1445714

Wi-Fi - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Wi-Fi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

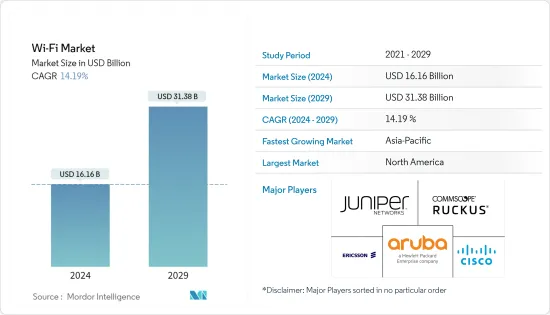

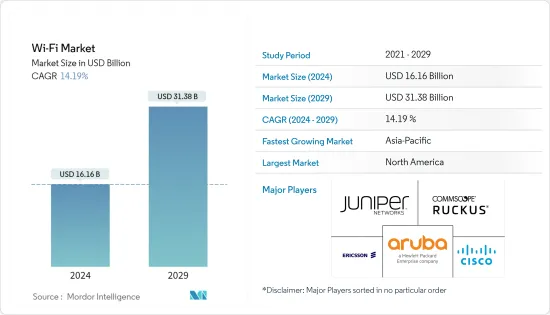

Wi-Fi 市場規模預計 2024 年為 161.6 億美元,預計到 2029 年將達到 313.8 億美元,預測期內(2024-2029 年)CAGR為 14.19%。

如今,在家工作已成為一種大趨勢。大規模遠端工作的轉變速度催生了個人設備,包括手機、筆記型電腦、平板電腦、桌上型電腦等。

主要亮點

- 我們也觀察到員工使用個人 Wi-Fi 網路連線來存取公司網路。 COVID-19 大流行造成的意外中斷促進了 Wi-Fi 的使用,以維持業務和關鍵功能的運作。此外,全球多個行業透過使用語音、視訊和物聯網設備等需要大量頻寬的應用程式,從 COVID-19 大流行中恢復過來。因此,隨著 Wi-Fi 需求的增加,無線網路變得超額訂閱,促使聯盟 IT 團隊限制應用程式效能。

- 機器對機器的應用越來越傾向於無線連線。對零售和製造業互聯互通的多項投資推動了成長。這種成長造成了 2.4 GHz 和 5 GHz 頻譜的擁塞,從而推動了對 6 GHz 頻譜分配的需求。

- 此外,邊緣網路和運算引導企業架構最佳化對物聯網應用和通訊資料集的關鍵資料分析的處理。超過 50% 的工作負載在企業資料中心外部執行。由於 5G 和 Wi-Fi 6 支援的多重存取邊緣,這進一步提高了對低延遲、即時通訊和高清視訊應用的需求。

- 對於服務而言,控制設備的網際網路應能夠直接相互通訊,而無需轉換或基於 IP 的標準。這種與無線連接和運算平台的整合方法可以實現設計創新。

- 國際電信聯盟 (ITU) 估計今年將有 53 億人(即世界人口的 66%)使用網路。這比 2019 年成長了 24%,同期約有 11 億人加入網路。隨著越來越多的人使用網際網路,本地和國際 Wi-Fi 路由器製造商將有更多機會推出新產品並提高頻寬,以獲得更大的市場佔有率。

- 此外,公共 Wi-Fi 網路(具有預先共用金鑰的網路)並不代表安全的選擇。儘管這些網路的意圖可能與零售商店不同,但它們缺乏一定程度的保證或法律義務來保護設備或資料,從而構成了威脅。同樣,用戶需要幫助來確定攔截以及他們無法讀取和修改其資料。

WiFi市場趨勢

室內預計將佔據重要市場佔有率

- 近年來,Wi-Fi 的普及程度不斷提高。區域網路 (LAN) 現在無需使用佈線或電纜即可運行,這使其成為企業和家庭的首選。 Wi-Fi 也被用來為筆記型電腦、智慧型手機、平板電腦和電子遊戲機等連接設備提供無線寬頻網路存取。

- 此外,GPS 是一種通常會被牆壁阻擋的技術,需要在建築物內更好的接收才能進行位置追蹤。為了解決這個問題,Wi-Fi 已成為計算即時定位系統 (RTLS) 資產標籤位置的熱門技術選擇。

- 雖然Wi-Fi的工作範圍一般較短,但訊號可擴展至150公尺。準確度通常由環境中部署的存取點數量決定。此區域中接入點的數量與精確定位的產生成正比。 Wi-Fi 定位系統不需要額外的硬體或基礎設施維護。由於大多數辦公空間、家庭和其他設施已經安裝了 Wi-Fi 基礎設施,因此無需額外投資即可提供基本水準的定位能力。

- 此外,Wi-Fi 通話是室內 Wi-Fi 設定中的另一個主要應用。不斷成長的行動訂閱率導致蜂窩網路在分發其產品和滲透現代建築方面面臨困難;人們已經開始透過 Wi-Fi 運行大部分資料。

- 此外,語音通話可以以 Skype 等 OTT 應用程式的形式或作為 femtocell 和 UMA 等措施透過 Wi-Fi 傳輸,以增強用戶家中行動語音服務的覆蓋範圍。此外,對國內和國際電話收取相同的費率使其成為一般網路資費的有吸引力的替代方案。

- 此外,大多數家庭正在轉變為“智慧家庭”,這需要網際網路來實現許多功能。 Amazon Echo 和 Google Home 等智慧電視和智慧音箱的出現推動了無線路由器市場的成長。

亞太地區成長最快

- 中國已經建立了5G生態系統,預計在預測期內將進一步發展。不過,5G技術很可能與目前的行動寬頻一起成為熱點技術,而成長預計將是漸進的。在亞太地區,中國是擁有最廣泛的5G網路的國家之一。據工信部稱,去年中國預計興建超過60萬個5G基地台。

- 在中國,Wi-Fi也廣泛應用於室內應用。憑藉其強勁的消費電子產業,預計該國將在預測期內見證 Wi-Fi 的快速普及。此外,2020年11月,中國公司中興通訊推出了首款帶有六個機上盒的Wi-Fi中興ZXV10 B860AV6,它提供高速網路存取以及高穩定性和低延遲。此外,它還支援Wi-Fi 6傳輸QoS解決方案和全屋智慧網路解決方案。

- 此外,日本政府同意一項旨在推動智慧城市發展投資的計劃。根據國土管理部的公告,政府早些時候同意了“智慧城市原則”,該原則主要涉及利用資訊技術發展現代城市空間和城市管理。這有效地為柬埔寨和日本之間的城市發展創造了一個公私合作平台。

- 2022 年 11 月,亞洲航空宣布與科技公司 Sugarbox 合作,並開始在其所有飛機上提供機上 Wi-Fi。該服務將使乘坐印度亞洲航空航班的旅客能夠觀看 1,000 多部國際和印度電影、網路連續劇和短片,並透過航班上安裝的系統從 OTT 應用程式串流傳輸無緩衝內容。

- 此外,根據 2020 年 12 月的更新,韓國在世界上首次在公共巴士上建立了免費的全國性無線網路。這樣做是為了讓公民輕鬆獲取資訊並降低通訊成本。此外,韓國政府計劃在公共區域安裝 10,000 個免費 Wi-Fi 接入點。到今年,它希望在全國交通站點、社區服務中心等公共場所總共安裝41,000個接入點。

WiFi產業概況

Wi-Fi 市場競爭非常激烈,有多家主要參與者。在市場上佔有顯著佔有率的主要參與者專注於擴大其在國外的客戶群。這些公司正在利用戰略合作計劃來增加其市場佔有率和盈利能力。市場上營運的公司也收購了從事無線路由器技術的新創公司,以增強其產品能力。市場的一些最新發展是:

2022年11月,全球物聯網解決方案供應商移遠無線宣布推出以高通QCA206x Wi-Fi 6E晶片為基礎的FC6xE系列Wi-Fi和藍牙模組。它旨在使 Wi-Fi 更快、更安全、更可靠。該系列還具有藍牙音訊功能。

2022 年 2 月,康普宣布與沃達豐德國合作,部署 Touchstone TG6442 DOCSIS 3.1 有線閘道器,為德國數百萬用戶提供 Wi-Fi 6 效能。此次合作將使沃達豐德國能夠增強其客戶的家庭 Wi-Fi 連接,並提供更快的寬頻速度和更低的延遲,從而透過 Wi-Fi 和其他延遲敏感的應用程式實現可靠的超高清視訊。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- COVID-19對Wi-Fi產業的影響(近期工作環境的變化促使室內Wi-Fi產品的需求增加以及BYOD趨勢的影響)

- Wi-Fi 標準與法規的演變

第 5 章:市場動態

- 市場促進因素

- 主要市場對智慧消費性電子設備的需求上升

- 正在進行的智慧城市專案重點關注新興地區戶外 Wi-Fi 的部署

- Wi-Fi 技術的持續進步(Wi-Fi 6 標準實施等)

- 市場課題

- 嚴格的政府指導方針和資料法規

- 密集環境中的營運課題

- 與戶外區域實施相關的擔憂

第 6 章:全球 WI-FI 市場 - 區隔

- 依產品類型

- 存取點

- 閘道

- 路由器和擴展器

- 服務(設計、實施和支援)

- 其他設備類型

- 其他解決方案

- 依應用類型

- 室內(住宅、企業、教育)

- 戶外(公共服務、交通、公用事業等)

- 地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 韓國

- 亞太其他地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第 7 章:競爭格局

- 公司簡介

- Cisco Systems Inc.

- Aruba Networks (HP Enterprise)

- CommScope (Ruckus Networks (Arris International))

- Juniper Networks Inc.

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd

- Aerohive Networks (Extreme Networks)

- MetTel Inc.

- Cloud4Wi Inc.

- Fortinet Inc.

- Purple Wi-Fi Ltd

- SingTel

- Ubiquiti Inc.

- Motorola Solutions Inc.

- New H3C Technologies Co. Ltd

第 8 章:投資分析

第 9 章:市場的未來

The Wi-Fi Market size is estimated at USD 16.16 billion in 2024, and is expected to reach USD 31.38 billion by 2029, growing at a CAGR of 14.19% during the forecast period (2024-2029).

Working from home has become a megatrend these days. The speed of the shift to large-scale remote work has resulted in personal devices, including mobile phones, laptops, tablets, desktops, etc.

Key Highlights

- Employees are also observed using personal Wi-Fi internet connections to access the corporate network. This unexpected disruption due to the COVID-19 pandemic boosted the use of Wi-Fi to keep businesses and critical functions operational. Moreover, multiple industries globally bounced back from the COVID-19 pandemic by engaging in bandwidth-hungry applications, such as voice, video, and IoT devices. Therefore, as the demand for Wi-Fi increases, wireless networks become oversubscribed, leading the allied IT teams to throttle application performance.

- Machine-to-machine applications are increasingly driven toward wireless connections. Multiple investments in connectivity for retail and manufacturing are contributing to the growth. Such growth creates congestion in the 2.4 and 5 GHz spectrums, driving the demand for the 6 GHz spectrum allocation.

- Further, edge networks and computing have led enterprise architectures to optimize processing for business-critical analysis of data sets from IoT applications and communications. More than 50% of the workloads are performed outside the enterprise data center. This further boosts the requirement for low-latency, real-time communications, and high-definition video applications thanks to the multi-access edge enabled by 5G and Wi-Fi 6.

- For services, the connected networks of control devices are expected to communicate directly with each other without translation or IP-based standards. This integrated approach with wireless connectivity and compute platforms may enable design innovation.

- In the current year, the International Telecommunication Union (ITU) estimates that 5.3 billion people, or 66% of the world's population, will be utilizing the Internet. This represents a 24% increase from 2019, with an estimated 1.1 billion people joining the Internet during that time. With so many more people using the internet, both local and international Wi-Fi router makers will have more chances to come out with new products and boost bandwidth in order to get a big share of the market.

- Additionally, public Wi-Fi networks (those with a pre-shared key) do not represent a safe option. While these networks may have different intentions than retail stores, the absence of a level of assurance or legal obligation for them to secure a device or data poses a threat. Again, users need help to be sure of the intercept and their inability to read and modify their data.

WiFi Market Trends

Indoor is Expected to Account For Significant Market Share

- The popularity of Wi-Fi has invariably increased in recent years. Local area networks (LANs) can now operate without the use of wiring or cables, making them the preferred choice for businesses and homes. Wi-Fi has also been utilized to provide wireless broadband Internet access for connected devices, such as laptops, smartphones, tablet computers, and electronic gaming consoles.

- Further, GPS is a technology typically obstructed by walls and needs better reception inside buildings for location tracking. To counter this, Wi-Fi has emerged as a popular technology choice for calculating the position of an asset tag for a real-time location system (RTLS).

- Although Wi-Fi generally has shorter operation ranges, the signal can be extended up to 150 meters. The accuracy is typically determined by the number of access points deployed in the environment. The number of access points in the area is directly proportional to the production of a precise and accurate location. Wi-Fi positioning systems do not require additional hardware or infrastructure maintenance. Since most office spaces, homes, and other facilities already have Wi-Fi infrastructure installed, providing a base level of positioning capability is possible without additional investments.

- Moreover, Wi-Fi calling is another primary application in indoor Wi-Fi settings. Increasing mobile subscription rates have been causing cellular networks to face difficulties distributing their offerings and penetrating modern buildings; people have begun running most of their data through Wi-Fi.

- Further, voice calls can be transmitted over Wi-Fi either in the form of OTT applications such as Skype or as initiatives such as femtocells and UMA to enhance the reach of mobile voice services in users' homes. Moreover, charging the same rate for domestic and international calls has made it an attractive alternative to general network tariffs.

- Further, most households are being transformed into "smart homes," which require the internet to facilitate many functions. The advent of smart TVs and smart speakers, such as Amazon Echo and Google Home, boosted the growth of the wireless router market.

Asia-Pacific to Witness the Fastest Growth

- China has an established 5G ecosystem, which is expected to grow further in the forecast period. However, the 5G technology is likely to serve as a hotspot technology along with the current mobile broadband, and the growth is expected to be gradual. In the Asia-Pacific region, China has one of the most extensive 5G networks. According to the Ministry of Industry and Information Technology, China expected to build over 600,000 5G base stations last year.

- In China, wi-fi is also widely used for indoor applications. With its robust consumer electronics industry, the country is expected to witness the rapid adoption of wi-fi over the forecast period. Additionally, in November 2020, a China-based company, ZTE, launched its first wi-fi with six set-top boxes, the ZTE ZXV10 B860AV6, which offers high-speed internet access along with high stability and low latency. Additionally, it supports wi-fi 6 transmission QoS solutions and a smart networking solution for the whole house.

- Further, the Government of Japan agreed to an initiative that seeks to drive investments in the development of smart cities. According to an announcement by the Ministry of Land Management, the government had earlier agreed to "smart city principles," which deal primarily with the use of IT to develop modern urban spaces and urban management. This has effectively created a public-private platform for urban development between Cambodia and Japan.

- In November 2022, AirAsia announced its partnership with technology firm Sugarbox and started providing in-flight Wi-Fi on all its aircraft. The service will enable travelers on AirAsia India flights to access over 1,000 international and Indian movies, web series episodes, and short movies, and stream buffer-free content from OTT apps from the system installed in the flight.

- Furthermore, according to a December 2020 update, South Korea established a free nationwide wireless internet network on public buses for the first time in the world. This was done to give citizens easy access to information and reduce communication costs. Also, the South Korean government plans to install 10,000 free wi-fi access points in public areas. By this year, it hopes to have installed 41,000 access points in total at public locations across the country, such as transportation stations and community service centers.

WiFi Industry Overview

The Wi-Fi market is highly competitive, with several major players. The major players with prominent shares in the market focus on expanding their customer bases across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. The companies operating in the market also acquire start-ups working on wireless router technologies to strengthen their product capabilities. Some of the recent developments in the market are:

In November 2022, Quectel Wireless Solutions, a global IoT solutions provider, announced the launch of the FC6xE series of Wi-Fi and Bluetooth modules based on Qualcomm's QCA206x Wi-Fi 6E chip. It is made to make Wi-Fi faster, more secure, and more reliable. The series also has Bluetooth audio capabilities.

In February 2022, CommScope announced its partnership with Vodafone Germany to deploy its Touchstone TG6442 DOCSIS 3.1 cable gateways to deliver Wi-Fi 6 performance to millions of subscribers across Germany. The partnership would enable Vodafone Germany to enhance its customers' in-home Wi-Fi connections and offer faster broadband speeds with lower latency, enabling reliable ultra-HD video over Wi-Fi and other delay-sensitive applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Wi-Fi Industry (Recent Changes in Work Environment has Led to Increasing Demand for Indoor Wi-Fi Products and the Impact of BYOD Trends)

- 4.5 Evolution of Wi-Fi Standards and Regulations

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Demand for Smart Consumer Electronics Devices in the Major Markets

- 5.1.2 Ongoing Smart City Projects Focused on Deployment of Outdoor Wi-Fi in Emerging Regions

- 5.1.3 Ongoing Technological Advancements in Wi-Fi Technology (Wi-Fi 6 Standard Implementation, Etc.)

- 5.2 Market Challenges

- 5.2.1 Stringent government guidelines and data regulations

- 5.2.2 Operational Challenges in Denser Environments

- 5.2.3 Concerns Related to Implementation in Outdoor Areas

6 GLOBAL WI-FI MARKET - SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Access Points

- 6.1.2 Gateways

- 6.1.3 Routers and Extenders

- 6.1.4 Services (Design, Implementation, and Support)

- 6.1.5 Other Device Types

- 6.1.6 Other Solutions

- 6.2 By Application Type

- 6.2.1 Indoor (Residential, Enterprises, Education)

- 6.2.2 Outdoor (Public Services, Transportation, Public Utilities, Etc.)

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Aruba Networks (HP Enterprise)

- 7.1.3 CommScope (Ruckus Networks (Arris International))

- 7.1.4 Juniper Networks Inc.

- 7.1.5 Telefonaktiebolaget LM Ericsson

- 7.1.6 Huawei Technologies Co. Ltd

- 7.1.7 Aerohive Networks (Extreme Networks)

- 7.1.8 MetTel Inc.

- 7.1.9 Cloud4Wi Inc.

- 7.1.10 Fortinet Inc.

- 7.1.11 Purple Wi-Fi Ltd

- 7.1.12 SingTel

- 7.1.13 Ubiquiti Inc.

- 7.1.14 Motorola Solutions Inc.

- 7.1.15 New H3C Technologies Co. Ltd