|

市場調查報告書

商品編碼

1445649

認證機構:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Certificate Authority - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

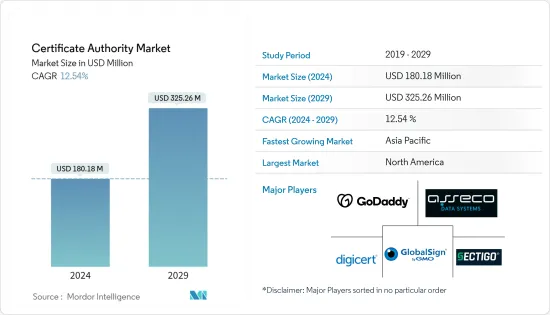

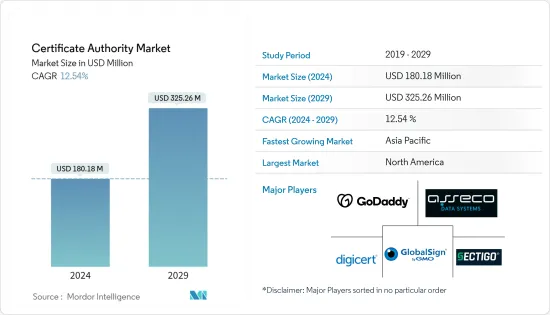

證書頒發機構市場規模預計到 2024 年為 1.8018 億美元,預計到 2029 年將達到 3.2526 億美元,在預測期內(2024-2029 年)成長 12.54%,年複合成長率成長。

網路用戶對安全網路存取的意識不斷提高,在不斷擴大的線上客戶群中建立信任的需求日益增加,以及嚴格的合規性和監管遵守將推動證書頒發機構市場在此期間的成長。這些是預計的一些驅動力來驅動這個。預測期。

主要亮點

- 憑證授權單位 (CA) 雖然很少被稱為憑證授權機構,但其作用是驗證實體(電子郵件地址、公司、網站、個人等)的身份並將其與加密金鑰綁定。公司或公司。頒發被認可為數位證書的電子文件。

- 網路用戶對安全網路存取的意識不斷提高,在不斷擴大的線上客戶群中建立信任的需求日益成長,以及嚴格的合規性和監管合規性將推動預測期內受調查市場的成長,這是預期的主要因素。

- 基於憑證的身份驗證使用數位憑證來識別使用者、機器或設備,然後再授予對資源、網路或應用程式的存取權限。隨著物聯網和 BYOD 趨勢的不斷發展,身分驗證憑證的採用預計也會增加。

- 憑證授權單位 (CA) 是頒發 SSL 憑證的受信任組織。這些數位憑證是以加密方式將實體連結到公鑰的資料檔案。 Web 瀏覽器使用這些來檢驗Web 伺服器提供的內容,確保您在線上看到的內容是可信任的。

- SSL 憑證因其完整性、不可否認性、加密和身分驗證功能而被認為佔據了憑證授權單位市場的主要佔有率。它是一種經過網域檢驗的全自動檢驗類型,可讓使用者在幾分鐘內開始保護電子商務、網路郵件、部落格訪客、登入等。這是為您的網站啟動 SSL 保護的最快且最經濟的方法之一。

- 由於保護客戶資料和滿足合規性要求的需求不斷擴大,醫療保健產業預計在預測期內將大幅成長。針對個人識別資訊 (PII)、電子健康記錄 (EHR) 和受保護的健康資訊 (PHI) 的網路攻擊的增加是醫療機構關注的主要問題。

- COVID-19 大流行並未對市場造成負面影響。大多數公司被迫在幾週甚至幾天內將員工轉移到遠距工作。該開關引入了許多新的安全隱患。在當今的環境中,多重身份驗證(例如 PKI 憑證和密碼)是為網路及其使用者應用靈活且可擴展的安全性的最有效方法。

認證機構市場趨勢

醫療保健終端用戶垂直領域預計將佔據重要的市場佔有率

- 所有醫療網站所有者都應確保其網站採用 HTTPS。選擇合適的SSL憑證也是醫療網站SSL網站安全的重要考量。我們建議取得 EV SSL 證書,該證書提供與醫療網站相關的必要加密等級和最高檢驗。

- 醫療保健產業預計將在未來見證最大的成長機會。診所和醫院等醫療機構儲存了大量敏感資料,因此醫療網站有必要實施數位憑證。醫療保健領域數位化投資不斷增加,這將為未來證書頒發機構市場創造新的成長機會。

- 醫療保健企業正在迅速採用先進技術,為患者提供直覺和客製化的體驗。醫療保健領域擴大策略使得保護使用者密碼和其他敏感資訊變得越來越困難。

- 數位證書幫助醫護人員保護電腦和智慧型手機等行動裝置上的個人健康資訊。此外,針對個人識別資訊 (PII) 的網路攻擊的增加也是醫療保健組織面臨的重大問題。據身分盜竊資源中心稱,今年美國醫療保健行業已發生超過 340 起資料外洩事件。

- 數位證書對於確保醫療保健解決方案符合 HIPAA 以及其他聯邦和州法規至關重要。一些行業組織已經建立了標準和最佳實踐,以幫助醫療保健公司購買許可的解決方案,他們確信這些解決方案可以滿足這些需求。無論是在傳統醫療保健應用還是連結的醫療設備聯網用例中,數位憑證在確保這種保證方面發揮關鍵作用。

預計北美將佔據重要市場佔有率

- 預計在預測期內,北美將在按地區分類的證書頒發機構市場中擁有最大的市場規模。北美市場的主要成長動力是主要證書頒發機構的大量存在以及嚴格的資料安全法規和合規性。

- 由於線上業務、數位轉型和物聯網趨勢的成長,預計北美將推動證書頒發機構市場的發展。此外,該地區的國家,即美國和加拿大,已經更新或引入了新的國家網路安全政策,以推動證書頒發機構市場的發展。

- 物聯網 (IoT) 趨勢的成長預計將為該地區的證書頒發機構市場創造重大成長機會。此外,醫療保健和醫療領域資料外洩和資料竊取的增加預計也將推動該地區證書頒發機構市場的成長。

- 在美國,醫療保健網路安全犯罪呈上升趨勢,並且仍然是美國主要關注的問題之一,促使公司在市場上推出解決方案。

- 隨著需求的成長,思科共用了有關雲端軟體國際安全合規性和認證要求的內部指南。 2022 年 5 月,思科公開了思科雲端控制框架 (CCF)。 CCF 旨在協助團隊確保雲端產品和服務符合安全和隱私要求,並透過簡化的合規性和風險管理策略「節省大量資源」。

認證機構產業概況

證書頒發機構市場競爭激烈,由多家主要企業組成。全球市場競爭日益激烈。儘管如此,主要的國際公司在這個市場上佔有重要地位。這些公司正在利用策略合作舉措來擴大市場佔有率並提高盈利。由於全球化,大多數公司都在積極進行併購。

2022年5月,SSL.com發布了eSignerCKA(雲端密鑰適配器)。此基於 Windows 的應用程式使用 CNG 介面(KSP 金鑰服務供應商)來允許 certutil.exe 和 Signtool.exe 等工具使用 eSignerCSC 進行程式碼簽章操作。

同月,WISeKey 開發了新的 INeS 物聯網設備管理平台,使客戶和開發人員能夠自動化設備和憑證管理並與製造鏈整合。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對市場的影響

- 監管狀況

第5章市場動態

- 市場促進因素

- 網路用戶對安全網路存取的意識不斷增強

- 嚴格的監管和合規控制

- 市場限制因素

- 使用自簽名證書

- 對安全證書的重要性缺乏認知

第6章市場區隔

- 按成分

- 證書類別

- SSL憑證

- 代碼簽署證書

- 安全電子郵件證書

- 認證證書

- 服務

- 證書類別

- 按組織規模

- 主要企業

- 中小企業

- 按行業 按最終用戶

- BFSI

- 零售

- 衛生保健

- 資訊科技和電信

- 其他最終用戶領域

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- DigiCert Inc.

- Sectigo Limited

- GoDaddy Inc.

- Asseco Data Systems SA(Asseco Poland SA)

- GlobalSign

- Entrust Corporation

- Actalis SpA

- SSL.Com

- Trustwave Holdings

- Network Solutions LLC

- WISeKey International Holdings

- Swisssign AG

- OneSpan Inc.

- Camerfirma SA

- Buypass AS

- Zerossl

第8章 主要文件簽名/電子簽章庫及郵件認證公司名單

第9章投資分析

第10章市場機會與未來趨勢

The Certificate Authority Market size is estimated at USD 180.18 million in 2024, and is expected to reach USD 325.26 million by 2029, growing at a CAGR of 12.54% during the forecast period (2024-2029).

The rise in awareness among internet users about secure web access, the increasing need to build trust among the expanding online customer base, and adhering to rigorous compliances and regulations are some of the driving factors anticipated to drive the growth of the certificate authority market during the forecast period.

Key Highlights

- A certificate authority (CA), also seldom mentioned as a certification authority, is a firm or company that works to authenticate the identities of entities (such as email addresses, companies, websites, or individual persons) and bind them to cryptographic keys through the issuance of electronic documents recognized as digital certificates.

- The rise in awareness among internet users about secure web access, the increasing need to build trust among the expanding online customer base, and adhering to rigorous compliances and regulations are the major factors anticipated to drive the market growth studied during the forecast period.

- The certificate-based authentication uses a digital certificate to identify a user, machine, or device before granting access to a resource, network, and application. The growing IoT and BYOD trends are also expected to increase the adoption of authentication certificates.

- A certificate authority (CA) is a reputable organization that issues SSL certificates. These digital certificates are data files that link an entity to a public key cryptographically. Web browsers use them to verify content provided from web servers, guaranteeing that content presented online is trustworthy.

- The SSL certificates segment deems for a principal share of the certification authority market due to its integrity, non-repudiation, encryption, and authentication features. It is a domain validated and completely automated validation type that allows users to start defending their eCommerce, webmail, blog visitors, logins, and more within a few minutes. It is one of the swiftest and most affordable means to activate SSL protection for the website.

- The healthcare industry vertical is anticipated to grow tremendously during the forecast period, owing to an expanding need to secure customers' data and satisfy compliance requirements. The growing incidents of cyber-attacks on Personally Identifiable Information (PII), Electronic Health Records (EHR), and Protected Health Information (PHI) are major concerns for healthcare organizations.

- Owing to the COVID-19 pandemic, the market did not witness any negative impact. Most businesses were compelled to move staff to remote work in weeks, if not days. The changeover has ushered in a slew of new security dangers. In today's environment, multifactor authentication, such as PKI certificates and passwords, is the most effective way to apply flexible, scalable security to networks and their users.

Certificate Authority Market Trends

Healthcare End User Vertical Segment is Expected to Hold Significant Market Share

- Every medical website owner must ensure that the website has HTTPS. Choosing the right SSL certificate should also be a key consideration for the SSL website security of a medical website. It is recommended to have an EV SSL certificate, which offers the required encryption level relevant to medical websites along with the highest validation.

- The Healthcare category is expected to demonstrate the highest growth opportunities in the future. In healthcare facilities such as clinics and hospitals, vast amounts of sensitive and confidential data are stored, making adopting digital certificates necessary for a healthcare website. Investments in digitalization have increased in the healthcare sector, which will create new growth opportunities for the certificate authority market moving forward.

- The healthcare business is rapidly adopting advanced technologies to provide patients with an intuitive, tailored experience. The expansion strategy of partnerships, mergers, and acquisitions in the healthcare sector vertical has increased the difficulty of protecting user passwords and other sensitive information.

- The digital certificates assist healthcare practitioners in securing personal health information on mobile devices such as computers and smartphones. Furthermore, the increasing number of cyber-attacks on Personally Identifiable Information (PII) is a significant concern for healthcare organizations. According to Identity Theft Resource Center, there have been more than 340 incidents of data compromises in the United States in the healthcare sector this year.

- Digital certificates will become vital in ensuring that healthcare solutions comply with HIPAA and other federal and state regulations. Several industry organizations are establishing standards and best practices that will allow healthcare companies to buy licensed solutions that they can be confident will meet these needs. In both traditional healthcare applications and IoT use cases for linked medical equipment, digital certificates play a critical role in ensuring this assurance.

North America is Expected to Hold Significant Market Share

- North America is expected to hold the largest market size in the certificate authority market by region during the forecast period. Primary growth drivers for the North American market constitute the significant presence of primary certificate authorities and stringent data security regulations and compliance.

- Due to growing online businesses, digital transformation, and IoT trends, North America is anticipated to drive the certificate authority market. Additionally, the countries in the region, namely the United States and Canada, have updated or introduced new national cybersecurity policies that would drive the certificate authority market.

- Growing Internet of Things (IoT) trends are expected to create vital growth opportunities for the certification authority market in the region. Moreover, the growing number of data breaches and data thefts in the healthcare and medical sector is also anticipated to boost the Certificate Authority Market growth in the region.

- Healthcare cybersecurity crimes are on the rise in the US and continue to be one of the major concerns in the country, fueling firms to drive solutions in the market.

- Amid the growing demand, Cisco shared an internal guide on international security compliance and certification requirements for cloud software. In May 2022, Cisco released the 'Cisco Cloud Controls Framework' (CCF) to the public. The CCF aims to help teams ensure cloud products and services meet security and privacy requirements with a simplified compliance and risk management strategy, 'saving significant resources.'

Certificate Authority Industry Overview

The Certificate Authority Market is highly competitive and consists of several major players. The market is gaining competition globally. Nonetheless, the market exhibits a strong presence of key international players. These companies leverage strategic collaborative initiatives to expand their market share and enhance profitability. Most companies are actively involved in mergers and acquisitions, owing to globalization.

In May 2022, SSL.com released eSignerCKA (Cloud Key Adapter). This Windows-based application uses the CNG interface (KSP Key Service Provider) to allow tools such as certutil.exe and signtool.exe to use the eSignerCSC for code signing operations.

In the same month, WISeKey developed a new INeS IoT device management platform to enable customers and developers to automate the device and certificate management, integrating it with the manufacturing chain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Regulatory Landscape

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Awareness Among Internet Users About Secure Web Access

- 5.1.2 Managing Strict Regulations and Compliance

- 5.2 Market Restraints

- 5.2.1 Using of Self-Signed Certificates

- 5.2.2 Lack of Awareness About the Importance of Security Certificates

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Certificate Types

- 6.1.1.1 SSL Certificates

- 6.1.1.2 Code Signing Certificates

- 6.1.1.3 Secure Email Certificates

- 6.1.1.4 Authentication Certificates

- 6.1.2 Services

- 6.1.1 Certificate Types

- 6.2 By Organization Size

- 6.2.1 Large Enterprises

- 6.2.2 Small and Medium-Sized Enterprises

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 IT and Telecom

- 6.3.5 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DigiCert Inc.

- 7.1.2 Sectigo Limited

- 7.1.3 GoDaddy Inc.

- 7.1.4 Asseco Data Systems SA (Asseco Poland SA)

- 7.1.5 GlobalSign

- 7.1.6 Entrust Corporation

- 7.1.7 Actalis SpA

- 7.1.8 SSL.Com

- 7.1.9 Trustwave Holdings

- 7.1.10 Network Solutions LLC

- 7.1.11 WISeKey International Holdings

- 7.1.12 Swisssign AG

- 7.1.13 OneSpan Inc.

- 7.1.14 Camerfirma SA

- 7.1.15 Buypass AS

- 7.1.16 Zerossl