|

市場調查報告書

商品編碼

1445643

FaaS(功能即服務):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Function As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

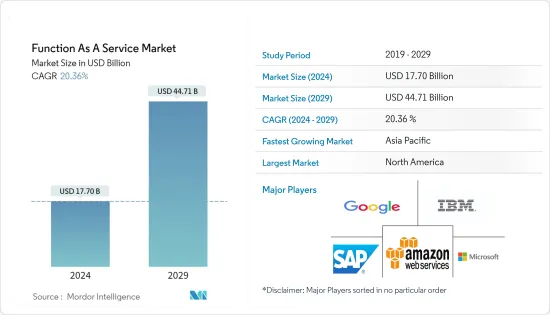

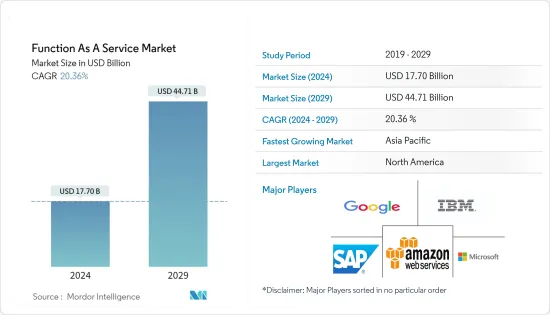

FaaS(功能即服務)市場規模預計到 2024 年為 177 億美元,預計到 2029 年將達到 447.1 億美元,在預測期內(2024-2029 年)將以 20.36% 的年複合成長率成長期間。

主要亮點

- FaaS(功能即服務)是一種雲端運算,它消除了開發人員管理應用程式基礎架構的需要,並使其能夠更有效率地運作。當開發人員使用 FaaS 平台時,平台會代表他們建置、運行和管理應用套裝程式。

- 從開發和營運 (DevOps) 到無伺服器運算、敏捷性、可擴展性以及託管服務的成熟度的不斷轉變正在推動市場成長。此外,企業對微服務最佳化和多平台管理的傾向預計將推動市場成長。

- 隨著 FaaS 的出現,用於應用程式部署的可程式雲端正在快速成長。據 Oracle 稱,預計雲端中共用的敏感資料將增加 600 倍。許多雲端供應商提供 FaaS,例如 AWS Lambda、Azure Functions 等。透過使用這些模型,開發人員可以尋求諸如簡單配置、減少營運工作量以及付費使用制定價等優勢。

- 除了 COVID-19 帶來的遠距工作的迫切需求之外,隨著各行業的公司開始意識到雲端運算的好處和價值,COVID-19 還促使公司投資 IT 和雲端資源。我加速了。

- FaaS 提供了固有的高可用性,因為它分佈在每個地理區域的多個可用區域中,並且可以部署在任意數量的區域中,無需額外成本。由於這種 FaaS,市場可能會在預測期內成長。

FaaS(功能即服務)市場趨勢

混合雲端推動關注安全和隱私的最終用戶的市場成長

- 與其他雲端相比,混合雲端市場由於其利用率較高,預計將推動市場成長。當企業需要減少投資來應對短期需求高峰或釋放本地資源以用於更敏感的資料和應用程式時,混合雲端部署可以為企業提供幫助。

- 隨著運算和處理需求的波動不斷增加,企業正在部署混合雲端,將其本地基礎設施擴展到公有公共雲端,而無需讓第三方資料中心存取其全部資料,以處理溢位問題。這些發展成功地解決了終端用戶的擔憂,他們擔心資料安全,並且之前猶豫是否要轉向該解決方案。

- 雲端和工業化服務的成長以及傳統資訊中心外包(DCO) 的衰退標誌著向混合基礎設施服務的大規模轉變。雖然傳統的 DCO 市場正在萎縮,但基礎設施公共事業服務以及主機代管和託管方面的支出也在增加。預計這將推動向雲端基礎架構即服務(IaaS) 和託管的轉變。由於其優勢,混合雲端部署在雲端市場的佔有率不斷增加。

- 此外,隨著年終激增的需求來源(例如利用混合IT 解決方案來滿足遠距工作要求的企業客戶)開始趨於平穩,超大規模活動在去年底趨於平穩。這種趨勢可能會持續下去,儘管速度比過去幾年更快。

- 此外,與其他雲端服務相比,混合雲端市場在過去幾年中整體呈現顯著成長。它為擁有大量資料集的組織提供了一定的好處。混合雲端允許企業擴展運算資源,當他們需要釋放本地資源以用於更敏感的資料或應用程式時,他們可以使用大量資金來處理短期需求高峰,而無需投入資本。

北美保持最高市場佔有率

- 北美市場佔有率最高。該地區是採用 5G、自動駕駛、物聯網、區塊鏈、遊戲和人工智慧 (AI) 等新技術的主導創新者和先驅。這一趨勢可能會推動該地區功能即服務的採用。

- 隨著越來越多的通訊服務供應商(CSP) 決定與多重雲端供應商合作提供 5G 服務,混合和多雲的未來正在迅速發展。資料消費量的顯著增加進一步推動了5G技術的發展並促進了市場的成長。

- 透過與超大規模雲端供應商 (HCP) 合作,通訊服務供應商(CSP) 正在擴展其雲端基礎設施並採用混合和多重雲端策略。

- 過去 20 年來,IBM 和 AT&T 一直在創新方面合作,幫助企業客戶轉型。兩個組織都宣布打算展示邊緣運算和 5G 無線網路在數位轉型方面的潛力。去年 2 月,AT&T 和 IBM 推出了一個虛擬環境,讓企業客戶能夠親身體驗 IBM混合雲端和人工智慧技術與 AT&T 連接相結合的強大功能。

- 隨著資料來源數量的增加,新業務洞察的成長將有助於美國市場的擴張。 FaaS 還可以顯著提高計算效能並改善結果,從而直接提高業務績效。此外,對業務敏捷性和彈性不斷成長的需求也增加了該地區的市場需求。

功能即服務業概述

由於公司眾多,功能即服務市場競爭非常激烈。該市場的主要企業包括Google、AWS、SAP、IBM、微軟等。市場上的公司利用新產品發布、擴張、協議、合資、合作、收購等來增加市場佔有率。下面列出了市場上的一些主要發展。

2022 年 6 月,全球最大的IT基礎設施服務供應商Kyndryl 與 Oracle 合作,透過向世界各地的企業提供託管雲端解決方案,協助客戶加快雲端之旅。作為合作夥伴關係的一部分,Kyndryl 將成為 Oracle 雲端基礎架構 (OCI) 的主要交付合作夥伴,進一步擴大其與使用 Oracle 產品和服務的客戶合作和支援的豐富經驗。

此外,2022年5月,全球領先的開放原始碼解決方案供應商紅帽公司與Accenture進一步拓展了近12年的策略合作夥伴關係,為全球企業推動開放混合雲端創新。兩家公司將共同投資共同開發新解決方案,使組織能夠更無縫地駕馭多重雲端和混合雲端世界、定義策略並加快創新步伐,以更快地實現價值。

此外,2022年8月,邊緣雲端供應商Ridge推出了全新的綜合雲端服務:混合雲端。 Ridge 表示,其分散式雲端架構允許企業在任何地方整合關鍵業務應用程式,無論是在本地還是在 Ridge 營運的託管位置。該公司表示,它可以輕鬆地在不同環境之間傳輸工作負載。企業還可以透過單一入口網站對其進行管理,從而為他們在所有公有和私有位置提供一致的雲端體驗。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 向無伺服器運算的轉變仍在繼續

- 越來越關注基礎設施敏捷性和降低成本

- 市場限制因素

- 部分應用與雲端環境不相容

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對市場的影響

第5章市場區隔

- 按雲端部署類型

- 公共

- 私人的

- 混合

- 按組織規模

- 中小企業

- 主要企業

- 按最終用戶

- BFSI

- 資訊科技/通訊

- 零售

- 醫療保健和生命科學

- 其他最終用戶(媒體與娛樂、政府、教育)

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- Amazon Web Services Inc.

- IBM Corporation

- Google Inc.

- Microsoft Corporation

- SAP SE

- Infosys Limited

- Dynatrace LLC

- Tibco Software Inc.

- Oracle Corporation

- Rogue Wave Software Inc

- Fiorano Software and Affiliates

第7章 投資分析

第8章市場機會及未來趨勢

The Function As A Service Market size is estimated at USD 17.70 billion in 2024, and is expected to reach USD 44.71 billion by 2029, growing at a CAGR of 20.36% during the forecast period (2024-2029).

Key Highlights

- Function as a Service (FaaS) is a type of cloud computing that allows developers to operate more efficiently by eliminating the need to manage application infrastructure. When developers use a FaaS platform, the platform builds, runs, and manages application packages on their behalf.

- The growing shift from development operations (DevOps) to serverless computing, agility, scalability, and the maturity of hosted services drive the market's growth. Also, companies' inclination towards optimizing microservices and managing multiple platforms is expected to boost the market's growth.

- With the emergence of FaaS, the programmable cloud has been rapidly growing for the deployment of applications. According to Oracle, it is estimated that there will be 600 times more sensitive data shared in the cloud. Many cloud providers offer FaaS, such as AWS Lambda, Azure Functions, etc. With these models, developers seek advantages in simple deployments, reduced operation efforts, and pay-as-you-go pricing.

- COVID-19 boosted the investments by companies in IT and cloud resources as companies across various industries started realizing the benefits and value of cloud computing, even beyond the immediate need for remote work generated by COVID-19.

- The FaaS offers inherent high availability because it is spread across multiple availability zones per geographic region and can be deployed across any number of areas without incremental costs. With this FaaS, the market will likely grow over the forecast period.

Function As A Service Market Trends

Hybrid Cloud to Drive the Growth of the Market for Security and Privacy Concerned End Users

- The hybrid cloud market is expected to drive market growth as they are highly used compared to other clouds. Hybrid cloud deployment helps companies reduce their investment for handling short-term spikes in demand and when the business needs to free up local resources for more sensitive data or applications.

- With the rise in fluctuating demand for computing and processing, hybrid cloud deployment allows companies to scale their on-premises infrastructure up to the public cloud to handle any overflow without giving third-party data centers access to the entirety of their data. These developments have adequately addressed the concerns of the end-users, who were concerned about their data security and were earlier hesitant to switch to this solution.

- The growth of cloud and industrialized services and the decline of traditional data center outsourcing (DCO) indicate a massive shift towards hybrid infrastructure services. While the conventional DCO market is shrinking, spending on colocation and hosting is increasing along with infrastructure utility services. This is expected to drive the shift toward cloud infrastructure-as-a-service (IaaS) and hosting. Owing to its benefits, hybrid cloud deployment occupies a continuously increasing share of the cloud market.

- Moreover, hyper-scale activity leveled out at the end of the previous year as demand drivers that spiked in recent years began to plateau, including enterprise clients utilizing hybrid IT solutions to accommodate remote working mandates. This trend will likely continue, albeit faster than in the last few years.

- Furthermore, the hybrid cloud market has experienced significant overall growth in the past few years compared to other cloud services. It offers certain benefits to organizations with a vast data set. Using a hybrid cloud allows companies to scale computing resources and helps eliminate the need to invest massive capital in handling short-term spikes in demand when the business needs to free up local resources for more sensitive data or applications.

North America to Hold Highest Market Share

- North America holds the highest market share. The region is among the lead innovators and pioneers in adopting new technologies such as 5G, autonomous driving, IoT, blockchain, gaming, and artificial intelligence (AI), among others. This trend will likely fuel the region's adoption of function as a service.

- As more communication service providers (CSPs) decide to deliver their 5G services in collaboration with hyper-scale cloud providers, a hybrid and multi-cloud future is quickly developing. The significant growth in data consumption is further boosting the 5G technology, thereby contributing to the market growth rate.

- Through collaborations with hyper-scale cloud providers (HCPs), communication service providers (CSPs) are growing their cloud infrastructures and are increasingly implementing a hybrid and multi-cloud strategy.

- Over the last two decades, IBM and AT&T have collaborated on innovations and supported enterprise clients' transformation. The two organizations announced intentions to demonstrate the possibilities of edge computing and 5G wireless networking for digital transformation. In February last year, AT&T and IBM launched virtual environments that allow business clients to physically experience the power of combining IBM hybrid cloud and AI technologies with AT&T connection.

- The growth of new business insights contributes to expanding the market in the United States as many data sources increase. FaaS can also dramatically boost computing performance and improve results that directly strengthen business performance. Furthermore, the rise in demand for business agility and flexibility is also increasing the market demand in the region.

Function As A Service Industry Overview

The function as a service Market is highly competitive due to the many players in the market. Key players in the market include Google, AWS, SAP, IBM, and Microsoft, among others. Players in the market use new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, etc., to increase their market share. Some of the key developments in the market are mentioned below.

In June 2022, Kyndryl, the world's largest IT infrastructure services provider, partnered with Oracle to help customers accelerate their journey to the cloud by delivering managed cloud solutions to enterprises worldwide. As part of the alliance, Kyndryl will become a key delivery partner for Oracle Cloud Infrastructure (OCI), expanding upon its deep experience of working with and supporting customers using Oracle products and services.

Moreover, in May 2022, Red Hat Inc., the world's leading provider of open source solutions, and Accenture expanded their nearly 12-year strategic partnership further to power open hybrid cloud innovation for enterprises worldwide. The companies are jointly investing in the co-development of new solutions to help organizations more seamlessly navigate a multi- and hybrid cloud world, define their strategy, and accelerate their pace of innovation to get to value faster.

Further, in August 2022, Ridge, a provider of edge clouds, launched a hybrid cloud, a brand-new all-inclusive cloud service. According to Ridge, its distributed cloud architecture allows businesses to unify business-critical apps across all their locations, whether on-premises or managed locations run by Ridge. According to the company, workloads can be transferred easily between different environments. Businesses can also manage them through a single portal, providing companies with a cohesive cloud experience across all public and private locations..

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing shift towards serverless computing

- 4.2.2 Increasing focus towards agility of infrastructure and cost reduction

- 4.3 Market Restraints

- 4.3.1 Incompatibility of some applications with cloud environment

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment on the Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type of Cloud Deployment

- 5.1.1 Public

- 5.1.2 Private

- 5.1.3 Hybrid

- 5.2 By Organization Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-User

- 5.3.1 BFSI

- 5.3.2 IT and Telecommunication

- 5.3.3 Retail

- 5.3.4 Healthcare and Life Sciences

- 5.3.5 Other End-Users (Media and Entertainment, Government, Educational Institutions))

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Amazon Web Services Inc.

- 6.1.2 IBM Corporation

- 6.1.3 Google Inc.

- 6.1.4 Microsoft Corporation

- 6.1.5 SAP SE

- 6.1.6 Infosys Limited

- 6.1.7 Dynatrace LLC

- 6.1.8 Tibco Software Inc.

- 6.1.9 Oracle Corporation

- 6.1.10 Rogue Wave Software Inc

- 6.1.11 Fiorano Software and Affiliates