|

市場調查報告書

商品編碼

1445630

物聯網設備管理:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)IoT Device Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

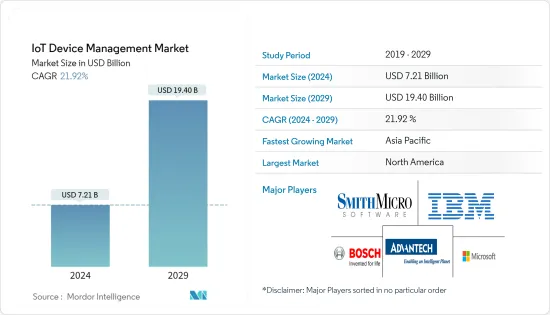

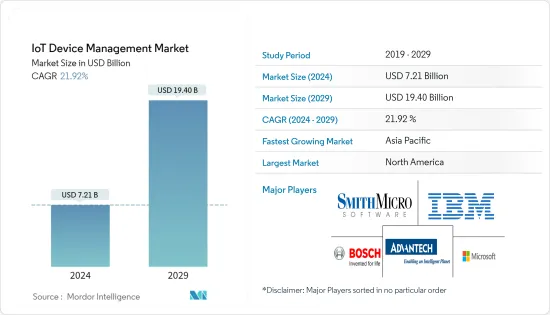

物聯網設備管理市場規模預計到 2024 年為 72.1 億美元,預計到 2029 年將達到 194 億美元,在預測期內(2024-2029 年)年複合成長率為 21.92%。

物聯網設備管理市場包括連接設備的配置、管理和監控,以及重現問題和採取糾正措施所需的診斷。

這個市場主要是由某些因素所驅動的。 5G網路部署並支援大規模物聯網與多接取邊緣運算(MEC)結合。此外,物聯網設備管理系統還可以實現資料收集和分析,這是預計推動市場成長的另一個因素。

預計未來幾年全球物聯網需求趨勢將從消費需求轉向工業領域,大量需求將由各種工業4.0應用驅動。預計大部分需求將來自製造業、能源、商業流動性、醫療保健和供應鏈。

近年來,由於智慧型手機和行動裝置的普及,物聯網設備管理的發展經歷了顯著的成長。

然而,隱私問題、即時複雜性、動態環境、缺乏相容性和連接性的敏感資訊暴露以及缺乏統一的物聯網互通性標準給市場帶來了重大挑戰。全球供應鏈正面臨一定程度的中斷。

最近的 COVID-19 爆發擾亂了全球供應鏈和電子產品需求,預計將嚴重影響物聯網設備管理市場的硬體採用。由於中國等國家停產,電子業出現了電子產品供不應求的情況。

物聯網設備管理市場趨勢

零售業佔據物聯網設備管理市場的主要佔有率

零售商可以利用智慧設備和物聯網來改善客戶體驗、提高轉換率並顯著影響日常業務。在零售業使用物聯網的好處包括能源管理、店內導航、防盜和消費者參與。

零售業中的物聯網和智慧設備使企業能夠收集客戶回饋並改善客戶體驗。能源管理、店內導航、防盜和消費者參與是物聯網設備支援零售業的好處。

商店經理可以與冰箱控制器連接,並使用具有這些先進電源管理設備的感測器來獲取優先資訊。物聯網設備管理市場的發展正在推動該產業的發展。

許多基於物聯網的平台使用嵌入式感測器來記錄、監控和發出蜂鳴警報,並通知店內工作人員有關溫度、瓦斯洩漏、電力故障、能源使用、暖氣等資訊。店主可以使用這些智慧型系統與冰箱控制器連接。除了能源管理工具外,還可以使用感測器來獲取優先順序資訊。

不斷增加的攻擊數量和惡意攻擊的性質促使市場上的最終用戶採用這些解決方案來降低風險。隨著攻擊性質的演變,這會增加需求。

北美保持市場主導地位

它是北美物聯網實施的領先地區之一。該地區尖端技術的使用不斷增加、網路攻擊數量不斷增加以及連接設備數量不斷增加是推動該地區物聯網設備管理市場成長的關鍵因素。數位化的興起和物聯網安全支出也是影響該地區市場的變數。

此外,物聯網在該地區製造業的日益普及正在推動物聯網安全解決方案的普及,並對市場擴張產生積極影響。

將物聯網設備的普及與住宅保險稅收優惠和折扣相結合,消費者和公共產業公司正在使他們的服務更加智慧和更新,以在這個不斷變化的市場中保持競爭力。鼓勵住宅建築商和業主採取行動使其適合。

採用新無線電 (NR) 的新興 5G 標準也針對諸如車聯網以及工業用例的通訊可靠、低延遲通訊等功能。此外,由 IEC 標準化的工業通訊匯流排(例如 PROFINET 和 Modbus)正在推動市場走向可靠、更安全的工業實施。

物聯網設備管理產業概述

物聯網設備管理市場競爭非常激烈。物聯網在各行業的普及大大增加了它提供的機會數量。目前,該市場由少數主要參與者主導,但隨著整個行業物聯網應用深度的增加,預計將有多家參與者進入該市場。大多數公司使用各種行銷策略來增加市場佔有率。為了在全球物聯網設備管理服務中獲得理想的地位,市場上的供應商在價格、品質、品牌、產品和服務差異化方面競爭。

2023 年 1 月,Tech Mahindra 和微軟宣佈建立策略合作夥伴關係,使通訊業者能夠利用全球雲端實現 5G 核心網路的現代化。 5G核心網轉型將通訊業者開發5G核心用例並支援客戶不斷成長的技術(擴增實境(AR)、虛擬實境(VR)、物聯網(IoT)和邊緣運算)需求。將幫助您滿足。這使您能夠現代化、最佳化和保護您的業務營運,並以更低的成本和更快的上市時間開發綠色網路。

2022年6月,研華與Actility建立合作夥伴關係,透過將先進耐用的研華工控機與嵌入式Actility軟體相結合,推出邊緣解決方案支援的套件,用於在客戶端部署企業物聯網LoRaWAN網路,實現高度可靠和安全的承載。此整合解決方案是一種服務級產品,具有與閘道器、雲端平台和設備的擴展相容性,使企業能夠以簡化、更快、更有效率的方式部署物聯網用例。旨在滿足快速成長的工業的需求自動化市場。這將加速工業4.0的實現。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 評估 COVID-19 對產業的影響

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間敵對的強度

第5章市場動態

- 市場促進因素

- 智慧連網型設備的日益普及

- 集中設備管理的需求不斷增加

- 市場限制因素

- 缺乏統一的物聯網互通性標準

第6章市場區隔

- 按成分

- 解決方案

- 安全解決方案

- 資料管理

- 遠端監控

- 其他解決方案(即時串流分析、網路頻寬管理)

- 服務

- 專業服務

- 管理服務

- 解決方案

- 按組織規模

- 中小企業

- 主要企業

- 按行業 按最終用戶

- 零售

- 衛生保健

- 運輸和物流

- 製造業

- 其他最終用戶垂直領域

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- Microsoft Corporation

- International Business Management(IBM)Corporation

- Smith Micro Software, Inc.

- Advantech Co., Ltd.

- Bosch Software Innovations GmbH

- Amplia Soluciones SL

- Aeris Communication, Inc.

- PTC Incorporation

- Oracle Corporation

- Smith Micro Software, Inc.

- Telit Communications PLC

- Cumulocity GmbH

- Enhanced Telecommunications Inc.

- Zentri Inc.

第8章投資分析

第9章市場機會與未來趨勢

The IoT Device Management Market size is estimated at USD 7.21 billion in 2024, and is expected to reach USD 19.40 billion by 2029, growing at a CAGR of 21.92% during the forecast period (2024-2029).

The IoT device management market encompasses connected device provisioning, administration, monitoring, and diagnostics necessary for trouble replication and corrective measures.

The market is primarily driven by certain factors, such as growing concerns over network security, the overall growth of IoT networks and systems, the growing need to monitor the health (on/off condition, power, connectivity, etc.) of IoT devices, and the deployment of 5G networks and its support for massive IoT, coupled with Multi-access Edge Computing (MEC). Besides, IoT device management systems also enable the collection and analysis of data, which is another factor anticipated to fuel market growth.

The global IoT demand trend is expected to shift towards industrial space from consumer demand over the coming years, with sheer volumes of demand driven by various Industry 4.0 applications. A significant share of the demand is expected by manufacturing industries, energy, business mobility, healthcare, and supply chain.

Owing to the expanding adoption of smartphones and mobile devices, coupled with the increasing penetration of the internet, the evolution of IoT device management has witnessed immense growth in recent years.

However, exposure of confidential information concerning privacy concerns, real-time complexity, dynamic environment, and lack of compatibility and connectivity, along with the absence of uniform IoT standards for interoperability, is a crucial challenge for the market. The global supply chain is undergoing a level of disruption.

Due to the recent outbreak of COVID-19, the global supply chain and demand for electronics were disrupted, owing to which the IoT device management market hardware adoption was expected to be severely influenced; due to the production shutdown in countries such as China, the electronics industry was observing a shortage of supply of electronics.

IoT Device Management Market Trends

Retail to Have a Major Share in the IoT Device Management Market

Retailers may enhance the customer experience and increase conversions with the help of smart devices and IoT, significantly impacting day-to-day operations. A few benefits of using IoT in the retail sector include energy management, in-store navigation, theft prevention, and consumer engagement.

IoT and smart devices in retail enable businesses to gather customer feedback and improve the customer experience. Energy management, in-store navigation, theft prevention, and consumer engagement are benefits of IoT devices that help the retail sector.

Store managers can interface with refrigerator controllers and obtain priority information using sensors with these sophisticated power management devices. IoT device management market developments are boosting the industry.

With embedded sensors, many IoT-based platforms may record, monitor, and beep alarms or notify the in-store staff about temperature, gas leakage, electricity breakdowns, energy usage, heating, etc. Store owners may interface with refrigerator controllers using these intelligent energy management tools, and they can also retrieve priority information with the aid of sensors.

The increased attacks and their nature of becoming malevolent have pushed for the market end-users to adopt these solutions to mitigate these risks. This has created an increasing demand owing to the evolving nature of attacks.

North America to Hold a Dominant Position in the Market

One of the key regions in North America for IoT implementation. The growing use of cutting-edge technologies, an increase in cyberattacks, and an increase in the number of connected devices in the area are the main factors propelling the growth of the IoT Device Management market in the region. The rise of digitalization and spending on IoT security are other variables that are having an impact on the market in the area.

Also, the region's expanding IoT use in the manufacturing sector encourages the uptake of IoT security solutions, which favorably impacts the market's expansion.

Consumers and utility companies have been encouraged to take action to make their services smart and suitable for the new generation of home builders and owners to remain competitive in such a changing market by the popularity of IoT devices, combined with tax incentives and discounts on home insurance.

Also, the emerging 5G standards with New Radio (NR) target capabilities such as vehicle-to-everything and ultra-reliable low-latency communications as industrial use cases. And, with industrial communication buses standardized by IEC, such as PROFINET and Modbus, the market is headed towards reliable and securer industrial adoption.

IoT Device Management Industry Overview

The IoT Device Management Market is competitive. The widespread use of IoT across industry verticals has resulted in a boom in the number of opportunities that the industry offers. Though dominated by a few significant players in the market as of now, the market is expected to witness the entry of several players as the depth of IoT applications across industries increases. Most businesses use various marketing tactics to increase their market share. To ensure an ideal place in the global IoT Device management services, the vendors on the market are competing on price, quality, brand, and product and service differentiation.

In January 2023, Tech Mahindra and Microsoft announced a strategic collaboration to enable global cloud-powered 5G core network modernization for telecom operators. The 5G core network transformation will help telecom operators to develop 5G core use cases and meet their customers' growing technological (Augmented Reality (AR), Virtual Reality (VR), IoT (Internet of Things), and edge computing) requirements. It will enable them to modernize, optimize, and secure business operations and develop green networks with reduced costs and a faster time to market.

In June 2022, Advantech Co., Ltd., and Actility announced the collaboration for the Launch an Edge Solution-Ready Package to Deploy Enterprise IoT LoRaWAN Networks, on customer premises, by combining advanced and ruggedized Advantech IPC with embedded Actility software, bringing a highly reliable and secure career-grade service with extended compatibility with gateways, cloud platforms, and devices, this integrated solution aims at meeting the needs of the fast-growing industrial automation market, by allowing businesses to deploy their IoT use cases in a simplified, quicker et more efficient way, thus accelerating the realization of Industry 4.0

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Smart Connected Devices

- 5.1.2 Accelerating Need for Converged Device Management

- 5.2 Market Restraints

- 5.2.1 Unavailability of Uniform IoT Standards for Interoperability

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.1.1 Security Solution

- 6.1.1.2 Data Management

- 6.1.1.3 Remote Monitoring

- 6.1.1.4 Other Solutions (Real-Time Streaming Analytics, Network Bandwidth Management)

- 6.1.2 Services

- 6.1.2.1 Professional Services

- 6.1.2.2 Managed Services

- 6.1.1 Solutions

- 6.2 By Organization Size

- 6.2.1 Small and Medium-Sized Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End-user Vertical

- 6.3.1 Retail

- 6.3.2 Healthcare

- 6.3.3 Transportation & Logistics

- 6.3.4 Manufacturing

- 6.3.5 Other End-user Vertical

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Microsoft Corporation

- 7.1.2 International Business Management (IBM) Corporation

- 7.1.3 Smith Micro Software, Inc.

- 7.1.4 Advantech Co., Ltd.

- 7.1.5 Bosch Software Innovations GmbH

- 7.1.6 Amplia Soluciones S.L.

- 7.1.7 Aeris Communication, Inc.

- 7.1.8 PTC Incorporation

- 7.1.9 Oracle Corporation

- 7.1.10 Smith Micro Software, Inc.

- 7.1.11 Telit Communications PLC

- 7.1.12 Cumulocity GmbH

- 7.1.13 Enhanced Telecommunications Inc.

- 7.1.14 Zentri Inc.