|

市場調查報告書

商品編碼

1445617

協作白板軟體:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Collaborative Whiteboard Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

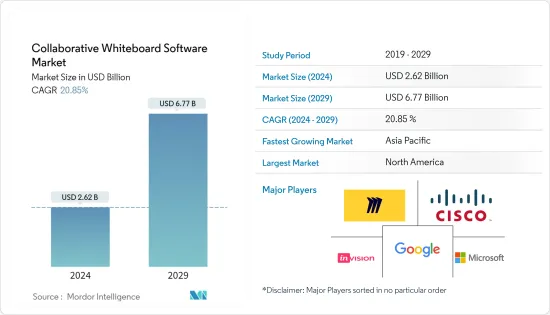

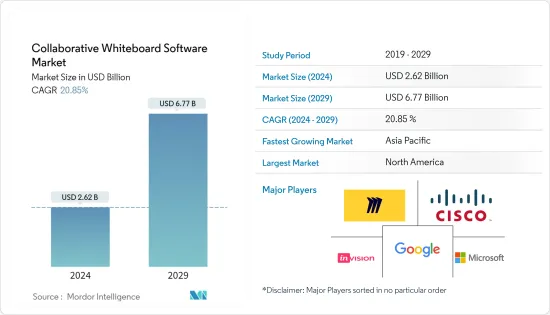

預計 2024 年協作白板軟體市場規模為 26.2 億美元,預計到 2029 年將達到 67.7 億美元,在預測期內(2024-2029 年)成長 20.85%。年複合成長率為

由於 COVID-19,數百萬人突然在家工作,對協作工具的需求大幅飆升。微軟透露,在實施社交定序措施和就地避難令的義大利,其協作和通訊服務 Microsoft Teams 的每月用戶數量增加了 775%。擁有超過 44 萬名員工的公司使用 Microsoft Teams,包括 Ernst & Young、SAP、Continental AG 和 Accenture。

主要亮點

- 協作白板軟體主要在您的設計中提供開放、單一或共用的空間,協作者可以在其中同時共用內容並從自己的裝置進行必要的編輯。這個工具,顧名思義,基本上就像一個實體白板。它提供了多種功能,使用者可以使用這些功能在可自訂的工作區中設計、儲存、共用和通訊內容。

- 這些工具主要在設計和計劃管理團隊中流行。來自不同學科的管理團隊可以從直覺且使用者友好的內容共用空間中受益。此外,雖然大多數協作白板解決方案都是獨立產品,但有些解決方案內建於其他設計軟體或視覺協作平台。

- 此外,協作在任何職場都發揮著重要作用,並被認為是任何職場的關鍵技能之一。例如,根據 Bluescape 2020 年的一項研究,約 71% 的受訪經理和員工將與他人的協作視為有效遠距工作的最重要技能。這些趨勢正在影響市場對協作軟體的需求。

- 無論任務領域如何,團隊意識、任務意識和存在意識對於協調位於同一地點的分散式團隊中的任務至關重要。隨著團隊距離越來越遠,需要在團隊成員之間傳播對訊息的理解以支持協調。

- 除了意識之外,還有很多其他問題,例如缺乏培訓、使用和執行不當、浪費訂閱(如果你的團隊成員不知道如何正確使用協作工具,你的訂閱將無法最佳化)等因素。例如無法改變市場)對所研究市場的成長構成挑戰。因此,使用者易用性和組織對協作白板軟體的適當培訓是協作軟體開發人員推動所研究市場成長的關鍵要素之一。

- 自COVID-19爆發以來,全球遠距工作的員工數量呈指數級成長,在不影響生產力的情況下給溝通和協作工具帶來壓力,董事會軟體解決方案正受到關注。

- 總體而言,協作白板軟體市場預計將在疫情後出現顯著成長。許多組織希望在世界各地的經濟開放後採用部分或完全遠端的工作文化。

協作白板軟體市場趨勢

組織內遠距工作和即時協作的增加

- 最近,由於 COVID-19 的爆發,許多組織已經適應了遠距工作策略。在 COVID-19 攻擊之前,遠距工作是組織內不斷成長的趨勢之一,因為它具有許多好處,包括降低固定營運成本和改善員工的工作與生活平衡。

- 隨著對遠距工作的依賴日益增加,組織需要合適的工具來跨團隊協作並最佳化流程。因此,遠距工作的趨勢在全球範圍內不斷增加,並被各種組織採用,推動了所研究市場的成長。

- 協作白板軟體工具為組織提供了各種即時協作優勢,包括提高生產力、有效的使用者適應、最新資訊、知識共用和即時回饋。

- 協作白板軟體的另一個好處是改進了日程安排。如果沒有安排,整個組織中員工的很大一部分工作時間可能會被浪費。規劃和安排其目標和活動的公司會取得更多成就,也更有效。每日、每周和每月的安排允許您的團隊有效地組織他們的工作流程。

預計北美將佔據重要市場佔有率

- 北美是研究市場中佔有重要佔有率的重要地區之一。 COVID-19 大流行對該地區產生了重大影響,對 IT 產業造成了重大干擾。然而,IT 公司已經成功引入了在家工作文化,現在正期待引入混合工作文化。

- 根據世界大型企業聯合會發布的報告,32%的美國CEO認為監管是一個重大挑戰,期待共同努力克服挑戰,確保員工靈活工作,我們希望更多地依靠任務。

- 70% 的 CEO 專注於自動化任務,加速數位轉型、修改經營模式和提高創新。隨著對混合工作文化的需求增加,這將推動市場的發展,混合工作文化預計將在預測期內透過重要的腦力激盪會議、策略規劃和有效的會議繼續下去。

- 同樣,Flexera Software 對北美514 名IT 高管進行的一項調查發現,49% 的受訪者表示,隨著越來越多的公司專注於協作平台、服務和通訊方面的投資,IT 支出預計將增加。這為協作白板軟體市場的供應商帶來了各種機會。例如,總部位於舊金山的 Micro 在協作白板上擁有 2,000 萬用戶,其中包括來自戴爾、思科、德勤、Okta、Pivotal 等的富裕用戶。

- 供應商也關注市場上的合作、合併和收購。例如,2022 年 3 月,思科宣布部分 Webex 產品將於 2022 年底支援 Apple AirPlay,讓用戶將 iPhone、iPad 和 Mac 螢幕投射到他們的裝置上。 Cisco Webex Board 裝置可作為 AirPlay 目標,讓 Apple 使用者可以將螢幕投射到其中一台裝置。

- 也分析了該地區的重大產品創新,以影響先進解決方案的採用。在 2022 年 3 月於佛羅裡達州舉行的 Enterprise Connect Conference and Expo 上,著名視覺解決方案供應商ViewSonic Corp. 宣布推出下一代 ViewBoard IFP62 系列數位白板。 ViewBoard IFP62 系列顯示器可實現無限的協作和創新。新一代數位白板顯示器旨在幫助您的團隊協作、聯繫、創建和共用想法,為您提供一種推進想法的方法。

協作白板軟體產業概述

市場仍處於採用的早期階段,供應商正在積極尋求擴大其用戶群。例如,Miro 擁有 2,000 萬用戶的強大用戶基礎。 Microsoft 等大公司能夠利用其他企業解決方案產品將解決方案作為捆綁包的一部分或單獨整合,從而顯著增加其用戶群。由於新玩家的增加,競爭環境變得更加激烈。由於需求不斷成長,這些解決方案和服務的市場對於傳統參與者和新參與者來說都非常活躍。儘管幾家主要科技公司(微軟和谷歌)已經開拓了這一領域,但市場上已經出現了各種利基玩家(Miro 和Crayon),它們提供更多功能、有競爭力的價格,並且透過提供整合,我們正在為類別領導者帶來激烈的競爭。現有的應用程式套件。

整體而言,競爭公司之間的敵對行動強度適中,預計在預測期內將會加劇。

2022 年 11 月,Miro 宣布發布多項新功能和一系列連接器,旨在改善 4,500 萬用戶的協作視覺體驗。該公司特別宣布了其最新功能,作為其數位中心的一部分,該中心透過將最廣泛使用的產品整合到單一團隊工作空間中來提高團隊生產力。

2022 年 3 月,思科宣布推出新的 Webex混合工作解決方案,使企業能夠以人為本。隨著組織採用領先的企業雲端呼叫在全球擴展業務,Webex Calling 用戶數量達到創紀錄的 600 萬。在 Webex 的內建應用程式框架中,客戶可以更多地存取他們喜愛的應用程式,例如用於視覺化白板的 InVision。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 價值鏈分析

- 評估 COVID-19感染疾病對產業的影響

- 協作白板的類型

第5章市場動態

- 市場促進因素

- 組織內遠距工作和即時協作的增加

- 市場限制因素

- 新興國家缺乏意識和數位資源

第6章市場區隔

- 作業系統

- Windows 和網路

- iOS

- android

- 部署方式

- 本地

- 雲

- 組織規模

- 主要企業

- 中小企業

- 最終用戶垂直領域

- BFSI

- 衛生保健

- 教育

- 資訊科技和電訊

- 其他最終用戶領域

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Cisco Systems Inc.

- Invisionapp Inc.

- Miro

- Mural

- Eztalks

- Explain Everything

- Beecanvas

- Bluescape

- Google Jamboard(Alphabet Inc.)

- Microsoft Corporation

- Zoom Video Communications

- Stormboard

- Limnu

- Conceptboard

- Twiddla

- Ziteboard-Overview

- Lucidspark

- Collaboard

- Edrawmind(Wondershare)

- Groupmap Technology Pty Ltd

- Vizetto

- Zira Technologies Inc.

- Trello Inc.(Atlassian Corporation PLC)

- Figma Inc.

- Ayoa(Opengenius Limited)

第8章投資分析

第9章市場的未來

The Collaborative Whiteboard Software Market size is estimated at USD 2.62 billion in 2024, and is expected to reach USD 6.77 billion by 2029, growing at a CAGR of 20.85% during the forecast period (2024-2029).

With millions of people suddenly working from home because of COVID-19's impact, collaboration tools are witnessing considerable spikes in demand. Microsoft revealed its Microsoft Teams collaboration and communication service had seen a 775% increase in monthly users in Italy, where social-distancing measures or shelter-in-place orders have been enforced. Companies such as Ernst & Young, SAP, Continental AG, and Accenture, which have over 440,000 employees, are using Microsoft Teams.

Key Highlights

- The collaborative whiteboard software primarily offers an open, singular, or shared space for a design where the collaborators can concurrently share their content and make necessary edits from their devices. The tool is basically like a physical whiteboard, as the name suggests. It offers a range of features that users can use to design, save, share, and communicate content in a customizable workspace.

- These tools are primarily popular among design and project management teams. Management groups across disciplines can benefit from an intuitive and user-friendly content-sharing space. Also, most collaborative whiteboard solutions are standalone products, but some are built into other design software or visual collaboration platforms.

- Additionally, collaboration plays a vital role in any job space and is considered one of the primary skills in any workspace. For instance, according to a study by Bluescape study in 2020, about 71% of the managers and employees part of the study mentioned collaborating with others as the top essential skill to work remotely effectively. Such trends are influencing the demand for collaborative software in the market.

- Regardless of the task domain, team awareness, task awareness, and presence awareness are essential for coordinating tasks in collocated and distributed teams. As the distance between the teams grows, it requires disseminating the understanding of information among team members to support coordination.

- Along with awareness, there are many other issues, such as lack of training, improper use and execution, and waste of subscriptions (If team members do not know how to use their collaboration tools properly, then they will not be able to optimize the subscription), among other factors, thus posing a challenge to the studied market growth. Therefore, ease of use among the user, along with proper training by the organization for this collaborative whiteboard software, is one of the important vital components for the joint software developer to enhance the growth of the market studied.

- Since the COVID-19 outbreak, the global number of employees working remotely has increased at an exponential rate, thus putting pressure on communication and collaboration tools without compromising the productivity, which is where collaborative whiteboard software solutions are gaining traction.

- Overall, the market for collaborative whiteboard software is expected to witness significant growth in the post-pandemic period. Many organizations have wished to adopt a partial or complete remote working culture post the opening of the economy across the world.

Collaborative Whiteboard Software Market Trends

Increasing Remote Working and Real-time Collaboration in Organizations

- Many organizations have adapted to the strategy of remote working in recent times due to the COVID-19 outbreak. Before the attack of COVID-19, remote working was one of the growing trends among the organization owing to many benefits, such as cost-saving in terms of fixed operating costs, and better work-life balance for employees, among others.

- With the growing dependency on remote working, the organization needs the proper tools to collaborate among the team to optimize the processes. Thereby, increasing remote working trends across the world adopted by the different organizations are driving the studied market growth.

- The collaborative whiteboard software tools benefit the organization in real-time collaboration in many ways, such as increasing productivity, effective user adaption, having up-to-date information, knowledge sharing, and instant feedback.

- Another benefit of collaboration whiteboard software is improved scheduling. Lack of scheduling can waste large percentages of employees' work time across the organizations. Businesses that plan and schedule their goals and activities get more done and are more effective. Daily, weekly, and monthly scheduling allows teams to organize their workflows efficiently.

North America is Expected to Hold Significant Market Share

- North America is one of the prominent regions with a significant share in the studied market. The COVID-19 pandemic largely impacted the region, and major disruptions occurred in the IT sector. However, the IT companies successfully implemented work from home culture and are now looking forward to introducing hybrid work culture.

- According to the report published by the Conference Board, 32% of the CEOs in the United States believed that regulations are a major challenge and would want to collaborate and rely more on technology to overcome challenges and ensure flexible working for the employees.

- 70% of the CEOs are focused on automated tasks to accelerate digital transformation, modify the business model and improve innovation. This increases the need for hybrid work culture, which drives the market as significant brainstorming sessions, strategy planning, and effective meetings are expected to continue in hybrid work culture during the forecast period.

- Similarly, according to the survey conducted by Flexera Software, among 514 IT executives in North America, 49% of the respondents believe that IT spending in the region is expected to increase as more businesses focus on investing in collaboration platforms and services and communication. This brings various opportunities for the vendors in the collaborative whiteboard software market. For instance, Micro, a San Francisco-based company, has 20 million users for their collaborative whiteboard and includes fortune users such as Dell, Cisco, Deloitte, Okta, and Pivotal.

- Vendors also focus on collaboration, mergers, and acquisitions in the market. For instance, in March 2022, Cisco announced that several Webex products would get Apple AirPlay later in 2022, allowing users to cast their iPhone, iPad, and Mac screens onto the devices. Cisco Webex Board devices will be able to serve as AirPlay targets, allowing Apple users to cast their screen to one of those devices.

- The significant product innovations in the region are also analyzed to impact the adoption of advanced solutions. At the Enterprise Connect Conference and Expo in March 2022 in Florida, ViewSonic Corp., a prominent visual solutions provider, unveiled its next-generation ViewBoard IFP62 series digital whiteboard. The ViewBoard IFP62 series of displays allow for unrestricted collaboration and innovation. This new generation of digital whiteboard displays is intended to assist teams in collaborating, connecting, creating, and sharing ideas and providing a way to move ideas forward.

Collaborative Whiteboard Software Industry Overview

The market is still in the early stages of adoption, and vendors are actively looking to expand their user base. For instance, Miro boasts a strong user base of 20 million users. Large enterprises, such as Microsoft, have a significantly higher user base as they can leverage their other enterprise solution offering to integrate the solution as part of the bundle or separately. The growing number of new players is further intensifying the competitive space. Due to the increasing demand, the market for these solutions and services is quite active for both legacy and newer players. While several key technology companies (Microsoft and Google) pioneered this space, the market has seen the rise of a range of niche players (Miro and Crayon) who are giving the category leaders fierce competition by offering more features, competitive pricing, and integration to the existing suite of applications.

Overall, the intensity of the competitive rivalry is moderate and expected to increase during the forecast period.

In November 2022, Miro announced the launch of several new functions and a collection of connectors aimed at improving the collaborative visual experience for its 45M users. The company specifically unveiled its newest features as a part of a digital hub that boosts team productivity by combining the most widely used products into a single team workspace.

In March 2022, Cisco unveiled new hybrid work solutions in Webex that empower companies to put people first. Webex Calling hit a record 6.0 million users as organizations adopt leading enterprise cloud calling to scale the business globally. Within Webex's Embedded Apps Framework, customers can access more of their favorite apps, including InVision, for visual whiteboarding.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

- 4.5 Types of Collaborative Whiteboards

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Remote Working and Real-time Collaboration in Organizations

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness and Digital Resources in Developing Countries

6 MARKET SEGMENTATION

- 6.1 Operating System

- 6.1.1 Windows and Web

- 6.1.2 iOS

- 6.1.3 Android

- 6.2 Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 Organization Size

- 6.3.1 Large Enterprises

- 6.3.2 Small and Medium Enterprises

- 6.4 End-user Vertical

- 6.4.1 BFSI

- 6.4.2 Healthcare

- 6.4.3 Education

- 6.4.4 IT and Telecommunications

- 6.4.5 Other End-user Verticals

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Invisionapp Inc.

- 7.1.3 Miro

- 7.1.4 Mural

- 7.1.5 Eztalks

- 7.1.6 Explain Everything

- 7.1.7 Beecanvas

- 7.1.8 Bluescape

- 7.1.9 Google Jamboard (Alphabet Inc.)

- 7.1.10 Microsoft Corporation

- 7.1.11 Zoom Video Communications

- 7.1.12 Stormboard

- 7.1.13 Limnu

- 7.1.14 Conceptboard

- 7.1.15 Twiddla

- 7.1.16 Ziteboard - Overview

- 7.1.17 Lucidspark

- 7.1.18 Collaboard

- 7.1.19 Edrawmind (Wondershare)

- 7.1.20 Groupmap Technology Pty Ltd

- 7.1.21 Vizetto

- 7.1.22 Zira Technologies Inc.

- 7.1.23 Trello Inc. (Atlassian Corporation PLC)

- 7.1.24 Figma Inc.

- 7.1.25 Ayoa (Opengenius Limited)