|

市場調查報告書

商品編碼

1445584

氣體分離膜:市場佔有率分析、產業趨勢與統計、成長預測 (2024:2029)Gas Separation Membrane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

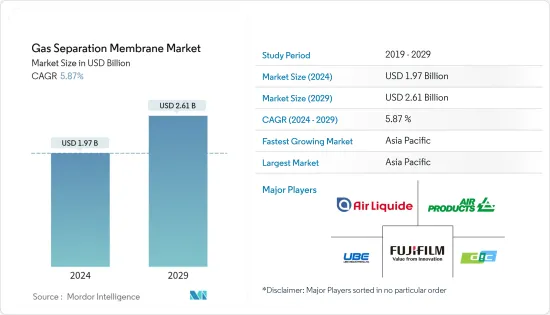

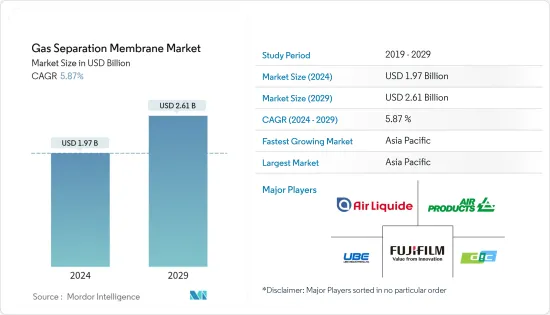

氣體分離膜市場規模預計到2024年為19.7億美元,預計到2029年將達到26.1億美元,在預測期內(2024-2029年)成長5.87%,年複合成長率成長。

由於多個地區的嚴格封鎖,COVID-19對石油天然氣行業、製藥行業和生物醫療醫療設備行業的整個供應鏈產生了重大影響,對氣體分離膜市場產生了負面影響。然而,隨著限制的取消,市場預計將隨著時間的推移而加快步伐,並在預測期內繼續成長。

主要亮點

- 推動市場研究的主要因素包括二氧化碳分離操作中對薄膜的需求不斷增加以及政府對溫室氣體排放的嚴格監管。

- 相反,聚合物膜在高溫應用中的塑化以及尺寸的增加和新膜的採用嚴重阻礙了市場的成長。

- 儘管如此,混合基質膜(MMM)和聚合物膜的發展及其應用的擴展預計將為相關市場帶來新的可能性。

- 亞太地區是最大的市場,由於中國、印度和日本的需求不斷成長,預計亞太地區將成為預測期內成長最快的市場。

氣體分離膜市場趨勢

制氮和富氧應用主導市場

- 氮氣生產和富氧製程是化學工業的一個組成部分,用於分離所需產品和回收反應物。氣體分離膜模組為商業和工業應用創建客自訂化的富氮或富氧空氣發生系統。

- 使用的主要薄膜類型之一是聚合物薄膜,它在環境溫度或溫暖溫度下運作並產生富氧空氣(25-50% 氧氣)。也使用可以提供高純度氧氣(>90%)的陶瓷膜。然而,它需要800至900攝氏度左右的高溫才能運作。

- 薄膜氣體分離用於提供富氮氣體取代空氣來填充噴射客機的燃料箱,減少意外燒燙傷或爆炸的機會。氮氣廣泛用於哈伯法生產氨。然後氨用於各種化學合成以生產肥料。除此之外,氮氣也用於包裝和冷凍。

- 此外,當今世界,工業部門對氧氣和氮氣的需求很高,鋼鐵生產需要大量的氧氣和氮氣。目前,現有的鹼性氧氣煉鋼每噸鋼消耗近2噸氧氣。因此,為了滿足氧氣需求,大多數鋼廠都採用對工廠運作至關重要的氣體分離模組。

- 根據世界鋼鐵協會的數據,2022年12月全球粗鋼產量為1.407億噸。 2022年全球粗鋼總產量約18.78億噸,較上年產量下降4%。然而,由於行業需求增加,預計 2023 年將出現正成長率,從而推動當前研究的市場。

- 近年來,醫療產業對氧氣濃縮機的需求激增,尤其是在疫情期間。由於需求增加,一些製造商計劃在世界各地擴建或開設更多工廠。例如,INOX Air Products Ltd 宣佈於 2022 年 3 月建造印度最大的待開發區工廠。該廠將生產2,150噸/日工業氣體,其中2,000噸/日氣態氧、150噸/日液氧和1,200噸/日液態氧。氮氣和氬氣,流速為 100 TPD。

- 因此,制氮和富氧需求的增加將導致氣體分離膜的需求激增,對市場產生正面影響。

亞太地區主導市場

- 由於該地區工業化程度的不斷提高推動市場成長,預計亞太地區將成為氣體分離膜最大且成長最快的市場。市場擴張主要是由於水庫二氧化碳去除需求的增加、衛生和淡水需求的增加、都市化的加快和生活水準的提高而推動的。快速擴張和創新,加上產業整合,可能會推動區域市場的顯著成長。

- 儘管如此,我國石油天然氣產業是氣體分離膜最重要的應用產業之一。過去二十年來,中國投資提高精製能力,以支持其不斷擴張的經濟。

- 此外,長期以來,中國各類原油的精製能力一直在穩步提高。根據能源調查(IEA),預計到年終,中國將擁有2000萬桶精製能力,將增加未來幾年對氣體分離膜的需求。

- 此外,預計2022年中國原油產量約2.046億噸,年增3%。根據中國國家統計局數據,2022年12月月度原油產量約1,700萬噸,較去年同期成長2.5%。氣體分離膜廣泛應用於石油和天然氣行業,從井口到石油回收和煉油廠,因此產品需求預計在不久的將來將激增。

- 印度擁有龐大的電力工業,由於人口成長、電氣化程度提高和人均用電量增加,預計未來幾年該電力工業將進一步擴張。根據印度品牌股權基金會(IBEF)統計,截至2022年10月31日,印度可再生能源裝置容量(含水電)為165.94GW,佔電力總裝置容量的40.6%。

- 此外,增加使用氣體分離膜來控制工業污水中的二氧化碳排放預計將產生正面的效果。政府加強控制氣體排放的法規預計將增加未來對該產品的需求。

- 此外,該地區天然氣產量的大幅增加可能會增加該地區市場對酸性氣體分離中氣體分離膜的需求。

氣體分離膜產業概況

氣體分離膜市場本質上是部分整合的,少數大型企業控制很大一部分市場。主要企業包括 Air Products and Chemicals, Inc.、UBE Corporation、Air Liquide Advanced Seperations、DIC Corporation 和 Fujifilm Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 二氧化碳分離過程對薄膜的需求不斷增加

- 嚴格的政府溫室氣體排放標準

- 抑制因素

- 高溫應用中聚合物膜的塑化

- 擴大規模並採用新膜

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔

- 材料類型

- 聚醯亞胺和聚醯胺

- 聚碸

- 醋酸纖維素

- 其他材質類型

- 目的

- 制氮和富氧

- 氫氣回收

- 二氧化碳移除

- 去除硫化氫

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- Air Liquide Advanced Separations

- Air Products and Chemicals Inc.

- DIC Corporation

- Evonik Industries AG

- Fujifilm Corporation

- Generon

- Honeywell International Inc.

- Linde PLC

- Membrane Technology and Research Inc.

- Parker Hannifin Corp.

- SLB(schlumberger)

- Toray Industries Inc.

- UBE Corporation

第7章市場機會與未來趨勢

- 混合基質膜(MMM)的開發

- 高分子膜的開發及應用領域的拓展

The Gas Separation Membrane Market size is estimated at USD 1.97 billion in 2024, and is expected to reach USD 2.61 billion by 2029, growing at a CAGR of 5.87% during the forecast period (2024-2029).

COVID-19 had a significant impact on the entire supply chain of the oil and gas industry, pharmaceutical industry, and biomedical devices industry, owing to strict lockdowns in several regions and thus negatively impacting the market for gas separation membranes. However, with the lifting of restrictions, the market is expected to gain pace with time and continue to grow during the forecast period.

Key Highlights

- The primary factors driving the market study include the rising demand for membranes in carbon dioxide separation operations and stringent government regulations governing GHG emissions.

- On the contrary, the plasticization of polymeric membranes in high-temperature applications and the upscaling and adoption of new membranes have significantly hampered market growth.

- Nevertheless, the development of mixed matrix membranes (MMM) and polymeric membranes, as well as expanding applications, are projected to open new potential in the market under consideration.

- The Asia-Pacific region is the largest market and is predicted to be the fastest-growing market throughout the projection period, owing to rising demand in China, India, and Japan.

Gas Separation Membrane Market Trends

Nitrogen Generation and Oxygen Enrichment Application to Dominate the Market

- The processes of nitrogen generation and oxygen enrichment are integral parts of the chemical industry for the isolation of required products and the recovery of the reactants. The gas separation membrane modules build custom-made nitrogen or oxygen-enriched air generator systems for commercial and industrial applications.

- One major type of membrane used is polymeric, which operates at ambient or warm temperatures and may produce oxygen-enriched air (25-50% oxygen). Ceramic membranes are the other types used that may provide high-purity oxygen (90% or more). However, they require higher temperatures-around 800-900 degrees Celsius-to operate.

- Membrane gas separation is used to provide nitrogen-rich gases instead of air to fill jetliners' fuel tanks, reducing the likelihood of inadvertent burns and explosions. Nitrogen is widely utilized in the Haber process to produce ammonia. Ammonia is then employed in various chemical syntheses to produce fertilizers. Nitrogen is also used in packing and refrigeration, among other things.

- Furthermore, in today's world, oxygen and nitrogen are in high demand from the industrial sector, and large volumes are necessary for steel production. Nowadays, current basic oxygen steelmaking consumes almost 2 tons of oxygen for each ton of steel. As a result, to meet the requirement for oxygen, most steel factories employ gas separation modules, which are an essential aspect of plant operations.

- According to the World Steel Association, global crude steel production was 140.7 million tons (Mt) in December 2022. The total world crude steel production in 2022 was approximately 1,878 million tons, a 4% decrease compared to the production in the prior year. However, in 2023, it is expected to register a positive growth rate due to the increased demand in the industry, thereby driving the current studied market.

- The medical business has seen a surge in demand for oxygen concentrators in recent years, particularly during the pandemic era. With rising demand, several manufacturers intend to expand or open additional plants around the world. INOX Air Products Ltd, for example, announced in March 2022 the construction of India's largest greenfield plant, which will produce 2,150 tons per day (TPD) of industrial gases, including 2000 TPD of gaseous oxygen, 150 TPD of liquid oxygen, 1200 TPD of gaseous nitrogen, and 100 TPD of argon.

- Thus, the increased demand for nitrogen generation and oxygen enrichment will lead to an upsurge in the demand for the gas separation membrane and therefore positively affect the market.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to be the largest and fastest-growing market for gas separation membranes, owing to the region's increasing industrialization, which drives the market's growth. The market's expansion is primarily driven by rising demand for carbon dioxide removal from reservoirs, a rising need for sanitation and freshwater, increased urbanization, and higher living standards. Fast expansion and innovation, combined with industry consolidations, will likely drive significant growth in the region's market.

- Nonetheless, the oil and gas industry in China is one of the most important application industries for gas separation membranes. Over the last two decades, China has invested in increasing its refining capacity to support its expanding economy.

- Furthermore, for a long time, China has steadily increased its refining capacity for all types of crude. According to the Institute for Energy Research (IEA), China is expected to have 20 million barrels of refining capacity by the end of 2025, resulting in an increased need for gas separation membranes in the coming years.

- Furthermore, China's crude oil output in 2022 was estimated to be about 204.6 million tons, a 3% increase over the same period last year. According to the National Bureau of Statistics (NBS) of China, the monthly output of crude oil in December 2022 was approximately 17 million tons, a 2.5% rise over the same period last year. Because gas separation membranes are widely employed in the oil and gas industry, from the oil wellhead to oil recovery to the refinery, product demand will skyrocket in the near future.

- Even though India has a large power industry, the growing population, coupled with rising electrification and increasing per capita usage, will propel the industry's size in the upcoming years. According to the Indian Brand Equity Foundation (IBEF), as of October 31, 2022, India's installed renewable energy capacity (including hydro) stood at 165.94 GW, representing 40.6% of the overall installed power capacity.

- Additionally, the increasing use of gas separation membranes to control CO2 emissions from industrial effluents is expected to have a positive impact. Strengthening government regulations to curb gaseous emissions is expected to fuel the demand for the product in the future.

- Furthermore, the significant growth of natural gas production in the region may propel the demand for gas separation membranes in acid gas separation in the regional market.

Gas Separation Membrane Industry Overview

The gas separation membrane market is partially consolidated in nature, with a few major players dominating a significant portion of the market. Some of the major companies are Air Products and Chemicals, Inc., UBE Corporation, Air Liquide Advanced Seperations, DIC Corporation, Fujifilm Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Membranes in Carbon Dioxide Separation Processes

- 4.1.2 Strict Government Norms Toward GHG Emissions

- 4.2 Restraints

- 4.2.1 Plasticization of Polymeric Membranes in High-Temperature Applications

- 4.2.2 Upscaling and Adoption of New Membranes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Polyimide and Polyamide

- 5.1.2 Polysulfone

- 5.1.3 Cellulose Acetate

- 5.1.4 Other Material Types

- 5.2 Application

- 5.2.1 Nitrogen Generation and Oxygen Enrichment

- 5.2.2 Hydrogen Recovery

- 5.2.3 Carbon Dioxide Removal

- 5.2.4 Removal of Hydrogen Sulphide

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide Advanced Separations

- 6.4.2 Air Products and Chemicals Inc.

- 6.4.3 DIC Corporation

- 6.4.4 Evonik Industries AG

- 6.4.5 Fujifilm Corporation

- 6.4.6 Generon

- 6.4.7 Honeywell International Inc.

- 6.4.8 Linde PLC

- 6.4.9 Membrane Technology and Research Inc.

- 6.4.10 Parker Hannifin Corp.

- 6.4.11 SLB (schlumberger)

- 6.4.12 Toray Industries Inc.

- 6.4.13 UBE Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Mixed Matrix Membranes (MMM)

- 7.2 Development in Polymeric Membranes and Expanding Applications

![氣體分離膜市場:趨勢、機遇、競爭對手分析 [2023-2028]](/sample/img/cover/42/1289736.png)