|

市場調查報告書

商品編碼

1445583

葉蠟石:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Pyrophyllite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

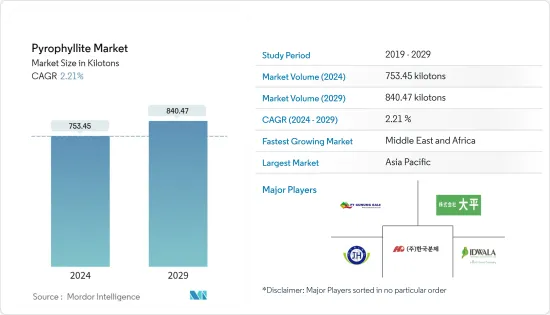

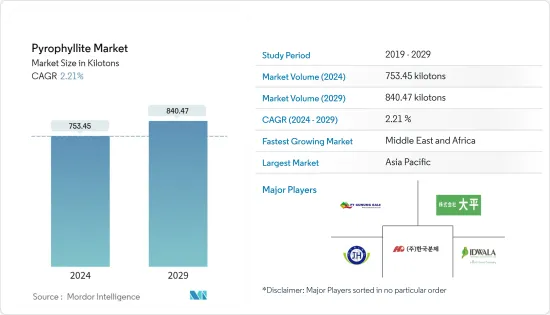

葉臘石市場規模預計到2024年為753,450噸,預計到2029年將達到840,470噸,在預測期內(2024-2029年)年複合成長率為2.21%。

2020年,由於臨時封鎖和停產,COVID-19影響了包括化學工業在內的各個產業。然而,由於建設活動增加,對油漆和陶瓷的需求增加,擴大了疫情後的葉臘石市場。

主要亮點

- 主要經濟體陶瓷對葉臘石的需求不斷成長是推動市場成長的關鍵因素之一。

- 採礦過程中葉臘石粉塵引起的健康問題預計將阻礙市場成長。

- 耐火材料和鑄造業對葉臘石作為滑石粉和高嶺土替代品的需求不斷成長,這可能是未來幾年探索市場的機會。

- 預計亞太地區將主導市場,其中中國和印度等國家的消費量最高。

葉蠟石市場趨勢

全球市場對陶瓷葉臘石的需求不斷增加

- 葉臘石是一種早變礦物,非常典型、優秀。它被發現是板岩、千枚岩、一些片岩和其他早期變質岩的成分。

- 葉蠟石被用作陶瓷原料,因為它可以降低燒成溫度,減少熱膨脹、收縮和裂紋,並提高抗熱震性。此外,成品具有高度的玻璃化度和良好的機械強度。

- 由於其韌性、硬度、電阻和化學惰性,未來幾年建設產業和汽車行業對陶瓷衍生葉蠟石的需求可能會增加。

- 中國是世界上最大的陶瓷生產國之一。根據中國陶瓷協會統計,2021年中國工業陶瓷產業市值為294億美元,高於2020年的281.8億美元。

- 此外,各行業對陶瓷的需求也促進了陶瓷的出口。根據聯合國COMTRADE國際貿易資料庫顯示,2021年印尼陶瓷產品出口額為3.74億美元,較2020年成長30%。澳洲陶瓷產業的成長正在增加相關市場的消費。

- 建設產業的繁榮加速了美國對瓷磚的需求。根據聯合國COMTRADE國際貿易資料庫,2022年美國陶瓷產品出口金額為24.9億美元。此外,根據北美磁磚委員會的數據,2021 年美國磁磚出貨為 9.18 億平方英尺。

- 因此,由於上述因素,陶瓷應用可能在預測期內佔據主導地位。

亞太地區主導市場

- 預計亞太地區將在預測期內主導市場。中國和印度等國家對葉臘石的需求不斷成長,以及建設產業陶瓷使用量的增加,預計將推動該地區的發展。

- 最大的葉臘石生產商位於亞太地區。 2021年5月,PPG宣布完成對中國嘉定油漆塗料工廠的1,300萬美元投資。該工廠包括八條新的粉末塗料生產線和一個擴建的粉末塗料技術中心,預計將增強 PPG 的研發能力。此次擴建將使該廠的產能每年增加8,000多噸。預計這些因素將在預測期內增加塗料產業對葉臘石的需求。

- 葉臘石是一種重要的礦物,在造紙和油漆工業中用作填充物。據印度紙張製造商協會(IPMA)稱,2021-22年印度的紙張和紙板出口將激增近80%,達到1396.3億印度盧比(16.8億美元)的歷史新高。

- 葉蠟石在農業中用作肥料載體,提高土壤保留養分的能力並減少淋濾。中國是世界上最大的化肥生產國。根據國家統計局數據,2021年我國氮磷鉀肥產量5,544萬噸,比2020年的5,496萬噸增加0.87%。

- 由於上述因素,亞太地區葉臘石市場預計將在研究期間顯著成長。

葉蠟石產業概況

葉臘石市場本質上高度整合。主要公司有Hancock Mineral Powder、品川Shirenga、Shokosan 工業、Ohira 工業、Minkyung Sangyo等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 全球市場對陶瓷葉臘石的需求不斷增加

- 耐火材料和鑄造廠消耗增加

- 抑制因素

- 採礦過程中千枚岩粉塵引起的健康問題

- 其他限制(替代人員的可用性)

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭程度

第5章市場區隔(市場規模(數量))

- 類型

- 葉蠟石天然

- 其他牌號(陶粒10、陶粒14等)

- 目的

- 陶瓷

- 玻璃纖維

- 填充材(紙、農藥、油漆)

- 肥料(土壤改良材料)

- 橡膠和屋頂材料(作為抑塵劑)

- 耐火材料

- 裝飾石

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- Anand Talc

- Hankook Mineral Powder Co. Ltd

- Idwala Industrial Holdings(Pty)Ltd

- Jinhae Pyrophyllite

- Minkyung Industrial Co. Ltd

- Ohira Co. Ltd

- Pt. Gunung Bale

- Rt Vanderbilt Holding Company Inc.

- Samirock Company

- Shinagawa Shirenga Co. Ltd

- Shokozan Kogyosho Co. Ltd

- SKKU Minerals

- Wonderstone

第7章市場機會與未來趨勢

The Pyrophyllite Market size is estimated at 753.45 kilotons in 2024, and is expected to reach 840.47 kilotons by 2029, growing at a CAGR of 2.21% during the forecast period (2024-2029).

In 2020, COVID-19 impacted various industries, including the chemical industry, due to the temporary lockdowns and halted production. However, the increasing demand for paints and ceramics with the growing construction activities propelled the pyrophyllite market post-pandemic.

Key Highlights

- The growing demand for pyrophyllite from ceramics across significant economies is one of the major factors driving the market growth.

- Health issues due to pyrophyllite dust during mining are expected to hinder the market's growth.

- The growing demand for pyrophyllite as an alternative to talc and kaolin in the refractory and foundry industry is likely to act as an opportunity for the market studied in the coming years.

- Asia-Pacific region is expected to dominate the market with the most significant consumption from countries like China and India.

Pyrophyllite Market Trends

Growing Demand of Pyrophyllite from Ceramics in Global Market

- Pyrophyllite is an early-time changeable mineral that is very typical and excellent. It is found as a constituent of slate, phyllite, a few schists, and other early-stage metamorphic rocks.

- Pyrophyllite is used as a raw material in ceramics as it lowers firing temperature, reduces thermal expansion, shrinking, and cracking, and improves thermal shock resistance. Additionally, the finished product includes a high degree of vitrification and good mechanical resistance.

- Demand for pyrophyllite from ceramic is likely to increase in the construction and automotive industries in the coming years due to its toughness, hardness, electrical resistance, and chemical inertness.

- China is one of the largest producers of ceramics across the globe. According to the China Ceramic Association, the market value of the industrial ceramic industry in China was USD 29.4 billion in 2021, which increased from USD 28.18 billion in 2020.

- Furthermore, the demand for ceramics in various industries propelled ceramics exports. According to the United Nations COMTRADE database on international trade, Indonesia's exports of ceramic products were valued at USD 374 million in 2021, which was 30% higher than in 2020. The increasing ceramics industry in Australia has raised consumption in the market under consideration.

- The surging construction industry accelerated the demand for ceramic tiles in the United States. In 2022, the exports of ceramic products in the United States were USD 2.49 billion, as per the United Nations COMTRADE database on international trade. Also, according to the Tile Council of North America, the ceramic tile shipments in the United States in 2021 accounted for 918 million square feet.

- Hence, due to the factors above, the application of ceramic is likely to dominate during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market during the forecast period. The rising demand for pyrophyllite and the growing use of ceramics in the construction industry in countries like China and India are expected to drive this region.

- The largest producers of pyrophyllite are based in the Asia-Pacific region. In May 2021, PPG announced the completion of its USD 13 million investment in its Jiading, China, paint and coatings facility. The facility includes eight new powder coating production lines and an expanded powder coating technology center that is expected to enhance PPG's research and development capabilities. The expansion will likely increase the plant's capacity by more than 8,000 metric tons annually. These factors are expected to increase the demand for pyrophyllite in the paint industry during the forecast period.

- Pyrophyllite is an essential mineral used in the paper and paint industries as a filler. According to the Indian Paper Manufacturers Association (IPMA), exports of paper and paperboard from India jumped to around 80% in 2021-22, touching a record value of INR 139.63 billion (USD 1.68 billion).

- Pyrophyllite is used as a fertilizer carrier in agriculture, increasing the soil's ability to hold nutrients and reducing leaching. China is the largest fertilizer manufacturer in the world. According to the National Bureau of Statistics of China, the nitrogen, phosphate, and potash fertilizer production volume in China accounted for 55.44 million tons in 2021, compared to 54.96 million tons in 2020, registering a growth of 0.87%.

- Owing to the factors above, the market for pyrophyllite in the Asia-Pacific region is projected to grow significantly during the study period.

Pyrophyllite Industry Overview

The pyrophyllite market is highly consolidated in nature. Some major companies are HANKOOK MINERAL POWDER CO. LTD., Shinagawa Shirenga Co. Ltd., Shokozan Kogyosho Co. Ltd., OHIRA CO. LTD., and Minkyung Industrial Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Pyrophyllite from Ceramics in the Global Market

- 4.1.2 Increasing Consumption in Refractory and Foundry

- 4.2 Restraints

- 4.2.1 Health Issues Due to Pyrophyllite Dust During Mining

- 4.2.2 Other Restraints (Availability of Substitutes)

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Pyrophyllite Natural

- 5.1.2 Other Grades (Ceramit 10, Ceramit 14, Etc.)

- 5.2 Application

- 5.2.1 Ceramics

- 5.2.2 Fiberglass

- 5.2.3 Filler Materials (Paper, Insecticides, Paints)

- 5.2.4 Fertilizer (Soil Conditioner)

- 5.2.5 Rubber and Roofing (As Dusting Agents)

- 5.2.6 Refractory

- 5.2.7 Ornamental Stones

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anand Talc

- 6.4.2 Hankook Mineral Powder Co. Ltd

- 6.4.3 Idwala Industrial Holdings (Pty) Ltd

- 6.4.4 Jinhae Pyrophyllite

- 6.4.5 Minkyung Industrial Co. Ltd

- 6.4.6 Ohira Co. Ltd

- 6.4.7 Pt. Gunung Bale

- 6.4.8 R.t. Vanderbilt Holding Company Inc.

- 6.4.9 Samirock Company

- 6.4.10 Shinagawa Shirenga Co. Ltd

- 6.4.11 Shokozan Kogyosho Co. Ltd

- 6.4.12 SKKU Minerals

- 6.4.13 Wonderstone

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Alternative of Talc and Kaolin in Refractory, Foundry Industry, and Other Industries