|

市場調查報告書

商品編碼

1445486

植物生長室:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Plant Growth Chambers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

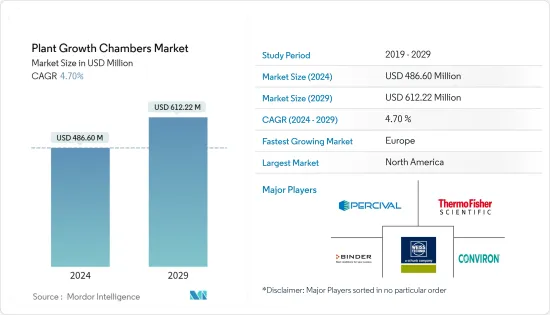

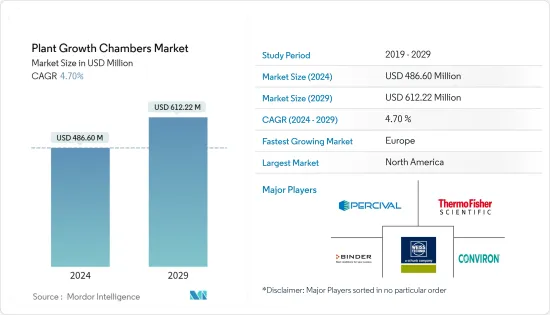

植物生長室市場規模預計到 2024 年為 4.866 億美元,預計到 2029 年將達到 6.1222 億美元,在預測期內(2024-2029 年)增加 470 萬美元,年複合成長率為 %。

主要亮點

- 快速都市化、人口成長和耕地減少正在加劇世界各地對糧食安全的擔憂。這是推動提高農地生產力的植物生長室需求的關鍵因素之一。這些室用於生產園藝作物,提供一致的作物品質、提高生產力、重新定位植物的彈性以及有效利用空間。

- 工業和學術研究目的擴大採用植物生長室。養活不斷成長的世界人口的需要以及對永續農業實踐不斷成長的需求導致世界各地對植物生長室的需求顯著增加。此外,世界各地耕地面積的減少正在增加對這些永續作物生產的人工生長室的需求。根據聯合國糧農組織統計,2020年全球耕地面積為138717.26萬公頃,低於2018年的138975萬公頃。

- 此外,生物技術的進步和基因改造作物的日益採用也促進了市場的成長。此外,在易受乾旱影響的乾旱氣候地區,植物生長室的日益普及也推動了市場的成長。

植物生長室的市場趨勢

糧食需求增加,耕地減少

養活不斷成長的世界人口的需要以及對永續農業實踐不斷成長的需求導致世界各地對植物生長室的需求顯著增加。據糧農組織稱,未來 36 年農業產量預計將加倍,以滿足 90 億人口的需求。生產大量糧食的需求增加了對永續作物生產的新技術和創新技術的需求。因此,植物生長室的好處越來越受到已開發國家和新興國家的廣泛接受和認可。

此外,隨著人均耕地面積的減少和人口的增加,全球作物產量必須增加才能滿足糧食生產需求。根據世界銀行統計,南亞地區耕地佔比從2018年的43.14%下降到2020年的43.13%。根據聯合國糧農組織統計,全球耕地總面積為1,560,853,700英畝。 2020年,2019年減少156166.76萬公頃。因此,南亞新興國家農業用地的減少和污染預計將增加對替代種植(包括室式種植)的需求。因此,預計未來幾年對植物生長室的需求將大幅成長。

中國約有3.34億英畝耕地,其中約3700萬英畝為非耕地。人口成長是一個主要威脅,有必要創造更多的耕地替代品,以提高當前耕地的產量和生產力。這包括採用產量品種、化肥和農藥管理、機械化、灌溉管理和植物生長室等農業新技術。

北美市場佔據主導地位

北美目前是世界上最大的植物生長室市場,美國、加拿大和墨西哥等國家已大規模採用培養箱來實現受控和永續的植物生長。這主要是由於耕地減少,導致美國和其他國家對植物生長室的需求增加。這些室在該地區得到大量利用,以避免持續供應食物的障礙,並開發創新、優質、無病害的植物。 Thermo Fisher、Caron 和 Conviron 等領先公司的存在對該地區的市場成長做出了重大貢獻。

此外,學術研究機構和化妝品行業擴大使用植物生長室也是推動該地區植物生長室需求的另一個關鍵因素。據國際園藝科學學會稱,美國有超過 250 個商業植物實驗室,農產品研究部門內可能還有 50 個實驗室。他們的產品可分為農業和園藝。此外,該國正在建造新的組織培養實驗室來進行研究活動,從而產生對植物生長室設備的需求。

隨著加拿大對健康、新鮮和永續農產品的需求不斷成長,在不久的將來有很多機會可以利用種植室擴大食品生產。亞伯達是實施保護性栽培、室內栽培和各種植物研究活動的領先省份之一。番茄、黃瓜和辣椒是該州種植室通常商業性種植的三種主要作物。其他種植的經濟作物包括生菜、羅勒、芝麻菜、茄子和菜豆。

植物生長室產業概況

植物生長室市場由主要產業參與者佔據市場大部分佔有率。 ThermoFisher、Conviron、Weiss Technik、Binder GmbH 和 Percival Scientific Inc. 是其中一些主要的公司。兩家公司主要專注於業務擴張、聯盟、併購等策略,以在全球市場上領先競爭對手。這些公司正在透過與國內製造商合作來擴大其在許多區域市場的影響力,以鞏固其市場立足點。新產品推出、聯盟和收購是國內市場領導者採取的關鍵策略。除了創新和擴張之外,研發投資和新產品系列的開發可能是未來幾年的關鍵策略。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 設備類型

- 到達

- 步入

- 目的

- 矮植物

- 高大的植物

- 功能

- 植物生長

- 種子發芽

- 環境最佳化

- 組織培養

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Aralab

- BINDER GmbH

- Brs Bvba

- CARON Products &Services Inc.

- Conviron

- Darwin Chambers

- Freezers India

- Hettich Benelux BV

- Percival Scientific Inc.

- Saveer Biotech Limited

- Thermo Fisher

- Weiss Technik

第7章市場機會與未來趨勢

The Plant Growth Chambers Market size is estimated at USD 486.60 million in 2024, and is expected to reach USD 612.22 million by 2029, growing at a CAGR of 4.70% during the forecast period (2024-2029).

Key Highlights

- Rapid urbanization, rising population, and declining arable land are leading to increasing food security concerns around the world. This represents one of the key factors catalyzing the demand for plant growth chambers as they enhance the productivity of agricultural land. These chambers are utilized in horticulture crop production and provide consistent crop quality, increased productivity, flexibility in changing plant location, and thus an efficient usage of the space.

- There is increasing adoption of plant growth chambers for both industrial and academic research purposes. The need to feed an ever-growing global population, coupled with the increasing demand for sustainable agricultural practices, fuelled a significant rise in the demand for plant growth chambers across the world. Moreover, a decreased arable land worldwide is driving the demand for these artificial growth chambers for sustainable crop production. According to the FAO, in the year 2020, the global arable land accounted for 1,387,172.6 thousand hectares, which decreased from 1,389,750.0 thousand hectares in 2018.

- Furthermore, advancements in biological engineering, along with the growing adoption of genetically modified crops, are also contributing to market growth. Moreover, the increasing popularity of plant growth chambers in dry climatic regions that are more susceptible to drought conditions is also driving the growth of the market.

Plant Growth Chambers Market Trends

Increasing Demand for Food and Decreasing Arable Land

The need to feed an ever-growing global population, coupled with increasing demand for sustainable agricultural practices, fueled a significant rise in demand for plant growth chambers across the world. According to FAO, agricultural production is anticipated to grow two-fold over the coming 36 years, to meet the demands of a population of 9 billion. The need to produce a larger quantity of food is fueling the demand for new innovative technologies for sustainable crop production. Thus, there is broader acceptance and recognition of the increasing benefits of plant growth chambers in developed and developing countries.

Additionally, with the amount of arable land per person declining and the population expanding, global crop yields must increase to meet the food production needs. According to the World Bank statistics, in South Asia, there was a decline in the arable land percentage of the total land, from 43.14% in 2018 to 43.13% in 2020. Also, as per FAO, the total global cropland accounted for 1,560,853.7 thousand hectares in the year 2019 decreased by 1,561,667.6 thousand hectares during the year 2020. Thus, a reduction in cropland and pollution in the developing countries of South Asia is expected to increase the demand for alternative cultivation, including growing in chambers. As a result, the most dramatic rise in the demand for plant growth chambers is likely to be witnessed in the coming years.

In China, there are approximately 334 million acres of arable land, of which around 37 million acres are non-cultivable. The growing population poses a major threat and is needed to create an alternative of more arable land to enhance the yield and productivity of the land currently being cultivated. The technology includes high-yielding varieties, the management of fertilizers and pesticides, mechanization, irrigation management, and employing new farming techniques, such as plant growth chambers.

North America Dominates the Market

North America is currently the largest market for plant growth chambers in the world, with countries, like the United States, Canada, and Mexico, demonstrating massive adoption of incubators for controlled and sustainable plant growth. This is largely attributed to the declining arable land, which spurred the demand for plant growth chambers in the United States and other countries. These chambers are significantly utilized in the region to avoid disturbances in the continuous supply of food and develop innovative and quality plants that are free of diseases. The presence of major companies, such as Thermo Fisher, Caron, and Conviron is majorly contributing to the growth of the market in this region.

Additionally, the rise in the use of plant growth chambers in academic research organizations and cosmetic industries is another key factor propelling the demand for plant growth chambers in the region. According to the international society for Horticultural Sciences, there are nearly over 250 commercial plant laboratories in the United States with probably 50 more within the research units of agribusinesses. Their products can be segmented between agriculture and horticulture. Moreover, new tissue culture laboratories are under progress in the country to undertake research activities, which, in turn, is creating a demand for plant growth chamber equipment.

Canada holds numerous sets of opportunities that embark on the possibility of scaling the production of foods using plant growth chambers over the near future as the need for healthy, fresh, and sustainable produce is increasing in the country. Alberta is one of the advanced provinces when it comes to adopting protected and indoor cultivation practices as well as carrying out various plant research activities. Tomatoes, cucumber, and peppers are the three main crops generally grown commercially in growth chambers in the province. Other commercial crops grown include lettuce, basil, arugula, eggplant, and snap beans, but typically on a much smaller scale.

Plant Growth Chambers Industry Overview

The plant growth chambers market is consolidated, with the major industry players occupying a majority share of the market. ThermoFisher, Conviron, Weiss Technik, Binder GmbH, and Percival Scientific Inc. are some of the major players. The companies are largely focusing on expansions, partnerships, mergers, and acquisitions, among other strategies, to move ahead of their competitors in the global market. These players are expanding their presence in many regional markets by partnering with domestic manufacturers to strengthen their foothold in the market. New product launches, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market, in the country. Along with innovations and expansions, investments in R&D and developing novel product portfolios are likely to be crucial strategies in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Equipment Type

- 5.1.1 Reach-in

- 5.1.2 Walk-in

- 5.2 Application

- 5.2.1 Short Plants

- 5.2.2 Tall Plants

- 5.3 Function

- 5.3.1 Plant Growth

- 5.3.2 Seed Germination

- 5.3.3 Environment Optimization

- 5.3.4 Tissue Culture

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Aralab

- 6.3.2 BINDER GmbH

- 6.3.3 Brs Bvba

- 6.3.4 CARON Products & Services Inc.

- 6.3.5 Conviron

- 6.3.6 Darwin Chambers

- 6.3.7 Freezers India

- 6.3.8 Hettich Benelux BV

- 6.3.9 Percival Scientific Inc.

- 6.3.10 Saveer Biotech Limited

- 6.3.11 Thermo Fisher

- 6.3.12 Weiss Technik