|

市場調查報告書

商品編碼

1445464

劑量計 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Dosimeter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

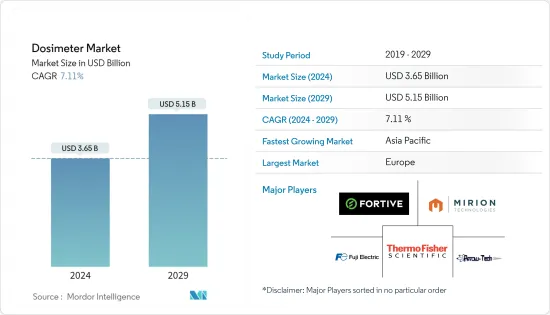

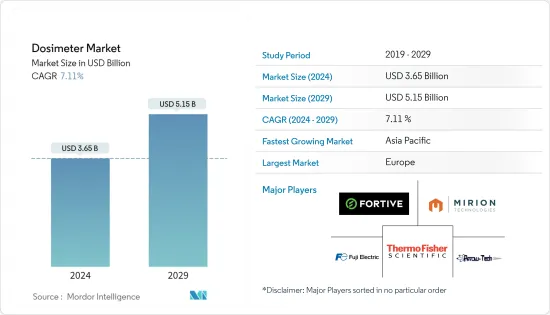

劑量計市場規模預計到 2024 年為 36.5 億美元,預計到 2029 年將達到 51.5 億美元,在預測期內(2024-2029 年)CAGR為 7.11%。

主要亮點

- 劑量計在各行業都有多種應用,包括醫療和製造業。在製造業中,放射源或 X 光機的使用增加了對劑量計長期監測輻射暴露的需求。被動劑量計,例如薄膜徽章和熱釋光劑量計,通常用於製造業的日常監測。

- 旨在控制排放和確保勞動安全的政府法規進一步支持了工業領域對劑量計的需求。然而,該設備的高成本及其對電磁場的敏感性以及機械不穩定性是阻礙主動劑量計市場成長的因素。

- COVID-19 大流行促使對劑量計的需求增加,特別是在使用紫外線的消毒環境中。劑量計用於測量參與消毒活動的工人的紫外線暴露量,以確保他們的安全。此外,某些參與疫情應對工作的產業,例如個人防護裝備(PPE)的製造,可能需要劑量計來監測輻射暴露程度。

- 整體而言,在輻射介導技術的使用增加、政府法規以及工人安全需求等因素的推動下,各行業對劑量計的需求預計將會成長。然而,市場成長可能會受到設備成本高及其對環境因素敏感度等因素的限制。

劑量計市場趨勢

工業領域放射性物質應用的增加推動了市場

- 科學和工業已經發現放射性同位素的許多應用,可以提高生產力並提供對材料和工藝的獨特見解。放射性同位素用作示踪劑,用於監測流體流動和過濾、檢測洩漏以及測量引擎磨損和製程設備的腐蝕。國際原子能總署 (IAEA) 估計,全世界有數十萬個此類儀器正在運行,測量材料吸收的輻射量。

- 放射性同位素也用於研究各種材料的混合和流速、檢查金屬零件以及評估各行業焊接的完整性。工業伽馬射線照相利用輻射的穿透力來有效地篩選材料。它的工作原理與機場安全檢查中使用的 X光類似,但在密封的鈦膠囊中裝有一小粒放射性物質。

- 此外,放射性同位素也用作核反應器的燃料,以發電並在製造過程中控制紙張、塑膠和金屬板的厚度。它們也用於製造發光塗料和具有輻射發光的物體。

- 印度近幾十年來經歷了快速的工業化,導致輻射和有害氣體增加。許多行業和醫院正在安裝劑量測量系統,以防止員工和醫療保健專業人員過度暴露於輻射。預計這些因素將推動印度市場的成長。

- 截至2022年5月,全球在建核反應器有53座,其中中國以15座位居第一,印度緊追在後,當時在建有8座核反應爐。

亞太地區預計將出現顯著成長

- 亞太地區預計將主導全球劑量計市場,這主要是由於各個最終用戶行業擴大採用輻射。由於人們日益關注核電發電以滿足不斷成長的能源需求,以及中國、日本和印度等新興國家對人身安全的嚴格監管,預計該地區的收入將顯著成長。

- 埃克森美孚預計,2040年,亞太地區核能需求將達到22兆BTU,佔45兆BTU。中國核能協會報告稱,2022年前5個月,中國核電產能年增4.5%,高峰達1,663億度。

- 據世界核能協會稱,到2030年,中國有望超越美國,成為世界領先的核能生產國。在研究期間,中國核電廠建設的不斷增加預計將增加劑量計的需求。例如,2022年,中國批准在南方新增兩座核電設施,耗資116.2億美元,使核准的核電廠總數達到10座,創十年來最高。

- 中國等國家將核安研發涵蓋國家科技規劃,成立國家核能與輻射安全監管研究發展中心,進行輻射環境監測與技術審查關鍵技術研究,提升安全水準。預計這些舉措將在研究期間推動中國劑量計的需求。

- 日本是世界上人口老化最嚴重的國家之一,其中很大一部分年齡在65歲以上,預計到2060年將大幅上升。根據世界銀行的數據,日本65歲以上人口比例從2021年的24%增加到2021年的29% ,成長了26%。人口老化可能會推動對醫療保健解決方案的需求,而老年人口癌症發生率的上升將影響醫療產業的劑量計市場。因此,預計未來幾年劑量計產業將在日本各地擴展。

- 此外,韓國作為全球最先進和工業化的國家之一,為癌症、心臟和血管疾病提供具有競爭力的一流治療方法。 2022 年 11 月,生物標靶放射治療公司 TAE Life Sciences (TLS) 宣布與 HDX Corporation (HDX) 合作,將 TLS 的標靶放射治療引入韓國。有關放射治療的不斷增加的舉措預計將推動該地區的市場成長。

劑量計行業概況

劑量計市場適度分散,主要參與者包括 Fortive Corporation、Mirion Technologies Inc.、Thermo Fisher Scientific Inc.、Arrow-Tech Inc. 和 Fuji Electric。這些市場參與者正在採取合作夥伴關係和收購等策略來增強他們的產品並獲得永續的競爭優勢。

2023 年 1 月,Mirion Technologies Inc. 推出了一項新技術,將 Spot 的輻射技術與 Spot 敏捷移動機器人整合在一起,使工作人員能夠在安全距離內測量和偵測輻射。這項創新技術透過 Mirion 背包得以實現,它允許整合各種類型的感測器和輸入,包括機器人控制器介面、RDS-32 測量儀、數據分析模組和 SPIR-Explorer 感測器(一種全整合式感測器)。一台用於劑量測定和光譜測量的偵測器。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- 整個醫療領域對輻射和監測設備的需求不斷成長

- 工業領域放射性物質的應用不斷增加

- 市場限制

- 產品精度高、政府監管嚴格、成本高

第 6 章:市場區隔

- 依類型

- 電子個人劑量計 (EPD)

- 熱釋光劑量計 (TLD)

- 光激發光劑量計 (OSL)

- 底片徽章劑量計

- 其他類型

- 依應用

- 積極的

- 被動的

- 依最終用戶產業

- 衛生保健

- 油和氣

- 礦業

- 核電廠

- 工業的

- 製造業

- 其他最終用戶產業

- 依地理

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第 7 章:競爭格局

- 公司簡介

- Fortive Corporation

- Mirion Technologies Inc.

- Thermo Fisher Scientific Inc.

- Arrow-Tech Inc.

- Fuji Electric Co. Ltd

- ATOMTEX

- Tracerco Limited

- Automess - Automation and Measurement GmbH

- SE International Inc.

- Radiation Detection Company, Inc.

第 8 章:投資分析

第 9 章:市場的未來

The Dosimeter Market size is estimated at USD 3.65 billion in 2024, and is expected to reach USD 5.15 billion by 2029, growing at a CAGR of 7.11% during the forecast period (2024-2029).

Key Highlights

- Dosimeters have found diverse applications in various industries, including the medical and manufacturing sectors. In the manufacturing sector, the use of radioactive sources or X-ray machines has increased the need for dosimeters to monitor radiation exposure over an extended period. Passive dosimeters, such as film badges and thermoluminescent dosimeters, are commonly used for routine monitoring in the manufacturing industry.

- The demand for dosimeters in the industrial sector is further supported by government regulations that aim to control emissions and ensure labor safety. However, the high cost of the device and its sensitivity to electromagnetic fields, and mechanical instability are factors that can hinder the growth of the active dosimeter market.

- The COVID-19 pandemic led to an increased demand for dosimeters, particularly in disinfection settings where UV light is used. Dosimeters are used to measure the UV exposure of workers involved in disinfection activities to ensure their safety. In addition, certain industries involved in pandemic response efforts, such as the manufacture of personal protective equipment (PPE), may require dosimeters to monitor radiation exposure levels.

- Overall, the demand for dosimeters is expected to grow in various industries, driven by factors such as the increasing use of radiation-mediated technology, government regulations, and the need for worker safety. However, the market growth may be limited by factors such as the high cost of the device and its sensitivity to environmental factors.

Dosimeter Market Trends

Rising Application of Radioactive Substances Across the Industrial Sector Drives the Market

- Science and industry have found numerous applications for radioisotopes that improve productivity and provide unique insights into materials and processes. Radioisotopes serve as tracers to monitor fluid flow and filtration, detect leaks, and gauge engine wear and corrosion of process equipment. The International Atomic Energy Agency (IAEA) estimates that several hundred thousand such gauges are operating worldwide, measuring the amount of radiation absorbed in materials.

- Radioisotopes are also used to study the mixing and flow rates of various materials, inspect metal parts, and assess the integrity of welds across a range of industries. Industrial gamma radiography utilizes the penetrating power of radiation to screen materials effectively. It works similarly to X-rays used in airport security checks but with a small pellet of radioactive material in a sealed titanium capsule.

- In addition, radioisotopes are used as fuel in nuclear reactors to generate power and control the thickness of paper, plastic, and metal sheets during manufacturing. They are also used for manufacturing luminescent paints and objects that exhibit radio-luminance.

- India has seen rapid industrialization in recent decades, leading to increased radiation and harmful gases. Dosimetry systems are being installed to prevent excessive radiation exposure to employees and healthcare professionals in many industries and hospitals. These factors are expected to propel the growth of the market in India.

- As of May 2022, there were 53 nuclear reactors under construction globally, with China ranking first with 15 units and India following closely with eight reactors under construction at the time.

Asia Pacific is Expected to Witness Significant Growth

- The Asia-Pacific region is expected to dominate the global dosimeter market, primarily due to the increasing adoption of radiation across various end-user industries. The region is anticipated to witness significant growth in terms of revenue, driven by the growing focus on nuclear power for electricity generation, to meet the rising energy demands, and stringent regulations for human safety in emerging countries such as China, Japan, and India.

- Exxon Mobil estimates that in 2040, nuclear energy demand in the Asia-Pacific region will reach 22 quadrillion BTUs, accounting for 45 quadrillion BTUs. China Nuclear Energy Association reported that China's nuclear power production capacity increased by 4.5% YoY during the first five months of 2022, reaching a peak of 166.3 billion kWh.

- According to the World Nuclear Association, China is on track to become the world's leading producer of nuclear energy by 2030, surpassing the United States. The increasing construction of nuclear power plants in China is expected to boost dosimeter demand over the study period. For instance, in 2022, China approved the construction of two additional nuclear power facilities in the country's south, with an expenditure of USD 11.62 billion, bringing the total number of approved atomic power plants to ten, the highest in a decade.

- Countries like China have included R&D in nuclear safety in their national planning for scientific and technological programs, established a National Research and Development Center for Nuclear and Radiation Safety Regulation, and conducted research on key technologies of radiation environment monitoring and technical review to enhance safety. These initiatives are expected to drive dosimeter demand in China during the study period.

- Japan has one of the world's aging populations, with a significant portion being over 65 years, expected to rise substantially by 2060. According to the World Bank, the proportion of Japan's population over 65 years increased from 24% in 2021 to 29% in 2021, a 26% increase. The aging population is likely to drive demand for healthcare solutions, and the rise in cancer incidence in the geriatric population will affect the medical sector market for dosimeters. Hence, it is projected that the dosimeter industry will expand throughout Japan in the coming years.

- Additionally, South Korea, being one of the most advanced and industrialized countries globally, offers competitive first-world treatments for cancer, cardiac, and vascular diseases. In November 2022, TAE Life Sciences (TLS), a biological-targeted radiation therapy company, announced a partnership with HDX Corporation (HDX) to bring TLS's targeted radiation therapy to South Korea. Rising initiatives regarding radiation therapy are expected to drive market growth in the region.

Dosimeter Industry Overview

The Dosimeter Market is moderately fragmented, with major players such as Fortive Corporation, Mirion Technologies Inc., Thermo Fisher Scientific Inc., Arrow-Tech Inc., and Fuji Electric Co. Ltd. These players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In January 2023, Mirion Technologies Inc. introduced a new technology that integrates Spot's radiation technology with the Spot agile, mobile robot, enabling workers to measure and detect radiation from a safe distance. This innovative technology is facilitated through the Mirion backpack, which allows for the integration of various types of sensors and inputs, including the Robot Controller Interface, RDS-32 Survey Meter, Data Analyst module, and SPIR-Explorer sensor, an all-in-one detector for dosimetry and spectroscopy measurements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Radiation and Monitoring Devices Across the Medical Sector

- 5.1.2 Rising Application of Radioactive Substances Across the Industrial Sector

- 5.2 Market Restraints

- 5.2.1 Product Accuracy, Stringent Government Regulations, and High Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Electronic Personal Dosimeter (EPD)

- 6.1.2 Thermo Luminescent Dosimeter (TLD)

- 6.1.3 Optically Stimulated Luminescence Dosimeters (OSL)

- 6.1.4 Film Badge Dosimeter

- 6.1.5 Other Types

- 6.2 By Application

- 6.2.1 Active

- 6.2.2 Passive

- 6.3 By End-user Industry

- 6.3.1 Healthcare

- 6.3.2 Oil and Gas

- 6.3.3 Mining

- 6.3.4 Nuclear Plants

- 6.3.5 Industrial

- 6.3.6 Manufacturing

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fortive Corporation

- 7.1.2 Mirion Technologies Inc.

- 7.1.3 Thermo Fisher Scientific Inc.

- 7.1.4 Arrow-Tech Inc.

- 7.1.5 Fuji Electric Co. Ltd

- 7.1.6 ATOMTEX

- 7.1.7 Tracerco Limited

- 7.1.8 Automess - Automation and Measurement GmbH

- 7.1.9 SE International Inc.

- 7.1.10 Radiation Detection Company, Inc.