|

市場調查報告書

商品編碼

1445430

DPaaS(資料保護即服務):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Data Protection as a Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

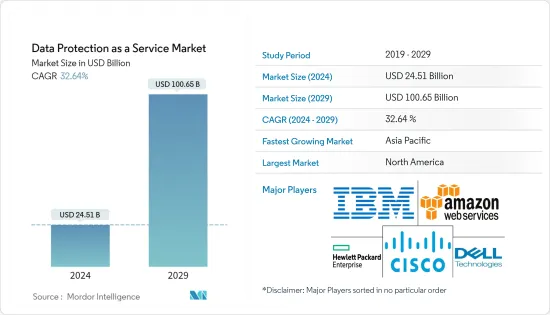

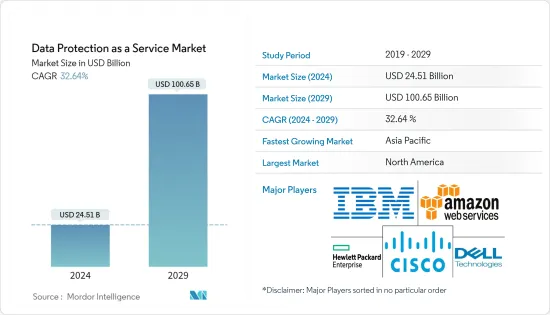

DPaaS(資料保護即服務)市場規模預計到 2024 年為 245.1 億美元,預計到 2029 年將達到 1006.5 億美元,在預測期內(2024-2029 年)將以 32.64% 的年複合成長率成長。

隨著雲端服務的成長和普及,許多公司正在尋求增強其託管服務以提供更好的優勢,例如更高的可擴展性、管理和恢復選項。各種雲端儲存和資料安全公司正在開發資料保護即服務模型,以更好地滿足客戶的需求,從而推動市場向前發展。

隨著時間的推移,網路攻擊的頻率和規模顯著增加。組織需要多層、高度連接的安全系統來降低風險並防止攻擊。隨著威脅的不斷增加和安全技能差距的擴大,內部安全團隊已不足以保護您的業務。因此,此類組織不可避免地會轉向資料保護即服務 (DPaaS) 解決方案。

儘管資料外洩和網路攻擊的數量不斷增加,但客戶並不害怕與第三方公司共用他們的資料。據 SurfShark 稱,2022 年第三季度,全球約有 1500 萬筆資料記錄因資料外洩而外洩。與上一季相比,這一數字成長了約 37%。資料外洩事件的增加使得 DPaaS(資料保護即服務)成為必要,並正在推動市場的顯著成長。

此外,快速採用下一代技術以及增加資料向雲端模型的遷移以獲得彈性和敏捷性並最佳化成本節約是促進市場成長的關鍵因素。因此,保護和儲存關鍵資料免受資料竊取、資料遺失和操作災難影響企業考慮雲端上的資料保護服務和解決方案,從而顯著推動市場成長。

然而,對隱私和安全的日益擔憂可能是在預測期內擴大市場整體成長率的因素。

一些政府以及公共和私人組織已採取措施來應對這場危機並限制 COVID-19 疾病的傳播。從保持社交距離到強制在家工作(如果可能)、取消不必要的實體會議以及推廣手部衛生通訊協定,人們的生活和工作方式已經改變了。這些措施的執行可能涉及私人入侵,需要公共當局和私人公司採取有效的資料保護措施,這將對 DPaaS(資料保護即服務)市場產生積極影響。

DPaaS(資料保護即服務)市場趨勢

混合雲端預計將佔據較大佔有率

- 公共雲端服務長期以來一直向組織承諾提供廣泛的好處,但對資料保護、安全性和合規性的擔憂始終阻礙了一些企業的發展。 HPE 最近委託的一份報告發現,當工作負載被認為不適合公共雲端時,這三個問題是最重要的因素。隨著混合雲端的混合雲端,形勢正在發生變化,為組織提供最好的本地、私有和公共雲端世界。

- 選擇與供應商無關的模型來分散資料外洩和安全漏洞風險的組織數量顯著增加。混合雲端是這演變的核心。這種方法可能會增加資料保護的複雜性,但也使資訊安全變得更加有用。

- 據 Evaluator Group 稱,58% 的組織使用混合雲端資料保護解決方案進行災害復原。同時保護資料中心內的實體資產和資料仍然是一項基本要求。虛擬資產和資料的保護也越來越受到重視。

- 採用混合雲端災難復原可以為企業帶來許多好處,包括消除對輔助災難復原站點的需求。此外,混合雲端還降低了系統維護和管理的複雜性和成本。所有這些因素都解釋了基於混合雲端的資料保護解決方案的成長。

- IBM 表示,透過採用混合平台作為支援關鍵應用程式工作負載的核心策略,企業可以從工作負載效率的提高中獲得業務效益。 IT 領導者報告稱,到 2022 年,在混合雲端中運行應用程式的最常見好處是能夠最佳化災害復原和業務連續性。

預計北美將佔據主要佔有率

- 由於高認知度和高採用需求,北美市場預計將主導 DPaaS(資料保護即服務)市場。此外,提供資料保護即服務的領先公司總部位於美國,包括 IBM、思科和 Amazon Web Services 等公司。

- 隨著中小企業數量的不斷增加,該地區的資料中心市場正在健康成長。此外,由於資料產生量的快速增加,資料從私有伺服器遷移到雲端網路的情況也已出現。這一趨勢需要有彈性且可靠的備份和復原解決方案,因為服務中斷會給服務供應商帶來重大損失。

- 在美國,沒有專門負責監督資料保護法的單一監管監督。負責聯邦層級監督的監管機構會根據相關法律或法規的差異而有所不同。例如,在金融服務領域,消費者金融保護局和各個金融服務監管機構已經實施了《美國金融服務業現代化法》,該法案規範了受監管公司如何收集、使用和披露非資訊資訊。我們採用了標準基於GLB。

- 根據美國衛生與公眾服務部的數據,2021 年受醫療資料外洩影響的美國居住者總數約為 4,600 萬人。該地區此類案例數量的不斷增加將對DPaaS(資料保護即服務)產生巨大的需求,進一步推動市場成長機會。

- 根據身分盜竊資源中心的數據,2022 年上半年美國資料外洩總數為 817總合。同時,同期,超過5,300萬個人受到資料外洩、資料外洩、資料外洩等資料外洩事件的影響。

DPaaS(資料保護即服務)產業概述

資料保護即服務 (DPaaS) 市場競爭適中,由多家主要企業組成。從市場佔有率來看,目前佔據市場主導地位的公司寥寥可數。然而,隨著資料儲存和安全系統的創新,兩家公司都在開發整個新興市場,以獲得新契約並擴大市場佔有率。

2022 年 11 月,資料安全和管理供應商 Cohesity 將與網路安全「相關人員」合作,在 Cohesity 的資料安全和管理高峰會ReConnect 上了解有關贏得網路攻擊之戰的更多資訊。宣布將為客戶提供一種方法資料安全聯盟增加了來自業界領先的網路安全和服務公司的一流解決方案,以及 Cohesity 無與倫比的資料管理和安全專業知識。

2022 年 7 月,T-Systems 宣布其在 Amazon Web Services (AWS) 身分和存取管理安全能力中獲得優秀評級。此頭銜體現了T-Systems 的AWS 品質和技術要求,旨在為客戶提供身分和存取管理方面的深層諮詢和軟體專業知識,幫助他們實現雲端安全目標。這是為了證明這些要求已得到適當滿足。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場動態

- 市場促進因素

- 海量資料對資料安全的需求日益成長

- 實施資料保護解決方案的嚴格規定

- 市場限制因素

- 雲端基礎的隱性成本不斷增加

第6章市場區隔

- 服務

- Storage-as-a-Service

- Backup-as-Service

- Disaster Recovery-as-a-Service

- 部署

- 公共雲端

- 私有雲端

- 混合雲端

- 最終用戶產業

- BFSI

- 保健

- 政府和國防

- 資訊科技和電信

- 其他最終用戶產業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- IBM Corporation

- Amazon Web Services Inc.

- Hewlett Packard Enterprise Company

- Dell Inc.

- Cisco Inc.

- Oracle Corporation

- VMware Inc.

- Commvault Systems Inc.

- Veritas Technologies LLC

- Asigra Inc.

- Quantum Corporation

- Quest Software Inc.

- NxtGen Datacenter &Cloud Technologies Pvt. Ltd.

- Hitachi Vantara Corporation

第8章投資分析

第9章市場的未來

The Data Protection as a Service Market size is estimated at USD 24.51 billion in 2024, and is expected to reach USD 100.65 billion by 2029, growing at a CAGR of 32.64% during the forecast period (2024-2029).

With the increased growth and popularity of cloud services, many businesses are looking to enhance their hosted services to give them better benefits, such as higher scalability, management, and recovery options. Various cloud storage and data security companies are developing data protection as a service model to meet better their client's needs, which propels the market forward.

Over time, the frequency and scale of cyberattacks have grown significantly. Organizations need a multi-layered, highly connected security system to mitigate risks and prevent attacks. With this growing threat and the increasing security skills gap, in-house security teams are no longer sufficient to protect businesses. Therefore, it has become inevitable for such organizations to look towards Data Protection as a Service (DPaaS) solution.

Even though the number of data breaches and cyberattacks has increased, customers are not afraid of sharing their data with third-party companies. As per SurfShark, during the third quarter of 2022, around 15 million data records were exposed worldwide through data breaches. It had increased by about 37% compared to the previous quarter. This rise in data breaches necessitates Data Protection-as-a-Service, driving the market's growth significantly.

Moreover, the surge in the adoption of next-generation technologies and rising data migration to a cloud model to gain flexibility and agility and optimize cost savings are vital factors contributing to market growth. Thus, safeguarding and storing critical data from data theft, data loss, and operational disasters influences enterprises to consider data protection services and solutions over the cloud, drastically enhancing the market's growth.

However, the rise in concerns regarding privacy and security might be a factor that could amplify the overall growth rate of the market throughout the forecast period.

Several governments and public and private organizations have introduced measures to tackle this crisis and help limit the spread of COVID-19. From social distancing to (where possible) mandatory teleworking, discontinuing nonessential physical meetings, and promoting hand hygiene protocol, the way people live, and work has changed. The enforcement of these measures can entail private-invasive actions that require efficient means of data protection by public institutions and private companies, which could positively impact the Data Protection as a Service market.

Data Protection as-a-Service (DPaaS) Market Trends

Hybrid Cloud is Expected to Hold Significant Share

- While public cloud services have long promised organizations a massive range of benefits, fears around data protection, security, and compliance have always held some firms back. A recent report commissioned by HPE found that these three issues were the most significant factors when workloads were considered unsuitable for the public cloud. With the growth of hybrid cloud, the landscape is changing, as hybrid cloud offers organizations the best of the on-premises, private, and public cloud worlds.

- There is a significant growth in the number of organizations opting for vendor-agnostic models that help them spread out the risks of data breaches and security lapses. The hybrid cloud is at the center of this evolution. While approaches like that may increase the complexity of the protection of the data, at the same time, it makes information security even more helpful.

- According to the Evaluator Group, 58% of organizations use hybrid cloud data protection solutions for disaster recovery. Protecting physical assets and data simultaneously in the data center remains an essential requirement. Protecting virtual assets and data is also gaining traction.

- Adopting hybrid cloud disaster recovery offers various advantages to businesses, such as eliminating the need for a secondary disaster recovery site. Further, the hybrid cloud also reduces the complexities and expenses of the maintenance and management of a system. All these factors account for the growth of hybrid cloud-based data protection solutions.

- As per IBM, with hybrid platforms as the central strategy for supporting key application workloads, firms are reaping the business benefits of improved efficacy of workload. In 2022, the most prevalent advantage of running applications on a hybrid cloud, as reported by IT leaders, was the ability to optimize disaster recovery and business continuity.

North America is Expected to Hold Major Share

- The North American market is expected to dominate the Data Protection as a Service Market due to high awareness and the high demand for implementation. Moreover, major players who offer Data Protection as a Service are headquartered in the United States, which includes companies such as IBM, Cisco, and Amazon Web Services.

- With the increasing number of SMEs, the data center market in the region has witnessed healthy growth. Further, a data shift has been observed from private servers to cloud networks due to exponential growth in data generation volume. This trend entails resilient and reliable backup and recovery solutions, as disruption of services results in enormous losses for the service providers.

- No single regulatory authority is dedicated to overseeing data protection law in the U.S. The regulatory authority responsible for oversight at the federal level depends on the law or regulation in question. In the financial services context, for example, the Consumer Financial Protection Bureau and various financial services regulators have adopted standards under the Gramm-Leach-Bliley Act (GLB) that dictates how firms subject to their regulation may collect, use, and disclose non-public personal information.

- According to the U.S. Department of Health and Human Services, in 2021, the total number of U.S. residents affected by healthcare data breaches was around 46 million. The rise in such cases in the region creates a massive demand for Data Protection as a Service, further enhancing the market's growth opportunities.

- As per Identity Theft Resource Center in the 1sthalf of 2022, the total number of data compromises in the U.S. came in at a total of 817 cases. Meanwhile, throughout the same time, over 53 million individuals were affected by data compromises, which included data breaches, data leakage, and data exposure.

Data Protection as-a-Service (DPaaS) Industry Overview

The Data Protection as a Service (DPaaS) market is moderately competitive and consists of several major players. In terms of market share, few players currently dominate the market. However, with innovation in data storage and security systems, the companies are increasing their market presence by securing new contracts by tapping across emerging markets.

In November 2022, Cohesity, a data security and management provider, announced at ReConnect, Cohesity's data security and management summit, that it is partnering with the 'who's who' of cybersecurity to provide customers more ways to win the war against the cyberattacks. The Data Security Alliance adds best-in-class solutions from industry-leading cybersecurity and services companies with exceptional data management and security expertise from Cohesity.

In July 2022, T-Systems declared that it had achieved an Identity and Access management distinction in the Amazon Web Services (AWS) Security Competency. This designation recognizes that T-Systems has demonstrated and successfully met the AWS's quality and technical requirements for offering customers with a deep level of consulting and software expertise in identity and access management to assist them achieve their cloud security goals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Data Security due to Huge Volume of Data

- 5.1.2 Stringent Regulations Regarding the Adoption of Data Protection Solutions

- 5.2 Market Restraints

- 5.2.1 Increasing Hidden Costs of Cloud-based Storage

6 MARKET SEGMENTATION

- 6.1 Service

- 6.1.1 Storage-as-a-Service

- 6.1.2 Backup-as-Service

- 6.1.3 Disaster Recovery-as-a-Service

- 6.2 Deployment

- 6.2.1 Public Cloud

- 6.2.2 Private Cloud

- 6.2.3 Hybrid Cloud

- 6.3 End-user Indsutry

- 6.3.1 BFSI

- 6.3.2 Heathcare

- 6.3.3 Government and Defense

- 6.3.4 IT and Telecom

- 6.3.5 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Amazon Web Services Inc.

- 7.1.3 Hewlett Packard Enterprise Company

- 7.1.4 Dell Inc.

- 7.1.5 Cisco Inc.

- 7.1.6 Oracle Corporation

- 7.1.7 VMware Inc.

- 7.1.8 Commvault Systems Inc.

- 7.1.9 Veritas Technologies LLC

- 7.1.10 Asigra Inc.

- 7.1.11 Quantum Corporation

- 7.1.12 Quest Software Inc.

- 7.1.13 NxtGen Datacenter & Cloud Technologies Pvt. Ltd.

- 7.1.14 Hitachi Vantara Corporation