|

市場調查報告書

商品編碼

1445411

公用事業計費軟體 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Utility Billing Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

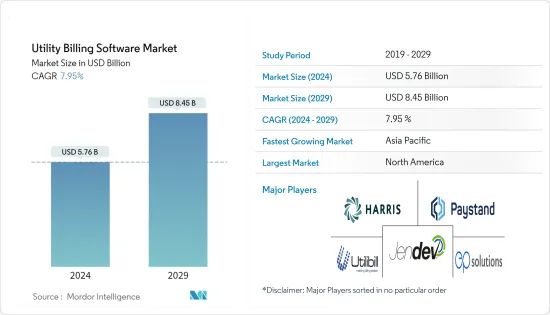

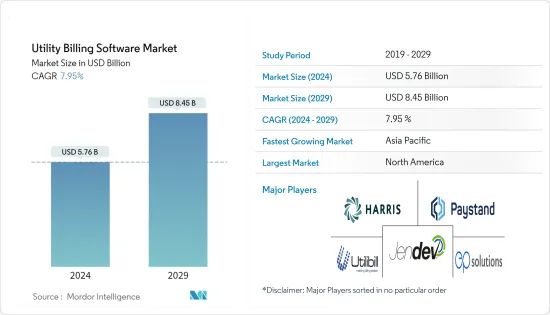

公用事業計費軟體市場規模預計到 2024 年為 57.6 億美元,預計到 2029 年將達到 84.5 億美元,在預測期內(2024-2029 年)CAGR為 7.95%。

公用事業計費軟體有助於管理公用事業營運、客戶資料以及水、下水道、燃氣、電力、廢棄物管理和分項計量公司的計費職責。企業使用公用事業計費系統來簡化客戶管理和計費程序,同時整合服務訂單、儀表維護歷史記錄和調度,以提高生產力和獲利能力。

主要亮點

- 為了適應公用事業業務不斷變化的動態,傳統計費系統發生了重大變化,例如雲端運算和物聯網 (IoT) 技術的結合。這促進了市場的擴大。

- 此外,數位化涵蓋訊息的傳遞和訊息本身。儘管傳統的計費系統隨著時間的推移而不斷改進,並且對碳排放沒有嚴格的限制,但能源公司正在專注於永續和無紙化的解決方案,以實現有效的工作環境。這項變更也促使企業安裝更好的IT基礎架構。

- 推動全球公用事業計費軟體產業的關鍵驅動力之一是遺留計費系統的不斷升級。電力供應產業擴大採用智慧電錶等智慧電網技術,這增加了公用事業計費和收費基礎設施的複雜性。

- 由於快速變化的工業環境、技術先進的消費者的存在以及數位設備和技術與傳統業務流程的融合,公用事業行業發現滿足客戶的需求更具課題性。在當今競爭激烈的市場中,讓客戶滿意已經變得很困難,尤其是依賴客戶滿意度的服務型產業。

- 不同的最終用戶產業都感受到了 COVID-19 的影響。例如,隨著冠狀病毒的傳播,獲得水成為一種重要的工具,使人們能夠定期清潔表面和洗手。為了確保這一點,一些政府命令公用事業公司免費或以折扣價提供它,但這些公用事業公司現在陷入困境。

公用事業計費軟體市場趨勢

配電產業預計將佔據重要市場佔有率

- 該行業的電力公司利用公用事業計費軟體來減少計費問題。由於精度提高,公用事業公司可以提供較低的成本,這也有助於他們吸引更多客戶並產生更多收入。

- 與公用事業公司收集每月能源使用資料以建立紙本發票並將其發送給客戶的時代相比,電費帳單已經發生了變化。使用智慧電錶(例如兩個通訊電錶)時,流程簡化更容易實現。

- 人們日益渴望以更低的價格提高整體營運效率,促進了各配電公司採用瑞銀解決方案。

- 由於公用事業公司重新專注於減少無用水量,智慧計量在美國的需求極高。智慧計費和洩漏檢測的額外優勢促使安裝智慧電錶,預計這將推動所調查產業的擴張。

- 此外,電力計費軟體BillMaster是由DataWest公司生產的,DataWest是為公用事業行業創建軟體產品的公司。在開發此公用事業計費軟體時,能源客戶的要求是首要任務。由於該公司在電力領域擁有豐富的經驗,BillMaster 目前擁有公用事業公司所需的所有特性和功能。這些知識是從電力公司的要求、程序和實踐的實際經驗中收集的。

北美預計將擁有重要的市場佔有率

- 由於其高度發達的公用事業基礎設施和可實現向營運開發過渡的資金可用性,預計北美將擁有相當大的市場。由於有重要的基礎設施支持,將這些產品推向市場也很簡單。

- 美國是世界上最大的經濟體,也是北美公用事業計費軟體的主要市場。透過早期採用,獲得了重要的市場佔有率。區塊鏈、物聯網的出現以及數位化的推動等因素正在促進該國所研究市場的發展。

- 該國的電力和能源產業正在經歷數位轉型。參與者正在利用資料並應用強大的分析來獲取更準確的資訊並提供基於事實的預測,從而幫助客戶更快地做出更好的業務決策,同時增強營運和消費者體驗。

- 此外,許多公用事業公司在某種程度上採用雲端進行IT營運;雲端可以為公用事業提供變革性的新機遇,以最佳化 IT/OT 成本並增強彈性和安全性。

- 例如,波特蘭通用電氣公司能夠快速開發停電管理和通訊系統,這些系統可以在風暴來襲時立即擴展,讓消費者了解電網狀態並減少停電時間,這要歸功於其採用雲端進行 IT 營運。

公用事業計費軟體產業概述

公用事業計費軟體市場具有凝聚力和一致性,使得市場上存在各種供應商。由於整個供應鏈中任何一方都缺乏控制,因此這樣的市場得到了促進。該市場正在經歷多次併購,新技術進步預計將推動全球擴張。

- 2022 年12 月- 全球垂直市場軟體供應商之一Harris 宣布收購Service-Link 並向其公用事業集團添加行動勞動力管理解決方案,該平台使公用事業公司能夠透過Service-Link 的可自訂工作流程增強其移動勞動力、最佳化調度等

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力 - 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭激烈程度

- 替代品的威脅

- Covid-19 對市場影響的評估

第 5 章:市場動態

- 市場促進因素

- 傳統計費系統和 IT 基礎設施的改進

- 對智慧電網技術的投資不斷增加

- 市場限制

- 最終用戶產業缺乏數位技能

第 6 章:市場區隔

- 依部署模式

- 基於雲端

- 本地部署

- 依最終用戶產業

- 水

- 石油和天然氣

- 電力調配

- 電信

- 其他最終用戶產業

- 依地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 亞太地區其他地區

- 世界其他地區

- 北美洲

第 7 章:競爭格局

- 公司簡介

- Harris Computer Systems

- PayStand Inc.

- Utilibill Pvt. Ltd.

- ePsolutions Inc.

- Jendev Corporation

- Exceleron Softwares Inc.

- Jayhawk Software Inc.

- Banyon Data Systems Inc.

- Sigma Software Solutions Inc.

- Oracle Corporation

第 8 章:投資分析

第 9 章:市場的未來

The Utility Billing Software Market size is estimated at USD 5.76 billion in 2024, and is expected to reach USD 8.45 billion by 2029, growing at a CAGR of 7.95% during the forecast period (2024-2029).

Utility billing software assists in managing utility operations, customer data, and billing duties for water, sewer, gas, electric, waste management, and sub-metering firms. Utility Billing Systems are used by businesses to streamline customer administration and billing procedures while integrating service orders, meter maintenance history, and scheduling to increase productivity and profitability.

Key Highlights

- To match the changing dynamics of the utility business, legacy billing systems have undergone significant changes, such as the incorporation of cloud computing and Internet of Things (IoT) technologies. This has contributed to the market's expansion.

- Additionally, digitalization covers the conveyance of information and the information itself. Energy firms are concentrating on sustainable and paperless solutions for an effective working environment even though the legacy billing system has been improving over time, and there are no strict limitations on carbon emissions. This change has also prompted businesses to install better IT infrastructure.

- One of the key drivers propelling the worldwide utility billing software industry is the continuous upgrading of legacy billing systems. The electrical power supply industry's increasing adoption of smart grid technology, such as smart meters, has raised complexity in the utilities' billing and collection infrastructure.

- The utility industry is finding it more challenging to satisfy its clients due to the fast-changing industrial environment, the existence of technologically advanced consumers, and the convergence of digital devices and technology coupled with traditional business processes. Keeping customers happy has become difficult in today's fiercely competitive marketplaces, primarily service-based industries that rely on customer satisfaction.

- The impact of COVID-19 has been felt across different end-user industries. For instance, as the coronavirus spread, access to water emerged as a critical tool, allowing people to clean surfaces and wash their hands regularly. To ensure this, some governments ordered utilities to provide it for free or at discounted rates, but those utilities are now struggling.

Utility Billing Software Market Trends

Power Distribution Industry Expected to Hold Significant Market Share

- Power firms in this industry utilize utility billing software to reduce billing problems. Utility companies can provide low costs because of the increased precision, which also helps them attract more customers and generate more money.

- Electricity billing had changed from the days when utilities would compile data on monthly energy use to create paper invoices that they would ship to customers. Process streamlining is easier to implement when using smart meters, such as two communicating meters.

- The adoption of UBS solutions by various power distribution firms is being facilitated by the growing desire to improve overall operational efficiency at lower prices.

- Due to the utilities' renewed focus on reducing NRW, smart metering is in extremely high demand in the United States. The installation of smart meters has been prompted by the additional benefits of smart billing and leak detection, which is anticipated to propel the expansion of the investigated industry.

- Moreover, Electric utility billing software BillMaster is produced by DataWest, a company that creates software products for the utility industry. The requirements of energy customers are a top priority when developing this utility billing software. As a result of the company's considerable experience in the power sector, BillMaster currently has all the features and functionalities that the utility requires. This knowledge was gleaned from practical experience with electric utilities' requirements, procedures, and practices.

North America Expected to Have Significant Market Share

- North America is anticipated to have a sizable market due to its highly developed utilities infrastructure and funding availability to enable the transition to operational developments. Launching these products on the market is also simple due to the presence of vital infrastructure for support.

- The largest economy in the world and a key market for utility billing software in North America is the United States. Gaining a significant market share was made possible by early adoption. Several factors, such as the emergence of Blockchain, the Internet of Things, and a push toward digitization, are aiding the development of the studied market in the nation.

- The nation's electricity and energy sector are going through a digital transition. Players are utilizing data and applying robust analytics to gain access to more accurate information and provide fact-based forecasts that will assist their clients in making better business decisions more quickly while enhancing operations and consumer experiences.

- Moreover, many utility companies are adopting the cloud for IT operations to some extent; there are transformative new opportunities the cloud can offer utilities to optimize IT/OT costs and enhance resilience and security.

- For instance, Portland General Electric was able to quickly develop outage management and communication systems that can scale immediately when a storm strikes, keep consumers informed of the grid status and reduce outage times, thanks to its adoption of the cloud for IT operations.

Utility Billing Software Industry Overview

The Utility Billing Software Market is both cohesive and consistent, enabling the presence of various suppliers in the marketplace. Such a market has been facilitated by the lack of control exercised by any party throughout the supply chain. This market is experiencing several mergers and acquisitions, and new technological advancements are anticipated to fuel global expansion.

- December 2022 - Harris, one of the global vertical market software providers, has announced the acquisition of Service-Link and added a mobile workforce management solution to its Utilities Group, where the platform empowers utilities to augment their mobile workforce with Service-Link's customizable workflows, optimized scheduling, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Improvement in Legacy Billing Systems and IT Infrastructure

- 5.1.2 Growing Investment in Smart Grid Technology

- 5.2 Market Restraints

- 5.2.1 Lack of Digital Skills Among End-user Industries

6 MARKET SEGMENTATION

- 6.1 By Deployment Mode

- 6.1.1 Cloud-based

- 6.1.2 On-premise

- 6.2 By End-user Industry

- 6.2.1 Water

- 6.2.2 Oil & Gas

- 6.2.3 Power Distribution

- 6.2.4 Telecommunication

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Harris Computer Systems

- 7.1.2 PayStand Inc.

- 7.1.3 Utilibill Pvt. Ltd.

- 7.1.4 ePsolutions Inc.

- 7.1.5 Jendev Corporation

- 7.1.6 Exceleron Softwares Inc.

- 7.1.7 Jayhawk Software Inc.

- 7.1.8 Banyon Data Systems Inc.

- 7.1.9 Sigma Software Solutions Inc.

- 7.1.10 Oracle Corporation