|

市場調查報告書

商品編碼

1445410

EHS軟體 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)EHS Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

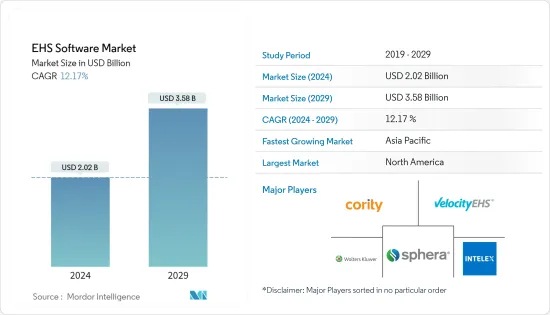

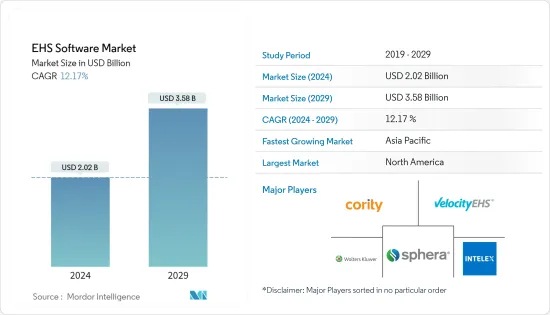

EHS軟體市場規模估計到2024年為20.2億美元,預計到2029年將達到35.8億美元,在預測期內(2024-2029年)CAGR為12.17%。

環境健康與安全(EHS)軟體解決方案在各種環境主題之間保持適當的平衡,包括法規遵循、企業生態保護永續發展、事故避免、環境審計和檢查、流程標準化和事件回應。

主要亮點

- 環境健康與安全(EHS)軟體解決方案負責在各種環境主題之間保持適當的平衡,包括法規遵循、企業環境保護的永續發展、事故避免、環境審計和檢查、流程標準化、事件回應等。

- EHS 解決方案成為每個企業組織的核心部分,以實現與環境互動相關的業務連續性、獲利成長、企業社會責任和卓越營運方面的轉型。政府法規、法律力量、經濟條件和技術的綜合環境已說服多個行業的組織將實施 EHS 解決方案作為基本營運需求。更重要的是,組織努力避免因環境保護和危險情況所包括的風險而產生的任何未來營運費用。

- 市場上的參與者進行了各種收購。2022年 1月,領先的 EHS 軟體和內容提供商 Red-online 宣布收購 GutwinskiManagement GmbH。 Gutwinski 總部位於維也納,是德語國家領先的 EHS 平台解決方案。此次收購預計將進一步擴大產品組合併擴大其客戶群。

- 公司也推出新的解決方案,以保持市場競爭力。例如,2021年10月,領先的環境、健康與安全(EHS)軟體平台供應商ProcessMAPCorporation宣布該公司在英國(UK)建立了創新中心。新中心將在促進與英國客戶和用戶社群的合作和加速共同創新方面發揮關鍵作用,並在英國和歐洲超過 15,000 個地點實現更強大的客戶成功參與。

- Enablon、Intelex、Cority、SAI Global、VelocityEHS 和 Quentic 等一些主要參與者憑藉其增強的產品供應和策略舉措在市場上佔據了更大的佔有率。作為參與者競爭力的一部分,所研究的市場全球範圍內經歷多次合作和收購。

- 例如,2022年 5月,環境、公用事業、廢棄物、回收和資源產業整合軟體和車輛技術的全球供應商 AMCS 簽署了收購總部位於德國的 EHS 和永續發展軟體供應商 Quentic 的協議。

- 各公司越來越需要 EHS 軟體,透過自動報告和管理病例、與工人溝通、加強自我評估和自願簽到,幫助提高在 COVID-19 期間監控工人健康和安全的能力。政府指導方針也呼籲雇主進行 COVID-19 風險評估,以建立必要的控制措施。有系統地進行這些風險評估並採用 EHS 軟體可以提供的集中管理方法非常重要。

- 即使大多數員工在 COVID-19 期間沒有在家工作(快速消費品和製藥等需要體力勞動的重要行業的組織可能會出現這種情況),EHS 軟體也有助於提高效率。 EHS 軟體自動化能力有助於節省工人、中高階主管的時間,這些時間可以更佳用於履行其工作的主要職責,而不是管理。在在家工作的場景中,EHS 軟體可以為 EHS 團隊提供快速評估風險、收集檢查結果和監控績效的手段,減少對營運的干擾。

環境健康與安全軟體市場趨勢

增加資料管理和報告要求可能會推動市場成長

- 組織在收集、管理並向利害關係人、監管機構和投資者報告 EHS資料方面面臨更大的壓力。 EHS 軟體提供強大的報告和分析功能,可更輕鬆地收集和分析資料,產生準確的報告並證明合規性。對有效資料管理和報告的需求推動了 EHS 軟體的採用。

- 包括投資者、員工、客戶和社區在內的利害關係人對組織的環境和社會績效越來越感興趣。他們期望 EHS 管理具有透明度、問責制和可衡量的進展。 EHS 軟體透過提供準確的資料、強大的報告以及對其 EHS 工作的清晰可見性,幫助組織滿足這些期望。

- 有效的資料管理和報告有助於組織的聲譽和風險管理工作。透過實施 EHS 軟體,組織可以展示其對環境永續性、工作場所安全和法規遵循的承諾。這又提高了他們的聲譽,降低了營運風險,並提高了利害關係人的信心。

- 此外,根據2022年 KPA 調查,EHS 軟體使用者報告的效能優於非使用者。在所有類別(從事件報告和追蹤到資料收集和分析)的 EHS 軟體使用者中,聲稱「良好」或「優秀」滿意度的受訪者更為重要。例如,與 35%的軟體使用者相比,55%的非使用者對其程式的資料收集和處理表示平均滿意度。

- 考慮到這些因素,不斷增加的資料管理和報告要求推動了 EHS 軟體的採用,使組織能夠有效地收集、管理、分析和報告 EHS資料。該軟體的功能支援合規工作,並有助於改善環境健康和安全方面的決策、風險管理和整體營運績效。

北美佔有重要的市場佔有率

- 北美,特別是美國和加拿大,一直是 EHS 軟體的重要市場。該地區擁有嚴格的環境和職業健康與安全法規,推動了 EHS 軟體解決方案的採用。此外,北美的製造業、能源和醫療保健等行業也很早就採用了 EHS 軟體來管理合規性、安全性和風險緩解。

- 此外,該地區擁有強大的 EHS 軟體供應商,為市場的成長做出了積極貢獻。一些北美供應商包括 Intelex Technologies Inc.、VelocityEHS、Sai Global Pty Limited、Dakota Software Corporation 和 Gensuite。

- 一些企業主動爭取零安全事故,並將營運對環境的影響降至最低。例如,資料智慧驅動的軟體解決方案供應商 ProcessMAPCorporation 協助客戶轉型為永續發展的企業,最近宣布財富 500 強公司 Fortune Brands Home & Security, Inc. 將推動其全球業務的數位轉型利用ProcessMAP 的智慧且可操作的資料智慧解決方案實施EHS 和ESG 計劃。

- 該地區的供應商增強他們的 EHS 軟體解決方案。 VelocityEHS 是基於雲端的環境、健康、安全(EHS)和永續發展軟體領域的參與者,最近收購了位於安娜堡的職業安全與健康感測和模擬技術開發先驅 Kinetica Labs。

- 同樣,VelocityEHS 最近收購了愛爾蘭軟體公司 OneLook Systems。此次收購將增強其企業範圍的平台服務和能力,以幫助用戶解決與 COVID-19 疫情及其他相關的新興風險管理問題。

- 這些國家及其各自地區國家製定了保護其公民的自然環境和健康的法規和要求。在美國和加拿大,製造、銷售、分銷和進口的產品受到越來越多複雜的地方、區域和聯邦(強制性和自我監管)環境要求的約束。這些環境和安全措施為全球和本地企業帶來了新的合規挑戰。

- 在北美地區,美國環保署(EPA)和美國職業安全與健康管理局(OSHA)嚴格執行工業安全,並推動了EHS軟體的採用。美國幾乎所有企業都遵守 OSHA 標準,因此它們是許多行業雇主和員工的相關關注點。

環境健康與安全軟體產業概述

環境健康與安全軟體市場是分散的。該行業有許多技術先進的知名企業,例如 VelocityEHS、Enablon、Cority 和 Sphera,競爭非常激烈,尤其是市場老牌企業之間的競爭。市場滲透率不斷成長,主要參與者在成熟市場中佔有一席之地。隨著對創新的日益關注,對人工智慧等新技術的需求不斷成長,這又推動了進一步發展的投資。

2023年 1月,總部位於歐洲的環境、健康與安全(EHS)軟體即服務(SaaS)供應商 EcoOnline 收購了總部位於英國的著名風險管理產品供應商 Alcumus 的軟體部門。該交易包括收購 Alcumus 軟體部門。 Alcumus 的軟體部門為組織提供了管理和審計各行業(包括製造、建築和零售)EHS 風險的工具。

2022年 5月,環境、公用事業、廢棄物、回收和資源產業整合軟體和車輛技術的全球供應商 AMCS 簽署了收購總部位於德國的 EHS 和永續發展軟體供應商 Quentic 的協議。

2022年5月,DNV與IOGP策略合作,制定脫碳標準,加速上游油氣轉型。此外,國際石油和天然氣生產商協會(IOGP)選擇 DNV 來支持 IOGP 成員的脫碳目標,這些成員生產的石油和天然氣佔全球的 40%。

2022年 3月,全球科技公司 Digital Intelligence Systems, LLC 宣布與 Cloud Native、AI 驅動的企業臨床、品質健康、安全和環境管理解決方案提供商 Discovery 建立合作夥伴關係,以提供變革性的環境健康為石油和天然氣產業的客戶提供安全(EHS)解決方案。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- 評估 COVID-19 對市場的影響

第5章 市場動態

- 市場促進因素

- 嚴格的政府法規和技術進步刺激了採用

- 增加資料管理和報告要求可能會推動市場成長

- 市場限制

- 實施、預算問題和缺乏分析

- 資料安全和隱私問題

- EHS解決方案的定性分析

- 事件管理

- 審核與檢查

- 合規管理

- 其他 EHS 解決方案

第6章 市場細分

- 依部署模式

- 雲端

- 本地部署

- 依最終用戶垂直領域

- 石油和天然氣

- 能源和公用事業

- 醫療保健和生命科學

- 建築與製造

- 化學品

- 採礦和金屬

- 食品和飲料

- 其他最終用戶垂直領域

- 按地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Enablon(Wolters Kluwer NV)

- Intelex Technologies, ULC

- VelocityEHS Holdings Inc.

- Cority Software Inc.

- Sphera Solutions, Inc.

- Sai Global Pty Limited(Intertek Group Plc)

- Dakota Software Corporation

- Benchmark Digital Partners LLC

- ProcessMAP Corporation

- Quintec GmbH

- IsoMetrix

- SAP SE

- iPoint-systems GmbH

- Evotix(SHE Software)

- DNV GL

第8章 投資分析

第9章 市場機會與市場未來

The EHS Software Market size is estimated at USD 2.02 billion in 2024, and is expected to reach USD 3.58 billion by 2029, growing at a CAGR of 12.17% during the forecast period (2024-2029).

Environmental health and safety (EHS) software solutions maintain adequate balance among various environmental themes, including regulatory compliance, corporate sustainability toward ecological protection, accident avoidance, environmental audit and inspection, process standardization, and incident response.

Key Highlights

- Environmental health and safety (EHS) software solutions are responsible for maintaining adequate balance among various environmental themes, including regulatory compliance, corporate sustainability toward protecting of environment, accident avoidance, environmental audit and inspection, process standardization, incident response, etc.

- EHS solutions are becoming a core part of every business organization to bring transformation in business continuity, profitable growth, corporate social responsibilities, and operational excellence related to environmental interaction. The integrated environment of government regulations, legal forces, economic conditions, and technologies have convinced organizations from multiple industries to implement EHS solutions as a basic operational need. More importantly, organizations are trying to avoid any future operational expenses due to environmental protection and risks involved with hazardous situations.

- There are various acquisitions by players in the market. In January 2022, Red-on-line, a leading EHS software and content provider, announced to have acquired GutwinskiManagement GmbH. Headquartered in Vienna, Gutwinskiis a leading EHS platform solution in German-speaking countries. The acquisition is further expected to expand the product portfolio and increase its customer base.

- Companies are also rolling out new solutions in order to remain competitive in the market. For instance, in October 2021, ProcessMAPCorporation, the leading Environmental, Health, and Safety (EHS) software platform provider, announced that the company had established an innovation center in the United Kingdom (UK). The new center will play a key role in facilitating collaboration and accelerating co-innovation with UK-based customers and user community and enabling even stronger customer success engagement at more than 15,000 locations across the UK and Europe.

- Some of the major players, such as Enablon, Intelex, Cority, SAI Global, VelocityEHS, and Quentic, have a greater hold in the market with their enhanced product offerings and strategic initiatives. The market studied is experiencing several partnerships and acquisitions at a global level as part of players' competitiveness.

- For instance, in May 2022, AMCS, a global supplier of integrated software and vehicle technology for the environmental, utility, waste, recycling, and resource industries, signed an agreement for the acquisition of Quentic, a German-headquartered EHS and sustainability software provider.

- There is an increasing need for EHS software by various companies to help increase the ability to monitor the health and safety of workers during COVID-19 by automating reporting and management of cases, communication with workers, increased self-assessments, and voluntary check-ins. Government guidelines have also called for employers to conduct COVID-19 risk assessments to establish needed controls. It is essential to conduct these risk assessments systematically and to have a centralized management method, which the EHS software can offer.

- Even when most staff is not working from home during COVID-19, which may be the case at organizations in essential industries requiring physical labor, such as FMCG and pharmaceutical, EHS software is helping improve efficiency. EHS software automation abilities help save workers, middle and upper- management time that is better employed on performing the primary duties of their jobs, rather than admin. With the work-from-home scenario, EHS software can equip the EHS team with the means to quickly assess risk, collect inspection results, and monitor performance, with which there can be less disruption to operations.

Environmental Health & Safety Software Market Trends

Increasing Data Management and Reporting Requirements may Drive the Market Growth

- Organizations face more pressure to collect, manage, and report EHS data to stakeholders, regulatory bodies, and investors. EHS software offers robust reporting and analytics capabilities, making it easier to collect and analyze data, generate accurate reports, and demonstrate compliance. The need for effective data management and reporting drives the adoption of EHS software.

- Stakeholders, including investors, employees, customers, and communities, are increasingly interested in organizations' environmental and social performance. They expect transparency, accountability, and measurable progress in EHS management. EHS software helps organizations meet these expectations by providing accurate data, robust reporting, and clear visibility into their EHS efforts.

- Effective data management and reporting contribute to an organization's reputation and risk management efforts. By implementing EHS software, organizations can demonstrate their commitment to environmental sustainability, workplace safety, and regulatory compliance. This, in turn, enhances their reputation, reduces operational risks, and improves stakeholder confidence.

- Moreover, according to the KPA Survey 2022, EHS software users report better performance than non-users. Respondents claiming "good" or "excellent" satisfaction percentages are more significant among EHS software users in all categories, from incident reporting and tracking to data collecting and analysis. For instance, compared to 35% of software users, 55% of non-users expressed average satisfaction with their program's data collecting and processing.

- Considering these factors, increasing data management and reporting requirements drive the adoption of EHS software by enabling organizations to efficiently collect, manage, analyze, and report EHS data. The software's capabilities support compliance efforts and contribute to improved decision-making, risk management, and overall operational performance in environmental health and safety.

North America Holds Significant Market Share

- North America, particularly the United States and Canada, has been a significant market for EHS software. The region has stringent environmental and occupational health and safety regulations, driving the adoption of EHS software solutions. Additionally, industries such as manufacturing, energy, and healthcare in North America have been early adopters of EHS software to manage compliance, safety, and risk mitigation.

- Moreover, the region has a strong foothold of EHS software vendors contributing positively to the market's growth. Some vendors based out of North America include Intelex Technologies Inc., VelocityEHS, Sai Global Pty Limited, Dakota Software Corporation, and Gensuite.

- Several players are taking the initiative to strive for zero safety incidents and minimize the impact of their operations on the environment. For instance, ProcessMAPCorporation, a data-intelligence-driven software solutions provider which helps empower customers to transform into a sustainable enterprises, recently announced that Fortune Brands Home & Security, Inc., a Fortune 500 company, will drive the digital transformation of its global EHS and ESG initiatives by leveraging ProcessMAP'ssmart and actionable data-intelligence solutions.

- Vendors in the region are enhancing their EHS software solutions. VelocityEHS, a player in cloud-based environmental, health, safety (EHS), and sustainability software, recently acquired Kinetica Labs, a pioneer in developing sensing and simulation technology for occupational safety and health in Ann Arbor.

- Similarly, VelocityEHS recently acquired OneLook Systems, an Irish software firm. The acquisition will boost its enterprise-wide platform services and capacity to assist users in addressing emerging risk management concerns related to the COVID-19 outbreak and beyond.

- The countries and their respective regional states have developed regulations and requirements to protect their citizens' natural environment and health. Products manufactured, sold, distributed, and imported are subject to an expanding list of complex local, regional, and federal (mandatory and self-regulated) environmental requirements in the United States and Canada. These environmental and safety measures create new compliance challenges for global and local businesses.

- In the North American region, the Environmental Protection Agency (EPA) and the US Occupational Safety and Health Administration (OSHA) strictly implement industrial safety, driving the adoption of EHS Software. Almost all businesses in the United States are subject to OSHA standards, so they are a relevant concern for employers and employees in many industries.

Environmental Health & Safety Software Industry Overview

The Environmental Health and Safety Software Market is fragmented. With many prominent, technologically advanced players in the industry, such as VelocityEHS, Enablon, Cority, and Sphera, the rivalry is intense, especially among the market incumbents. Market penetration is growing, with a strong presence of major players in established markets. With an increasing focus on innovation, the demand for new technologies, such as AI, is growing, which, in turn, is driving investments for further developments.

In January 2023, EcoOnline, a Europe-based provider of environment, health, and safety (EHS) software as a service (SaaS), acquired the software division of Alcumus, a prominent provider of risk management products with headquarters in the United Kingdom. This deal involves the acquisition of the Alcumus software division. The software segment of Alcumus provides organizations with tools to manage and audit EHS risk in various industries, including manufacturing, construction, and retail.

In May 2022, AMCS, a global supplier of integrated software and vehicle technology for the environmental, utility, waste, recycling, and resource industries, signed an agreement for the acquisition of Quentic, a German-headquartered EHS and sustainability software provider.

In May 2022, DNV collaborated strategically with IOGP to establish decarbonization standards, expediting the upstream oil and gas transition. Furthermore, the International Association of Oil and Gas Producers (IOGP) chose DNV to support the decarbonization ambitions of IOGP members, who produce 40% of the world's oil and gas.

In March 2022, Digital Intelligence Systems, LLC, a global technology firm, announced a partnership with ComplianceQuest, a provider of cloud-native, AI-powered, Enterprise Clinical, Quality Health, Safety, and Environmental Management solutions, to offer transformative Environmental Health and Safety (EHS) solutions for customers in the oil and gas industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Government Regulations and Technology Advancements has Spurred Adoption

- 5.1.2 Increasing Data Management and Reporting Requirements may Drive the Market Growth

- 5.2 Market Restraints

- 5.2.1 Implementation, Budgetary Concerns, and Lack of Analytics

- 5.2.2 Data Security and Privacy Concerns

- 5.3 Qualitative Analysis of EHS Solutions

- 5.3.1 Incident Management

- 5.3.2 Audit and Inspection

- 5.3.3 Compliance Management

- 5.3.4 Other EHS Solutions

6 MARKET SEGMENTATION

- 6.1 By Deployment Mode

- 6.1.1 Cloud

- 6.1.2 On-Premise

- 6.2 By End-user Vertical

- 6.2.1 Oil and Gas

- 6.2.2 Energy and Utilities

- 6.2.3 Healthcare and Life Sciences

- 6.2.4 Construction and Manufacturing

- 6.2.5 Chemicals

- 6.2.6 Mining and Metals

- 6.2.7 Food and Beverages

- 6.2.8 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Enablon (Wolters Kluwer N.V.)

- 7.1.2 Intelex Technologies, ULC

- 7.1.3 VelocityEHS Holdings Inc.

- 7.1.4 Cority Software Inc.

- 7.1.5 Sphera Solutions, Inc.

- 7.1.6 Sai Global Pty Limited (Intertek Group Plc)

- 7.1.7 Dakota Software Corporation

- 7.1.8 Benchmark Digital Partners LLC

- 7.1.9 ProcessMAP Corporation

- 7.1.10 Quintec GmbH

- 7.1.11 IsoMetrix

- 7.1.12 SAP SE

- 7.1.13 iPoint-systems GmbH

- 7.1.14 Evotix (SHE Software)

- 7.1.15 DNV GL