|

市場調查報告書

商品編碼

1445408

雷射氣體分析儀:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Laser-based Gas Analyzers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

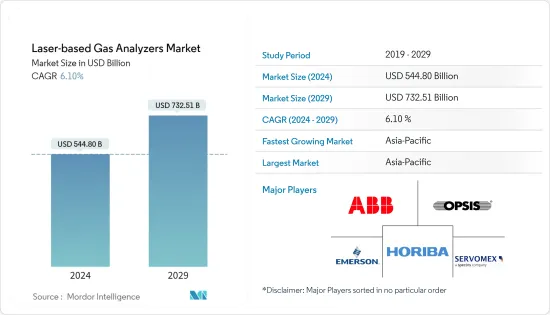

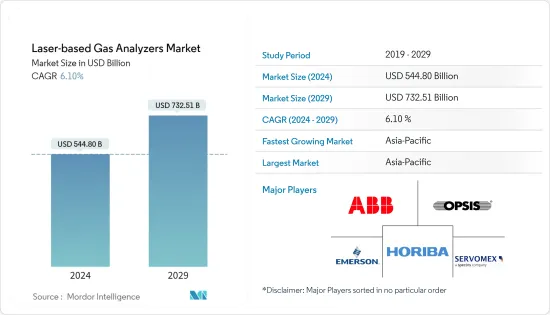

雷射氣體分析儀市場規模預計到2024年為5,448億美元,預計到2029年將達到7,325.1億美元,在預測期(2024-2029年)增加61億美元,預計將以年複合成長率成長的% 。

由於頁岩氣和緻密油的發現不斷增加,全球對雷射氣體分析儀的需求不斷增加。因為這些資源被用來阻止天然氣管道基礎設施的腐蝕。政府立法和職業安全與健康法規的執行也強制在某些工業環境中使用基於雷射的氣體分析儀。

主要亮點

- 公眾對氣體洩漏和排放危險的認知不斷提高,導致擴大採用雷射氣體分析儀。製造商正在將基於雷射的氣體分析儀與行動電話和其他無線設備整合,以提供即時監控、遠端控制和資料備份。

- 此外,人們對職場有毒有害氣體相關危害的認知不斷提高,正在推動雷射氣體分析儀的採用,特別是在石油和天然氣、化學和石化以及金屬和採礦業。

- 此外,由於政府收緊汽車二氧化碳排放,汽車排放氣體分析儀在市場上越來越受歡迎。汽車製造商正在努力提高引擎性能以減少二氧化碳排放。因此,許多汽車和汽車測試公司都採用了基於雷射的氣體分析系統。

- 提高競爭力和減少風險是市場上所有製造商的通用。這導致了產品複雜性的增加、成本的持續壓力以及最大限度地減少環境足跡的立法,這需要更好的控制、更便宜和更少的廢棄物。

- 在 COVID-19 大流行期間,科學進步和政府為支持多個行業基礎設施而增加的投資,再加上對研發和自動化的關注,對所研究的市場產生了重大影響。

雷射氣體分析儀市場趨勢

不斷發展的化學工業

- 在化學工業中,氧氣是許多不必要的污染物之一,它會影響反應或劣化公司最終產品的品質。例如,當烯烴進料流不含氧時,烯烴助催化劑系統提供最終聚烯產物的高品質和產率。在這種情況下,具有低 ppm 能力的氧氣分析儀發揮關鍵作用,確保產品保持在最佳水平。

- 覆蓋是在儲存或運輸高度易燃產品時為降低爆炸風險而執行的最常見操作之一。覆蓋過程使用雷射氣體分析儀來監測爆炸風險以下不必要的氣體的存在。

- 例如,當儲存槽中儲存碳氫化合物液體時,空氣可能會洩漏到液位上方的頂部空間並形成爆炸性氣體混合物。將二氧化碳或氮氣注入液體上方的頂部空間以消除其存在。

- 製程氣體分析儀在確保眾多化學品生產步驟的安全執行和效率方面發揮關鍵作用。製程氣體分析儀是從防止反應器中形成爆炸條件到控制熱氧化器中的燃燒等各個方面的關鍵組件。

- 氫氣是化學工業的重要產品和中間體之一。例如,氫氣在工業中通常用作生產氨的原料。因此,工業上對用於測量氣體混合物中氫氣濃度的氫氣分析儀有很大的需求。

- 化學工業近期的快速成長預計將顯著增加對氣體分析儀的需求。例如,BASF顯示,2021年全球工業產業成長率為6.1%。根據BASF,2022年全球化學品產量預計將成長3.5%,高於新冠病毒大流行前幾年的平均值。

亞太地區主導市場

- 亞太地區是近年來唯一一個油氣產能成長的地區。該地區新增約四家煉油廠,使全球原油產量增加約 75 萬桶/日。石油和天然氣、鋼鐵、電力、化學品和石化領域新工廠投資的增加以及國際安全標準和實踐的日益採用預計將影響市場成長。

- 由於氣體分析儀在石油和天然氣行業的應用,該地區的工業發展正在推動氣體分析儀的成長,包括監控過程、提高安全性以及提高效率和品質。因此,該地區的煉油廠正在其工廠中安裝氣體分析儀。

- 亞太地區是老年人口最多的地區。根據人口研究所統計,中國65歲以上人口約1.66億,是日本、德國和義大利老年人口總和的兩倍。

- 此外,氣體分析儀也用於分析整個城市的污染程度。中國和印度等國家的污染水平達到歷史最高水平,正在部署氣體分析儀來監測和控制污染水平。

- 研究人員正在努力減少世界各地的溫室氣體,氣體分析儀用於分析這些氣體。例如,東南亞的科學家透過研究不同飼養方式的影響並部署 Gasmet Technologies 的可攜式FTIR 氣體分析儀,投資測量山羊和牛的溫室氣體 (GHG)排放。預計這些因素將推動該地區的氣體分析儀市場。

雷射氣體分析儀產業概況

在基於雷射的氣體分析儀市場中,知名製造商的不斷增加預計將加劇預測期內競爭公司之間的敵意。 ABB Ltd.、Opsis AB、Emerson Electric Co.、HORIBA Ltd、Servomex Group Limited、Honeywell International Inc. 等市場老牌企業對整個市場有重大影響。

- 2022 年 12 月,ABB 推出了 Sensi+,這是一款用於監測天然氣品質的突破性分析儀。 ABB 基於雷射的技術幾乎消除了錯誤讀數,並且還提供快速響應時間以實現可靠的製程控制。 Sensi+ 提供卓越的效能和較低的總擁有成本,專為遠端和危險環境而設計。

- 2022 年 6 月,仕富梅推出了一款新型分析儀,提供最先進的光強度氣體分析解決方案。這款新型分析儀圍繞著易於使用的數位平台而設計,是一款強大且可靠的產品,適用於各種工業應用,包括乙烯生產、碳捕獲、二氯乙烷生產和直接還原鐵製程。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 收緊排放氣體法規

- 對強大的模組化系統的需求

- 市場限制因素

- 數學分析過程複雜,高成本

第6章市場區隔

- 透過加工

- In Situ

- 提取的

- 按類型

- 可調諧二極體雷射光譜 (TDLS)

- 拉曼光譜 (RA)

- 光腔衰蕩光譜 (CRDS)

- 量子級聯雷射光譜 (QCLS)

- 按最終用戶產業

- 電力

- 採礦和金屬

- 衛生保健

- 車

- 紙漿/紙

- 油和氣

- 化學品

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- ABB Ltd

- Opsis AB

- Emerson Electric Co.

- HORIBA Ltd

- Servomex Group Limited

- KNESTEL Technology &Electronics GmbH

- Hangzhou Zetian Chunlai Technology Co. Ltd

- Yokogawa Electric Corporation

- NEO Monitors AS(Nederman Group)

- Endress+Hauser AG

- Fuji Electric Co. Ltd

- Siemens AG

- Anton Paar GmbH

- AMETEK Land Instruments International

- Bruker Corporation

- Mettler Toledo

第8章投資分析

第9章市場的未來

The Laser-based Gas Analyzers Market size is estimated at USD 544.80 billion in 2024, and is expected to reach USD 732.51 billion by 2029, growing at a CAGR of 6.10% during the forecast period (2024-2029).

The global demand for laser-based gas analyzers has been boosted by increased shale gas and tight oil discoveries since these resources are utilized to stop corrosion in the infrastructure of natural gas pipelines. The use of laser-based gas analyzers has also been enforced in several industrial settings by government law and the enforcement of occupational health and safety rules.

Key Highlights

- The growing public consciousness of the dangers of gas leaks and emissions contributed to the increased adoption of laser-based gas analyzers. Manufacturers are integrating laser-based gas analyzers with mobile phones and other wireless devices to offer real-time monitoring, remote control, and data backup.

- Moreover, the growing awareness of workplace toxic and hazardous gas-related dangers is also driving the adoption of laser-based gas analyzers, especially in the oil and gas, chemicals and petrochemicals, and metals and mining industries.

- Further, automotive emission analyzers gained popularity in the market due to government stringencies over the CO2 emissions from vehicles. Automotive manufacturers are making efforts to improve their engine performances, to combat CO2 emissions. Hence, many automotive and automotive testing companies are adopting laser-based gas analyzer systems.

- Increasing competitiveness and reducing exposure to risk is common to all manufacturers in the market. This translates into increased product complexity, constant pressure on costs, and legislated minimization of environmental footprint, which in turn requires better control, more cheaply and with less waste.

- During the COVID-19 pandemic, the growing investments by governments to support scientific progress and infrastructure in several industries, coupled with the focus on R&D and automation, have significantly impacted the studied market.

Laser Based Gas Analyzers Market Trends

Chemical Industry to Witness Growth

- In the chemicals industry, oxygen is one of the many undesired contaminants that can impact the reaction or degrade the final product of the company. For example, olefin co-catalyst systems provide high quality and yield of the final polyolefin product if the olefin feedstock stream is free from oxygen. In such cases, oxygen gas analyzers play a vital role, with low ppm capabilities, to ensure that the products can be maintained at an optimum level.

- Blanketing is one of the most common activities performed when highly flammable products are stored or transported to reduce the risk of explosion. In blanketing, laser gas analyzers are used to monitor the presence of undesired gases below the explosion risk.

- For instance, while storing hydrocarbon liquids in tanks, it is possible that air will leak into the headspace above the liquid level, which may form explosive gas mixtures. Carbon dioxide or nitrogen is injected above the liquid into the headspace to remove its presence.

- Process gas analyzers play a crucial role in ensuring the safe running and efficiency of numerous chemical production steps. Process gas analyzers are critical components, from preventing the development of explosive conditions in reactors to controlling combustion in thermal oxidizers.

- Hydrogen is one of the essential products and intermediates of the chemical industry. For instance, hydrogen is commonly used as feedstock in the industry to produce ammonia. Thus, a significant demand exists for hydrogen analyzers in the industry, which are used to determine the concentration of hydrogen in a gas mixture.

- The strong growth in the chemicals industry in recent times is expected to fuel the demand for gas analyzers significantly. For instance, BASF shows that growth in the global chemical industry was 6.1% in 2021. According to the organization, global chemical production was expected to grow by 3.5% in 2022, which is above the average for the years before the coronavirus pandemic.

Asia-Pacific to Dominate the Market

- Asia-Pacific is the only region to register an oil and gas capacity growth in recent years. About four new refineries were added in the region, which has added about 750,000 barrels per day to global crude oil production. Increased investments in new plants in oil and gas, steel, power, chemical, and petrochemicals and the rising adoption of international safety standards and practices are expected to influence market growth.

- The development of industries in the region is driving the growth of gas analyzers, owing to their use in the oil and gas industry, such as monitoring processes, increased safety, enhanced efficiency, and quality. Hence, the refineries in the region are deploying gas analyzers in the plants.

- The APAC region has the largest older population demographic. As per the Population Reference Bureau, China has about 166 million citizens aged over 65, which is twice the elderly population of Japan, Germany, and Italy combined.

- Furthermore, gas analyzers are also being used to analyze the pollution levels across a city. In countries like China and India, pollution levels are at an all-time high, leading to gas analyzers being deployed to monitor and control pollution levels.

- Researchers are making efforts to reduce greenhouse gas across the world, and for the analysis purposes of these gases, they are using the gas analyzer. For example, scientists from Southeast Asia are investing in measuring Greenhouse Gas (GHG) emissions from goats and cattle by investigating the effects of different feeding regimes and implementing a portable FTIR gas analyzer from Gasmet Technologies. These factors are expected to drive the market for gas analyzers in the region.

Laser Based Gas Analyzers Industry Overview

The growing presence of prominent manufacturers in the Laser-based Gas Analyzers Market is expected to intensify competitive rivalry during the forecast period. Market incumbents, such as ABB Ltd., Opsis AB, Emerson Electric Co., HORIBA Ltd, Servomex Group Limited, Honeywell International Inc., etc., greatly influence the overall market.

- In December 2022, ABB introduced Sensi+, a ground-breaking analyzer for monitoring natural gas quality. False readings are almost eliminated by ABB's laser-based technology, which also offers quick response times for dependable process control. Sensi+ provides exceptional performance and a low total cost of ownership and is designed for remote and dangerous settings.

- In June 2022, Servomex unveiled a new analyzer to deliver the most advanced photometric gas analysis solution. Designed around an easier-to-use digital platform, the new analyzer is a rugged and reliable product ready to handle a wide range of industrial applications, including ethylene production, carbon capture, ethylene dichloride production, and the direct reduction iron process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emission Regulation

- 5.1.2 Demand for Robust and Modular Systems

- 5.2 Market Restraints

- 5.2.1 Complex Mathematical Analysis Process and High Costs

6 MARKET SEGMENTATION

- 6.1 By Process

- 6.1.1 In Situ

- 6.1.2 Extractive

- 6.2 By Type

- 6.2.1 Tuneable Diode Laser Spectroscopy (TDLS)

- 6.2.2 Raman Spectroscopy (RA)

- 6.2.3 Cavity Ring Down Spectroscopy (CRDS)

- 6.2.4 Quantum Cascade Laser Spectroscopy (QCLS)

- 6.3 By End-user Industry

- 6.3.1 Power

- 6.3.2 Mining and Metal

- 6.3.3 Healthcare

- 6.3.4 Automotive

- 6.3.5 Pulp and Paper

- 6.3.6 Oil and Gas

- 6.3.7 Chemical

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Opsis AB

- 7.1.3 Emerson Electric Co.

- 7.1.4 HORIBA Ltd

- 7.1.5 Servomex Group Limited

- 7.1.6 KNESTEL Technology & Electronics GmbH

- 7.1.7 Hangzhou Zetian Chunlai Technology Co. Ltd

- 7.1.8 Yokogawa Electric Corporation

- 7.1.9 NEO Monitors AS (Nederman Group)

- 7.1.10 Endress + Hauser AG

- 7.1.11 Fuji Electric Co. Ltd

- 7.1.12 Siemens AG

- 7.1.13 Anton Paar GmbH

- 7.1.14 AMETEK Land Instruments International

- 7.1.15 Bruker Corporation

- 7.1.16 Mettler Toledo