|

市場調查報告書

商品編碼

1445403

丙烷:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Propane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

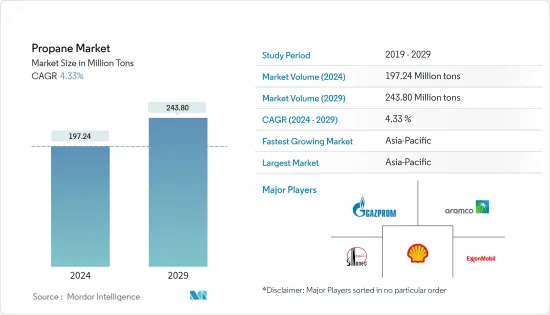

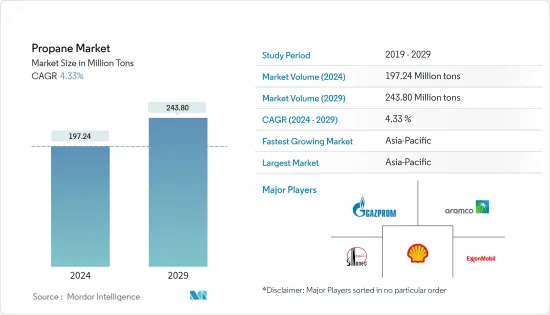

預計2024年丙烷市場規模為1.9724億噸,預計到2029年將達到2.438億噸,預測期內(2024-2029年)年複合成長率為4.33%,預計還會成長。

COVID-19 大流行顯著減少了最終用戶行業(包括商業、運輸和其他行業)的丙烷需求。然而,住宅領域對液化石油氣(LPG)的需求增加導致全球丙烷消耗量增加。

主要亮點

- 短期內,工業、建築和石化等各種最終用戶行業的需求增加等因素可能會推動市場成長。

- 高濃度丙烷的不利影響預計將阻礙市場成長。

- 丙烷在發電中的使用預計將成為市場機會。

- 亞太地區主導了全球丙烷市場。最大的消費量是中國和印度。

丙烷氣市場趨勢

住宅領域主導市場

- 在住宅領域,丙烷用於空調、熱水、烹飪、食品冷藏、服裝類烘乾、照明以及作為壁爐燃料。

- 丙烷主要用於沒有天然氣服務的鄉村房屋和移動房屋。數百萬家庭使用丙烷來滿足部分能源需求。

- 美國大約有 1,200 萬戶家庭使用丙烷作為主要供暖來源,大約五分之一的移動房屋使用丙烷取暖。根據美國能源資訊管理局 (EIA) 的數據,2022 年 2 月第一週的住宅丙烷價格為 2.825 美元/加侖。

- 住宅銷售的增加預計將增加美國丙烷的需求。 2020年和2021年住宅需求激增,住宅銷售量分別飆升至822,000套和770,000套。此外,根據美國人口普查局和住房與城市發展部,2022 年 11 月新建單戶住宅銷售量經季節性已調整的後的年成長率為 64 萬套。

- 使用丙烷作為主要能源來源的家庭在室外設有大型丙烷罐,在壓力下將丙烷以液體形式儲存。丙烷經銷商每年多次根據需要透過卡車將丙烷運送到住宅並加註丙烷。

- 住宅丙烷罐平均可容納 500 至 1,000 加侖液體燃料。數以百萬計的後院廚師使用丙烷驅動的燃氣烤架進行烹飪。此外,休閒車通常配備丙烷動力設備,為烹飪、熱水和冷凍提供可攜式能源來源。丙烷氣通常用於戶外烹飪,由於其攜帶性而特別受到露營車和移動住宅車主的歡迎。

- 然而,丙烷使用效率的提高可能需要未來丙烷需求的數量增加。

- 新住宅的增加和持續的燃油轉換預計將抵消電力和天然氣造成的住宅供暖損失,從而導致 2027 年住宅供暖客戶數量略有成長。

- 預計上述因素將在預測期內推動住宅領域的丙烷需求。

中國主導亞太市場

- 中國是全球最大的丙烷消費國,估計比重約20%。中國從其他國家進口大量丙烷以滿足其龐大的國內需求。國內丙烷進口增加的主要因素被認為是丙烷脫氫或PDH裝置的需求增加。

- 根據國家統計局資料,2022年1-7月我國液化石油氣、石腦油、汽油、航空煤油、輕油、重油產量29161萬噸,同期原油吞吐量下降6.3%。 ,與前一年同期比較成長3.9% 。 2022年5月中國進口液化石油氣、丙烷、丁烷212萬噸,較上季成長7.1%。

- 中國是亞太地區最大的汽車瓦斯市場之一。中國的汽車燃氣市場主要是透過推廣替代燃料的區域計畫來發展的,以解決該國日益惡化的空氣污染問題。

- 根據中國工業協會統計,2021年新能源汽車累計交付量為351萬輛。此外,2022年上半年,中國新能源汽車新登記221萬輛,與前一年同期比較增100.26%,創歷史新高。

- 總體而言,在最初的預測期內,中國丙烷市場在從 COVID-19 大流行中恢復後預計將迅速成長。

丙烷行業概況

由於全球範圍內存在大量天然氣生產公司,全球丙烷氣市場本質上是分散的。俄羅斯天然氣工業股份公司、中國石油化工股份有限公司、埃克森美孚、沙烏地阿拉伯石油公司(沙烏地阿美)和殼牌公司(排名不分先後)等大型石油公司由於在世界各地的多個設施生產大量天然氣,因此正在生產丙烷. 在以下方面領先市場

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 住宅和交通部門的需求增加

- 石化產業需求

- 抑制因素

- 高濃度丙烷的有害影響

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(市場規模:數量)

- 最終用戶產業

- 住宅

- 商業的

- 交通設施

- 工業的

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率/排名分析

- 主要企業採取的策略

- 公司簡介

- Air Liquide

- BP PLC

- Chevron Corporation

- China Petroleum &Chemical Corporation(Sinopec)

- China National Petroleum Corporation(PetroChina)

- ConocoPhillips Company

- Eni SpA

- Exxon Mobil Corporation

- GAIL(India)Limited

- Gazprom

- Shell PLC

- Saudi Aramco

- Suburban Propane

- Total

第7章市場機會與未來趨勢

- 丙烷在發電中的用途

The Propane Market size is estimated at 197.24 Million tons in 2024, and is expected to reach 243.80 Million tons by 2029, growing at a CAGR of 4.33% during the forecast period (2024-2029).

Owing to the COVID-19 pandemic, the demand for propane from end-user industries, including commercial, transportation, and other industry, declined drastically. However, the increased demand for liquefied petroleum gas (LPG) from the residential sector propelled propane consumption globally.

Key Highlights

- In the short term, factors such as the increasing demand from various end-user industries, such as industrial, construction, and petrochemical, are likely to drive market growth.

- The harmful effects of propane at higher concentrations are expected to inhibit the market's growth.

- Propane usage in power generation is expected to act as an opportunity for the market.

- Asia-Pacific dominated the global propane market. The largest consumption was witnessed in China and India.

Propane Market Trends

Residential Segment to Dominate the Market

- In the residential segment, propane is used for air conditioning, heating water, cooking, refrigerating foods, drying clothes, lighting, and fueling fireplaces.

- Propane is used mainly in homes in rural areas that do not have natural gas services and mobile homes. Millions of homes use propane to meet some of their energy requirements.

- In the United States, about 12 million households use propane as their primary heating source, and around one-fifth of mobile homes use propane for heating. In the first week of February 2022, the value of residential propane stood at USD 2.825/gallon, according to the United States Energy Information Administration (EIA).

- The rising sales of new residential will boost the demand for propane in the United States. In 2020 and 2021, demand for housing surged, and house sales volumes spiked to 822,000 and 770,000, respectively. Additionally, sales of new singlefamily houses in November 2022 were at a seasonally adjusted annual rate of 640 thousand units per e U.S. Census Bureau and the Department of Housing and Urban Development.

- Homes that use propane as the primary energy source have a large propane tank outside the house that stores propane under pressure as a liquid. Propane dealers deliver propane to residences in trucks, filling the tanks several times a year as per the requirement.

- The average residential propane tank holds between 500 and 1,000 gallons of liquid fuel. Millions of backyard cooks use propane-powered gas grills for cooking. Moreover, recreational vehicles usually have propane-fueled appliances, giving them a portable energy source for cooking, hot water, and refrigeration. People often use propane for outdoor cooking, and because of its portability, it is especially popular with campers and mobile homeowners.

- However, due to improvements in propane usage efficiency, the demand, in terms of volume for propane, may need to grow in the future.

- The increasing new residential construction, combined with continuing fuel oil conversions, is expected to offset residential space heating losses to electricity and natural gas and lead to slow growth in the number of residential space heating customers through 2027.

- The abovementioned factors are anticipated to drive the demand for propane from the residential sector during the forecast period.

China to Dominate the Asia-Pacific Market

- China is the world's largest propane consumer, with an estimated share of about 20%. China imports large amounts of propane from other countries to satisfy the huge domestic demand. The primary factor attributed to the rise in propane imports in the nation is the increased demand for propane dehydrogenation or PDH plants.

- In 2022, China produced 291.61 million mt of LPG, naphtha, gasoline, jet/kerosene, gasoil, and fuel oil over January-July, up 3.9% year on year, despite crude throughput falling 6.3% over the same period, as per NBS data. China imported 2.12 million mt of LPG, propane, and butane, in May 2022, up 7.1% month on month.

- China represents one of the largest autogas markets in Asia-Pacific. The autogas market in China developed primarily due to local programs to promote alternative fuels to tackle the worsening problem of air pollution in the nation.

- According to the China Association of Automobile Manufacturers, the total deliveries of new energy vehicles stood at 3.51 million units in 2021. In addition, 2.21 million NEVs were newly registered in China during the first half of 2022, a year-on-year increase of 100.26%, a record high.

- Overall, the market for propane in China is projected to increase rapidly post-recovery from the COVID-19 pandemic during the early forecast period.

Propane Industry Overview

The global propane gas market is fragmented in nature, owing to the presence of a vast number of natural gas producers around the world. Major oil companies (not in any particular order), such as Gazprom, China Petroleum & Chemical Corporation, ExxonMobil, Saudi Arabian Oil Co. (Saudi Aramco), and Shell PLC, lead the market in terms of propane production, owing to their vast production outputs of natural gas at several facilities around the world.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in Demand from the Residential and Transportation Sectors

- 4.1.2 Demand in the Petrochemical Industry

- 4.2 Restraints

- 4.2.1 Harmful Effects of Propane at Higher Concentrations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-user Industry

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.1.3 Transportation

- 5.1.4 Industrial

- 5.1.5 Other End-user Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 UK

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 BP PLC

- 6.4.3 Chevron Corporation

- 6.4.4 China Petroleum & Chemical Corporation (Sinopec)

- 6.4.5 China National Petroleum Corporation (PetroChina)

- 6.4.6 ConocoPhillips Company

- 6.4.7 Eni SpA

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 GAIL (India) Limited

- 6.4.10 Gazprom

- 6.4.11 Shell PLC

- 6.4.12 Saudi Aramco

- 6.4.13 Suburban Propane

- 6.4.14 Total

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Usage of Propane in Power Generation