|

市場調查報告書

商品編碼

1444963

DWaaS(資料倉儲即服務):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Data Warehouse as a Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

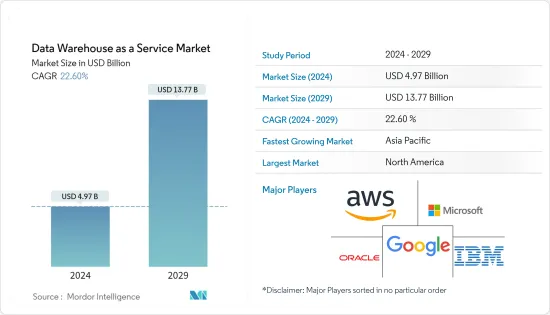

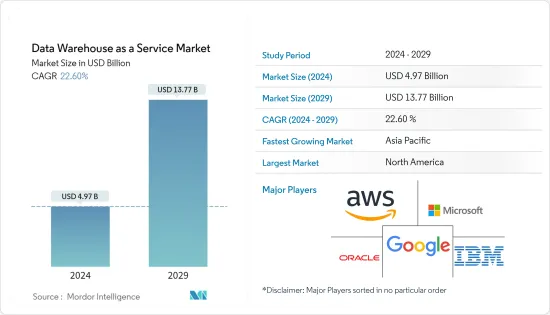

DWaaS(資料倉儲即服務)市場規模預計到 2024 年為 49.7 億美元,在預測期內(2024-2029 年)預計到 2029 年將達到 137.7 億美元。期間年複合成長率為 22.60% 。

公司越來越有興趣了解有關其業務流程、產品、客戶和服務的可用資訊,以抓住新的商機,這對市場產生了積極影響。

主要亮點

- 近年來,由於人們越來越關注資料管理的簡易性和複雜性,資料倉儲引起了人們的極大興趣,特別是在金融、商業、醫療保健和其他行業的實際應用中。

- 市場需求預計將由對低延遲和高速分析的需求不斷成長以及商業智慧在整個企業生態系統的企業管理中日益重要的推動。然而,控制和執行資料品質的複雜性日益增加,可能需要進行改進才能擴大所研究的市場。

- 此外,隨著 BFSI、零售和電子等多個最終用戶行業資料的資料顯著增加,資料倉儲服務(尤其是雲端基礎的部署)的需求預計將增加。 -電子商務、政府、公共部門和製造業。例如,騰訊控股計劃在日本開設第三個資料中心,日本對線上遊戲和直播系統的雲端服務需求強勁。

- 此外,擴大採用資料倉儲來執行高級分析、資料量的快速成長、法規遵從性的提高以及多重雲端架構的興起,意味著沒有足夠的空間來採用雲端基礎的資料倉儲解決方案。 。

- 企業使用報告、儀表板和分析工具從資料集集中提取見解並監控業務績效以支援決策。這些報告、儀表板和分析工具是資料倉儲的一部分,允許高效儲存資料並將查詢結果同時高速交付給多個用戶,使資料倉儲在新興市場上可用(即服務)。

- COVID-19 的爆發和世界各地實施的封鎖限制正在影響世界各地的資本投資和工業活動。在COVID-19感染疾病導致全球經濟衰退後,由於疫情上半年數位轉型的加速,DWaaS(資料倉儲即服務)市場實現了成長。由於封鎖限制,大多數最終用戶行業(主要是製造業和汽車業)的公司都關閉了生產基地。

DWaaS(資料倉儲即服務)市場趨勢

BFSI 領域更多地使用資料倉儲服務來推動市場。

- 銀行、金融服務和保險將極大有利於 DWaaS(資料倉儲即服務)市場的成長,因為它們處理定期產生的大量客戶資料。由於 BFSI 部門會產生大量資料,企業需要資料倉儲解決方案來自動追蹤系統中儲存的資訊的效能和行為。

- 您還需要透過具有 BI 功能的解決方案進行分析來制定創新商務策略並提高整體業務效率。紐約梅隆銀行、摩根士丹利、美國銀行、瑞士信貸和 PNC 等銀行已經在製定以業務巨量資料為中心的策略,其他銀行也正在迅速迎頭趕上。

- 美國加州矽谷誕生了多家金融科技Start-Ups。此舉可望增加貸款業務並升級零售銀行機構的付款領域。這將加強信貸承銷流程,因為公司將在巨量資料分析的幫助下向更多個人和小型企業提供貸款。

- 線上資料的數量、種類和速度不斷增加,需要社交媒體分析等分析解決方案來了解與每種產品和服務相關的消費者購買行為。因此,保險公司擴大採用雲端基礎的資料倉儲解決方案,從而部署社交媒體監控和分析工具來增加保險產品銷售並了解與保險產品相關的客戶情緒分析。

- 此外,金融顧問公司擴大採用資料倉儲即服務 (DWaaS),以減輕重複更新本地軟體的負擔。此外,整個 BFSI 行業的 DWaaS(資料倉儲即服務)市場的需求正在增加,因為由於可以存取高速網際網路連接,可以從任何地方存取 DWaaS(資料倉儲即服務)。

預計北美將佔據最大的市場佔有率

- 由於技術先進的資料倉儲基礎設施的可用性,預計北美將獲得重要的市場佔有率。美國的組織正在多個行業積極採用分析解決方案。由於對營運資料管理的巨大需求以及雲端解決方案供應商的日益崛起,這些國家被認為是市場領先國家。

- 隨著雲端基礎的資料倉儲解決方案的可用性和使用變得更加普及,雲端運算市場格局在全部區域不斷發展。幾乎每家公司都在尋找能夠減少資料搜尋時間並提高員工和組織效率的解決方案。這增加了 DWaaS(資料倉儲即服務)的使用並提高了業務流程的效率。

- 此外,美國公司之間的聯盟和合作夥伴關係的範圍和規模正在擴大,以支援和擴展整個資料倉儲服務領域的提供者服務。雲端服務資料倉儲提供者也已成為許多 IT 服務公司的重要合作夥伴,在需要時提供彈性和擴充性。

- 此外,隨著行動裝置的使用和社交網路等消費化趨勢的引入,資訊資料量正在迅速增加,為了在北方國家中保持競爭力,有必要對其進行儲存、分析和管理。有效的方法。美國市場預計資料倉儲市場將進一步成長。

- 全部區域知名企業的存在進一步增強了競爭形勢,例如 Google LLC、Teradata Corp.、SAP SE、IBM Corp.、Microsoft Corp.、一些主要供應商以及 DWaaS(資料倉儲即服務)重點規範專業服務以支援市場。

DWaaS(資料倉儲即服務)產業概述

DWaaS(資料倉儲即服務)市場競爭激烈,由多個關鍵參與者組成。目前,少數參與者在市場佔有率方面佔據主導地位。全部區域的知名企業如 Google LLC、Teradata Corp.、SAP SE、IBM Corp.、Microsoft Corp. 和 Amazon Web Services Inc. 等主要供應商的存在進一步強化了競爭形勢。專注於支援資料倉儲服務交付的專業服務正規化的公司。然而,隨著技術進步和產品創新,各種中型企業正在透過贏得新合約和開拓新市場來擴大其市場佔有率。

- 2022 年 6 月 - HCL Technologies 與 Amazon Web Services 合作。 AWS 使 HCL 能夠提供可擴展、經濟高效、安全且高效能的企業資料倉儲解決方案。 Amazon Redshift 提供由最新 AI/ML 功能支援的資料驅動型業務洞察,以提高營運效率、決策制定並加快 HCL 技術的上市時間。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場動態

- 市場促進因素

- 快速部署雲端基礎的解決方案並專注於即時資料分析

- BFSI 產業資料倉儲服務的使用增加,推動市場發展

- 資料分析和商業智慧有望在企業管理中發揮重要作用

- 市場挑戰

- 對資料安全的擔憂可能會阻礙市場成長

- 評估 COVID-19 對市場的影響

第6章市場區隔

- 組織

- 主要企業

- 中小企業 (SME)

- 最終用戶產業

- BFSI

- 政府

- 衛生保健

- 電子商務與零售

- 媒體與娛樂

- 其他最終用戶產業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Amazon Web Services Inc.

- IBM Corporation

- Microsoft Corporation

- Google LLP

- Oracle Corporation

- SAP SE

- Micro Focus International PLC

- Cloudera Inc.

- Snowflake Computing Inc.

- Pivotal Software Inc.

- Yellowbrick BV

- Teradata Corporation

- Veeva Systems Inc

第8章投資分析

第9章市場的未來

The Data Warehouse as a Service Market size is estimated at USD 4.97 billion in 2024, and is expected to reach USD 13.77 billion by 2029, growing at a CAGR of 22.60% during the forecast period (2024-2029).

The growing interest of companies to understand the available information regarding business processes, products, customers, and services to grab new business opportunities is positively impacting the market.

Key Highlights

- Due to rising concerns about data manageability and increasing complexity in recent years, data warehousing has attracted significant interest in real-life applications, especially in finance, business, healthcare, and other industries.

- The market demand is anticipated to be driven by the rising demand for low latency and high-speed analytics and the expanding importance of business intelligence in enterprise management throughout the company ecosystem. However, expanding the market under study may need to be improved due to the growing complexity of controlling and enhancing data quality.

- Further, the demand for data warehouse services, especially across the cloud-based deployment, is expected to rise, owing to tremendous growth in the volume of the structured and unstructured data generated across multiple end-user industries, such as BFSI, retail and e-commerce, government, and public sector, and manufacturing industries. For instance, Tencent Holdings planned to open a third data center in Japan, where its cloud services for online games and live streaming systems are in robust demand.

- Also, the growing adoption of the data warehouse to perform advanced analytics, rapid growth in data volumes, and an increase in regulatory compliance, along with the rise of multi-cloud architecture, creates ample opportunities for adopting cloud-based data warehouse solutions.

- Enterprises are using reports, dashboards, and analytics tools to extract insights from the datasets, thereby monitoring the business performance that supports decision-making. These reports, dashboards, and analytics tools are a part of the data warehouse, which stores data efficiently and delivers query results at high speeds across multiple users simultaneously, thereby driving the adoption of the data warehouse as a service across emerging economies.

- The COVID-19 outbreak and the lockdown restriction imposed across the globe have affected capital investments and industrial activities across the world. Following the global economic recession led by COVID-19, data warehouse as a service market has seen growth due to accelerated digital transformation in the first half of the pandemic. Most enterprises operating in the end-user industries (majorly manufacturing and automotive) had shut down their production sites due to lockdown restrictions.

Data Warehouse as a Service Market Trends

Rising use of Data Warehouse services in BFSI sector to drive the market.

- Banking, financial services, and insurance are highly lucrative for growth in the Data Warehouse-as-a-Service market as it deals with massive customer data generated regularly. Due to the large amount of data generated across the BFSI sector, enterprises need data warehousing solutions to automatically track the performance and behavior of the information stored in their systems.

- Also, they require analytics to develop innovative business strategies and improve their overall operational efficiency through solutions with BI capabilities. Banks like BNY Mellon, Morgan Stanley, Bank of America, Credit Suisse, and PNC are already working on strategies around Big Data in Banking, and other banks are rapidly catching up.

- Several FinTech start-ups are coming up in Silicon Valley, California, United States. This is expected to increase the lending business and upgrade the payments domain of retail banking institutions. This, in turn, will enhance credit underwriting procedures, as firms will lend to many individuals and small businesses with the help of big data analytics.

- The rising volume, variety, and velocity of online data need analytics solutions, such as social media analytics, to understand consumer buying behavior related to its respective products and service offerings. Therefore, insurance firms are increasingly adopting cloud-based data warehousing solutions, thereby implementing social media monitoring and analytical tools to increase insurance product sales and analyze customer sentiments related to insurance products.

- Further, financial consulting companies are increasingly adopting Data Warehouse-as-a-Service to set themselves free from the burden of updating their on-premise software repeatedly. Moreover, they can access Data Warehouse-as-a-Service anywhere by having access to fast internet connectivity, which, in turn, is driving the demand for the Data Warehouse-as-a-Service market across the BFSI sector.

North America is Expected to Hold the Largest Market Share

- North America is anticipated to have a significant market share owing to the availability of technologically-advanced data warehouse infrastructure. The US organizations are higher adopters of analytics solutions across several verticals. They are considered the leading country in the market due to the significant demand for managing operational data and the increased emergence of cloud solution providers.

- The market environment for cloud computing continues to develop across the region as the availability and usage of cloud-based data warehouse solutions become more prevalent. Almost all enterprises are looking for a solution to reduce the time to search for data and improve the efficiency of both the employees and the organizations. This has increased the utilization of data warehouse-as-a-service, thereby increasing the efficiency of business processes.

- Also, the scope and scale of alliances and partnerships among enterprises in the United States are expanding to support and expand upon provider offerings across the data warehouse services space. Also, the data warehouse providers of cloud services are becoming essential partners for many IT services firms, offering them flexibility and scale whenever required.

- Moreover, the adoption of consumerization trends, such as the usage of mobile devices and social networking, is leading to an exponential rise in the volume of informational data that needs an effective way to be stored, analyzed, and managed to stay competitive among the North American market, which is further anticipated to amplify the data warehousing market growth.

- The competitive landscape is consolidated with the presence of some of the prominent players across the region, such as Google LLC, Teradata Corp., SAP SE, IBM Corp., and Microsoft Corp., who are some of the leading vendors, placing significant emphasis on the formalization of professional services to support the data warehousing-as-a-service market.

Data Warehouse as a Service Industry Overview

The Data Warehouse as a Service Market is competitive and consists of several significant players. Some of the players currently dominate the market in terms of market share. The competitive landscape is consolidated with the presence of some of the prominent players across the region, such as Google LLC, Teradata Corp., SAP SE, IBM Corp., and Microsoft Corp., Amazon Web Services Inc. are some of the leading vendors that are placing significant emphasis on the formalization of professional services to support the data warehouse services delivery. However, with technological advancement and product innovation, various mid-size companies are increasing their market presence by securing new contracts and tapping new markets.

- June 2022 - HCL Technologies partnered with Amazon Web Services. AWS allows HCL to offer scalable, cost-effective, secure, and high-performing enterprise data warehouse solutions. Amazon Redshift provides data-driven business insights enabled by modern AI/ML capabilities to improve operational efficiency, decision-making, and faster time to market to HCL Technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Adoption of Cloud-based Solutions and Focus on Real-time Data Analysis

- 5.1.2 Rising use of Data Warehouse services in BFSI sector to drive the market.

- 5.1.3 Data analytics and business intelligence are expected to play a major role in enterprise management.

- 5.2 Market Challenges

- 5.2.1 Concerns Over Data Security might hinder the market growth

- 5.3 Assessment of the Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 Organization

- 6.1.1 Large Enterprises

- 6.1.2 Small and Medium Enterprises (SME)

- 6.2 End User Vertical

- 6.2.1 BFSI

- 6.2.2 Government

- 6.2.3 Healthcare

- 6.2.4 E-Commerce and Retail

- 6.2.5 Media and Entertainment

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 UK

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 UAE

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Amazon Web Services Inc.

- 7.1.2 IBM Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 Google LLP

- 7.1.5 Oracle Corporation

- 7.1.6 SAP SE

- 7.1.7 Micro Focus International PLC

- 7.1.8 Cloudera Inc.

- 7.1.9 Snowflake Computing Inc.

- 7.1.10 Pivotal Software Inc.

- 7.1.11 Yellowbrick B.V

- 7.1.12 Teradata Corporation

- 7.1.13 Veeva Systems Inc