|

市場調查報告書

商品編碼

1444961

氫氣:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Hydrogen Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

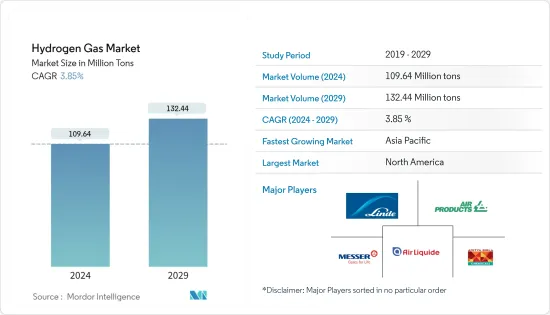

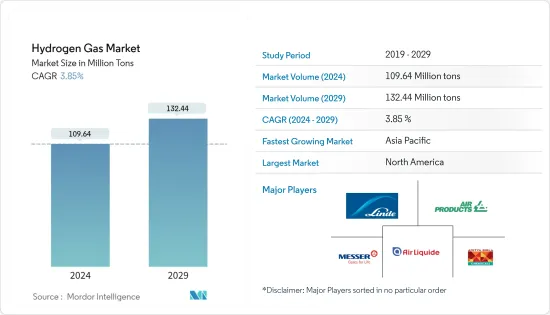

2024年氫氣市場規模預估為1,0964萬噸,預估至2029年將達到1,3,244萬噸,預測期內(2024-2029年)年複合成長率為3.85%成長。

COVID-19 大流行對 2020 年的市場產生了負面影響。由於疫情相關的限制,氫氣產量大幅下降。但2021年由於限制的放鬆和疫情情勢的好轉,略有成長。

主要亮點

- 從中期來看,化學工業需求的增加和煉油廠氫氣使用的擴大預計將成為所研究市場的促進因素。

- 另一方面,藍氫和綠氫的高生產成本以及不斷增加的運輸和儲存成本可能會阻礙市場成長。

- 太空探勘和航空的日益普及、燃料電池電動車需求的增加以及低碳經濟中該行業對氫的準備程度可能會在預測期內為市場帶來機會。

- 亞太地區在氫氣市場上佔據主導地位,並且由於中國和印度的巨大需求,預計將繼續佔據主導地位。

氫氣市場趨勢

氨產量主導市場需求

- 氨是世界各地生產的主要化學品之一。哈伯-博世工藝,也稱為非生物、人工或工業固氮,用於氨的工業工業。

- Haber 哈伯法由 Fritz Haber 和 Karl Bosch 在 1900 年代初期開發,是最傳統使用的同化氫氣生產氨的工業製程。該過程涉及大氣中的氮氣和氫氣在鈾、鋨等金屬催化劑存在下在高溫高壓下發生化學反應。

- 哈伯-博世製程所使用的氫氣通常從石化燃料原料中獲得。取得氫氣最常見的技術是透過天然氣原料與蒸氣在蒸氣重組中反應來獲得氫氣。氫氣也可以透過原油餾分的裂解和煤的部分氧化法過程來生產。

- 由於儲存和運輸氫氣的複雜性,氨和化肥生產廠通常由整合製氫裝置 (HGU)(改性)組成,這些裝置使用石化燃料等化石燃料。

- 2021年全球氨產量約1.5億噸,與前一年同期比較增加約2%。

- 2021年氨產量最高的地區是東亞,約6,460萬噸。中國是全球最大的氨生產國,2021年產量約3,900萬噸。

- 根據美國地質調查局的數據,美國是最大的氨生產國之一,16 家公司的 35 座設施生產了 1,400 萬噸氨。

- 估計佔氨市場 80% 佔有率的農業是氨作為化肥消費量增加的主要動力。東南亞是亞太地區主要化肥消費國,2021年中國佔亞太化肥市場42.5%的佔有率。根據記錄,亞洲對氮肥的需求極為重要,這為亞太地區工業固氮應用創造了巨大的氫氣需求潛力。

- 2022年7月,巴西公司Unigel在卡馬卡里工業開始建造全球最重要的綠色氫氨整合工廠。該廠初始產能為每年1萬噸綠色氫氣和6萬噸綠色氨。該計劃將耗資約1.2億美元,預計於2023年終啟動。

- 因此,預計上述因素將在未來幾年對市場產生重大影響。

亞太地區主導市場

- 亞太地區對氫氣的需求龐大。該地區是成長最快的地區,預計將繼續主導全球氫氣需求,佔氫氣總需求量的 45% 以上。

- 在亞太地區,中國和印度是全球最大的需求國之一,中國透過兩國的各種計劃主導了全球氫氣市場。

- 2022年3月,中國政府宣布了該國第一個長期氫能計劃,涵蓋2021年至2035年。該計劃的重點是逐步發展國內氫工業並獲得技術和製造能力。

- 邯鄲經濟技術開發區氫能裝備產業叢集計劃預計將利用陸域風電和電解製程生產氫氣。該計劃計劃於 2026 年啟動,生產的氫氣將用於行動和家庭供暖行業。

- 張家口陽原靖西新能源基地計劃將利用各種可再生資源和電解製程生產氫氣。該計劃計劃於 2024 年啟動。

- 2022年2月,印度政府宣布了新的綠氫能政策。該政策旨在幫助政府實現氣候變遷目標,並透過實現2030年生產500萬噸綠氫的目標,使印度成為綠氫中心。

- 印度新能源和可再生能源部表示,印度計劃在未來五到七年內斥資2億美元推廣低碳氫的使用。此外,政府也要求國家石油和天然氣公司在未來幾年內建立七個氫試點工廠。

- 此外,中國和印度的氨產量和需求位居世界前列,最終推動了這些國家的氫氣市場。

- 所有上述因素都可能在預測期內推動該地區氫市場的成長。

氫氣產業概況

氫氣市場趨於整合,主要參與者佔據了市場需求的很大佔有率。市場主要企業包括(排名不分先後)Air Liquide、Linde plc、Air Products and Chemicals, Inc、Aditya Birla Chemicals、Messer SE &Co. KGaA 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 化學工業的需求不斷增加

- 擴大煉油廠的氫氣使用

- 抑制因素

- 藍氫和綠氫生產成本高

- 運輸和倉儲成本高

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(市場規模(數量))

- 發行

- 管道

- 高壓長管拖車

- 圓柱

- 目的

- 氨

- 甲醇

- 精製

- 直接還原鐵 (DRI)

- 燃料電池汽車(FCV)

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- Aditya Birla Chemicals

- Air Liquide

- Air Products and Chemicals, Inc

- BASF SE

- Equinor ASA

- Gujarat Alkalies and Chemicals Limited

- Gulf Cryo

- Linde plc

- Lords Chloro Alkali Limited

- Matheson Tri-Gas Inc.

- Messer SE &Co. KGaA

- PAO NOVATEK

- TAIYO NIPPON SANSO CORPORATION

- Universal Industrial Gases Inc.

第7章市場機會與未來趨勢

- 太空探勘和航空業的採用率增加

- 燃料電池電動車的需求不斷增加

- 低碳經濟中工業的氫氣準備就緒

The Hydrogen Gas Market size is estimated at 109.64 Million tons in 2024, and is expected to reach 132.44 Million tons by 2029, growing at a CAGR of 3.85% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market in 2020. Due to restrictions associated with the pandemic, hydrogen gas production decreased significantly. However, with the relaxation in regulations and improvement in the pandemic situation, it slightly increased in 2021.

Key Highlights

- Over the medium term, increasing demand from the chemical Industry and expanding usage of hydrogen in refineries are likely to act as driving factors for the market studied.

- On the flip side, the high production cost of blue and green hydrogen and increased transportation and storage cost is likely to hamper the market's growth.

- Increased space exploration and aviation adoption, increasing demand for fuel cell electric vehicles, and industry readiness of hydrogen in a low carbon economy are likely to act as an opportunity for the market over the forecast period.

- The Asia-Pacific region is dominating the market for hydrogen gas and is expected to remain dominating owing to massive demand from China and India.

Hydrogen Gas Market Trends

Ammonia Production to Dominate the Market Demand

- Ammonia is one of the leading chemicals produced across the world. The industrial production of ammonia uses the Haber-Bosch process, also referred to as abiotic or artificial, or industrial nitrogen fixation.

- The Haber-Bosch process, developed by Fritz Haber and Carl Bosch in the early 1900s, is the most conventionally used industrial process for producing ammonia in assimilation with hydrogen. The process involves a chemical reaction between atmospheric nitrogen and hydrogen in the presence of a metal-based catalyst, such as Uranium, Osmium, etc., at high temperature and pressure.

- Hydrogen used in the Haber-Bosch process is typically derived from fossil fuel feedstocks. The most prevalent technique for sourcing hydrogen is the reaction of natural gas feedstocks with steam in a steam reforming unit for deriving hydrogen. Hydrogen is also produced from cracking crude oil fractions or subjecting coal to partial oxidation processes.

- Due to hydrogen gas's storage and transportation complexities, ammonia and fertilizer production plants usually comprise integrated hydrogen generation units (HGUs) (i.e., reformers) fed with fossil fuels, such as natural gas and others.

- In 2021, global ammonia production amounted to around 150 million metric tons, registering an increase of about 2% compared to the previous year.

- East Asia had the highest ammonia production in 2021, with approximately 64.6 million metric tons. China is the top ammonia producer globally, producing around 39 million metric tons in 2021.

- According to the U.S. geological survey, the United States is one of the largest ammonia producers, producing 14 million metric tons at 35 facilities belonging to 16 companies.

- The agriculture industry, with an estimated share of 80% in the ammonia market, is the primary driver of the rising ammonia consumption in fertilizers. Southeast Asia is the major fertilizer consumer in Asia-Pacific, with China representing a 42.5% share in the Asia-Pacific fertilizer market in 2021. The demand for nitrogenous fertilizers in Asia is recorded as vital, creating a huge demand potential for hydrogen gas in industrial nitrogen fixation applications.

- In July 2022, the Brazilian company Unigel began constructing the world's most significant integrated green hydrogen and ammonia plant in the Camacari Industrial Complex. The plant will have an initial production capacity of 10,000 tons per year of green hydrogen and 60,000 tons per year of green ammonia. Costing around USD 120 million, the project will come on stream by the end of 2023.

- Therefore, the above factors are expected to impact the market in the coming years significantly.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific accounts for an enormous demand for hydrogen gas. It is estimated to be the fastest-growing region and to remain at the dominant position in global hydrogen gas, accounting for more than 45% of the total demand for hydrogen gas.

- In the Asia-Pacific region, China and India are among the largest countries in the world with the highest demand, with China dominating the global market for hydrogen gas owing to various projects in the countries.

- In March 2022, the Chinese government released the country's first-ever long-term plan for hydrogen, covering the period of 2021-2035. The program is focused on a phased approach to developing a domestic hydrogen industry and mastering technologies and manufacturing capabilities.

- Hydrogen Energy Equipment Industrial Cluster Project in Handan Economic and Technological Development Zone is expected to generate hydrogen using onshore wind and electrolysis process. The project is expected to come online in 2026, and the hydrogen produced will be used in the mobility and domestic heating industries.

- Zhangjiakou Yangyuan Jingxi New Energy Base Project will generate hydrogen using various renewable sources and electrolysis processes. The project is expected to come online in 2024.

- In February 2022, the government of India announced a new green hydrogen policy. The policy aims to help the government meet its climate targets and make India a green hydrogen hub by reaching the production target of 5 million tons of green hydrogen by 2030.

- According to the Ministry of New and Renewable Energy, India will spend USD 200 million over the next five to seven years to promote the use of low-carbon hydrogen. Moreover, the government asked its state-run oil and gas companies to set up seven hydrogen pilot plants in the next few years.

- Furthermore, ammonia production and demand in China and India stand at the top globally, ultimately driving the hydrogen gas market in these countries.

- All the factors mentioned above are likely to see growth in the Hydrogen market in the region over the forecasted period.

Hydrogen Gas Industry Overview

The hydrogen gas market is consolidated, where major players hold a significant share of the market demand. Some of the major players in the market include (not in any particular order) Air Liquide, Linde plc, Air Products and Chemicals, Inc, Aditya Birla Chemicals, and Messer SE & Co. KGaA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand From Chemical Industry

- 4.1.2 Expanding Usage Of Hydrogen In Refinery

- 4.2 Restraints

- 4.2.1 High Production Cost Of Blue And Green Hydrogen

- 4.2.2 High Transportation And Storage Cost

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Distribution

- 5.1.1 Pipelines

- 5.1.2 High-Pressure Tube Trailers

- 5.1.3 Cylinders

- 5.2 Application

- 5.2.1 Ammonia

- 5.2.2 Methanol

- 5.2.3 Refining

- 5.2.4 Direct Reduced Iron (DRI)

- 5.2.5 Fuel Cell Vehicles (FCV)

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aditya Birla Chemicals

- 6.4.2 Air Liquide

- 6.4.3 Air Products and Chemicals, Inc

- 6.4.4 BASF SE

- 6.4.5 Equinor ASA

- 6.4.6 Gujarat Alkalies and Chemicals Limited

- 6.4.7 Gulf Cryo

- 6.4.8 Linde plc

- 6.4.9 Lords Chloro Alkali Limited

- 6.4.10 Matheson Tri-Gas Inc.

- 6.4.11 Messer SE & Co. KGaA

- 6.4.12 PAO NOVATEK

- 6.4.13 TAIYO NIPPON SANSO CORPORATION

- 6.4.14 Universal Industrial Gases Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Adoption In Space Exploration And Aviation Industry

- 7.2 Increasing Demand For Fuel Cell Electric Vehicles

- 7.3 Industry Readiness Of Hydrogen In Low Carbon Economy