|

市場調查報告書

商品編碼

1444921

固定 LTE:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029 年)Fixed LTE - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

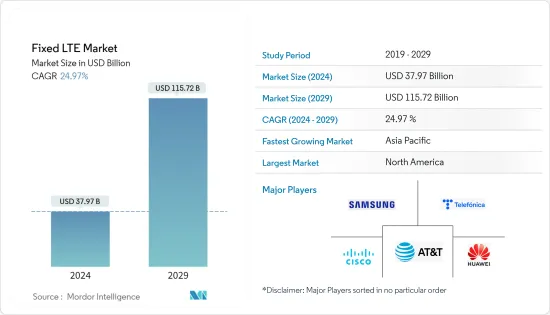

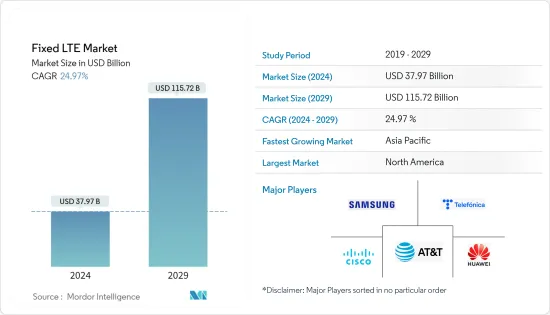

預計2024年固定LTE市場規模為379.7億美元,預計到2029年將達到1157.2億美元,在預測期內(2024-2029年)成長24.97%,預計將以年複合成長率成長。

主要亮點

- 根據聯合國電訊統計,全球約有 270 萬人從未使用過網路服務。因此,隨著世界各地的電信業者和政府努力為每個家庭提供網路接入,成長潛力很大。網路存取是一項基本權利,數位素養可以幫助人們、企業和政府在經濟上取得成功。

- 2022 年 12 月,微軟和 Viasat 聯手為世界各地的貧困社區提供網路存取。 Microsoft Airband Initiative 的目標是到年終將全球網路覆蓋範圍擴大到 500 萬人。兩家公司計劃將連結和數位素養引入關鍵市場,以改善醫療保健、教育和經濟機會。 Microsoft 及其合作夥伴以及 Airband 已經為超過 5,100 萬人提供高速網路存取。其中超過 400 萬人生活在美國服務水準低的農村地區,另外 4,700 萬人生活在美國以外的 16 個欠低度開發國家。

- COVID-19 大流行大大改變了我們的生活、工作、學習和經商方式。現在人們需要高速網路來獲取服務、支援和機會。世界各國政府都在大力投資擴大農村和偏遠地區的寬頻服務。

- 2022年9月,印度政府宣布投資300億美元,在農村地區建立強大的數位基礎設施,確保全國每個村莊都能接入4G和5G最後一哩網路。為了給全國每個村莊帶來優質、快速的寬頻連接,並使村莊參與發展過程,政府目前正在開發一個完整的鄉村企業家生態系統。

- 不存在阻礙固定 LTE 市場成長的重大挑戰。然而,客戶駐地設備(CPE)的高成本阻礙了網路安裝。隨著越來越多的製造商加入市場,價格可能會下降,固定 LTE 的擴張可能會進一步加速。

固定 LTE 市場趨勢

住宅類用戶預計佔比較大

- 由於多種因素,包括人們從選擇、線上教育、視訊串流、網路研討會、視訊通話等轉向工作,住宅對固定 LTE 的需求迅速成長。服務供應商已經認知到需要強大的系統來為其用戶提供不間斷的網路。他們正在為家庭或住宅用戶投資固定 LTE 技術,預計這將對預測期內的市場成長產生積極影響。

- 2023 年 1 月,Consistent Infosystems 推出了一款無線雙頻 4G 路由器,可與以乙太網路為基礎的WAN 和 GSM 網路搭配使用。對於需要在農場、田地、倉庫、車庫、庭院等進行遠端連接或監控,但需要訪問本地 ISP 或本地網際網路受限的農村地區的人來說,這款路由器可以說是一個福音。

- 2022 年 6 月,南非 ISP(網路服務供應商)Supersonic 透過推出固定 LTE 家庭解決方案擴展了其寬頻產品組合。 FLTE 計劃和 5G 網路技術為 125 個地點的居民提供無限的資料連接。使用者將多個裝置連接到一個網路基地台。

- 2022 年 10 月,Bharati Telecom 在印度推出了 Always On 物聯網連接解決方案。這使得 IoT 設備能夠在 eSIM 內維持與不同行動網路營運商的行動網路的連線。此連接對於車輛追蹤或在遠端位置運行的設備需要通用連接時非常有用。

北美佔有很大的市場佔有率

- T-Mobile 和 Verison 主導了北美家庭網路市場 (FWA)。根據 T-Mobile 第三季業績,該公司新增 578,000 名家庭網路 (FWA) 客戶,總合達到 210 萬。同期,Verison 新增 234,000 名 FWA 用戶,使總合超過 62 萬名。 Version 也為企業提供 FWA,擁有超過 44 萬名客戶。

- 愛立信預計,到 2027 年,北美地區的 FWA 連線數將達到約 2.3 億個。在同一項研究中,愛立信收集了全球 311 家服務供應商的資料,其中 238 家已經提供固定無線存取。

- 根據諾基亞的一份報告,90% 的美國都使用網路解決方案。超過 50% 的美國電信業者固定寬頻線路由諾基亞的固定網路提供支援。

- 2022 年 1 月,加拿大政府進行了大量投資,為農村和偏遠地區的居民提供高速網路連線。政府已宣佈為兩個計劃提供資金,這兩個項目將為安省 Flamborough 和 Limehouse 附近農村社區的 310 個家庭提供高速網路。加拿大政府將向通用寬頻基金(UBF)快速回應流投資 27.5 億美元,以實現到 2030 年實現 100% 連接的目標,並到 2026 年為加拿大人提供 98% 連接的目標。高速網路。

- 2022年4月,USCellular與高通、Inseego合作推出家庭網路+解決方案。此解決方案為居民和企業提供高速無線網路存取。這項5G毫米波高速網路服務最初將在約10個城市提供,速度輸出高達300Mbps。這比 4G LTE 家庭網路速度提高了 10-15 倍。透過美國蜂窩家庭網路服務,超過 1,220 萬個家庭可以使用無限的 4G、5G 或 5G 毫米波家庭連線。

固網LTE產業概況

由於參與者眾多,固定 LTE 市場競爭非常激烈。 AT&T、華為技術有限公司和思科系統公司等市場領導不斷創新,這使他們比其他小型公司更具競爭優勢。為了承受價格競爭,公司定期改變定價結構並提供客製化套餐以滿足客戶需求。

- 2023 年 1 月:在巴塞隆納,考克斯有線電視公司向農村社區推廣行動服務和簡單的支付計畫。我們特別針對沒有無限資料方案的客戶推出了 Pay As You Gig 計畫。利用無線作為停電期間消費者的安全網並優先考慮綜合服務的速度是該公司未來展望的一部分。

- 2022 年 10 月:利比亞郵政通訊和資訊科技公司 (LPTIC) 將與思科合作實施數位轉型和資料自動化領域的計劃。該計分類析了未來的商業領域,例如智慧公司、城市和國家,以供未來投資。

- 2022 年 10 月:沃達豐與法國通訊公司 Altice 合作,在德國建造價值 68 億美元的光纖寬頻網路。這可能有助於它擊敗德國電信等其他通訊競爭對手。憑藉 Altice 的行業專業知識和成熟的光纖建設能力,該協議將有助於擴大沃達豐下一代網路的覆蓋範圍。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與限制因素簡介

- 市場促進因素

- 公共安全 LTE 的採用率有所提高

- 農村地區對高速寬頻的需求不斷增加

- 與 DSL、光纖和電纜相比,固定 LTE 前景樂觀

- 市場限制因素

- 網路效能問題

- 價值鏈分析

- 產業吸引力波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間敵對的強度

第5章市場區隔

- 依使用者類型

- 住宅

- 商業的

- 按解決方案類型

- LTE基礎設施

- 其他解決方案類型(室內CPE、室外CPE)

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 亞太地區其他地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Huawei Technologies Co. Ltd

- Arris International PLC

- Netgear Inc.

- Sagemcom SAS

- Technicolor SA

- ZyXel Communications Corp

- ZTE Corporation

- Telenet Systems Pvt. Ltd

- Aztech Group Ltd

- Shenzhen Zoolan Technology Co. Ltd

- L-com Global Connectivity

- Samsung Group

- Motorola Solutions Inc.

- Telrad Networks Ltd

- Teltronics(Hytera)

- Telefonica SA

- AT&T Inc.

- Cisco Systems Inc.

- Datang Telecom Technology&Industry Group

第7章 投資分析

第8章市場機會與未來趨勢

The Fixed LTE Market size is estimated at USD 37.97 billion in 2024, and is expected to reach USD 115.72 billion by 2029, growing at a CAGR of 24.97% during the forecast period (2024-2029).

Key Highlights

- According to the International Telecommunication Union the UN, around 2.7 million people worldwide have never used internet services. Therefore growth potential is high as telecom companies and Governments worldwide strive to get every house access to the internet. Internet access is a fundamental right, and digital literacy helps people, businesses, and governments succeed economically.

- In December 2022, Microsoft and Viasat collaborated to provide underprivileged communities worldwide with internet access. Microsoft Airband Initiative will increase internet availability to 5 million people worldwide by the end of 2025. The duo plans to bring connectivity and digital literacy to critical markets for improved healthcare, education, and economic opportunities. Microsoft and its partners, along with Airband, have already provided high-speed internet access to more than 51 million people, including over 4 million in underserved rural areas of the United States and an additional 47 million in 16 underdeveloped nations outside of the United States.

- The COVID-19 pandemic has drastically changed how we live, work, learn, and conduct business. People now demand high-speed internet to access services, support, and opportunities. Governments around the world are investing heavily in the expansion of broadband services in rural and remote areas.

- In September 2022, the Government of India announced an investment of USD 30 billion to establish a robust digital infrastructure in rural areas and guarantee last-mile network accessibility for 4G and 5G in every village nationwide. To bring high-quality, fast broadband connectivity to every village in the nation and to include them in the growing process, The Government is now developing an entire ecosystem of village entrepreneurs.

- No big challenge can hamper the growth of the fixed LTE market. However, the high cost of customer premises equipment (CPE) will slow the installation of networks. Once more producers join the market, prices may decrease, and the expansion of Fixed LTE will become faster.

Fixed LTE Market Trends

Residential Type of User Expected to Account for Significant Share

- The demand for fixed LTE in residential areas took a steep rise because of multiple factors like people turning to work from options, online education, video streaming, webinars, video calling, and more. The service providers realized the need for a robust system to provide users with an interruption-free network. They invested in fixed LTE technology for home or residential users, which is expected to impact the market's growth over the forecast period positively.

- In January 2023, Consistent Infosystems launched Wireless Dual Band 4G Router that works on local ethernet-based WAN and a GSM network. The router will be a boon to people who need remote connectivity or surveillance in farms, fields, warehouses, garages, terraces, etc. but need access to a local ISP or rural locations with restricted local internet.

- In June 2022, Supersonic, the South African ISP (internet service provider), expanded its broadband portfolio by launching Fixed-LTE Home Solutions. The FLTE plans and 5G network technology will serve residents in 125 locations with unlimited data connectivity. Users will be to connect multiple devices to a single access point.

- In October 2022, Bharati Telecom launched the Always On IoT connectivity solution in India, which allows an IoT device to remain connected to a mobile network from different mobile network operators in the eSIM. The connectivity will be helpful in vehicle tracking or in cases where universal connectivity is required for equipment working in remote locations.

North America Accounts for Significant Share in the Market

- T-Mobile and Verison have dominated North America's home internet market (FWA). According to the third quarter earnings of T-mobile, the telecom had added 0.578 million home internet (FWA) customers to take its total to 2.1 million. During the same period, Verison added 0.234 million FWA users to take its total to more than 0.62 million. Version also provides FWA to businesses and has more than 0.44 million customers for the same.

- Ericsson estimates that North America will have roughly 230 million FWA connections by 2027. In the same study, Ericsson captured the data for 311 global service providers, of which 238 already have a fixed wireless access offering.

- A report by Nokia states that 90% of the US population is connected to network solutions. More than 50% of the telco fixed broadband lines in the United States are powered by Nokia's fixed networks.

- In January 2022, the Government of Canada was investing heavily to connect residents of rural and distant regions to high-speed Internet. The government announced funding for two projects that will bring high-speed Internet to 310 households in rural areas near Flamborough and Limehouse, Ontario. By investing USD 2.75 billion in the UBF (Universal Broadband Fund) Rapid Response Stream, the Canadian government hopes to reach its goal of 100% connectivity by 2030 and connect 98% of Canadians to high-speed Internet by 2026.

- In April 2022, USCellular, in partnership with Qualcomm and Inseego, launched the Home Internet+ solution. The solution provides high-speed internet access wirelessly to residents as well as businesses. This 5G mmWave high-speed internet service will initially be available in parts of 10 cities with a speed output of up to 300 Mbps, a 10 to 15-fold improvement over its 4G LTE home internet speed. More than 12.2 million households can access unlimited 4G, 5G or 5G mmWave in-home connectivity with UScellular's Home Internet service.

Fixed LTE Industry Overview

The fixed LTE market is highly competitive because of many players. Market leaders like AT&T, Huawei Technologies, and Cisco Systems constantly work towards innovation, which gives with a competitive advantage over other smaller players. To withstand price competency, the companies regularly alter their pricing schemes and offer customized packages per customer needs.

- January 2023 - In Barcelona, Cox cable player promotes mobile services and simple payment plans for rural communities. It launched the Pay As You Gig plan, especially for customers without an unlimited data plan. Leveraging wireless as a consumer safety net during outages and prioritized speeds for converged services are some of the future outlooks of the company.

- October 2022 - Libyan Post, Telecommunication and Information Technology Company (LPTIC) collaborated with Cisco, intending to execute projects in the digital transformation and data automation fields. The project will analyze prospective business areas like smart companies, cities, and countries for future investment.

- October 2022 - Vodafone and French Telecom player Altice partnered to build Germany's 6.8 billion USD fiber broadband network. This will help beat the other telecom sector rivals, like Deutsche Telekom. With Altice's industrial expertise and proven fiber-to-the-home construction capabilities, the deal will help Vodafone expand its reach of the next-generation network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increased Adoption of Public Safety LTE.

- 4.3.2 Growing Demand For High Speed BroadBand In Rural Areas

- 4.3.3 Positive Outlook of Fixed LTE Compared to DSL, Fiber and Cable

- 4.4 Market Restraints

- 4.4.1 Network Performance Concerns

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type of User

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.2 By Type of Solution

- 5.2.1 LTE Infrastructure

- 5.2.2 Other Solution Types (Indoor CPE, Outdoor CPE)

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of the Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Huawei Technologies Co. Ltd

- 6.1.2 Arris International PLC

- 6.1.3 Netgear Inc.

- 6.1.4 Sagemcom SAS

- 6.1.5 Technicolor SA

- 6.1.6 ZyXel Communications Corp

- 6.1.7 ZTE Corporation

- 6.1.8 Telenet Systems Pvt. Ltd

- 6.1.9 Aztech Group Ltd

- 6.1.10 Shenzhen Zoolan Technology Co. Ltd

- 6.1.11 L-com Global Connectivity

- 6.1.12 Samsung Group

- 6.1.13 Motorola Solutions Inc.

- 6.1.14 Telrad Networks Ltd

- 6.1.15 Teltronics (Hytera)

- 6.1.16 Telefonica SA

- 6.1.17 AT&T Inc.

- 6.1.18 Cisco Systems Inc.

- 6.1.19 Datang Telecom Technology & Industry Group