|

市場調查報告書

商品編碼

1444867

實驗室過濾 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Laboratory Filtration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

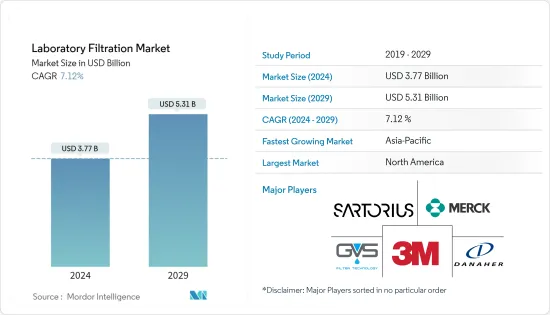

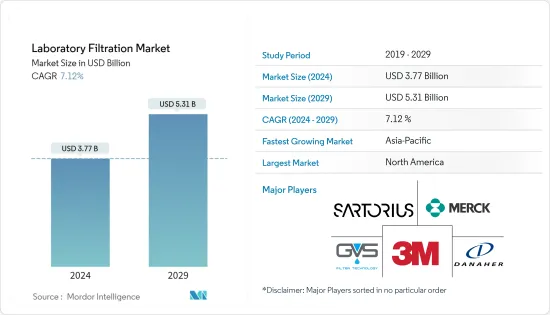

實驗室過濾市場規模預計到 2024 年為 37.7 億美元,預計到 2029 年將達到 53.1 億美元,在預測期內(2024-2029 年)CAGR為 7.12%。

COVID-19 的爆發影響了實驗室過濾市場。大流行期間對疫苗開發和製造的需求不斷增加,增加了實驗室過濾的採用。疫苗的生產採用各種過濾技術。例如,根據 NCBI 2021 年 4 月發布的研究報告,在 COVID-19 大流行期間,疫苗生產簡化了新的純化和過濾方法,以擴大生產規模。同一消息人士還表示,密西根理工大學的研究人員創建了新流程來改進純化和過濾步驟,佔疫苗製造成本的 50.0% 至 70.0%。實驗室過濾設備是進行疫苗過濾程序的基本要求。因此,這種有利於疫苗接種的措施的增加可能會增加疫苗產量,進而可能推動對實驗室過濾的需求。因此,疫情對市場產生了積極影響,預計在預測期內將繼續呈上升趨勢。

實驗室過濾領域新的變革性創新技術的推出、有利於疫苗接種的舉措的增加、有利的患者人口統計以及新生兒和兒童疫苗接種的增加是市場的主要驅動力。例如,2021年10月,VisakhaAgency啟動了「Tika Express」計劃,以加快疫苗接種速度。流動貨車將醫務人員運送到偏遠地區,透過組織營地為現場人員注射疫苗。此外,2022 年 8 月舉辦了全國免疫宣傳月,以提高人們對疫苗接種對於預防慢性和致命疾病的重要性的認知。此外,2022 年 11 月,Touchligh 正在進一步推進其專有的狗骨 DNA 疫苗平台的臨床前開發。其最新研究由比爾及梅琳達蓋茲基金會的一項新撥款資助。比爾及梅琳達蓋茲基金會向 Touchlight 授予 240 萬美元資金,以進一步推進其狗骨 DNA 疫苗平台的臨床前開發。這種有利於疫苗接種的措施的增加可能會增加疫苗產量,從而推動對實驗室過濾的需求。因此,預計在預測期內市場將出現相當大的成長。

有利的患者人口統計數據以及新生兒和兒童疫苗接種的增加也推動了市場的成長。例如,根據美國兒科學會發表的資料,2022年3月,美國有超過100萬人長期感染B型肝炎,嬰兒時期感染B型肝炎的人中有90%患有B型肝炎。一生中患有肝癌等嚴重慢性疾病的機會。據同一來源稱,美國每年有 400 萬人感染水痘。超過1萬人住院,100多人死亡。輕微的病例可能會導致孩子缺課一周或更長時間。此外,小兒麻痺病毒仍在美國境外傳播,未接種疫苗的兒童也面臨風險。為了克服和降低發病率、死亡率和經濟損失,越來越多的新生兒和兒童接種疫苗,預計將加快疫苗的生產速度。由於實驗室過濾是疫苗生產的重要步驟,因此疫苗生產速度的提高預計將推動實驗室過濾的需求,從而推動市場成長。

然而,消毒級過濾器的重複使用和專用過濾器的高成本可能會阻礙預測期內的市場成長。

實驗室過濾市場趨勢

預計超濾領域將在預測期內顯著成長

超濾是從液體中分離極小顆粒和溶解分子的過程。分離的主要依據是分子的大小,儘管過濾器的滲透性可能受到樣品的化學、分子或靜電特性的影響。要用超濾分離,分子的大小必須相差至少一個數量級,且分子量必須在 1 kDa 到 1000 kDa 之間。超濾膜可用於清潔濾液或收集滯留物。它通常用於從緩衝液成分中分離蛋白質,以進行緩衝液交換、濃縮或脫鹽。

超濾的優勢和廣泛適用性,例如蛋白質純化和分離、疫苗製造以及研發投資的增加,是該區隔市場成長的主要驅動力。例如,根據 NCBI 於 2021 年 1 月發表的研究報告,蛋白質的濃縮產品或分離物可能是有益的,其中超濾等膜過濾方法包括在多種蛋白質來源中的應用。此外,超濾技術的優勢,例如高產品通量和快速產生結果的能力,也促進了超濾的使用。此外,色譜等傳統技術需要複雜的儀器支援才能有效運行,並且以極高的成本產生低通量的產品,由於超濾技術克服了這些缺點,因此變得越來越流行。

預計疫苗需求的增加也將推動該領域的成長。例如,2022 年2 月,印度聯邦衛生和家庭福利部部長曼蘇赫·曼達維亞(Mansukh Mandavia) 博士在印度啟動了2022 年國家脊髓灰質炎免疫運動,向衛生和家庭福利部的五歲以下兒童注射小兒麻痺疫苗。因此,疫苗需求的增加預計將激增疫苗產量,推動區隔市場的成長,因為疫苗超濾是疫苗生產和製造的重要步驟之一。因此,超濾、廣泛適用性和疫苗產量增加的優勢預計將推動該領域在預測期內的成長。

預計北美在預測期內將大幅成長

預計北美在預測期內將大幅成長。這一成長歸因於公共和私營部門研究工作的增加以及研發投資的增加。例如,根據美國研究中心2022年1月發布的報告,預計2021年美國醫療健康研發投資超過2,451.27億美元,而2020年約為2,214.38億美元。報道也稱,產業企業的研發投入也較前幾年增加。 2021年,分產業投資超過1,617.66億美元,而2020年則為1,482.05億美元左右。因此,投資的增加表明公共和私營部門都在專注於開發新的和先進的產品,這可能為實驗室過濾市場創造新的機會。因此,預計這些因素將促進北美市場的成長。

關鍵產品的發布、市場參與者或製造商在該地區的高度集中以及主要參與者之間的收購和合作夥伴關係是市場的主要驅動力。此外,美國生物製藥公司加大研發投入也推動了該國實驗室過濾市場的成長。例如,2021 年 10 月,美國國家生物製藥創新研究所 (NIIMBL) 批准撥款 300 萬美元,用於六種新的生物製藥製造設備。北卡羅來納州立大學、麻薩諸塞大學、喬治亞大學、密西根大學、德拉瓦大學和卡內基美隆大學等機構將獲得資助。區域研發投資的增加預計將推動市場成長。此外,薄膜過濾器和相關過濾系統新產品的推出可能會推動該地區預測期內的市場成長。例如,2021 年 11 月,杜邦水解決方案 (DWS) 推出了 TapTec LC HF-4040 逆滲透膜過濾器,該過濾器兼具高流量和可靠性。因此,由於該國在研發和產品推出方面的投資增加,預計在預測期內美國市場將出現可觀的成長。

實驗室過濾產業概述

實驗室過濾市場的競爭必將加劇,因為一些主要參與者正致力於透過收購和與公司合作來擴大其實驗室過濾產品組合。研究的市場預計將為新參與者以及目前已建立的市場領導者提供一些機會。競爭格局包括對一些擁有市場佔有率且知名的國際和本地公司的分析,包括 3M 公司、默克公司、丹納赫公司(頗爾公司)、賽多利斯集團和 GVS SpA 等。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 推出實驗室過濾新變革與創新技術

- 增加有利於疫苗接種的舉措

- 有利的患者人口統計和新生兒和兒童疫苗接種的增加

- 市場限制

- 滅菌級過濾器的重複使用和專用過濾器的高成本

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 依技術

- 微濾

- 超濾

- 逆滲透

- 真空過濾

- 納濾

- 依產品分類

- 過濾介質

- 薄膜過濾器

- 濾紙

- 過濾微孔板

- 無注射器過濾器

- 注射式過濾器

- 囊式過濾器

- 過濾組件

- 微濾組件

- 超濾組件

- 真空過濾組件

- 逆滲透組件

- 納濾組件

- 過濾配件

- 過濾介質

- 地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 亞太地區其他地區

- 中東和非洲

- 海灣合作理事會

- 南非

- 中東和非洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第 6 章:競爭格局

- 公司簡介

- 3M

- Merck KGaA

- Danaher Corporation (Pall Corporation)?

- Sartorius Group

- GVS SpA

- Cole-Parmer Instrument Company LLC

- Agilent Technologies Inc.

- Ahlstrom-Munksjo

- Abcam PLC

- Purolite

第 7 章:市場機會與未來趨勢

The Laboratory Filtration Market size is estimated at USD 3.77 billion in 2024, and is expected to reach USD 5.31 billion by 2029, growing at a CAGR of 7.12% during the forecast period (2024-2029).

The outbreak of COVID-19 has impacted the laboratory filtration market. The increasing demand for vaccine development and manufacturing during the pandemic has increased the adoption of laboratory filtration. Various filtration techniques are used for the manufacturing of vaccines. For instance, according to the NCBI research study published in April 2021, new purification and filtration methods were streamlined for vaccine manufacturing to scale up production during the COVID-19 pandemic. The same source also stated that researchers at Michigan Technological University created new processes to improve the purification and filtration step, which accounts for 50.0% to 70.0% of a vaccine's manufacturing costs. Laboratory filtration equipment is an essential requirement for carrying out vaccine filtration procedures. Thus, such an increase in initiatives favoring vaccinations may increase vaccine production, which in turn may propel the demand for laboratory filtration. Therefore, the pandemic positively impacted the market and is expected to continue the upward trend over the forecast period.

The launch of new, transforming, and innovative technology in lab filtration, an increase in initiatives favoring vaccinations, favorable patient demographics, and growing vaccinations of newborns and children are the major drivers for the market. For instance, in October 2021, the 'Tika Express program was launched to speed up vaccination in VisakhaAgency. The mobile vans carried the health staff to far-flung areas, where vaccines are administered to people on the spot by organizing camps. Additionally, in August 2022, National Immunization Awareness Month was conducted to raise awareness about how important vaccination is to prevent chronic and fatal diseases. Furthermore, in November 2022, Touchligh is furthering the pre-clinical development of its proprietary doggybone DNA vaccine platform. Its latest research is financed by a new grant from the Bill & Melinda Gates Foundation. The Bill & Melinda Gates Foundation awarded Touchlight USD 2.4 million in funding to further the preclinical development of its doggybone DNA vaccine platform. Such an increase in initiatives favoring vaccinations may increase vaccine production, propelling the demand for laboratory filtration. Thus, considerable market growth is expected over the forecast period.

The favorable patient demographics and growing vaccinations of newborns and children are also driving the market growth. For instance, according to data published by the American Academy of Pediatrics, in March 2022, more than 1 million people in the United States have long-term hepatitis B infections, and people who are infected with hepatitis B as a baby have a 90% chance of developing serious, chronic conditions like liver cancer in their lifetime. As per the same source, chickenpox infects 4 million people in the United States every year. More than 10,000 were hospitalized, and more than 100 died. A mild case can cause a child to miss school for a week or more. Additionally, the polio virus is still circulating outside the United States, and unvaccinated children are at risk. To overcome and reduce morbidity, mortality, and economic toll, there is a growing vaccination for newborns and children, which is expected to accelerate the manufacturing rate of vaccines. Since laboratory filtration is an essential step for vaccine manufacturing, thus increasing rate of vaccine manufacturing is expected to propel the demand for laboratory filtration, thereby surging the market growth.

However, the reuse of sterilizing-grade filters and the high cost of specialized filters is likely to impede the market growth over the forecast period.

Laboratory Filtration Market Trends

Ultrafiltration Segment is Expected to Witness Significant Growth Over the Forecast Period

Ultrafiltration is the process of separating extremely small particles and dissolved molecules from liquids. The primary basis for separation is the size of the molecules, although the permeability of the filter can be affected by the sample's chemical, molecular or electrostatic properties. To be separated by ultrafiltration, molecules must differ in size by at least an order of magnitude and have a molecular weight between 1 kDa and 1000 kDa. Ultrafiltration membranes can be used to clean the filtrate or collect the retentate. It is typically used to separate proteins from buffer components for buffer exchange, concentration, or desalting.

The advantages and wide applicability of ultrafiltration, such as protein purification and isolation, vaccine manufacturing, and increased investments in research and development, are the major drivers for segment growth. For instance, according to the NCBI research study published in January 2021, proteins could be beneficial in their concentrated products or isolates, of which membrane filtration methods such as ultrafiltration include application in a wide range of protein sources. Furthermore, the advantages of ultrafiltration technology, such as the high product throughput and ability to generate rapid results, also boost the use of ultrafiltration. Moreover, traditional techniques such as chromatography require complex instrumentation support to run efficiently and yield low throughput of product at an extremely high cost owing to which ultrafiltration technique is becoming more popular as it overcomes such disadvantages.

The increased demand for vaccines is also anticipated to propel the segment's growth. For instance, in February 2022, Union Minister for Health and Family Welfare Dr. Mansukh Mandavia launched the National Polio Immunization Drive for 2022 in India by administering polio drops to children below five years of age in the Ministry of Health and Family Welfare. Thus, increased demand for vaccines is expected to surge vaccine production, propelling segment growth as vaccine ultrafiltration is one of the essential steps in the production and manufacture of vaccines. Therefore, the advantages of ultrafiltration, wide applicability, and increased vaccine production are anticipated to propel the segment growth over the forecast period.

North America is Expected to Witness Considerable Growth Over the Forecast Period

North America is expected to witness considerable growth over the forecast period. The growth is due to increasing research work and rising investments in research and development by the public and private sectors. For instance, as per the report published by Research America in January 2022, the estimated Medical and Health R&D Investment in the United States was more than USD 245,127 million in 2021, whereas in 2020, it was around USD 221,438 million. It also reported that the investment in R&D by industrial players has also increased from the previous years. In 2021, the investment by industry was more than USD 161,766 million, whereas, in 2020, it was around USD 148,205 million. Therefore, increased investment indicates that both public and private sectors are focusing on developing new and advanced products, which may create new opportunities for the laboratory filtration market. Therefore, these factors are anticipated to promote market growth in North America.

The key product launches, high concentration of market players or manufacturer's presence in the region, and acquisition & partnerships among major players are the major drivers for the market. In addition, increased investments by biopharmaceutical companies in R&D in the United States are also driving the growth of the laboratory filtration market in the country. For instance, in October 2021, the United States National Institute for Innovation in Manufacturing Biopharmaceuticals (NIIMBL) approved a USD 3.0 million grant for six new biopharmaceutical manufacturing devices. North Carolina State University, the University of Massachusetts, the University of Georgia, the University of Michigan, the University of Delaware, and Carnegie Mellon University are among the institutions that will receive funding. The increase in regional R&D investments is expected to boost market growth. Further, new product launches of membrane filters and related filtering systems are likely to fuel market growth over the forecast period in the region. For instance, in November 2021, DuPont Water Solutions (DWS) introduced the TapTec LC HF-4040 reverse osmosis membrane filter, which combines high flow rates with reliability. Therefore, owing to increased investments in research and development and product launches in the country, considerable market growth is expected in the United States over the forecast period.

Laboratory Filtration Industry Overview

The Laboratory Filtration Market competition is set to intensify, as several key players are focusing on the expansion of their laboratory filtration portfolio through acquisition and collaboration with companies. The market studied is expected to open up several opportunities for new players, as well as currently established market leaders. The competitive landscape includes an analysis of a few international and local companies that hold market shares and are well known, including 3M Company, Merck KGaA, Danaher Corporation (Pall Corporation), Sartorius Group, and GVS S.p.A among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defination

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Launch of New Transforming and Innovative Technology in Lab Filtration

- 4.2.2 Increase In Initiatives Favoring Vaccinations

- 4.2.3 Favourable Patient Demographics and Growing Vaccinations of Newborns and Children

- 4.3 Market Restraints

- 4.3.1 Reuse of Sterilizing-Grade Filters and High Cost of Specialized Filters

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Technology

- 5.1.1 Microfiltration

- 5.1.2 Ultrafiltration

- 5.1.3 Reverse Osmosis

- 5.1.4 Vacuum Filtration

- 5.1.5 Nanofiltration

- 5.2 By Product

- 5.2.1 Filtration Media

- 5.2.1.1 Membrane Filters

- 5.2.1.2 Filter Papers

- 5.2.1.3 Filtration Microplates

- 5.2.1.4 Syringeless Filters

- 5.2.1.5 Syringe Filters

- 5.2.1.6 Capsule Filters

- 5.2.2 Filtration Assemblies

- 5.2.2.1 Microfiltration Assemblies

- 5.2.2.2 Ultrafiltration Assemblies

- 5.2.2.3 Vacuum Filtration Assemblies

- 5.2.2.4 Reverse Osmosis Assemblies

- 5.2.2.5 Nanofiltration Assemblies

- 5.2.3 Filtration Accessories

- 5.2.1 Filtration Media

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M

- 6.1.2 Merck KGaA

- 6.1.3 Danaher Corporation (Pall Corporation)?

- 6.1.4 Sartorius Group

- 6.1.5 GVS S.p.A

- 6.1.6 Cole-Parmer Instrument Company LLC

- 6.1.7 Agilent Technologies Inc.

- 6.1.8 Ahlstrom-Munksjo

- 6.1.9 Abcam PLC

- 6.1.10 Purolite