|

市場調查報告書

商品編碼

1444828

網路安全保險 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Cybersecurity Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

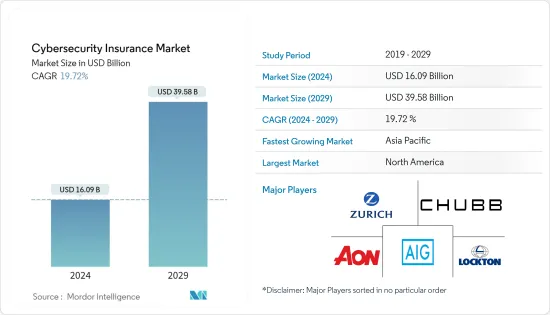

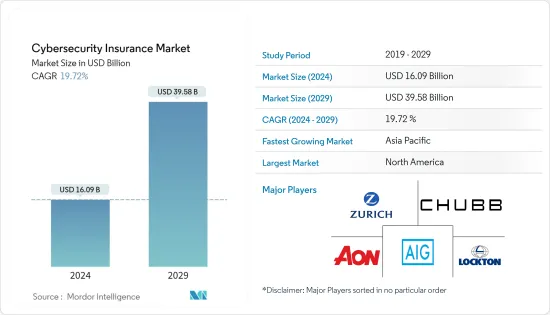

網路安全保險市場規模預計到 2024 年為 160.9 億美元,預計到 2029 年將達到 395.8 億美元,在預測期內(2024-2029 年)CAGR為 19.72%。

商業和社會中的數位化程度不斷提高,雲端、巨量資料、物聯網和人工智慧 (AI) 的快速發展,以及萬物互聯的不斷增強,增加了本已緊張的 IT 團隊的工作量。

主要亮點

- IT進步、通信技術和智慧能源電網正在改變每個國家所有關鍵基礎設施和商業網路的格局。然而,隨著技術的快速發展,威脅也在迅速發展。個人數據很有價值,這促使網路犯罪分子犯罪,個人資訊將在暗網上出售,如信用卡號、身份、醫療記錄等。這是促使網路安全需求增加的少數因素之一。

- 雲端運算是發展最快的最新技術之一,它消除了 IT 的傳統界限,創造了新的市場,刺激了行動趨勢,並推動了統一通訊的進步。各種技術利害關係人和組織正在轉向新的保險模式,以減輕在現代網路安全環境中儲存敏感資料的風險。

- 隨著網路安全保險領域的不斷成熟,保險公司將在評估中考慮更廣泛的安全控制和技術。因此,組織資料的敏感度及其充分掩蓋資料的能力將在確定整體風險方面發揮關鍵作用,從而推動微著色等新技術的採用。微分片技術將資料分解成小至個位數字節的碎片,然後將碎片分佈到多個位置,以減少攻擊面並消除資料敏感性。

- 網路保險保單和業務涵蓋廣泛的風險,保險公司並不總是就承保哪些損失事件達成一致。網路事件具有一些特徵,使得編寫全面的策略變得具有課題性,例如有限的損失歷史、預測未來事件時過去的資料不可靠,以及發生大規模攻擊且跨公司和行業損失高度相關的可能性。此外,保險公司仍在研究網路攻擊和物聯網等新技術影響的精確標準。如果在沒有明確定義危險以及不了解這些攻擊如何影響保險公司的情況下發生大規模網路攻擊,網路保險承保範圍可能會無效,並使公司遭受相當大的損失。

- 這場大流行加速了數位工具的採用,這推動了對網路安全保險的更大需求。許多公司一直期待將保險與網路安全工具結合,以幫助企業減輕和管理網路風險。 2020 年,網路保險公司 Coalition 收購了 BinaryEdge,這是一個類似於 BitSight 和 Security Scorecard 的平台,用於搜尋網路並繪製組織的攻擊面。該聯盟已將來自 BinaryEdge 的數 TB資料與索賠和其他網路安全資料來源合併,以透過機器學習和自然語言處理來實現其風險評估流程。此外,由於新冠肺炎 (COVID-19) 疫情持續蔓延,世界各國已採取預防措施。隨著學校關閉和社區被要求留在家裡,多個組織找到了讓員工在家工作的方法。這促使視訊通訊平台的採用率上升。過去6-8個月,包括Zoom在內的這些視訊通訊平台的新網域註冊量迅速增加。

網路安全保險市場趨勢

BFSI 區隔市場預計將佔有重要佔有率

- BFSI 產業是面臨多次資料外洩和網路攻擊的關鍵基礎設施領域之一,因為該產業服務的客戶群龐大且財務資訊受到威脅。網路犯罪分子正在最佳化無數邪惡的網路攻擊,以癱瘓金融業,因為這是一種利潤豐厚的營運模式,利潤驚人,而且風險和可檢測性相對較小。木馬、ATM、勒索軟體、資料外洩、機構入侵、資料竊取、財務外洩和其他威脅都是這些攻擊的威脅環境的一部分,這進一步增加了 BFSI 領域對網路安全保險的需求。

- 例如,根據 Orange 的資料,該惡意軟體是 2021 年 10 月至 2022 年 9 月期間金融和保險組織最常見的網路攻擊形式。該攻擊向量針對全球超過 40% 的組織。網路和應用程式異常位居第二,有 23% 的組織報告了此類網路攻擊,其次是系統異常,佔 20%。

- 網路安全保險日益成為銀行和金融機構的重要組成部分。預計該行業在預測期內將佔據重要的全球市場佔有率。它是受到高度監管和監管的行業之一,也容易發生身份欺詐,從而增加需求,從而進一步增加 BFSI 行業網路安全保險市場的需求。

- 例如,2021 年 10 月,聯邦貿易委員會發布了一項修訂後的規則,增加了金融機構為保護客戶財務資料而必須實施的資料安全預防措施。近年來,由於大規模資料外洩和網路攻擊,消費者遭受了巨大的痛苦,包括金錢損失、身分盜竊和其他形式的財務困境。聯邦貿易委員會修訂後的保障規則要求抵押貸款經紀人、汽車經銷商和發薪日貸款機構等非銀行金融公司建立、實施和維護強大的安全系統,以保護其客戶資訊。政府政策將大大推動市場。

- 隨著安全漏洞的增加,銀行和金融機構應採用網路安全保險來保護客戶的資料並防止經濟損失。例如,2021 年 12 月,加密貨幣交易平台 Bitmart 發生巨大安全漏洞,導致駭客竊取約 2 億美元資產。私鑰被盜是安全漏洞的主要來源,影響了其以太坊和幣安的兩個創新鏈熱錢包。

美國可望佔據北美地區主要佔有率

- 美國被認為是世界上最重要的網路安全保險市場。該國還擁有大量在市場上營運的主要參與者,這是該國高佔有率的另一個原因。

- 美國的網路攻擊正在迅速增加,並達到歷史最高水平,這主要是由於該地區連網設備數量的迅速增加。在美國,消費者正在使用公有雲,他們的許多行動應用程式都預先安裝了他們的個人訊息,以方便銀行、購物、通訊等。

- 據白宮經濟顧問委員會稱,有害網路活動每年給美國經濟造成約 570 億至 1,090 億美元的損失。為了最大限度地減少網路攻擊造成的損失,網路安全保險提供者提供的解決方案至關重要,並且該地區對網路安全保險的需求正在增加。

- 多年來,該地區發生了大量資料外洩事件。根據身分盜竊資源中心 2022 年發布的報告,已記錄了 1,789 起資料外洩事件。大量的資料外洩事件鼓勵各行業的組織選擇網路安全保險,從而推動市場的成長。

- 美國政府簽署法律成立網路安全和基礎設施安全局(CISA),以加強對網路攻擊的防禦。它與聯邦政府合作提供網路安全工具、事件回應服務和評估能力,以保護支援合作夥伴部門和機構基本運作的政府網路。因此,它將為新公司和現有公司投資專為該行業設計的合適網路安全套件開闢新途徑。

網路安全保險產業概況

網路安全保險市場得到適度整合,重要參與者提供卓越的技術並透過現有的分銷管道促進成長。這些技術領導者正在投資創新、合併、收購和合作夥伴關係活動,以保持市場競爭優勢。

- 2023 年 2 月 - CloudCover Re 與保險經紀公司 Hylant Global Captive Solutions (Hylant) 合作推出 CloudCover CyberCell,這是一項網路安全「租用自保」保險計劃。該計劃可供協會、親和團體和大型企業使用,允許用戶以可管理的成本為自我保險的網路風險提供資金。這減少了網路攻擊的潛在責任,並有助於為公司創造更可觀的收入,因為他們可以以更低的成本和更廣泛的覆蓋範圍提供網路保險。

- 2022 年 11 月 - 網路安全公司 Agilicus 與領先的普通保險管理機構之一 Ridge Canada Cyber Solutions Inc.(RCCS) 合作,協助加拿大中小企業 (SMB) 獲得網路安全保險資格。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- 行業指南和政策

- 評估 COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- 擴大採用基於雲端的服務

- 資料安全漏洞不斷增加

- 市場限制

- 網路保險實施難度高、成本高

第 6 章:市場區隔

- 組織規模

- 中小企業 (SME)

- 大型企業

- 最終用戶產業

- 衛生保健

- 零售

- BFSI

- 資訊科技和電信

- 製造業

- 其他最終用戶產業

- 地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太

- 印度

- 中國

- 日本

- 新加坡

- 亞太其他地區

- 世界其他地區

- 北美洲

第 7 章:競爭格局

- 公司簡介

- American International Group Inc.

- Zurich Insurance Co. Ltd

- Aon PLC

- Lockton Companies Inc.

- The Chubb Corporation

- AXA XL

- Berkshire Hathaway Inc.

- Insureon

- Security Scorecard Inc.

- Allianz Global Corporate & Specialty (AGCS)

- Munich Re Group

第 8 章:投資分析

第 9 章:市場機會與未來趨勢

The Cybersecurity Insurance Market size is estimated at USD 16.09 billion in 2024, and is expected to reach USD 39.58 billion by 2029, growing at a CAGR of 19.72% during the forecast period (2024-2029).

Increasing digitalization and rapid development in the cloud, Big Data, IoT, and artificial intelligence (AI) in business and society and the growing connectivity of everything have increased the workload of already strained IT teams.

Key Highlights

- IT advances, communication technologies, and the smart energy grid are changing the landscape of all every country's critical infrastructure and business networks. However, with rapidly evolving technology comes rapidly advancing threats. Personal data is valuable, which prompts cybercriminals to commit crimes, where personal information will be sold on the dark web, like a credit card number, identity, medical records, etc. It is among the few factors that have led to an increased demand for cybersecurity.

- Cloud computing is one of the most rapidly growing recent technologies, eliminating the traditional boundaries of IT, creating new markets, spurring the mobility trend, and enabling advances in unified communications. Various tech stakeholders and organizations are turning to new insurance models to mitigate the risks of storing sensitive data in the modern cybersecurity landscape.

- As the cybersecurity insurance space continues to mature, insurers will consider a broader range of security controls and technologies in their assessments. Hence, the sensitivity level of an organization's data and its ability to adequately obscure it will play a key role in determining the overall risk, which is driving the adoption of new technologies like micro shading. Microsharding technology breaks data into fragments that can be as small as single-digit bytes before polluting and distributing shards to multiple locations to reduce the attack surface and eliminate data sensitivity.

- Cyber insurance policies and businesses cover a wide range of risks, and insurers do not always agree on which loss events are covered. Cyber events have characteristics that make it challenging to write comprehensive policies, such as limited loss history, the unreliability of past data when predicting future events, and the possibility of a large-scale attack with highly correlated losses across companies and industries. Furthermore, insurers are still working on precise and accurate criteria for cyberattacks and the impact of new technologies like the Internet of Things. Cyber insurance coverage could be ineffective and expose firms to considerable damage if big cyberattacks occur without well-defined dangers and an understanding of how they affect insurers.

- The pandemic accelerated the adoption of digital tools, which has driven a greater need for cybersecurity insurance coverage. Various companies have been looking forward to combining insurance with cybersecurity tools to help businesses mitigate and manage cyber risk. In 2020, Coalition, a cyber insurance company, acquired BinaryEdge, a platform akin to BitSight and Security Scorecard that searches the internet and maps an organization's attack surface. The Coalition has merged terabytes of data from BinaryEdge with claims and other cybersecurity data sources to enable its risk evaluation process with machine learning and natural language processing. Further, due to the ongoing COVID-19 pandemic, countries worldwide have implemented preventive measures. With schools being closed and communities being asked to stay at home, multiple organizations found a way to enable employees to work from their homes. This resulted in a rise in the adoption of video communication platforms. In the past 6-8 months, the new domain registration on these video communication platforms, including Zoom, rapidly increased.

Cybersecurity Insurance Market Trends

The BFSI Segment is Estimated to Hold a Significant Share

- The BFSI industry is one of the critical infrastructure segments facing multiple data breaches and cyberattacks, owing to the massive client base that the sector serves and the financial information at stake. Cybercriminals are optimizing myriad diabolical cyberattacks to immobilize the financial industry since it is a highly lucrative operating model with amazing profits and the bonus of relatively little risk and detectability. Trojans, ATMs, ransomware, data breaches, institutional invasion, data thefts, fiscal breaches, and other threats are all part of the threat environment for these attacks, which further necessitated the demand for cybersecurity insurance in the BFSI sector.

- For instance, according to the data from Orange, the malware was the most frequent form of cyber attack in financial and insurance organizations between October 2021 and September 2022. The attack vector targeted over 40% of the world's organizations. Network and application anomalies came in second, with 23% of organizations reporting such cyberattacks, followed by System anomalies with 20%.

- Cybersecurity Insurance is increasingly becoming a vital part of banking and financial institutions. The industry is expected to command a significant global market share during the forecast period. It is one of the highly regulated, governed industries and is also prone to identity frauds that augment demand, thus further proliferating the demand for the cybersecurity insurance market in the BFSI sector.

- For instance, in October 2021, the Federal Trade Commission issued an amended rule that increases the data security precautions financial institutions must implement to secure their clients' financial data. In recent years, consumers have suffered enormous suffering due to massive data breaches and cyberattacks, including monetary loss, identity theft, and other forms of financial misery. The revised Safeguards Rule from the Federal Trade Commission requires non-banking financial firms, such as mortgage brokers, car dealers, and payday lenders, to establish, implement, and maintain a robust security system to protect their clients' information. Government policies will significantly drive the market.

- With increased security breaches, banks and financial institutes should adopt cybersecurity insurance to safeguard their customers' data and prevent economic losses. For instance, in December 2021, a huge security breach at Bitmart, a crypto trading platform, resulted in hackers removing about USD 200 million in assets. A stolen private key was the primary source of the security compromise, which affected two of its Ethereum and Binance innovative chain hot wallets.

The United States is Expected to Hold the Major Share in the North American Region

- The United States is considered the world's most prominent cybersecurity insurance market. The country is also home to a significant number of key players operating in the market, which is another reason for the country's high share.

- Cyberattacks in the United States are rising rapidly and have reached an all-time high, primarily owing to the rapidly increasing number of connected devices in the region. In the United States, consumers are using public clouds, and many of their mobile applications are preloaded with their personal information for the convenience of banking, shopping, communication, etc.

- According to the White House Council of Economic Advisers, the US economy loses approximately USD 57 billion to USD 109 billion per year to harmful cyber activity. To minimize this loss due to cyber attacks, the solutions offered by cyber security insurance providers are essential, and the demand for cyber security insurance is increasing in the region.

- The region has been witnessing a significant number of data breaches over the years. According to the report published in 2022 by the Identity Theft Resource Center, 1,789 data breach incidents have been recorded. The high number of data breaches encourages organizations across various industries to opt for cybersecurity insurance, driving the market's growth.

- The United States government signed the law to establish Cybersecurity and Infrastructure Security Agency (CISA) to enhance the defense against cyber attacks. It works with the federal government to provide cybersecurity tools, incident response services, and assessment capabilities to safeguard the governmental networks that support essential operations of the partner departments and agencies. As a result, it will open new avenues for the new and existing companies to invest in suitable cyber security suite designed for this industry.

Cybersecurity Insurance Industry Overview

The cybersecurity insurance market is moderately consolidated, with significant players offering superior technology and fostering growth through their existing distribution channels. These technology leaders are investing in innovations, mergers, acquisitions, and partnership activities to maintain a competitive edge in the market.

- February 2023 - CloudCover Re collaborated with insurance brokerage Hylant Global Captive Solutions (Hylant) to launch CloudCover CyberCell, a cybersecurity 'rent-a-captive' insurance program. Available to associations, affinity groups, and large enterprises, the program allows users to finance self-insured cyber risks at a manageable cost. This reduces the potential liability of cyber attacks and facilitates more significant revenue generation for companies, as they can provide cyber insurance at a lower cost and broader coverage.

- November 2022 - Agilicus, a cybersecurity firm, and Ridge Canada Cyber Solutions Inc.(RCCS), one of the leading managing general insurance agencies, collaborated to assist Canadian small to midsize businesses (SMBs) qualify for and obtain cybersecurity insurance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Guidelines and Policies

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Cloud-based Services

- 5.1.2 Rising Data Security Breaches

- 5.2 Market Restraints

- 5.2.1 Difficulties in Implementing Cyber Insurance and High Costs

6 MARKET SEGMENTATION

- 6.1 Organization Size

- 6.1.1 Small and Medium Enterprises (SMEs)

- 6.1.2 Large Enterprises

- 6.2 End-user Industry

- 6.2.1 Healthcare

- 6.2.2 Retail

- 6.2.3 BFSI

- 6.2.4 IT and Telecom

- 6.2.5 Manufacturing

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Singapore

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 American International Group Inc.

- 7.1.2 Zurich Insurance Co. Ltd

- 7.1.3 Aon PLC

- 7.1.4 Lockton Companies Inc.

- 7.1.5 The Chubb Corporation

- 7.1.6 AXA XL

- 7.1.7 Berkshire Hathaway Inc.

- 7.1.8 Insureon

- 7.1.9 Security Scorecard Inc.

- 7.1.10 Allianz Global Corporate & Specialty (AGCS)

- 7.1.11 Munich Re Group