|

市場調查報告書

商品編碼

1444827

簽名驗證 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Signature Verification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

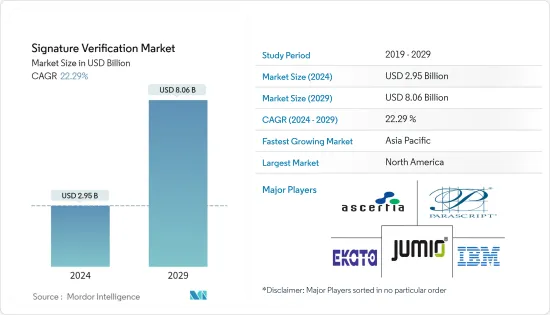

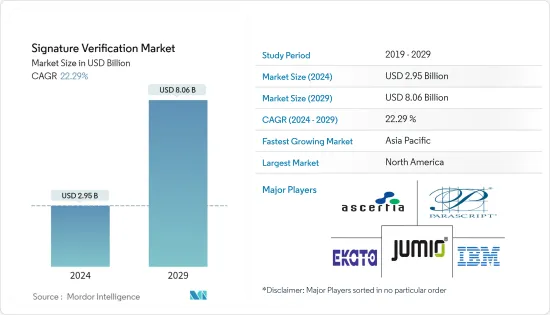

簽名驗證市場規模預計到 2024 年為 29.5 億美元,預計到 2029 年將達到 80.6 億美元,在預測期內(2024-2029 年)CAGR為 22.29%。

由於 COVID-19 大流行,許多組織採用了遠端工作模式,促使對電子簽名驗證軟體的需求增加。簽名是政府、企業和金融組織等實體授權交易和文件的獨特驗證手段。由於各個組織對安全和個人身份驗證的需求不斷成長,生物特徵簽名驗證 (BSV) 重新引起了人們的興趣。動態簽名驗證 (DSV) 在全球範圍內越來越受歡迎,大多數政府都已頒布立法,承認數位簽章與手寫簽章等效。

主要亮點

- 該行業的市場供應商正在推出新產品並透過收購加強業務。疫情導致詐欺行為急劇增加,進一步增加了對文件認證的需求。由於疫情期間文件驗證變得更加困難,簽名驗證硬體或軟體提高了自動化程度。電子簽名的驗證可能很複雜,存在多種課題,例如應用副簽名的多種方式、眾多的簽名和文件格式以及確定簽名者是否有權簽名等。

簽名驗證市場趨勢

醫療保健產業預計將佔據重要的市場佔有率

- 醫療保健行業受到嚴格監管,需要大量文件。簽名驗證是該領域的法律要求。交易詐欺和安全漏洞的增加促使對簽名驗證解決方案的需求不斷成長,以防止關鍵資料遺失。

- 根據健康保險流通與責任法案 (HIPAA) 雜誌,2022 年發生了 11 起醫療資料外洩事件,涉及超過100 萬筆記錄,14 起外洩事件涉及超過50 萬筆記錄。其中大多數外洩是由網路攻擊造成的,包括勒索軟體或勒索嘗試。

- 醫療保健產業可以合法使用電子簽名來遵守 HIPAA 和統一電子交易法等地區法規。此外,越來越需要開發強大的醫療保健基礎設施,以加強病患照護、降低成本、防止設備或記錄遺失或錯放,同時消除錯誤。電子簽名解決方案可用於各種應用,包括客戶文件、醫療流程批准、醫療帳單支付、簽署醫療記錄、開立醫療收據以及提高患者滿意度。

- 全球醫療保健支出的成長是醫療保健產業所研究市場的主要驅動力。根據醫療保險和醫療補助服務中心 (CMMS) 的數據,到 2030 年,美國的醫療總支出預計將達到 6.7 兆美元左右。

北美佔據最大的市場佔有率

- 美國已在各個領域廣泛實施數位簽名驗證,包括銀行和金融機構、醫療保健、BPO 服務和政府機關。為了確保正確使用,政府制定了多項監管數位簽名驗證的規則和規定。

- 在 2020 年選舉期間,由於 COVID-19 大流行對選民流動的限制,美國數位簽章軟體的使用出現了異常成長。政府鼓勵採用數位投票,從而增加了簽名驗證技術的實施。

- 網路安全與基礎設施安全局 (CISA) 選舉基礎設施政府協調委員會和部門協調委員會的聯合新冠病毒工作組發布了明確的指導方針,以監控和整合 2020 年選舉的自動簽名驗證程序。 Parascript 等公司提供了自動簽名驗證軟體來支援 2020 年美國大選。隨著準確性的提高,數位簽名驗證預計將在未來變得更加廣泛。

- 同樣,在加拿大,數位簽名具有法律效力,這鼓勵了更多公司採用簽名驗證平台。 COVID-19 大流行襲擊該國後,政府制定了符合《個人資訊保護和電子文件法》的簽名驗證軟體解決方案指南。

- 加拿大數位身分和認證委員會 (DIACC) 促進商業、工業、政府和公民的數位身分和文件驗證。加拿大金融機構擴大採用數位身分驗證解決方案。

- 加拿大皇家銀行是第一家於 2020 年 3 月實施數位身分驗證的銀行,並且更早採用了簽名驗證技術。加拿大皇家銀行為加拿大、美國和其他 34 個國家的 1,700 萬客戶提供服務。它推出了開戶數位身份驗證,可在銀行分行或透過手機及其網站遠端進行。

簽名驗證行業概況

簽名驗證市場高度整合,頂級廠商佔據了相當大的市場。由於生物辨識簽章ID (JC Lads Corporation)、CERTIFY Global Inc.、Ascertia Ltd.、Kofax Inc.、Entrust Datacard Corporation、Odyssey Technologies Limited 和Scriptel 等現有參與者佔據主導地位,新參與者發現進入市場具有課題性公司。

2022 年 7 月,25 年來一直提供高效能自動化的軟體公司 Parascript 推出了最新版本的詐欺防護工具 SignatureXpert.AI。 SignatureXpert.AI 2.0 允許將保存為軌蹟的數位收集簽名與整篇論文或文件摘錄上的簽名照片進行比較,從而提供市場上最高水平的簽名驗證準確性。這項新功能提高了該工具先前的性能和可用性,使其成為簽名驗證市場的寶貴補充。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 嚴格的法規和合規需求

- 市場限制

- 驗證設備的可變性以及與傳統系統的兼容性

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- COVID-19 對市場的影響

第 5 章:市場區隔

- 依解決方案類型

- 硬體

- 軟體

- 依最終用戶產業

- 金融服務

- 政府

- 衛生保健

- 運輸與物流

- 其他最終用戶產業

- 依地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 世界其他地區

- 北美洲

第 6 章:競爭格局

- 公司簡介

- Parascript LLC

- Ascertia Ltd

- Jumio Corp.

- Ekata Inc.

- IBM Corporation

- SutiSoft Inc.

- Acuant Inc.

- Mitek Systems Inc.

- CERTIFY Global Inc.

- Scriptel Corporation

- iSign Solutions Inc.

- Veriff

第 7 章:投資分析

第 8 章:市場的未來

The Signature Verification Market size is estimated at USD 2.95 billion in 2024, and is expected to reach USD 8.06 billion by 2029, growing at a CAGR of 22.29% during the forecast period (2024-2029).

Many organizations adopted remote working models due to the COVID-19 pandemic, leading to an increased demand for electronic signature verification software. Signatures serve as a unique means of verification for entities such as governments, businesses, and financial organizations to authorize transactions and documents. Biometric signature verification (BSV) has gained renewed interest due to the increasing need for security and individual authentication across various organizations. Dynamic signature verification (DSV) is gaining traction worldwide, and most governments have enacted legislation recognizing digital signatures as equivalent to handwritten signatures.

Key Highlights

- Market vendors in the industry are launching new products and strengthening their businesses through acquisitions. The pandemic led to a sharp increase in fraudulent behavior, further increasing the demand for document authentication. Signature verification hardware or software improved automation as document verification became more difficult during the outbreak. The verification of e-signatures can be complex, with challenges such as multiple ways of applying countersignatures, numerous signatures and document formats, and determining whether the signer was authorized to sign..

Signature Verification Market Trends

Healthcare Industry is Expected to Hold Significant Market Share

- The healthcare industry is heavily regulated and requires extensive documentation. Signature verification is a legal requirement in this sector. The rise of transaction fraud and security breaches has resulted in a growing demand for signature verification solutions to prevent the loss of critical data.

- According to the Health Insurance Portability and Accountability Act (HIPAA) Journal, there were 11 healthcare data breaches involving more than 1 million records and 14 breaches involving more than 500,000 records in 2022. Most of these breaches were caused by cyberattacks, including ransomware or extortion attempts.

- The healthcare sector can legally use e-signatures to comply with regional regulations such as HIPAA and the Uniform Electronic Transactions Act. Additionally, there is an increasing need to develop a robust healthcare infrastructure to enhance patient care, reduce costs, and prevent the loss or misplacement of equipment or records while eliminating errors. E-signature solutions are useful in various applications, including client documentation, medical process approvals, medical bill payments, signing medical records, issuing medical receipts, and enhancing patient satisfaction.

- The growing global healthcare expenditure is a major driver for the studied market in the healthcare industry. According to The Centers for Medicare & Medicaid Services (CMMS), the total health expenditure of the United States is projected to reach around USD 6.7 trillion by 2030.

North America Accounts For the Largest Market Share

- The United States has extensively implemented digital signature verification in various sectors, including banking and financial institutes, healthcare, BPO services, and government offices. To ensure proper usage, the government has established multiple rules and regulations for monitoring digital signature verification.

- During the 2020 elections, the United States saw an exceptional increase in the use of digital signature software due to the COVID-19 pandemic's restrictions on voter movement. The government encouraged the adoption of digital voting, leading to increased implementation of signature verification technology.

- The Cybersecurity and Infrastructure Security Agency (CISA) Elections Infrastructure Government Coordinating Council and Sector Coordinating Council's Joint COVID Working Group released clear guidelines to monitor and integrate automatic signature verification procedures for the 2020 elections. Companies such as Parascript provided automated signature verification software to support the U.S. elections in 2020. Digital signature verification is expected to become even more widespread in the future as accuracy improves.

- Similarly, in Canada, digital signatures are legally enforceable, which has encouraged more companies to adopt signature verification platforms. After the COVID-19 pandemic hit the country, the government established guidelines for signature verification software solutions aligned with the Personal Information Protection and Electronic Documents Act.

- The Digital Identification and Authentication Council of Canada (DIACC) facilitates digital identity and document verification for commerce, industry, governments, and citizens. Canadian financial institutions are adopting digital identity verification solutions at an increasing rate.

- The Royal Bank of Canada was the first bank to implement digital identity verification in March 2020 and had adopted signature verification technology much earlier. The Royal Bank of Canada serves 17 million customers in Canada, the United States, and 34 other countries. It rolled out digital identity verification for account opening, which is available at bank branches and remotely via mobile and its website.

Signature Verification Industry Overview

The signature verification market is highly consolidated, with top players occupying a significant share of the market. New players find it challenging to enter the market due to the dominance of existing players such as Biometric Signature ID (J C Lads Corporation), CERTIFY Global Inc., Ascertia Ltd., Kofax Inc., Entrust Datacard Corporation, Odyssey Technologies Limited, and Scriptel Corporation.

In July 2022, Parascript, a software business that has been providing high-performing automation for over 25 years, launched the latest version of its fraud protection tool, SignatureXpert.AI. SignatureXpert.AI 2.0 offers the highest level of signature verification accuracy on the market by allowing the comparison of digitally gathered signatures saved as a trajectory against photographs of signatures on whole papers or document excerpts. This new feature improves the tool's prior performance and usability, making it a valuable addition to the signature verification market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Regulations and Need for Compliance

- 4.3 Market Restraints

- 4.3.1 Variability of Verification Devices and Compatibility with Legacy Systems

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type of Solution

- 5.1.1 Hardware

- 5.1.2 Software

- 5.2 By End-user Industry

- 5.2.1 Financial Services

- 5.2.2 Government

- 5.2.3 Healthcare

- 5.2.4 Transport and Logistics

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Parascript LLC

- 6.1.2 Ascertia Ltd

- 6.1.3 Jumio Corp.

- 6.1.4 Ekata Inc.

- 6.1.5 IBM Corporation

- 6.1.6 SutiSoft Inc.

- 6.1.7 Acuant Inc.

- 6.1.8 Mitek Systems Inc.

- 6.1.9 CERTIFY Global Inc.

- 6.1.10 Scriptel Corporation

- 6.1.11 iSign Solutions Inc.

- 6.1.12 Veriff