|

市場調查報告書

商品編碼

1444810

光傳輸網路 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Optical Transport Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

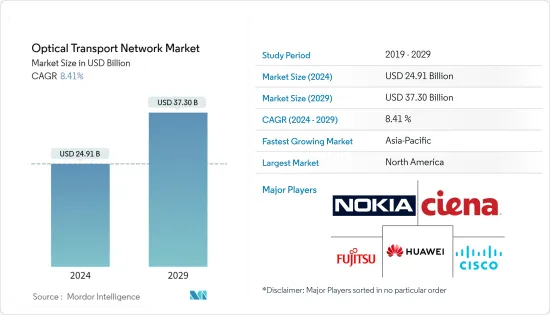

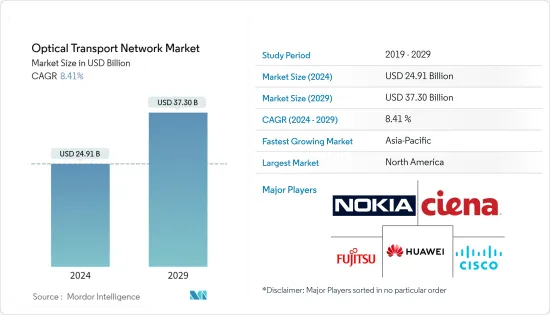

2024年光傳輸網路市場規模預計為249.1億美元,預計到2029年將達到373億美元,在預測期內(2024-2029年)CAGR為8.41%。

家庭和工作中網路使用者的快速成長創造了新的網路頻寬需求。線上遊戲、社交網路、視訊會議和其他即時串流活動的日益普及預計將推動所研究市場的需求。光傳輸網路市場成長的關鍵原因之一是它提供無縫資料傳輸,同時最大限度地減少延遲。

主要亮點

- 此外,雲端的持續擴展、資料中心容量的增加以及5G的快速部署正在推動網路流量和對網路容量的需求不斷增加,這將為所研究的市場創造顯著的成長機會。例如,愛立信表示,2021 年至 2025 年間,全球 5G 用戶預計將增加,從超過 1,200 萬增加到超過 30 億。預計東北亞、東南亞、印度、尼泊爾和不丹的訂閱量最高。

- 隨著城市數位化、智慧化,通訊已成為繼水、電、氣、交通後的第五大基礎設施網路。數位技術和產業的擴張決定了城市的智慧程度。支援它們的通訊網路已成為城市營運和提供服務的重要方面。因此,全球超過 150 個政府宣布了光纖政策或網路舉措,承諾向公眾免費提供網路基礎設施。各國政府正在提供稅收減免或補貼,以加速骨幹網路建設,擴大網路覆蓋範圍,縮小數位鴻溝,促進國家經濟發展。

- 例如,根據美中經濟與安全審查委員會的數據,到2023年,中國政府在智慧城市計畫上的支出將達到389.2億美元。智慧城市的此類發展將增加對光傳輸網路解決方案的需求。

- 網路設備安裝和維護的初始投資較高,預計將阻礙全球 OTN 市場的擴張。此外,包括40G到100G在內的現代技術可以加快資料流量和資料傳輸的處理速度;然而,這些技術價格昂貴。大量的資本投資導致投資回收期延長。客戶經常以非常低的價格將這些項目提供給供應商,儘管它們的部署需要數年時間,特別是在電信業。因此,建立 OTA 所需的巨額初始支出預計將抑制全球 OTN 設備市場的發展。

- 由於為了控制新冠肺炎 (COVID-19) 的傳播而實施了行動限制,經合組織估計的 13 億公民中有越來越多的人在家工作和學習。七國集團和二十國集團等重要的國際政策協調都是透過各種平台在線上進行的。固定和行動寬頻業者、內容和雲端供應商以及網路網路連線交換流量的地方(稱為網際網路交換點 (IXP))的網路流量比疫情爆發前增加了 60%。這些變數影響了疫情期間和之後的光傳送網路市場。

光傳輸網路市場趨勢

IT 和電信業將推動市場發展

- 住宅和商業消費者對頻寬不斷成長的需求是 OTN 的主要推動力。對儲存在雲端中的個人資訊、線上遊戲、線上購物、長距離保持連線、社交網路、視訊會議和其他因素的需求不斷成長,都促進了住宅網路使用的增加。這些應用程式需要通訊和服務提供者增加網路頻寬。

- 例如,根據 DataReportal 的數據,到 2022 年初,全球網路使用者已增至 49.5 億,網路普及率目前佔全球總人口的 62.5%。此外,每天大約創建 1.134 兆 MB 的資料。這些數字本身表明全球資料使用量不斷增加,這需要 OTN 等快速可靠的資料網路。

- 此外,根據高速網際網路、資料中心和雲端服務獨立目錄 CloudScene 的數據,截至 2022 年 1 月,美國有 2,701 個資料中心,德國有 487 個資料中心。中國擁有443個資料中心,而英國擁有456個,位居第三。全球共有 6,334 個資料中心,而且還在不斷增加,而且新的資料中心正在迅速建置。

- 由於電子商務、行動和網路銀行、線上政府服務、工業自動化、物聯網 (IoT)、公用事業網路和其他相關技術的興起,服務提供者面臨商業客戶的高容量需求。

- 縱觀網際網路使用及其在 IT 和電信行業中應用的不斷成長,隨著全球資料和網際網路需求的增加,對 OTN 的需求將繼續蓬勃發展。

亞太地區成長最快

- 根據 Internet World Stats 的數據,截至 2021 年 6 月,亞太地區人口占人類總人口的 54.94%,平均網路普及率為 64.1%。中國和印度是亞洲用戶佔有率最大的兩個國家,分別佔亞洲網路用戶總數的35.7%和27.3%。因此,這兩個國家是所研究市場的潛在市場領導者。

- 2021年,中國物聯網設備數量將突破20億台。中國也公佈了2025年機器人和智慧製造的規劃。根據規劃,到2025年,中國70%以上的大型企業數位化,更多全國將建設500多個示範生產基地。這項戰略措施預計將增加該地區 OTN 解決方案的需求和潛在成長。

- 隨著人工智慧、5G、物聯網、虛擬實境等新技術的快速發展以及這些新技術的商業應用,資料處理和資訊互動的需求不斷成長,預計將加快中國資料中心的建設。並帶動行業爆發式成長。據 Cloud Scene 稱,資料中心的一些頂級市場包括中國、日本、澳洲、印度和新加坡。

- 此外,2022 年 3 月,三菱電機公司宣布將開始交付用於第五代 (5G) 行動基地台光纖通訊的 50Gbps 分散式回饋 (DFB) 雷射二極體樣品。這種新型二極體滿足所有基本的光收發器要求,並且具有適合 5G 行動網路中高速、大容量資料傳輸的工作溫度範圍。

光傳送網產業概況

由於企業數量眾多,光傳送網市場的競爭格局呈現分散化。該市場的一些主要參與者包括富士通、華為、思科和中興通訊公司等。該行業的參與者不斷致力於開發新的產品組合。他們試圖透過併購、合作和不斷創新來獲得競爭優勢。

2022年7月,NEC透過在國內公司債市場公開發行的方式發行了日本首隻具有三個期限的永續發展相關債券。此次債券發行是NEC利用融資來證明其對其重大問題之一「特別關注氣候變遷(脫碳)的環境行動」的承諾的一個例子。這些基於SDGs的融資措施是NEC集團的「宗旨」付諸行動。它們使 NEC 能夠與各個利害關係人就其永續發展管理措施進行對話和共同創造。

2022年6月,全球領先的企業和消費者行動網際網路技術解決方案供應商中興通訊聯合土耳其第四大城市布爾薩創建了第一個支援12THz超寬頻譜的商用光傳輸網路(OTN)。特克塞爾。 Turkcell選擇建置先進的城域WDM(波分複用)網路,是因為5G網路需要數倍於4G網路的容量才能適應5G網路流量的大幅成長。

2022年6月,在華為光創新論壇上,華為宣布了光傳送網路的新願景。這個新願景的核心是向邊緣節點提供光傳輸網路(OTN),以提供無處不在的優質連接並建立環保且簡單的光網路,幫助營運商實現財務成功。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力——波特五力

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- 評估 COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- 隨著高速網路需求的增加,網路滲透率不斷提高

- OTN解決方案提供者的技術創新

- 市場課題

- 初始投資高

第 6 章:市場區隔

- 依技術

- 波分複用

- 密集波分複用

- 其他技術

- 透過提供

- 服務

- 網路維護與支援

- 網路設計

- 成分

- 光傳輸

- 光開關

- 光學平台

- 服務

- 依最終用戶垂直領域

- 資訊科技和電信

- 衛生保健

- 政府

- 其他最終用戶垂直領域

- 依地理

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第 7 章:競爭格局

- 公司簡介

- Nokia Corporation

- Ciena Corporation

- Cisco Systems Incorporation

- Huawei Technologies Co. Ltd

- ZTE Corporation

- Fujitsu Ltd

- Infinera Corporation

- Telefonaktiebolaget LM Ericsson

- NEC Corporation

- Yokogawa Electric Corporation

第 8 章:投資分析

第 9 章:市場機會與未來趨勢

The Optical Transport Network Market size is estimated at USD 24.91 billion in 2024, and is expected to reach USD 37.30 billion by 2029, growing at a CAGR of 8.41% during the forecast period (2024-2029).

The rapid increase in internet users at home and work has created a new network bandwidth demand. The increased popularity of online games, social networking, video conferencing, and other real-time streaming activities are expected to drive the demand for the market studied. One of the critical reasons for the optical transport network market's growth is that it delivers seamless data transfer while minimizing latency.

Key Highlights

- Further, the continuing expansion of the cloud, the increase of data center capacity, and the quick deployment of 5G are driving network traffic and increasing demand for network capacity, which would significantly create an opportunity for the market studied to grow. For instance, according to Ericsson, 5G subscriptions are expected to increase globally between 2021 and 2025, rising from over 12 million to over 3 billion. Subscriptions are predicted to be highest in Northeast Asia, Southeast Asia, India, Nepal, and Bhutan.

- As cities become digital and smart, communication has become the fifth primary infrastructure network after water, electricity, gas, and transportation. The expansion of digital technologies and industries dictates how smart cities can be. The communications networks that support them have become an essential aspect of how cities may operate and offer services. As a result, more than 150 governments worldwide have announced fiber policies or internet initiatives, promising to make network infrastructure freely available to the public. Governments are providing tax breaks or subsidies to accelerate the construction of backbone networks, enhance network coverage, bridge the digital gap, and boost national economic development.

- For instance, according to the US-China Economic and Security Review Commission, government spending on smart city initiatives in China will reach USD 38.92 billion in 2023. Such developments in smart cities would increase the demand for optical transfer network solutions.

- The high initial investment in network equipment installation and maintenance is projected to hinder the expansion of the global OTN market. Furthermore, modern technologies, including 40G to 100G, can expedite handling data traffic and data transfer; however, these technologies are expensive. The significant capital investment leads to an extended payback period for the investment. Customers frequently give these projects to suppliers at a very low price, although their deployment takes years, notably in the telecom industry. As a result, the significant initial expenditure necessary to establish OTAs is expected to stifle worldwide market development for OTN equipment.

- As mobility limitations were imposed to control the spread of COVID-19, an increasing number of the OECD's estimated 1.3 billion citizens were working and learning from home. Critical international policy coordination, such as the G7 and G20, occurred online through various platforms. Fixed and mobile broadband operators, content and cloud providers, and places where internet networks join to exchange traffic, known as Internet exchange points (IXPs), are seeing up to 60% more Internet traffic than before the outbreak. These variables influenced the optical transport network market during and after the pandemic.

Optical Transport Network Market Trends

IT and Telecom Sector to Drive the Market

- The rising demand for bandwidth from residential and commercial consumers is the main motivator for OTN. The increasing need for personal information stored in the cloud, online gaming, online shopping, staying connected over long distances, social networking, video conferencing, and other factors have all contributed to an increase in residential internet use. These applications demand increased network bandwidth from communications and service providers.

- For instance, according to DataReportal, Global internet users have climbed to 4.95 billion at the start of 2022, with internet penetration now standing at 62.5 percent of the world's total population. Moreover, there is approximately 1.134 Trillion MB of data created each day. These numbers themselves project the rising amount of data usage worldwide, which requires fast and reliable data networks like OTN.

- Additionally, according to CloudScene, an independent directory of high-speed internet, data centers, and cloud services, as of January 2022, there were 2,701 data centers in the United States and 487 more in Germany. China had 443 data centers, while the United Kingdom had 456, placing it third among all nations. In total, there were 6,334 data centers worldwide and counting, as new data centers are being constructed rapidly.

- Due to the rise in e-commerce, mobile and internet banking, online government services, industrial automation, Internet of Things (IoT), utility networking, and other related technologies, service providers are facing high-capacity demand from their commercial customers.

- Looking at the increasing pace of internet usage and its application in the IT and Telecommunication industry, the demand for OTN will continue to thrive as the demand for data and the internet increases globally.

Asia-Pacific to Witness Fastest Growth

- According to Internet World Stats, the population of the Asia-Pacific region is 54.94% of total mankind, with average internet penetration of 64.1% as of June 2021. The two countries that constitute the significant user share in Asia is China and India, with 35.7% and 27.3% of the total internet user in Asia. Thus, these two countries are potential market leaders in the market studied.

- The number of IoT devices in China crossed 2 billion in 2021. It has also unveiled plans for robotics and smart manufacturing by 2025. As per the plan, by 2025, more than 70% of large-scale Chinese enterprises should be digitalized, and more than 500 demonstration manufacturing facilities will be built nationwide. Such a strategic measure is expected to increase the demand and potential growth of OTN solutions in the region.

- With the rapid development of AI, 5G, the internet of things, virtual reality, and the commercial application of these new technologies, the demand for data processing and information interaction is growing, which is expected to speed up the construction of data centers in the region and lead to the explosive growth of the industry. According to Cloud Scene, some of the top markets in data centers include China, Japan, Australia, India, and Singapore.

- Furthermore, in March 2022, Mitsubishi Electric Corporation announced that it would begin shipping samples of its 50Gbps distributed-feedback (DFB) laser diode for optical-fiber communication in fifth-generation (5G) mobile base stations. The novel diode meets all essential optical-transceiver requirements and has an operating temperature range for high-speed, large-capacity data transmission in 5G mobile networks.

Optical Transport Network Industry Overview

The competitive landscape of the optical transport network market is fragmented because of the presence of a large number of companies. Some key players in this market are Fujitsu, Huawei, Cisco, and ZTE Corporation, among others. The players in this industry are constantly working on developing new product portfolios. They are trying to gain a competitive advantage with mergers and acquisitions, partnerships, and constant innovations.

In July 2022, NEC issued Japan's first sustainability-linked bond with three maturities through a public offering in the domestic corporate bond market. The bond issuance is an example of NEC using financing to demonstrate its commitment to one of its material issues, "environmental action with a particular focus on climate change (decarbonization)." These SDGs-based financing initiatives are the NEC Group's "Purpose" put into action. They allow NEC to dialogue and co-creation with various stakeholders about their sustainability management initiatives.

In June 2022, ZTE Corporation, a prominent global provider of enterprise and consumer technology solutions for mobile internet, created the first commercial Optical Transport Network (OTN) supporting 12THz ultra-wide frequency spectrum in Bursa, Turkey's fourth-largest city, in conjunction with Turkcell. Turkcell chose to build an advanced metro WDM (Wavelength Division Multiplexing) network because 5G networks require several times the capacity of 4G networks to accommodate the massive increase in 5G network traffic.

In June 2022, at the Huawei Optical Innovation Forum, Huawei announced its new vision for optical transport networks. This new vision is centered on delivering the optical transport network (OTN) to edge nodes to provide all-pervasive premium connectivity and construct eco-friendly and straightforward optical networks, assisting operators in achieving financial success.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Internet Penetration with Demand for High-speed Internet

- 5.1.2 Technological Innovations by OTN Solution Providers

- 5.2 Market Challenges

- 5.2.1 High Initial Investment

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 WDM

- 6.1.2 DWDM

- 6.1.3 Other Technologies

- 6.2 By Offering

- 6.2.1 Service

- 6.2.1.1 Network Maintenance and Support

- 6.2.1.2 Network Design

- 6.2.2 Component

- 6.2.2.1 Optical Transport

- 6.2.2.2 Optical Switch

- 6.2.2.3 Optical Platform

- 6.2.1 Service

- 6.3 By End-user Vertical

- 6.3.1 IT and Telecom

- 6.3.2 Healthcare

- 6.3.3 Government

- 6.3.4 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 Ciena Corporation

- 7.1.3 Cisco Systems Incorporation

- 7.1.4 Huawei Technologies Co. Ltd

- 7.1.5 ZTE Corporation

- 7.1.6 Fujitsu Ltd

- 7.1.7 Infinera Corporation

- 7.1.8 Telefonaktiebolaget LM Ericsson

- 7.1.9 NEC Corporation

- 7.1.10 Yokogawa Electric Corporation