|

市場調查報告書

商品編碼

1444798

飲料包裝:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

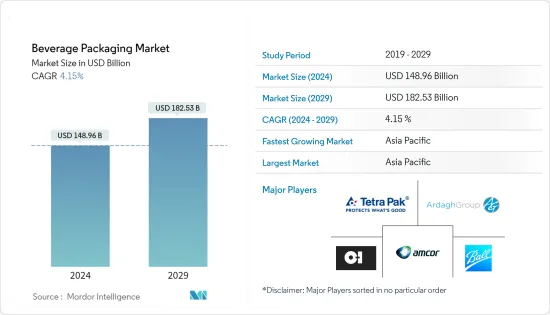

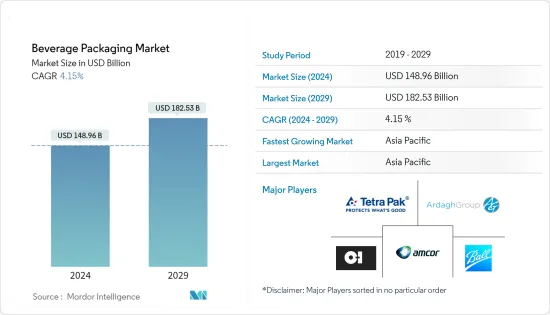

飲料包裝市場規模預估2024年為1,489.6億美元,預估至2029年將達1,825.3億美元,預測期(2024-2029年)年複合成長率為4.15%成長。

市場規模反映了最終用戶產業飲料包裝產品的消費價值,並以實際價值計算。瓶、罐、袋、紙盒和啤酒桶等飲料包裝產品被認為屬於研究市場範圍。

主要亮點

- 飲料包裝提供防篡改和保護,並滿足飲料的物理、化學或生物需求。此外,飲料包裝可促進營養並確保在整個價值鏈中快速可靠的分銷。

- 由於各種因素,包括日益成長的健康問題,飲料包裝尺寸在過去十年中變得兩極化。過量攝取碳酸飲料等消耗品會破壞血液中糖的平衡。它會損害肝臟處理糖攝取的能力,使您面臨 2 型糖尿病的風險。因此,飲料製造商面臨著減少包裝尺寸的壓力,以便為消費者提供更多選擇並更好地控制其攝取量。此外,各個製造商都承諾降低卡路里含量,從而增加了對較小包裝的需求。

- 充滿活力的生活方式以及由此產生的消費者對包裝飲料的依賴也增加了塑膠和紙瓶及容器等飲料包裝產品的銷售量。由於塑膠產品具有優異的阻隔性能、方便的格式、高品質的印刷適性以及對材料資源的明智利用,這一趨勢正在加強塑膠產品的銷售。

- 包裝成本的增加是由於疫情導致的需求激增所致。由於消費者被困在家裡,網上購物的轉變加劇。因此,電子商務包裝現在幾乎成為所有線上企業運送訂單的關鍵要求。由於供需的基本經濟學以及飲料包裝市場相關人員面臨的挑戰,原料和成品包裝的價格上漲是不可避免的。

- 由於 COVID-19 的傳播,消費者行為發生了顯著變化。買家比以往任何時候都更加關注產品衛生和永續性。隨著這場危機的持續,消費者不斷變化的需求和以消費者為中心的方法仍然至關重要。同時,隨著市場進一步適應當前情況,消費者行為無疑將在預測期內繼續改變。因此,就需求而言,後COVID-19飲料包裝方法看起來很有前景。

飲料包裝市場趨勢

瓶裝水引領市場

- 飲料業是先驅之一,大力投資於技術的擴展和現代化。水包裝是一個複雜的產業技術領域。隨著大眾對純淨飲用水需求意識的增強,包裝水和瓶裝水包裝產業正在經歷快速成長。

- 瓶裝水因其方便性而被認為是消費最多的飲料之一。瓶裝包裝也適合遠距運輸水。在家燒水既耗時又能源效率低。預計這將大大促進瓶裝水包裝市場的成長。在新興市場,它已成為健康生活方式的象徵。

- 瓶裝水有許多不同類型,每種都有不同的產地、成分和加工需求。礦泉水的進步因其高效益和對健康的正面影響而導致全球消費量的增加。對存放在高品質瓶子中的自然資源礦泉水的需求不斷增加,正在推動瓶裝水包裝市場的成長。

- 玻璃瓶廣泛用於水包裝。然而,熱灌裝/保溫/冷卻過程必須小心以避免容器破裂。隨著人們對塑膠垃圾的環境問題日益關注,飯店等各種旅館業都在使用玻璃水瓶。

- 例如,2022 年 12 月,認知到全球塑膠廢棄物比例不斷增加,並在物聯網 (IoT) 的推動下,全球水技術Start-UpsBoon 宣布了一項逐步淘汰寶特瓶的計劃。我們與孟買君悅酒店合作。如果您用永續的玻璃水瓶替換它們,您的碳排放將可以忽略不計。 Boone 獨特的零英里水系統利用物聯網和人工智慧來監控每一滴水的質量,使飯店能夠大幅減少對外部系統的依賴。這些措施將進一步撬動玻璃水瓶市場。

- 這是由於玩家數量的顯著增加以及對有吸引力的包裝的日益關注。為了吸引更多消費者並產生利潤,領先公司增加在廣告和行銷活動上的支出預計將補充預測期內的市場成長。此外,製造商正在創新瓶裝水,包括注入完整冰川水的水。這將吸引那些想要體驗水的感覺以保持水分的新消費者,從而推動瓶裝水包裝市場的發展。

亞太地區將經歷最高的成長

- 亞太地區發展潛力大,是最未來性發展前景的國家。在印度,飲料包裝近年來經歷了顯著成長。推動市場成長的關鍵因素包括全國飲料包裝趨勢的快速變化。包裝已大量採用新技術。新的飲料包裝趨勢側重於包裝材料的結構變化以及能夠與產品或其環境相互作用的新活性系統的開發,從而提高客戶接受度、安全性和某些飲料的保存期限。根據包裝所使用的材料,市場可以進一步細分為玻璃、塑膠、紙張和金屬(主要是鋁)。

- 推動未來成長的主要因素將是都市化、充滿活力的年輕人及其在勞動力中所佔比例的增加、可支配收入的增加和連結性的改善,特別是在小城鎮。政府指令為飲料包裝市場帶來了新的發展。包裝廢棄物被認為對環境有害,因此正在嘗試減少廢棄物的產生量。這導致該行業選擇可回收且更永續的包裝方案。

- 由於經濟成長和高購買力的中階不斷壯大,中國包裝產業正快速穩定成長。近年來,中國飲料市場經歷了顯著成長,導致對飲料包裝的需求不斷增加。雖然每個飲料類別都帶來不同的挑戰和機遇,但中國消費者生活方式中正在出現的新趨勢正在幫助塑造市場。

- 由於消費者繁忙的工作日程和久坐的生活方式,即即溶飲料(RTD) 飲料的消費量不斷增加,正在推動日本飲料包裝市場的發展。此外,消費者對胃食道逆流(GERD)、潰瘍和胃腸炎等腸道相關疾病高發生率的健康擔憂導致機能飲料消費量增加,這被認為是銷售成長的主要動力。市場。

- 飲料產業具有高度創新性,可以快速適應新的或不斷變化的消費者需求和趨勢,例如轉向更短的保存期限、更健康、更新鮮和更少加工的食品。新加工、分離和包裝技術的開發等創新是亞洲飲料包裝成功的關鍵。由於產品擴展、推出、升級、永續性等,市場預計將成長。例如,2022年6月,Packamama在澳洲推出了澳洲製造的Ecoflat瓶。這些瓶子由當地回收的 PET 製成,由墨爾本包裝市場領導Visy 製造。

飲料包裝產業概況

由於跨國公司和中小企業的存在,飲料包裝市場高度分散。市場參與者正在採取合作、併購、創新、投資和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2022 年 11 月 - 利樂與 Uniboard 簽署了一項價值 250 萬美元的協議,建立一個用於廢棄飲料紙盒 (UBC) 的紙板回收裝置。該投資將用於建造一座每年能夠回收 8,000 噸 UBC 的設施,預計將於 2023 年運作。

- 2022 年 5 月 - OI Glass Inc. 和 Coca-Cola United 宣佈建立合作關係,回收玻璃瓶。可口可樂聯合公司希望到 2030 年其瓶子的回收率達到 50%,作為其建造廢棄物世界承諾的一部分。為了收集更多的回收玻璃並將其轉化為新的玻璃瓶,該裝瓶公司正在與 OI Glass 合作。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對飲料包裝產業的影響

第5章市場動態

- 市場促進因素

- 小型化、降低成本等產品創新

- 不斷變化的人口和生活方式因素

- 市場挑戰

- 原料成本變動

第6章市場區隔

- 依材料類型

- 塑膠

- 金屬

- 玻璃

- 紙板

- 依產品類型

- 瓶子

- 能

- 小袋

- 紙盒

- 啤酒桶

- 按用途

- 碳酸飲料

- 有酒精的飲品

- 瓶裝水

- 牛奶

- 水果和蔬菜汁

- 機能飲料

- 植物來源飲料

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 奧地利

- 波蘭

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- OI Glass Inc.(Owens-Illinois Inc.)

- Tetra Laval International SA

- Ball Corporation

- Ardagh Group

- Amcor PLC

- Mondi PLC

- Verallia SA

- Vidrala SA

- Vetropack Holding Ltd

- Crown Holdings Inc.

- Silgan Containers LLC

- CCL Container Inc.

- Berry Global Inc.

- Sonoco Products Company

- Glassworks International Limited

第8章投資分析

第9章市場的未來

The Beverage Packaging Market size is estimated at USD 148.96 billion in 2024, and is expected to reach USD 182.53 billion by 2029, growing at a CAGR of 4.15% during the forecast period (2024-2029).

The market size reflects the value of the consumption of beverage packaging products across end-user industries and is computed in real terms. Beverage packaging products such as bottles, cans, pouches, cartons, and beer kegs are considered within the scope of the market studied.

Key Highlights

- Beverage packaging offers tamper resistance and protection and meets beverages' physical, chemical, or biological needs. Additionally, beverage packaging encourages nutrition and guarantees rapid and reliable distribution across the value chain.

- The size of beverage packaging has been a polarizing trend for a decade owing to various factors, including growing health concerns. Excessive consumption of consumables such as aerated drinks creates an imbalance of sugar in the bloodstream. It damages the ability of the liver to process sugar intake, leading to the risk of Type 2 diabetes. As a result, beverage manufacturers are under increased pressure to reduce the size of their packaging to give consumers more options and permit them to have greater control over how much they consume. In addition, various manufacturers have pledged to reduce the calorie content, driving the need for smaller packaging.

- The dynamic lifestyles and the consequent dependence of consumers on packaged beverages are also augmenting the sales of beverage packaging products such as plastic and paper bottles and containers. This trend bolsters the sales of plastic products, owing to their superior barrier properties, convenient format, high-quality printability, and prudent usage of material resources.

- The rise in packaging costs is the pandemic's surge in demand. Since consumers were stranded at home, the shift to online purchasing intensified. As a result, practically all online firms now have a significant requirement for e-commerce packaging for shipping orders. The fundamental economics of supply and demand and the problems faced by beverage packaging market players resulted in inescapable rises in raw materials and completed packaging.

- As a result of the COVID-19 outbreak, consumer behavior has changed substantially. Buyers are more concerned than ever before about products' hygiene and sustainability. The shoppers' evolving needs and a consumer-focused approach will remain crucial as this crisis continues. Consumer behavior will undoubtedly continue to change during the forecast period as the market simultaneously acclimates more to the current scenario. Thus, the post-COVID-19 method for beverage packaging looks promising in terms of demand.

Beverage Packaging Market Trends

Bottled Water to Drive the Market

- The beverage industry is one of the pioneers with considerable expansion and technology modernization investments. Packaging water is a complex technical area of the industry. The packaged and bottled water packaging industries are experiencing rapid growth as public awareness of the need for pure drinking water increases.

- Bottled water is considered one of the most consumed beverages due to its convenience. The bottle packaging is also suitable for long-distance transportation of water. Boiling water at home is time-consuming and energy inefficient. This is anticipated to contribute significantly to the growth of the bottled water packaging market. In emerging markets, it has become a symbol of a healthy lifestyle.

- There are different types of bottled water, each with different origins, compositions, and processing requirements. Advances in mineral water have led to increased consumption worldwide due to its high benefits and positive health impacts. Growing demand for mineral water from natural sources stored in quality bottles drives the growth rate of the bottled water packaging market.

- The use of glass bottles for water packaging is widespread. However, the hot-fill/hold/cool process had to be applied with care to avoid the breakage of the containers. With rising environmental concerns about plastic wastage, various hospitality businesses, such as hotels, are using glass water bottles.

- For instance, in December 2022, recognizing the increasing rate of plastic waste worldwide, Boone, a global water technology startup enabled by the Internet of Things (IoT), partnered with Mumbai's Grand Hyatt to eliminate plastic bottles. A sustainable glass water bottle replaced them with a negligible carbon footprint. Boone's unique Zero Mile Water system, which uses IoT and AI to monitor the quality of every drop of water, allows hotels to reduce their reliance on external systems significantly. Such initiatives would further leverage the market for glass water bottles.

- Owing to the significant increase in the number of players and increasing focus on attractive packaging. Major players' increased spending on advertising and marketing activities to reach many consumers and generate profits is anticipated to complement the market's growth over the forecast period. Moreover, manufacturers are innovating bottled water, such as water infused with water from unscathed glaciers. This will likely attract new consumers to experience the feel of water to keep up with their hydration, thus driving the bottled water packaging market.

Asia Pacific to Witness Highest Growth

- The Asia-Pacific region holds significant potential for development in terms of the most prospective countries. In India, beverage packaging has witnessed significant growth in recent years. The key factors that drive the market growth include the rapid changes in beverage packaging trends across the country. There has been significant adoption of novel techniques for packaging. New beverage packaging trends focus on the structure modification of packaging materials and the development of new active systems that can interact with the product or its environment, customer acceptability, security, and improving the conservation of several beverages. Based on the materials used in packaging, the market can be further divided into glass, plastic, paper, and metals, predominantly aluminum).

- The key factors driving future growth are urbanization, vibrant youth and their growing share in the workforce, increasing purchasing disposable income, and improved connectivity, particularly in smaller towns. Government directives have brought a new development in the beverage packaging market. Since packaging waste is deemed toxic to the environment, attempts have been made to curb the amount of waste generated. This has nudged the industry towards recyclable and more sustainable packaging options.

- China's packaging industry has been growing at a rapid and stable pace due to the country's growing economy and increasing middle class with higher purchasing power. The demand for beverage packaging is growing because China's beverage market has experienced considerable growth over the past several years. While each beverage category will present different challenges and opportunities, there are emerging trends in the Chinese consumer lifestyle which are helping shape the market.

- The growing consumption of ready-to-drink (RTD) beverages due to hectic consumer work schedules and sedentary lifestyles is propelling the market for beverage packaging in Japan. Also, the rising consumer health concerns regarding the high prevalence of gut-related disorders, such as Gastroesophageal Reflux Disease (GERD), ulcers, gastroenteritis, etc., has increased the consumption of functional drinks are considered the key driving factor of growth for the market.

- The beverage industry is very innovative and can adapt fast to new or changing consumer demands and trends, such as the move to healthier, fresher, and less processed foods, with short storage time. Innovation, such as developing new processing, separation, and packaging technologies, is key to Asian beverage packaging success. The market is expected to grow due to product expansion, launch, upgradation, sustainability, and more. For instance, In June 2022, Packamama launched in Australia with Australian-made eco-flat bottles. Bottles are made from locally sourced recycled PET and produced by packaging market leader Visy in Melbourne.

Beverage Packaging Industry Overview

The beverage packaging market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Players in the market are adopting strategies such as partnerships, mergers, innovations, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2022 - Tetra Pak signed a USD 2.5 million contract with Uniboard to establish a cardboard recycling unit for used beverage cartons (UBC). The investment will be used to build a facility able to recycle 8,000 tonnes of UBC annually and should be operational in 2023.

- May 2022 - O-I Glass Inc. and Coca-Cola UNITED announced a partnership to recycle glass bottles. By 2030, Coca-Cola UNITED hopes to use 50% recycled material in its bottles as part of its commitment to building a world without waste. To collect more recycled glass to be turned into new glass bottles, the bottling firm is collaborating with O-I Glass.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Beverage Packaging Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Product Innovations like Downsizing Coupled with Cost Reduction

- 5.1.2 Changing Demographic and Lifestyle Factors

- 5.2 Market Challenges

- 5.2.1 Volatile Raw Material Costs

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Metal

- 6.1.3 Glass

- 6.1.4 Paperboard

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Cans

- 6.2.3 Pouches

- 6.2.4 Cartons

- 6.2.5 Beer Kegs

- 6.3 By Application

- 6.3.1 Carbonated Drinks

- 6.3.2 Alcoholic Beverages

- 6.3.3 Bottled Water

- 6.3.4 Milk

- 6.3.5 Fruit and Vegetable Juices

- 6.3.6 Energy Drinks

- 6.3.7 Plant-based Drinks

- 6.3.8 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Austria

- 6.4.2.7 Poland

- 6.4.2.8 Russia

- 6.4.2.9 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Mexico

- 6.4.4.2 Brazil

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 O-I Glass Inc. (Owens-Illinois Inc.)

- 7.1.2 Tetra Laval International SA

- 7.1.3 Ball Corporation

- 7.1.4 Ardagh Group

- 7.1.5 Amcor PLC

- 7.1.6 Mondi PLC

- 7.1.7 Verallia SA

- 7.1.8 Vidrala SA

- 7.1.9 Vetropack Holding Ltd

- 7.1.10 Crown Holdings Inc.

- 7.1.11 Silgan Containers LLC

- 7.1.12 CCL Container Inc.

- 7.1.13 Berry Global Inc.

- 7.1.14 Sonoco Products Company

- 7.1.15 Glassworks International Limited