|

市場調查報告書

商品編碼

1444729

行銷自動化軟體市場 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Marketing Automation Software Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

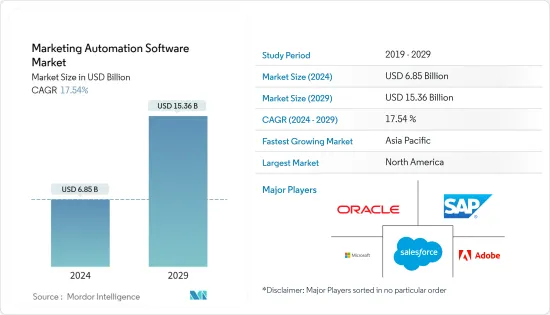

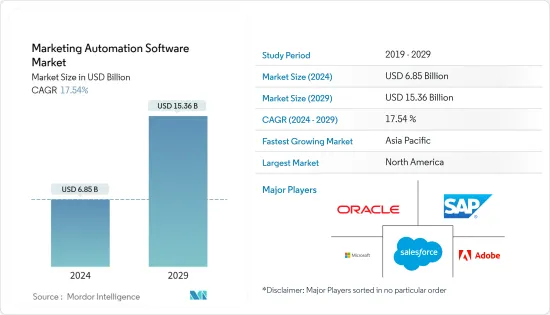

行銷自動化軟體市場規模預計到 2024 年為 68.5 億美元,預計到 2029 年將達到 153.6 億美元,在預測期內(2024-2029 年)CAGR為 17.54%。

由於行銷在創造銷售和保留客戶方面的重要性日益增加,行銷服務支出也隨之增加。

主要亮點

- 為了讓企業隨時了解全球最新的技術顛覆,行銷經理正在策略性地投資於行銷自動化解決方案和工具,以採用最新的數位行銷趨勢。

- 行銷自動化是一項技術,可以幫助企業透過消除繁瑣的活動並讓行銷人員專注於更重要的因素來創建更強大的消費者參與活動。除此之外,該技術也讓管理潛在客戶開發和客戶生命週期行銷變得更加容易。因此,自動化行銷工具近年來引起了廣泛關注,預計在研究期間將繼續上升。

- 從社群媒體行銷到搜尋引擎最佳化或內容行銷,行銷經理正在大力投資以支持和促進銷售。人工智慧(AI)、數據驅動的促銷和搜尋引擎最佳化(SEO)將為行銷解決方案提供者在數位化和積極的促銷技術時代提供優勢。在未來幾年,人工智慧將為企業、部門和國家提供可能的機會。

- 由於社交媒體行銷活動的成長,有機可見度預計會增加。各種品牌透過增加社群媒體行銷預算來提高投資報酬率 (ROI)。透過模仿Google的 AdWords 平台,社群媒體廣告定位可能會變得高度針對性。

- 隨著新的自動化技術的引入,市場也缺乏合格的個人來指導消費者如何充分利用分析解決方案並利用它們來獲取有用的資訊和見解。然而,大型企業正集中精力收購小型企業,並藉助 IaaS 和 SaaS 等雲端技術和平台提供稱為「行銷雲」的整合軟體套件。透過併購,公司可以透過獲取必要的知識、技術和客戶群來擴大市場佔有率和主導地位。

- 隨著COVID-19疫情的爆發,許多B2B行銷公司採取了「謹慎行事」的方式,他們減少了行銷預算,直到他們能夠分析對其業務的影響,並不得不等待經濟狀況的改善。

行銷自動化軟體市場趨勢

娛樂和媒體預計將佔據重要的市場佔有率

- 虛擬實境 (VR)、OTT 影片和線上廣告預計將成為科技採用主導的發展中經濟體娛樂和媒體公司成長最快的收入來源,例如美國的網路廣告和行銷市場,乃至全球。這些趨勢增加了對高網路行銷活動的需求,而這些活動的自動化採用率不斷上升,為所研究的市場中的供應商提供了廣闊的空間。

- 根據 GSMA 行動經濟的數據,隨著智慧型手機的普及率達到全球行動用戶群的近 70%,資料生成呈指數級成長。這些統計數據進一步表明對行動最佳化行銷和自動化支援軟體的需求。據 GSMA 稱,到 2022 年,全球 68% 的人口擁有行動訂閱。預計到2030年這數字將達到73%。

- 據 TrackMaven 稱,與其他行業相比,媒體和娛樂行業的電子郵件開啟率是全球最高的。透過社群媒體分析工具的客戶洞察,媒體和娛樂公司可以使用分段行銷資料(基於人口統計和興趣)來指導特定內容。

- 例如,由於龐大的消費者需求,在數位化和廣告收入增加的支持下,印度和加拿大的娛樂和媒體產業已處於快速成長階段的邊緣。外國傳媒娛樂巨頭在該地區的投資率不斷上升,使得該地區的影視基礎設施得到了更大程度的發展。

北美地區預計將佔據重要市場佔有率

- 北美地區包括美國和加拿大。該地區是市場上許多知名供應商的所在地,包括 Adobe、HubSpot、Marketo、Oracle、Salesforce Pardot 等,這加劇了在提供的新價格、目標群體和提供的功能等關鍵方面的競爭。

- 與傳統行銷相比,隨著數位全通路行銷的轉變,該地區行銷自動化軟體的採用不斷增加。根據美國行銷協會和杜克大學的 CMO 調查(n=356),2021 年 1 月,美國 B2B 產品行銷人員表示,他們在傳統廣告上的支出預計在隔年下降 0.61%,而數位行銷支出預計會成長14.32%

- SaaS 雲端服務的日益普及、對資料整合服務的需求不斷增加以及 5G 網路覆蓋範圍的擴大是市場研究估計在該地區範圍廣泛的一些重要因素。

- 對於行銷人員來說,將分析用於重複性任務(例如電子郵件行銷)和行銷自動化軟體等行銷技術(有助於有效使用和分析大量電子郵件活動期間收集的資料)已成為當務之急。 SharpSpring 等供應商透過其行銷自動化平台提供電子郵件追蹤和分析功能。個人化服務也正在成為市場的重要驅動力,因為它們提供了很高的投資報酬率。據個人化登陸頁面提供商 Instapage 稱,88% 的美國行銷人員表示,由於個人化,他們看到了可衡量的改進。

- 因此,由於數位行銷管道、政府舉措和供應商相關投資的採用,北美市場正在快速成長。

行銷自動化軟體產業概述

行銷自動化軟體市場有許多公司提供多種產品,因此市場高度分散。因此,市場創新至關重要,因為消費者會選擇具有最新功能的產品。資本支出也很高,這有助於具有強大競爭策略的公司快速前進。

- 2023 年 3 月 - Keap 是小型企業銷售和行銷自動化軟體領域的領先公司之一,宣布收購 The Factory。 The Factory 是 Keap 的前合夥人,幫助小型企業主制定強大的行銷策略並實施銷售和行銷自動化。

- 2023 年 1 月 - Yodelpop 是一家為協會和非營利組織提供服務的女性數位機構,推出了 RaiserSync 和 YourMemberSync,這是 HubSpot Marketing Hub 的兩個易於安裝的整合。這些新推出的整合允許協會和非營利組織將 YourMembership 協會管理系統或 Raiser's Edge NXT 捐贈者管理系統連接到 HubSpot 的行銷自動化軟體,以創建高效且有吸引力的行銷活動和溝通。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 持續轉向數位行銷活動

- 組織意識到數據支援的決策過程的好處

- 基於 SMAC 的技術的採用持續增加

- 市場課題

- 與遺留問題相關的實施課題

- 市場機會

- 產業生態系統分析

- COVID-19 對行銷自動化軟體市場的影響

- 短期影響

- B2B 行銷預算的變化及其對 Martech 預算分配的整體影響

- 長期影響

- 向數位媒體的遷移以及個人化行銷活動的需求

- 資料整理的成長增加了情勢化的需求

- 佔相當大佔有率的大型組織相對不受影響

- HubSpot 等供應商已成功創建了支持生態系統,幫助他們融入中小企業

- 短期影響

- 數位轉型實踐的廣泛採用和持續朝向整合 CRM 空間的影響

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 部署

- 基於雲端

- 本地部署

- 組織規模

- 大規模

- 中小企業為主

- 應用

- 活動管理

- 潛在客戶管理

- 銷售支援計劃

- 分析和報告解決方案

- 其他應用

- 最終用戶垂直領域

- 娛樂與媒體

- 金融服務

- 政府

- 衛生保健

- 製造業

- 零售

- 其他最終用戶垂直領域

- 地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第 6 章:競爭格局

- 公司簡介

- Hubspot, Inc.

- Adobe Systems Incorporated

- Oracle (Eloqua)

- Acoustic, LP

- Marketo Inc. (Adobe)

- Microsoft Corporation

- Salesforce (Pardot)

- Salesfusion Inc. (Sugar CRM)

- SAS SE

- Teradata Corporation

- SAP SE

- Act-On Software

- Klaviyo

- Active Campaign

- Keap

- Omnisend

- Thryv

- Drip

第 7 章:MI 的策略建議

- 後疫情時代供應商採取的主要措施分析

- Hubspot 等主要供應商實施的策略性措施的主要收穫

- 市場需求復甦的保守、現實、樂觀情勢分析

- 分析師對 MAS 市場格局的見解

第 8 章:供應商定位分析

第 9 章:市場前景

The Marketing Automation Software Market size is estimated at USD 6.85 billion in 2024, and is expected to reach USD 15.36 billion by 2029, growing at a CAGR of 17.54% during the forecast period (2024-2029).

Due to the increasing significance of marketing in generating sales and customer retention, marketing services are witnessing a rise in spending.

Key Highlights

- In Order to keep businesses updated with the recent technological disruptions worldwide, marketing managers are strategically spending on marketing automation solutions and tools to adopt the latest digital marketing trends.

- Marketing automation is a technology that aids businesses in creating stronger consumer engagement campaigns by removing tedious activities and allowing the marketing staff to concentrate on more important factors. In addition to other things, the technology makes it easier to manage lead generation and customer lifecycle marketing. As a result, Automated Marketing Tools have drawn a lot of attention in recent years, and it is anticipated that they will continue to rise during the research period.

- From social media marketing to SEO or content marketing, marketing managers are investing significantly to support and boost their sales. Artificial intelligence (AI), data-driven promotion, and search engine optimization (SEO) will give marketing solution providers an advantage in the era of digitization and aggressive promotion techniques. In the upcoming years, AI will present possible opportunities for businesses, sectors, and nations.

- Organic visibility is expected to increase due to the growth in social media marketing campaigns. Various brands improve their return on investment (ROI) by increasing their social media marketing budget. Social media advertisement targeting will likely become highly targeted by mirroring Google's Adwords platform.

- With the introduction of new automation technologies, the market is also experiencing a lack of qualified individuals who can instruct consumers on how to make the most of analytics solutions and use them for helpful information and insights. However, large-sized businesses are concentrating on acquiring smaller ones and providing integrated software suites termed "Marketing Cloud" with the aid of cloud technologies and platforms like IaaS and SaaS. Through mergers and acquisitions, companies can grow their market share and domination by acquiring the necessary knowledge, technology, and client base.

- With the onset of the COVID-19 outbreak, many B2B marketing companies adopted a "play it safe" approach through which they reduced their marketing budgets until they could analyze the impact on their businesses and had to wait for the economic scenario to improve.

Marketing Automation Software Market Trends

Entertainment and Media Expected to have a Significant Market Share

- Virtual reality (VR), over-the-top (OTT) video and online advertising are projected to be among the fastest-growing revenue generators for entertainment and media companies in developing economies where technology adoption is dominant, like the United States internet advertising and marketing market, and globally. These trends increase the need for high internet marketing activity, and the rising automation adoption for these activities supports the substantial scope for the vendors in the market studied.

- With smartphone adoption reaching nearly 70% of the global mobile user base, according to GSMA Mobile Economy, data generation has exponentially increased. Such statistics further indicate the need for mobile-optimized marketing and automation-supporting software. According to GSMA, in 2022, 68% of the global population was reported to have had a mobile subscription. This figure is expected to reach 73% by 2030.

- Compared to other industries, open email rates for media and entertainment are the highest globally, according to TrackMaven. With customer insights from social media analytics tools, media and entertainment companies can use segmented marketing data (based on demographics and interest) to direct specific content.

- For instance, India and Canada's entertainment and media sectors have positioned themselves on the verge of an intense growth phase, backed by digitization and improving advertising revenues, owing to the enormous consumer demand. The rising rate of investments by foreign media and entertainment majors in the region has developed the M&E infrastructure to a higher extent.

North America Region is Expected to Hold Significant Market Share

- The North American region includes the United States and Canada. The region is home to a number of prominent vendors in the market, including Adobe, HubSpot, Marketo, Oracle, Salesforce Pardot, and others, which increases competition on crucial aspects such as new prices offered, target group, and features offered.

- The adoption of marketing automation software has been increasing in the region as there has been a shift to digital omnichannel marketing compared to traditional marketing. According to the CMO Survey by American Marketing Association and Duke University (n=356), in January 2021, B2B product marketers in the United States suggested that their spending on traditional advertising was expected to decline by 0.61% in the following year, while the digital marketing spending was projected to increase by 14.32%

- The growing adoption of SaaS cloud services, increasing demand for data integration services, and expanding 5G network coverage are some of the significant factors that the market studied is estimated to have a massive scope in the region.

- The use of analytics for repetitive tasks such as email marketing and marketing technologies such as marketing automation software that helps efficient use and analysis of data collected during bulk email campaigns has become imperative for marketers. Vendors such as SharpSpring offers email tracking and analytics features with their marketing automation platform. Personalization services are also becoming a vital driver for the market as they offer a high probability of return on investment. According to Instapage, a provider of personalized landing pages, 88% of US marketers reported seeing measurable improvements due to personalization.

- Thus, the market for North America is growing at a rapid pace owing to the adoption of digital marketing channels, government initiatives, and vendor-related investments.

Marketing Automation Software Industry Overview

The marketing automation software market has several products available with a number of companies in the market, making it highly fragmented. Hence, innovation in the market is crucial, as consumers opt for products with the latest features. The capital expenditure is also high, which has helped companies with powerful competitive strategies to move forward rapidly.

- March 2023 - Keap, one of the leading companies in sales and marketing automation software for small businesses, announced that it had acquired The Factory. A former Keap partner, The Factory assists small business owners with building powerful marketing strategies and implementing sales and marketing automation.

- January 2023 - Yodelpop, a women-owned digital agency serving associations and nonprofits, launched RaiserSync and YourMemberSync, two easy-install integrations for HubSpot Marketing Hub. These newly launched integrations allow associations and nonprofits to connect the YourMembership association management system or Raiser's Edge NXT donor management system to HubSpot's marketing automation software to create efficient and engaging marketing campaigns and communications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ongoing Shift Toward Digital-based Campaigns

- 4.2.2 Organizations Realizing the Benefits of Data-backed Decision Process

- 4.2.3 Sustained Increase in Adoption of SMAC-based Technologies

- 4.3 Market Challenges

- 4.3.1 Legacy-related Implementation Challenges

- 4.4 Market Opportunities

- 4.5 Industry Ecosystem Analysis

- 4.6 Impact of COVID-19 on the Marketing Automation Software Market

- 4.6.1 Short-term Impact

- 4.6.1.1 Changes in B2B marketing budgets and their overall impact on martech budget allocations

- 4.6.2 Long-term Impact

- 4.6.2.1 Migration to Digital Mediums and Need for Personalized Campaigns to Gather Traction

- 4.6.2.2 Growth in Collation Of Data Has Increased the Need for Contextualization

- 4.6.2.3 Large-scale Organizations Which Account for a Sizeable Share Remain Relatively Unaffected

- 4.6.2.4 Vendors such as HubSpot Have Successfully Created a Supporting Ecosystem Which Has Helped Them Onboard SMEs

- 4.6.1 Short-term Impact

- 4.7 Impact of Higher Adoption of Digital Transformation Practices and Ongoing Move towards an Integrated CRM Space

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 Cloud-based

- 5.1.2 On-Premise

- 5.2 Organization Size

- 5.2.1 Large-scale

- 5.2.2 SME-based

- 5.3 Application

- 5.3.1 Campaign Management

- 5.3.2 Lead Management

- 5.3.3 Sales Enablement Programs

- 5.3.4 Analytics & Reporting Solutions

- 5.3.5 Other Applications

- 5.4 End-user Vertical

- 5.4.1 Entertainment & Media

- 5.4.2 Financial Services

- 5.4.3 Government

- 5.4.4 Healthcare

- 5.4.5 Manufacturing

- 5.4.6 Retail

- 5.4.7 Other End-user Verticals

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Hubspot, Inc.

- 6.1.2 Adobe Systems Incorporated

- 6.1.3 Oracle (Eloqua)

- 6.1.4 Acoustic, L.P.

- 6.1.5 Marketo Inc. (Adobe)

- 6.1.6 Microsoft Corporation

- 6.1.7 Salesforce (Pardot)

- 6.1.8 Salesfusion Inc. (Sugar CRM)

- 6.1.9 SAS SE

- 6.1.10 Teradata Corporation

- 6.1.11 SAP SE

- 6.1.12 Act-On Software

- 6.1.13 Klaviyo

- 6.1.14 Active Campaign

- 6.1.15 Keap

- 6.1.16 Omnisend

- 6.1.17 Thryv

- 6.1.18 Drip

7 Strategic Recommendations from MI

- 7.1 Analysis of Key Initiatives Undertaken by Vendors in the Post-COVID World

- 7.2 Major Takeaways from the Strategic Initiatives Implemented by Major Vendors such as Hubspot

- 7.3 Analysis of Conservative, Realistic, and Optimistic Scenarios on the Recovery of the Market Demand

- 7.4 Analyst Insights on the MAS Market Landscape