|

市場調查報告書

商品編碼

1444728

混凝土外加劑:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Concrete Admixtures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

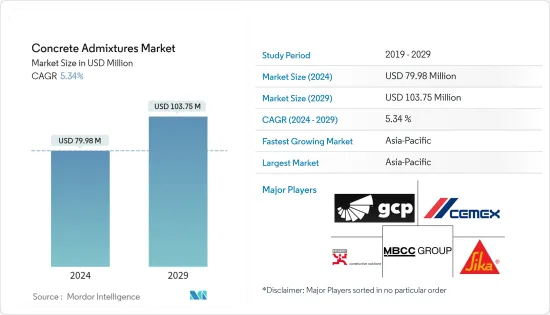

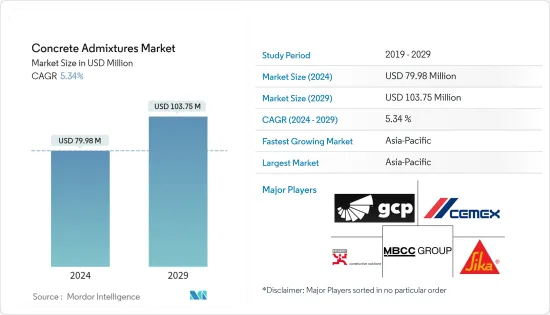

混凝土外加劑市場規模預計2024年為7,998萬美元,預計2029年將達到1.0375億美元,在預測期內(2024-2029年)年複合成長率為5.34%成長。

COVID-19 對 2020 年市場產生了負面影響。建設活動的限制、供應鏈中斷和勞動力短缺對混凝土外加劑市場產生了負面影響。然而,情況將在 2022 年恢復,預計將有利於預測期內研究的市場。

主要亮點

- 短期來看,住宅建築領域需求的增加和基礎設施領域投資的增加正在推動市場需求。

- 然而,對更多熟練勞動力的需求和建設產業工人的意識是限制市場成長的因素。

- 儘管如此,中東和非洲的成長機會可能成為未來混凝土外加劑市場的成長機會。

- 預計亞太地區將主導市場,並且在預測期內也可能出現最高的年複合成長率。

混凝土外加劑市場趨勢

住宅建築中的使用增加

- 預計全球住宅計劃需求的成長將在預測期內推動全球混凝土外加劑市場的發展。全球範圍內,滿足住宅需求的供應嚴重短缺。這為投資者和開發商提供了採用替代施工方法和新合作夥伴關係來推動發展的重大機會。

- 人口成長、從家鄉遷移到服務業群聚以及核心家庭的趨勢都在推動全球住宅建設。此外,土地人口比的下降以及高層住宅和城鎮建設的增加趨勢正在推動混凝土外加劑在住宅建築領域的使用。

- 公寓、平房和別墅等住宅在新興國家越來越受歡迎,這主要是由於都市化。

- 最近,由於中國和印度住宅建築市場的擴張,預計亞太地區的住宅建築成長率最高。亞太地區包括最大的低成本住宅建築市場,以中國、印度和東南亞國家主導。

- 此外,該國擁有世界上最大的建築市場,佔全球建築投資的20%。預計未來十年中國將在建築上花費近13兆美元,為混凝土外加劑市場創造了積極的市場前景。

- 根據美國人口普查局的數據,2022年美國公共住宅支出為91.5億美元。

- 同樣,根據美國人口普查局的數據,預計 2022 年美國新建單戶住宅將達到 1,010 套,總計 900住宅。

- 印尼是東南亞最大、成長最快的住宅建築市場之一。此外,印尼政府還啟動了一項在印尼各地建造約 100 萬套住宅的計劃,並為此撥款約 10 億美元。

- 此外,在英國,耗資3.33億美元位於曼徹斯特市中心阿爾比恩街的一棟40層住宅大樓和14層辦公大樓已開始建設,並於去年第三季竣工。預計2年後。

- 加拿大政府的多個計劃支持該行業的擴張,包括經濟適用房舉措(AHI)、加拿大新建計劃 (NBCP) 和加拿大製造。

- 預計上述因素將對預測期內住宅建築領域混凝土外加劑的需求產生重大影響。

亞太地區主導市場

- 預計亞太地區將主導受調查的市場。在該地區,以GDP計算,中國是最大的經濟體。中國和印度是世界上成長最快的新興經濟體之一。

- 購買力的增強和人口從農村到都市區的遷移預計將繼續推動中國建築業的需求。

- 由於共享辦公空間的成長趨勢和線上零售的興起,全球商業建設產業在過去幾年經歷了溫和成長。

- 中國政府正在推出一項大規模的建設計畫,其中包括為未來十年將2.5億人遷入新的特大城市做準備,併計劃在未來的建設過程中使用混凝土外加劑等各種應用。為建築材料創造了一個大的覆蓋範圍。增強建築物特徵的活動。

- 根據中國2022年1月公佈的五年計劃,預計2022年中國建築業將成長6%左右。中國計劃增加裝配式建築的建設,以減少建築工地的污染和廢棄物。

- 未來5年預計將投資1.43兆美元用於大型建設計劃。據國家發展和改革委員會 (NDRC) 稱,上海計劃包括未來三年投資 387 億美元。相較之下,廣州新簽基礎建設計劃16個,投資金額80.9億美元。

- 非住宅基礎設施預計也將顯著成長。該國的人口老化正在創造醫療保健設施和新醫院建設的需求。近年來,中國經濟發生結構性變化,服務業佔GDP比重不斷提高,商業辦公空間建設大量湧現。

- 此外,印度政府正在積極推動住宅建設,為約13億人提供住宅。

- 預計未來六到七年,該國的住宅投資將達到約 1.3 兆美元。該國可能將新建6,000萬套住宅,這將是顯著提振受訪市場的因素。

- 該國經濟適用住宅的供應量預計將在兩年內增加約 70%。透過政府的經濟適用住宅舉措,包括基礎設施開發和全民住宅以及智慧城市計劃,印度預計到年終將為建設產業貢獻約 6,400 億美元。

- 印度政府在 2022-23 年聯邦預算中撥款 100 萬盧比(1,305.7 億美元)用於加強基礎設施部門,大力推動基礎設施部門發展。

- 所有上述因素預計將增加該地區對混凝土外加劑的需求。

混凝土外加劑產業概況

混凝土外加劑市場本質上是分散的。主要參與者包括(排名不分先後)Sika AG、Fosroc Inc.、CEMEX SAB de CV、GCP Applied Technologies Inc.、MBCC Group 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 住宅建築業需求增加

- 加大基礎建設領域投資

- 抑制因素

- 建設產業工人缺乏熟練勞動力和意識

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔

- 功能

- 減水劑(塑化劑)

- 緩速器

- 加速器

- 加氣劑

- 黏度調節劑

- 減縮劑

- 高範圍減水劑(減水劑)

- 其他特性

- 建築業

- 商業的

- 住宅

- 基礎設施

- 產業和機構

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- CAC Admixtures

- Cemex SAB de CV

- CICO Group

- Fosroc Inc.

- GCP Applied Technologies Inc.

- HA-BE Betonchemie

- MAPEI SpA

- MBCC Group

- Pidilite Industries Ltd

- RPM International Inc.

- Saint Gobain

- Sika AG

第7章市場機會與未來趨勢

- 中東和非洲的成長機會

The Concrete Admixtures Market size is estimated at USD 79.98 million in 2024, and is expected to reach USD 103.75 million by 2029, growing at a CAGR of 5.34% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020. Restrictions on construction activities, supply chain disruptions, and labor shortages negatively affected the concrete admixtures market. However, the condition is recovering in 2022, which is expected to benefit the market studied during the forecast period.

Key Highlights

- Over the short term, the increasing demand from the residential construction sector and increasing investments in the infrastructure sector are driving market demand.

- However, the need for a more skilled workforce and awareness of the construction industry workers are the factors that are hindering the market's growth.

- Nevertheless, growth opportunities in the Middle East and Africa may act as growth opportunities for the concrete admixtures market in the future.

- The Asia-Pacific region is expected to dominate the market and may also witness the highest CAGR during the forecast period.

Concrete Admixtures Market Trends

Increasing Usage in the Residential Construction

- The increasing demand for residential projects worldwide is expected to drive the global concrete admixtures market over the forecast period. Globally, there is a significant undersupply to meet the demand for housing. It presented a major opportunity for investors and developers to embrace alternative construction methods and new partnerships to bring forward development.

- Growth in population, migration from hometowns to service sector clusters, and the growing trend of the nuclear family are some factors driving residential construction on a global scale. Besides, the decreasing land-to-population ratio and the growing trend of constructing high-rise residential buildings and townships have been driving the application of concrete admixtures in the residential construction segment.

- Residential properties such as apartments, bungalows, and villas are gaining popularity in emerging nations and are mainly driven by urbanization.

- In the recent past, the highest growth rate regarding residential construction was expected in the Asian-Pacific region due to the expanding housing construction market in China and India. Asia-Pacific includes the largest low-cost housing construction segment, led by China, India, and Southeast Asian countries.

- In addition, the country includes the largest construction market in the world, encompassing 20% of all construction investments worldwide. China is expected to spend nearly USD 13 trillion on buildings over the decade, creating a positive market outlook for the concrete admixtures market.

- According to US Census Bureau, public residential construction spending in the United States accounted for USD 9.15 billion in 2022.

- Similarly, according to the US Census Bureau, the volume of new single-family home construction in the United States in 2022 was 1,010 and is expected to reach 900 in total numbers of housing.

- Indonesia is one of the largest- and fastest-growing residential construction markets in Southeast Asia. Moreover, the Indonesian government started a program to build about one million housing units across Indonesia, for which the government allocated about USD 1 billion in the budget.

- Furthermore, in the United Kingdom, with an investment of USD 333 million, the construction of a 40-story residential tower and a 14-story office building at Albion Street in Central Manchester was commissioned in the third quarter of the previous year, with completion estimated in two years.

- Various government projects in Canada, including the Affordable Housing Initiative (AHI), New Building Canada Plan (NBCP), and Made in Canada, supported the sector's expansion.

- The abovementioned factors are expected to significantly impact the demand for concrete admixtures in the residential construction sector during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asian-Pacific region is expected to dominate the market studied. In the region, China is the largest economy in terms of GDP. China and India are among the fastest emerging economies in the world.

- Increasing spending power, combined with the population migrating from rural to urban areas, is expected to continue to drive the demand for the construction sector in China.

- The growing trend of co-working space and increasing online retailing have resulted in moderate growth for the global commercial construction industry over the past few years.

- The Chinese government rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities over the next ten years, creating a major scope for construction materials, such as concrete admixtures used in the future in various applications during construction activities to enhance the building properties.

- According to China's five-year plan unveiled in January 2022, the construction industry in the country is estimated to register a growth rate of approximately 6% in 2022. China plans to increase the construction of prefabricated buildings to reduce pollution and waste from construction sites.

- The country is expected to invest USD 1.43 trillion in the next five years in major construction projects. According to National Development and Reform Commission (NDRC), the Shanghai Plan includes an investment of USD 38.7 billion in the next three years. In contrast, Guangzhou signed 16 new infrastructure projects with an investment of USD 8.09 billion.

- Non-residential infrastructure is also expected to grow considerably. The aging population in the country is creating demand for the construction of healthcare facilities and new hospitals. Structural changes have been observed in the Chinese economy over the past few years as the service sector is taking a larger share of the total GDP, which gave rise to the construction of huge commercial and office spaces.

- Moreover, the Indian government is actively boosting housing construction to provide homes to about 1.3 billion people.

- The country will likely witness around USD 1.3 trillion of investment in housing over the next six to seven years. It is likely to witness the construction of 60 million new homes in the country, a major boosting factor for the market studied.

- The availability of affordable housing in the country is expected to rise by around 70% in two years. By the end of this year, India is expected to contribute about USD 640 billion to the construction industry due to government initiatives in infrastructure development and affordable housing, such as housing for all, smart city plans, etc.

- In Union Budget 2022-23, the Indian government gave a massive push to the infrastructure sector by allocating INR 10 lakh crore (USD 130.57 billion) to enhance the infrastructure sector.

- All the factors mentioned above are expected to boost the demand for concrete admixtures in the region.

Concrete Admixtures Industry Overview

The concrete admixtures market is fragmented in nature. The major players include Sika AG, Fosroc Inc., CEMEX S.A.B. de C.V., GCP Applied Technologies Inc., and MBCC Group, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Residential Construction Sector

- 4.1.2 Increasing Investments In the Infrastructure Sector

- 4.2 Restraints

- 4.2.1 Lack of Skilled Workforce and Awareness in Construction Industry Workers

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Function

- 5.1.1 Water Reducer (Plasticizer)

- 5.1.2 Retarder

- 5.1.3 Accelerator

- 5.1.4 Air Entraining Admixture

- 5.1.5 Viscosity Modifier

- 5.1.6 Shrinkage-reducing Admixture

- 5.1.7 High-range Water Reducer (Superplasticizer)

- 5.1.8 Other Functions

- 5.2 Construction Sector

- 5.2.1 Commercial

- 5.2.2 Residential

- 5.2.3 Infrastructure

- 5.2.4 Industrial and Institutional

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 CAC Admixtures

- 6.4.2 Cemex S.A.B. de C.V.

- 6.4.3 CICO Group

- 6.4.4 Fosroc Inc.

- 6.4.5 GCP Applied Technologies Inc.

- 6.4.6 HA-BE Betonchemie

- 6.4.7 MAPEI S.p.A.

- 6.4.8 MBCC Group

- 6.4.9 Pidilite Industries Ltd

- 6.4.10 RPM International Inc.

- 6.4.11 Saint Gobain

- 6.4.12 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth Opportunities in Middle-East and Africa