|

市場調查報告書

商品編碼

1444708

奈米物聯網 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Internet Of Nano Things - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

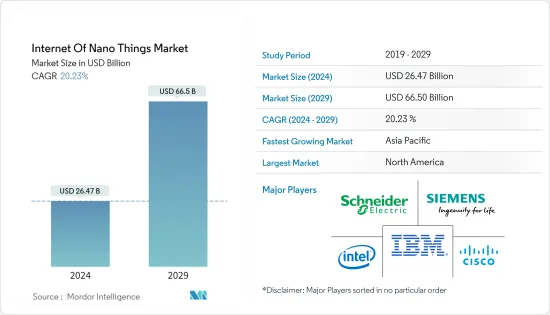

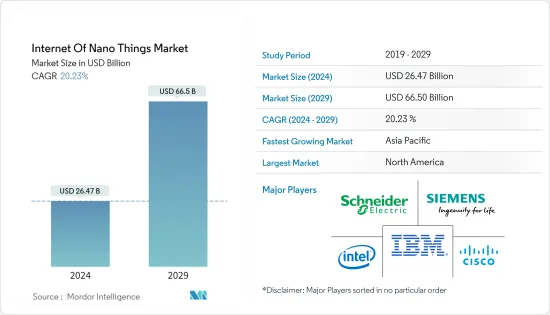

2024年奈米物聯網市場規模估計為264.7億美元,預計到2029年將達到665億美元,在預測期內(2024-2029年)CAGR為20.23%。

奈米物聯網 (IoNT) 促進了奈米感測器和奈米設備與市場上現有通訊技術(包括網際網路)的互連。開發具有通訊能力並與微觀和宏觀設備互連的奈米機器將為IoNT賦能,這越來越被視為下一個重大技術創新。這些設備的尺寸從 1 nm 到 100 nm 不等,並與經典網路互連,從而形成新的網路範例。

主要亮點

- IoNT 是一項現代技術,可讓眾多奈米設備透過高速網路相互通訊。 IoNT 用於資料收集、預處理以及與最終用戶共用。它還透過雲端運算、巨量資料和機器學習 (ML) 等新技術開闢了許多可能性。

- 政府在航空航太和國防領域的支出增加預計將在預測期內推動 IoNT 市場,因為 IoNT 在奈米無人機領域發現了重要應用,可用於監測和攜帶足以穿透目標的爆炸物主題。

- 過去幾年的技術進步主要促使了智慧環境(辦公室、家庭和城市等)的快速成長。此類環境的快速成長為應用程式和網際網路使用的互連鋪平了道路,從而促進了物聯網技術的出現。物聯網概念的擴展也帶來了 IoNT,這是一種主要基於奈米技術和物聯網的新通訊網路範式。

- 重要的市場參與者專注於策略合作和改進解決方案,這增加了物聯網市場的機會。 2022 年 1 月,Qualcomm Technologies, Inc. 在 2022 年消費性電子展 (CES) 上宣布與微軟合作,以發展和加速擴增實境 (AR) 在消費者和企業領域的採用。兩家公司都相信元宇宙,Qualcomm Technologies 正在與微軟合作開展多項舉措,推動生態系統向前發展,包括開發客製化AR 晶片,以實現新一波節能、輕量級AR 眼鏡,從而提供豐富且身臨其境的體驗。並計劃整合微軟Mesh和Snapdragon SpacesTM XR開發者平台等軟體。

- 用於監視和運輸軍隊的奈米無人機是物聯網的另一個關鍵用途。此外,IoNT 還可以提供更詳細、最新的城市、房屋和工廠圖像。在智慧城市專案中使用物聯網可以監測整個大都市的各種特徵,例如空氣和水質。 IoNT 可以擷取即時資料,這些數據可用於改善基礎設施、公共設施和服務等。此外,人們對物聯網諸多好處和奈米機器發展的認知不斷提高,將在整個預測期內顯著提高市場收入成長。

- 隨著設備的互聯程度越來越高,物聯網變得越來越豐富,設備數量的急劇增加預計將使公司能夠改善服務、提供更新的產品或簡化現有流程。 IoNT 生態系統正在多個行業中廣泛採用,並且對支援 IoNT 的設備的需求不斷增加。奈米物聯網 (IoNT) 提供了藉助高速網路連接各種奈米設備的媒介。

- COVID-19 改變了全球企業的本質和工作條件。公司的營運更加自動化,而員工則繼續遠距工作。 IoNT 開發人員致力於實施 \IoNT 技術,這有助於 IoNT 業務的蓬勃發展。奈米無人機幫助運送醫療物資並監控特定地點,它們不再被視為僅僅是戰爭和默默無聞的武器。此外,醫療保健領域的 IoNT 解決方案提供了許多好處,例如降低服務成本和提高治療效果,推動 IoNT 市場向前發展。

奈米物聯網市場趨勢

醫療保健產業預計將佔據重要佔有率

- 奈米技術和奈米物聯網 (IoNT) 不斷影響醫療保健產業及其轉型,並取得更好的成果。透過奈米材料和裝置將奈米技術涵蓋醫學,稱為奈米醫學,為疾病的預防、診斷和治療帶來了許多好處。

- 預計醫療保健和生命科學領域將在預測期內快速成長。 IoNT 可以及早發現危及生命的疾病,並協助收集患者的即時資料,從而採取挽救生命的醫療措施。

- 根據美國癌症協會預測,2022 年美國預計將新增 190 萬癌症病例,其中 609,360 人因癌症死亡。因此,癌症患者數量的增加推動了醫療保健奈米技術產業的發展。

- 奈米技術產品在醫療保健領域越來越有益,開發了獨特的奈米系統,用於診斷、成像和治療各種疾病,包括癌症、心血管、眼科和中樞神經系統疾病。

- 將物聯網理念融入醫療保健領域,使健康監測和治療更加個人化、及時、便利。因此,奈米技術和物聯網有可能徹底改變21世紀的醫療保健,創造一個能夠早期發現和診斷疾病的系統,然後進行準確、及時、有效的治療,從而顯著降低醫療成本。

- 奈米藥物和奈米設備的進步促使許多研究人員尋求替代療法,因為目前的方法在早期識別和治療方面受到限制。各種奈米材料和奈米系統的顯著特徵和應用使其在創造即將部署的技術中無處不在。

- IoNT 還可以形成身體感測器網路 (BSN),輕鬆應用內部奈米感測器來監測患者健康和生理活動。患者可以與醫生一起在穿戴式裝置上查看奈米感測器獲得的資料。

- 智慧型穿戴裝置在擴大物聯網產業範圍方面發揮了重要作用。健身追蹤設備的大規模採用以及 Apple、Fitbit 和 Android 等公司不斷增加的投資透過添加更多醫療保健功能進一步擴大了產品範圍。許多新創公司也將創新帶入該行業。

北美預計將佔據最大佔有率

- 美國的現代製造設施依靠新技術和創新來以更低的成本生產更高品質的產品。快速、安全的 5G 連線有望實現敏捷營運和靈活生產。這項技術預計將促進自動化倉庫、自動化組裝、連網物流、包裝、產品處理和自動推車。

- 該地區的知名企業專注於策略性收購和合作,以保持競爭力並增強自身能力。例如,2022 年 7 月,英特爾和聯發科宣布達成合作協議,使用英特爾代工服務 (IFS) 的先進製程技術製造半導體。此次合作旨在透過增加在美國和歐洲擁有強大產能的新代工合作夥伴,協助聯發科開發更平衡、更有彈性的供應鏈。

- 此外,2022 年 7 月,英特爾宣布推出首款開源 AI 參考套件,讓在本地、雲端和邊緣環境中營運的企業更容易使用 AI。這些參考套件首次在英特爾視覺大會上亮相,其中包括人工智慧模型程式碼、端到端機器學習管道指令、函式庫和英特爾 one API 元件,以實現跨架構效能。這些套件教導資料科學家和開發人員如何在醫療保健、製造、零售和其他行業中更快速、更輕鬆地部署人工智慧,從而提高準確性、改善效能並降低整體實施成本。

- 預計從現有技術中湧現的新興技術將改變美國的製造業,其中包括人工智慧和 IoNT 的融合,SAS Software 等公司將 IoNT 視為基於奈米技術的物聯網的下一波浪潮。

- 該地區的主要參與者正在開發新的解決方案以保持市場競爭力。 2021年5月,IBM宣布開發出全球首款採用2奈米(nm)奈米片技術的晶片,標誌著半導體設計與製程的里程碑。半導體用於各種應用,包括計算、電器、通訊設備、運輸系統和關鍵基礎設施。

- 此外,新興的 5G 標準具有新無線電 (NR) 的目標功能,例如車輛到一切和超可靠的低延遲通訊,作為工業用例。借助 IEC 標準化的工業通訊匯流排(例如 PROFINET 和 Modbus),市場正朝著可靠、安全的工業採用方向發展。

奈米物聯網產業概況

奈米物聯網市場是半競爭性的,由施耐德電機、IBM 和英特爾等幾個主要參與者組成。然而,市場仍然處於整合狀態,許多參與者都試圖佔領佔有率。他們透過大力投資研發來不斷創新產品和服務的能力使他們能夠比其他參與者獲得競爭優勢。

2022 年 1 月,Nokia和 Nordic Semiconductor 公佈了一項突破性的新策略,用於授權使用蜂窩物聯網標準基本專利。 Nordic 現在將為企業提供購買諾基亞領先行業的一系列令人印象深刻的蜂窩專利許可的機會。

2021年9月,西門子股份公司專注於加強分銷能力。例如,該公司宣布與 Digi-Key Electronics 建立策略性分銷合作夥伴關係,提供其自動化和控制產品。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

- 研究框架

- 二次研究

- 初步研究

- 主要研究方法及主要受訪者

- 數據三角測量與洞察生成

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- 價值鏈分析

- 評估 COVID-19 對市場的影響

- 技術簡介

第 5 章:市場動態

- 市場促進因素

- 設備的廣泛連接

- 奈米科技的出現

- 市場課題/限制

- 安全問題

- 技術成本高

第 6 章:市場區隔

- 依組件

- 硬體

- 軟體

- 連線/服務

- 依最終用戶

- 衛生保健

- 後勤

- 國防和航太

- 製造業

- 能源與電力

- 零售

- 其他最終用戶

- 依地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第 7 章:競爭格局

- 公司簡介

- Schneider Electric SE

- Siemens AG

- IBM Corporation

- Intel Corporation

- Cisco Systems Inc.

- SAP SE

- Juniper Networks Inc.

- Qualcomm Inc.

- Nokia Corporation

第 8 章:投資分析

第 9 章:市場機會與未來趨勢

The Internet Of Nano Things Market size is estimated at USD 26.47 billion in 2024, and is expected to reach USD 66.5 billion by 2029, growing at a CAGR of 20.23% during the forecast period (2024-2029).

The internet of nano things (IoNT) facilitates the interconnection of nano-sensors and nanodevices with the existing communication technologies in the market, including the internet. Developing nano-machines with communication capabilities and interconnection with micro-and macro-devices will empower IoNT, which is increasingly seen as the next major technological innovation. These devices have dimensions ranging from 1 nm to 100 nm and are interconnected with classical networks leading to new networking paradigms.

Key Highlights

- IoNT is a modern technology that allows numerous nano gadgets to communicate with one another via a high-speed network. IoNT is used for data gathering, pre-processing, and sharing with end users. It also opens up many possibilities with new technologies, such as cloud computing, big data, and machine learning (ML).

- The increased government spending in the aerospace and defense sector is expected to drive the IoNT market during the forecast period, as IoNT has found significant applications in the fields of nano-drones that could be used for monitoring and carrying explosives sufficient enough to penetrate the targetted subject.

- The technological advancements over the past few years have primarily led to the rapid growth of smart environments (offices, homes, and cities, among others). This rapid increase in such environments has paved the way for the interconnectivity of applications and internet usage, prompting the emergence of IoT technology. The expansion of the IoT concept has also given access to IoNT, a new communication network paradigm primarily based on nanotechnology and IoT.

- The significant market players focused on strategic collaborations and improving the solutions, which increased opportunities for the IoNT Market. In January 2022, Qualcomm Technologies, Inc. announced a collaboration with Microsoft at the 2022 Consumer Electronics Show (CES) to grow and accelerate the adoption of augmented reality (AR) in both the consumer and enterprise sectors. Both companies believe in the metaverse, and Qualcomm Technologies is collaborating with Microsoft on several initiatives to propel the ecosystem forward, including the development of custom AR chips to enable a new wave of power-efficient, lightweight AR glasses to deliver rich and immersive experiences as well as plans to integrate software such as Microsoft Mesh and the Snapdragon SpacesTM XR Developer Platform.

- Nano-drones, employed for monitoring and transporting military troops, are another key use of IoNT. In addition, IoNT can provide more detailed and up-to-date images of cities, houses, and factories. The use of IoNT in smart city projects may monitor various characteristics, such as air and water quality, throughout a metropolis. IoNT can capture real-time data that can be utilized to improve infrastructure, public utilities, and services, among other things. Furthermore, rising awareness of the many benefits of IoNT and the development of nano-machines will considerably enhance market revenue growth throughout the forecast period.

- As devices become more connected and IoT becomes abundant, the sheer rise in the volume of devices is expected to enable companies to improve service, offer newer products, or streamline existing processes. The IoNT ecosystem is gaining widespread adoption across multiple industries and increasing demand for IoNT-enabled devices. The Internet of Nano Things (IoNT) offers a medium to connect various nanodevices with the help of high-speed networks.

- COVID-19 altered the nature and working conditions of businesses worldwide. Companies automated their operations even more while employees continued to work remotely. IoNT developers were working on implementing \IoNT techniques, which helped the IoNT business to flourish. Nano drones helped deliver medical supplies and monitor specific locations, and they were no longer regarded as merely a weapon of war and obscurity. Furthermore, IoNT solutions in the healthcare sector offered numerous benefits, such as lowering service costs and increasing treatment outcomes, propelling the IoNT market forward.

Internet of Nano Things Market Trends

Healthcare Industry is Expected to Hold a Significant Share

- Nanotechnology and the Internet of Nano Things (IoNT) have continuously impacted the healthcare sector and its transformation and contributed to better results. Including nanotechnology in medicine through nanomaterials and devices, known as nanomedicine, has brought many benefits to disease prevention, diagnosis, and treatment.

- The healthcare and life sciences area is predicted to grow rapidly during the forecast period. IoNT can detect life-threatening disorders early on and assists in the collecting of real-time data from patients, allowing for life-saving medical measures.

- According to the American Cancer Society, an expected 1.9 million new cancer cases will be identified in the United States in 2022, with 609,360 cancer deaths. As a result, the rising number of cancer patients propels the healthcare nanotechnology industry forward.

- Nanotechnology products have been increasingly beneficial in healthcare, developing unique nanosystems for diagnosing, imaging, and treating various diseases, including cancer, cardiovascular, ophthalmic, and central nervous system ailments.

- Incorporating the concept of IoNT into healthcare has enabled more personalized, timely, and convenient health monitoring and treatment. Therefore, nanotechnology and IoNT have the potential to revolutionize healthcare in the 21st century completely, creating a system that enables early detection and diagnosis of illness, followed by accurate, on-time, and effective treatment, significantly reducing medical costs.

- The advancement of nanomedicines and nanodevices has spurred many researchers to seek alternative remedies, as current approaches are limited in earlier identification and treatment. The remarkable features and applications of diverse nanomaterials and nanosystems have made them ubiquitous in creating technologies that will be deployed shortly.

- The IoNT can also form a body sensor network (BSN) that easily applies internal nano-sensors to monitor patient health and physiological activity. The patient can view this data obtained by the nano-sensor on a wearable gadget with a doctor.

- Smart wearables have played a significant role in expanding the scope of IoNT in the sector. The massive adoption of fitness tracking devices and growing investments by companies like Apple, Fitbit, and Android enhance the range further by adding more healthcare features. Many startups are also bringing innovation into the sector.

North America is Expected to Hold the Largest Share

- Modern manufacturing facilities in the United States rely on new technologies and innovations to produce higher quality products significantly with lower costs. Fast and secure 5G connectivity is expected to enable agile operations and flexible production. This technology is expected to facilitate automated warehouses, automated assembly, connected logistics, packing, product handling, and autonomous carts.

- The prominent players in this region are focused on strategic acquisitions and collaborations to remain competitive and enhance their capabilities. For instance, in July 2022, Intel and MediaTek announced a collaborative agreement to manufacture semiconductors using advanced process technology from Intel Foundry Services (IFS). The partnership is intended to assist MediaTek in developing a more balanced, resilient supply chain by adding a new foundry partner with significant capacity in the United States and Europe.

- Moreover, in July 2022, Intel announced the first open-source AI reference kits to make AI more accessible to enterprises operating in on-premises, cloud, and edge environments. The reference kits first unveiled at Intel Vision feature AI model code, end-to-end machine learning pipeline instructions, libraries, and Intel one API components for cross-architecture performance. These kits teach data scientists and developers how to deploy AI more quickly and easily in healthcare, manufacturing, retail, and other industries, resulting in increased accuracy, better performance, and reduced overall cost of implementation.

- Among emerging technologies that are expected to emerge out of the existing technologies transforming manufacturing in the United States is expected to include the convergence of AI and IoNT, with companies like SAS Software touting IoNT as the next wave for IoT based upon nanotechnology.

- The key players across this region are developing new solutions to remain competitive in the market. In May 2021, IBM announced the development of the world's first chip with 2 nanometers (nm) nanosheet technology, marking a milestone in semiconductor design and process. Semiconductors are used in various applications, including computing, appliances, communication devices, transportation systems, and critical infrastructure.

- Also, the emerging 5G standards with New Radio (NR) target capabilities, such as vehicle-to-everything and ultra-reliable low-latency communications, as industrial use cases. With industrial communication buses standardized by IEC, such as PROFINET and Modbus, the market is headed toward reliable and securer industrial adoption.

Internet of Nano Things Industry Overview

The internet of nano things market is semi competitive and consists of several key players like Schneider Electric, IBM, and Intel. However, the market remains consolidated, with many players trying to occupy the share. Their ability to continually innovate their products and services by investing significantly in research and development has allowed them to gain a competitive advantage over other players.

In January 2022, a ground-breaking new strategy for licensing the use of cellular IoT Standard Essential Patents was revealed by Nokia and Nordic Semiconductor. Nordic will now offer businesses the chance to purchase licenses to Nokia's impressive collection of cellular patents, which leads the industry.

In September 2021, Siemens AG focused on enhancing its distribution capabilities. For instance, the company announced that it entered a strategic distribution partnership with Digi-Key Electronics to offer its automation and control products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Primary Research Approach and Key Respondents

- 2.5 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Wide Connectivity in Devices

- 5.1.2 Emergence of Nanotechnology

- 5.2 Market Challenges/Restraints

- 5.2.1 Security Concerns

- 5.2.2 High Costs of the Technology

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Connectivity/Services

- 6.2 By End User

- 6.2.1 Healthcare

- 6.2.2 Logistics

- 6.2.3 Defense and Aerospace

- 6.2.4 Manufacturing

- 6.2.5 Energy and Power

- 6.2.6 Retail

- 6.2.7 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Siemens AG

- 7.1.3 IBM Corporation

- 7.1.4 Intel Corporation

- 7.1.5 Cisco Systems Inc.

- 7.1.6 SAP SE

- 7.1.7 Juniper Networks Inc.

- 7.1.8 Qualcomm Inc.

- 7.1.9 Nokia Corporation