|

市場調查報告書

商品編碼

1444701

聚烯烴 (PO) - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Polyolefin (PO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

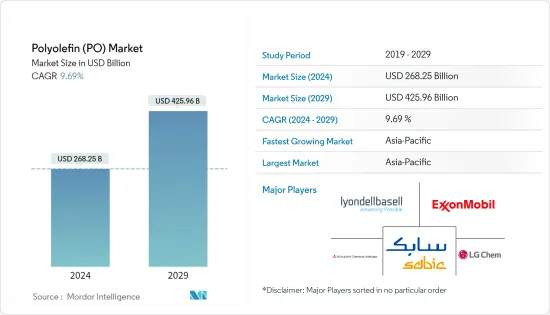

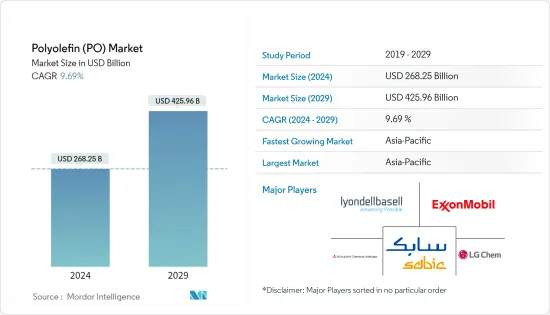

聚烯烴市場規模2024年估計為2,682.5億美元,預計到2029年將達到4,259.6億美元,在預測期(2024-2029年)CAGR為9.69%。

COVID-19的傳播損害了市場,因為它導致許多最終用戶行業關閉。在大流行期間,中國嚴重阻礙了聚烯烴市場,這是由於其強大的包裝、玩具製造、建築和汽車等工業,是聚烯烴的主要消費國之一。然而,隨著2021年各行業恢複製造活動,研究的市場也可能復甦。

主要亮點

- 聚烯烴因其先進的性能而用於電子、汽車和其他行業。預計這將有助於市場在短期內成長。

- 然而,各國政府對塑膠實施的日常嚴格的環境法規可能會限制市場。

- 對綠色聚烯烴的日益關注可能會在未來幾年創造新的機會。

- 亞太地區主導全球市場,最大的消費來自印度、中國等。

聚烯烴市場趨勢

薄膜和片材的需求不斷增加

- 薄膜和片材可用於運輸、包裝、農業、建築和建築業等。

- 農業部門推動市場的擴張,對溫室用聚烯烴薄膜和片材、覆蓋物和青貯飼料拉伸膜的需求。青貯飼料片和窗膜以及醫療領域也有這種需求。

- 聚烯烴農業薄膜還可以保護蔬菜免受霜凍、風雨和害蟲的影響,同時加速水果、蔬菜和花卉的成熟,使農民能夠在一年內種植多種作物。聚烯烴薄膜也有助於減少蒸發,節省用水。

- 另一方面,聚烯烴片材用於建築領域。用作蒸氣緩凝劑的聚乙烯板安裝在板下方。這些片材可以延遲較長時間而不會分解。因此,建築業對聚烯烴的需求不斷擴大。

- 亞太地區建築業預計將成為全球規模最大、成長最快的行業,全球建築支出的 45%佔有率來自該地區。未來幾年,這可能會讓更多的人想要薄膜和板材。

- 2022會計年度,印度聚烯烴總產能超過1.2萬噸,其中大部分聚烯烴由Reliance Industries Limited生產,約佔印度聚烯烴總產能的47%。

- 由於這些因素,隨著薄膜和片材需求的增加,聚烯烴市場在未來幾年可能會成長。

亞太地區將主導市場

- 由於中國是全球聚烯烴的主要消費國,亞太地區是聚烯烴市場的主導地區。該成長是由電子商務的成長推動的,因為快遞業務的強勁導致對塑膠包裝的需求激增。該國的製造業是其經濟的主要貢獻者之一。

- 中國政府宣布了未來10年的大型建設計劃,其中包括將2.5億人遷移到新特大城市的計劃。這是建築化學品在施工過程中以多種方式使用以改善建築性能的絕佳機會。

- 智慧型手機、OLED電視、平板電腦和其他消費性電子產品等電子產品市場上成長最快。隨著中產階級口袋裡的錢越來越多,對電子產品的需求將會增加,這將推動該國對聚烯烴的需求。

- 在中國,到2023年底,電子產品市場預計將達到 3,850 億美元以上。

- 所有上述因素都可能增加預測期內對聚烯烴的需求。

聚烯烴產業概況

聚烯烴市場本質上是整合的。一些主要參與者(排名不分先後)包括 LyondellBasell Industries Holdings BV、Exxon Mobil Corporation、SABIC、LG Chem 和三菱化學控股公司等。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 促進要素

- 偏好從硬包裝轉向軟包裝

- 對低成本室內陳設的需求不斷成長

- 限制

- 日益嚴格的環境法規

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章 市場區隔(市場價值規模)

- 材料種類

- 聚乙烯(PE)

- 聚丙烯(PP)

- 聚烯烴彈性體(POE)

- 乙烯醋酸乙烯酯(EVA)

- 應用

- 薄膜和片材

- 射出成型

- 吹塑成型

- 擠壓塗布

- 纖維和Raffia

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第6章 競爭格局

- 併購、合資、合作與協議

- 市佔率/排名分析

- 領先企業採取的策略

- 公司簡介

- Arkema Group

- BASF SE

- Braskem

- Chevron Phillips Chemical Company

- China National Petroleum Corporation

- China Petrochemical Corporation

- Daelim

- Dow

- ExxonMobil Corporation

- Formosa Plastics Corporation

- Japan Polypropylene Corporation

- LG Chem Ltd.

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Holdings Corporation

- Mitsui Chemicals Incorporated

- Nova Chemicals Corporation

- PetroChina Company Limited

- Reliance Industries Limited

- SABIC(Saudi Basic Industries Corporation)

- Sasol Ltd.

- Tosoh Corporation

第7章 市場機會與未來趨勢

- 越來越關注綠色聚烯烴

The Polyolefin Market size is estimated at USD 268.25 billion in 2024, and is expected to reach USD 425.96 billion by 2029, growing at a CAGR of 9.69% during the forecast period (2024-2029).

The spread of COVID-19 hurt the market because it caused many end-user industries to shut down.During the pandemic, China hampered the polyolefins market intensively, as it is one of the major consumers of polyolefins owing to its strong industries such as packaging, toy manufacturing, construction, and automotive. However, as the industries resumed their manufacturing activities in 2021, the studied market may also recover.

Key Highlights

- Polyolefin is used in electronics, cars, and other industries because of its advanced properties. This is expected to help the market grow in the short term.

- However, growing environmental regulations on plastic imposed by various governments may constrain the market.

- The growing focus on green polyolefin is likely to create new opportunities in the coming years.

- Asia-Pacific dominated the market worldwide, with the largest consumption coming from India, China, etc.

Polyolefins Market Trends

Increasing Demand from Films and Sheets

- Films and sheets can be used in the transportation, packaging, agriculture, building and construction, and building industries, among others.

- The agricultural sector is driving the market's expansion, with demand for polyolefin films and sheets for greenhouses, mulch, and silage stretch films. The demand is also seen in silage sheets and window films, as well as in the medical sector.

- Polyolefin-based agricultural films also protect vegetables from frost, wind, rain, and pests while speeding up the ripening of fruits, vegetables, and flowers, allowing farmers to grow several crops in a year. Polyolefin films also help reduce evaporation, thus saving water.

- On the other hand, polyolefin sheets are used in the building sector. The polyethylene sheeting, which works as a vapor retarder, is installed beneath the slab. These sheets can retard for a longer time without degrading. As a result, the demand for polyolefin from the construction industry is expanding.

- The Asia-Pacific construction industry is projected to become the world's largest and fastest-growing industry, with a 45% share of global construction spending coming from the region. In the coming years, this is likely to make more people want films and sheets.

- In fiscal year 2022, India had a total polyolefins production capacity of over 12 thousand kilotons.The most polyolefins were made by Reliance Industries Limited, which made up almost 47% of India's total polyolefins production capacity.

- Because of these things, the polyolefin market is likely to grow in the coming years as the demand for films and sheets rises.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is the dominant region in the polyolefins market, owing to China being the major consumer of polyolefins worldwide. The growth is driven by increasing e-commerce, as the strong courier business led to a spike in demand for plastic packaging. The country's manufacturing sector is one of the major contributors to its economy.

- The Chinese government announced big building plans for the next 10 years, including plans to move 250 million people to new megacities. This is a big chance for construction chemicals to be used in a variety of ways to improve building properties during construction.

- Electronic items, such as smartphones, OLED TVs, tablets, and other consumer electronics, are recording the fastest growth in the market. With more money in the pockets of the middle class, there will be more demand for electronics, which will drive the demand for polyolefins in the country.

- In China, the electronics segment is projected to reach over USD 385 billion by the end of 2023.

- All the above-mentioned factors will likely increase the demand for polyolefins over the forecast period.

Polyolefins Industry Overview

The polyolefin market is consolidated by nature. Some of the major players (not in any particular order) include LyondellBasell Industries Holdings BV, ExxonMobil Corporation, SABIC, LG Chem, and Mitsubishi Chemical Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Shift in Preferences from Rigid Packaging to Flexible Packaging

- 4.1.2 Growing Demand for Low-Cost Interior Furnishings

- 4.2 Restraints

- 4.2.1 Growing Environmental Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Polyethylene (PE)

- 5.1.2 Polypropylene (PP)

- 5.1.3 Polyolefin Elastomer (POE)

- 5.1.4 Ethylene Vinyl Acetate (EVA)

- 5.2 Application

- 5.2.1 Films and Sheets

- 5.2.2 Injection Molding

- 5.2.3 Blow Molding

- 5.2.4 Extrusion Coating

- 5.2.5 Fibers and Raffia

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema Group

- 6.4.2 BASF SE

- 6.4.3 Braskem

- 6.4.4 Chevron Phillips Chemical Company

- 6.4.5 China National Petroleum Corporation

- 6.4.6 China Petrochemical Corporation

- 6.4.7 Daelim

- 6.4.8 Dow

- 6.4.9 ExxonMobil Corporation

- 6.4.10 Formosa Plastics Corporation

- 6.4.11 Japan Polypropylene Corporation

- 6.4.12 LG Chem Ltd.

- 6.4.13 LyondellBasell Industries Holdings BV

- 6.4.14 Mitsubishi Chemical Holdings Corporation

- 6.4.15 Mitsui Chemicals Incorporated

- 6.4.16 Nova Chemicals Corporation

- 6.4.17 PetroChina Company Limited

- 6.4.18 Reliance Industries Limited

- 6.4.19 SABIC (Saudi Basic Industries Corporation)

- 6.4.20 Sasol Ltd.

- 6.4.21 Tosoh Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Focus on Green Polyolefin