|

市場調查報告書

商品編碼

1444685

數位物流 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Digital Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

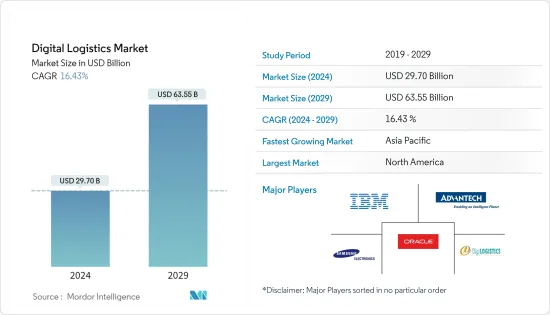

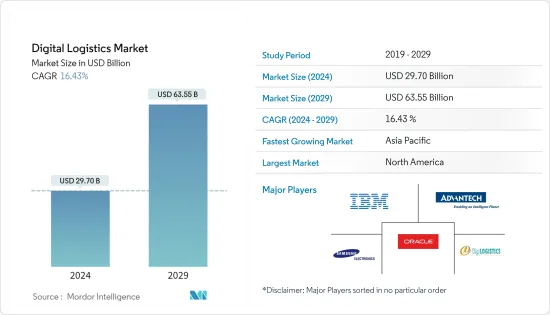

預計2024年數位物流市場規模將達297億美元,預計2029年將達到635.5億美元,在預測期間(2024-2029年)CAGR為16.43%。

主要亮點

- 物流業擴大採用先進技術,推動了成長。此外,這些數位解決方案正在幫助物流公司降低產生的成本。物流和技術的整合,以及延伸到整個供應鏈的基於雲端的協作解決方案,倉庫、運輸和最終消費者資訊的緊密整合,以及整個供應鏈的透明度正在推動所研究市場的成長。

- 數位市場的技術進步和雲端應用的不斷增加預計將推動對數位物流解決方案的需求。例如去年4月,Locus與loconav宣布戰略合作。 loconav 和 Locus 之間的合作將透過供應鏈流程自動化來促進物流領域的數位轉型。

- 隨著 COVID-19 的爆發,由於各國政府實施的封鎖,許多產業都面臨嚴重的供應鏈和物流中斷。公司正在利用數位物流平台轉變其供應鏈能力,以滿足這些重要的交付需求。根據《物流新聞》報道,使用人工智慧和支援數位支付的數位供應鏈是應對 Covid-19 大流行等緊急情況的解決方案。

- 過去十年,由於網路購物和網路用戶的發展,電子商務公司經歷了巨大的成長。由於電子商務的發展,需要更快速、更有效率的運輸提供者。在線上購物時,客戶期望準確的訂單、及時的出貨和退貨程序。企業正在尋找降低訂單運輸成本和時間的方法。電子商務是可見性、成本、易用性、交付速度和無憂退貨背後的驅動力。必須透過自動化配送路線、數位化物流規劃和物料移動來創建新的模型和技術來滿足這一需求。因此,履行服務變得更快、更多樣化,尤其是最後一英里的配送和退款。

數位物流市場趨勢

倉庫管理系統(WMS)部門預計將獲得主要佔有率。

- 數位市場的技術進步和雲端應用的不斷增加預計將推動對數位物流解決方案的需求。例如,京東和中石化宣布計劃透過其數位供應鏈模式建立廣泛的合作夥伴關係。 2022年3月,中國石化安徽省分公司與京東簽署合作協議,雙方將在多項供應鏈服務上展開合作,推動全通路經營。該協議涵蓋產品和數位供應鏈、共享倉庫設施和智慧物流。京東將運用技術與供應鏈服務優勢,協助安徽石化提高產能、降低成本。

- 此外,物流領域不斷成長的產品創新正在顯著提高市場成長率。例如,2022年6月,Semtech推出了LoRa雲端定位器服務來測試LoRa Edge的超低功耗資產追蹤能力。透過在基於雲端的求解器中而不是在設備本身上求解資產的位置,Semtech 的 LoRa Edge 技術大大降低了功耗。因此,設備的電池壽命可達十年甚至更長。 LoRa Edge LR 系列晶片使用 GNSS 和 Wi-Fi 掃描任何室內或室外位置的設備的緯度和經度。無論資產位於何處,與 Semtech 的 LoRa 無線電傳輸到雲端相結合,都可以獲得持續覆蓋。

- 感測器和物聯網分析市場的進步預計將吸引物流供應商投資數位解決方案。物流中的物聯網可以簡化產品儲存並確保高效率的倉庫管理。此外,現代技術使倉庫運作的檢修變得更加簡單。 RFID標籤和感測器可以監控庫存物品的狀態和位置。執行倉庫自動化還可以最大限度地減少人為錯誤,因為流程是根據需要啟用和使用的。

亞太地區預計將出現最快的成長率

- 據分析,由於中國、印度等國家採用數位技術,亞太地區在預測期內將以最高的成長率成長。物聯網、人工智慧和雲端等技術進步進一步促進了市場成長。

- 面對包括新冠肺炎 (COVID-19) 疫情在內的眾多障礙,中國的物流業正在採用數位技術來提高效率。 2022年4月,中共中央、國務院聯合印發《關於加速建構國內統一市場的意見》。聲明表示,中國將最佳化商貿流通基礎設施設計,鼓勵線上線下融合發展。

- 這些措施符合中央政府鼓勵第三方物流配送數位平台發展、培育一批具有全球影響力的供應鏈業務的承諾。例如,中國卡車叫車公司滿車聯盟正在加強利用數位技術來提高受疫情影響地區的物流效率。

- 此外,印度的國家物流政策預計將透過降低物流成本和增強國內商品在全球市場上的競爭力,為該國的經濟發展創造一條無縫的道路。由於這些高昂的物流費用,印度國內生產的商品在國際市場上銷售已處於劣勢。印度製造商一直渴望的轉變將透過全面的政策改革來實現,使他們能夠在國際市場上為其產品設定有競爭力的價格。統一物流介面平台、數位化系統整合、物流便利化和系統改進組是這個新物流專案的四個主要部分。 「印度製造」、「數位印度」和「Atma-nirbhara」政策在全國範圍內的成功執行,為國家物流政策帶來了另一個組成部分。

數位物流行業概況

由於有大量滿足各種類型組織(例如中小企業到大型企業)的參與者,數位物流市場呈現碎片化。該市場的一些主要參與者包括 IBM 公司、研華公司和三星電子等。市場的一些主要發展是:

- 2023 年 11 月,Suttons International 與 LogChain 開始建立數位化合作關係。此次合作源於 LogChain 最近成功推動了全球首次完全數位化的跨境運輸,象徵雙方致力於增強物流領域的數位透明度和可擴展性。 Suttons International 正在整合其平台,作為其數位轉型之旅的關鍵組成部分。該平台的採用凸顯了 Suttons 致力於引領業界數位創新的重要一步。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 競爭激烈程度

- 替代產品的威脅

第 5 章:市場動態

- 市場促進因素

- 數位科技的出現

- 電子商務產業的成長與多通路分銷網路的出現

- 擴大採用基於雲端的應用程式

- 市場限制

- ICT基礎設施缺乏和資料安全問題

- COVID-19 對產業影響的評估

第 6 章:市場區隔

- 類型

- 庫存管理

- 倉庫管理系統(WMS)

- 車隊的管理

- 其他類型

- 最終用戶垂直領域

- 汽車

- 製藥/生命科學

- 零售

- 食品與飲品

- 油和氣

- 其他最終用戶垂直領域

- 地理

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第 7 章:競爭格局

- 公司簡介

- IBM Corporation

- Advantech Corporation

- Oracle Corporation

- Samsung Electronics Co. Ltd

- DigiLogistics Technology Ltd

- Hexaware Technologies Limited

- Tech Mahindra Limited

- JDA Software Pvt Ltd

- UTI Worldwide Inc.(DSV Group)

- SAP SE

- Manhattan Associates Inc.

- HighJump Software Inc.

- Vinculum Group

第 8 章:投資分析

第 9 章:市場的未來

簡介目錄

Product Code: 52939

The Digital Logistics Market size is estimated at USD 29.70 billion in 2024, and is expected to reach USD 63.55 billion by 2029, growing at a CAGR of 16.43% during the forecast period (2024-2029).

Key Highlights

- Growth is driven owing to the increasing adoption of advanced technologies in the logistics sector. Moreover, these digital solutions are helping logistic companies in reducing incurred costs. Convergence of logistics and technology, along with cloud-based collaborative solutions that extend through the entire supply chain, tight integration of warehouse, transport, and end consumer information, and transparency through the supply chain are driving the growth of the market studied.

- The technological advancement in the digital market and rising cloud adoption are expected to fuel the demand for digital logistic solutions. For instance, in April last year, Locus and loconav announced a strategic cooperation. This partnership between loconav and Locus will promote digital transformation in the logistics sector by automating supply chain processes.

- With the outbreak of COVID-19, many industries have faced significant supply chain and logistic disruption owing to the lockdown imposed by various governments. Companies are transforming their supply chain capabilities with digital logistics platforms to meet those essential deliveries. According to Logistics News, digital supply chains using artificial intelligence and enabling digital payments are the solution to emergencies such as the Covid-19 pandemic.

- Over the past ten years, the e-commerce company has experienced tremendous growth due to the development of online shopping and Internet users. More rapid and efficient transportation providers are required due to the growth of e-commerce. When shopping online, customers expect accurate orders, prompt shipment, and return procedures. Businesses are looking for ways to reduce order shipping costs and timeframes. E-commerce is the driving force behind visibility, cost, ease of use, delivery speed, and hassle-free returns. New models and technologies must be created to accommodate this need by automating distribution routes, digitalizing logistics planning, and material movement. As a result, fulfillment services have become quicker and more varied, especially for last-mile delivery and refunds.

Digital Logistics Market Trends

Warehouse Management System (WMS) segment is expected to acquire major share.

- The technological advancement in the digital market and rising cloud adoption are expected to fuel the demand for digital logistic solutions. For instance, JD and Sinopec announced a plan to build a broad partnership with their digital supply chain model. In March 2022, Sinopec's Anhui province branch and JD.com signed a partnership agreement under which they will collaborate on a number of supply chain services and advance omnichannel operations. The agreement encompasses product and digital supply chains, sharing warehouse facilities, and smart logistics. JD will use its technology and supply chain services advantages to assist Sinopec Anhui in boosting productivity and cutting costs.

- Further, the growing product innovations in the logistics sector are significantly boosting the market growth rate. For instance, in June 2022, Semtech introduced the LoRa Cloud Locator Service to test the LoRa Edge's ultra-low power asset tracking capabilities. By solving the asset's position in a Cloud-based solver rather than on the device itself, Semtech'sLoRa Edge technology considerably lowers power usage. As a result, the device's battery life can last up to or even longer than ten years. The LoRa Edge LR-series chips use GNSS and Wi-Fi to scan for a device's latitude and longitude in any interior or outdoor location. Regardless of where assets are located, continuous coverage is obtained when combined with Semtech'sLoRa radio transmission to the Cloud.

- Advancements in the sensors and IoT analytics market are expected to attract logistics vendors, to invest in digital solutions. IoT in logistics can simplify storing products and ensure efficient warehouse management. Additionally, modern technology has made it much simpler to overhaul warehouse operations. RFID tags and sensors can monitor the status and location of the inventory items. Executing warehouse automation can also minimize human errors because the processes are enabled and used as needed.

Asia Pacific is Expected to Register the Fastest Growth Rate

- Asia-pacific is analyzed to grow at the highest growth rate during the forecast period owing to the adoption of digital technologies in countries such as China, India, and so on. Technological advancements such as IoT, AI, and Cloud further contribute to market growth.

- China's logistics sector is embracing digital technologies to increase efficiency in the face of numerous obstacles, including the COVID-19 pandemic. A directive on accelerating the creation of a unified domestic market was jointly published in April 2022 by the Communist Party of China Central Committee and the State Council. It stated that China would optimize the design of the infrastructure for commerce and trade circulation and encourage the fusion of online and offline development.

- The initiatives are in accordance with the central government's commitment to encourage the development of digital platforms for third-party logistics delivery and to foster a number of supply chain businesses with a global reach. For instance, Full Truck Alliance Co Ltd, a Chinese truck-hailing business, is boosting efforts to use digital technology to improve logistical effectiveness in pandemic-affected areas.

- Further, India's national logistics policy is anticipated to create a seamless course for economic development in the country by lowering logistic costs and enhancing the competitiveness of domestic goods on the global market. Due to these high logistical expenses, domestic commodities produced in India that are sold on the international market are already at a disadvantage. The shift that Indian manufacturers have been yearning for will be brought about by a comprehensive policy overhaul, allowing them to set competitive prices for their goods on the international market. Unified Logistics Interface Platform, Integration of Digital System, Ease of Logistics, and System Improvement Group are the four main parts of this new logistical project. The successful policy execution of Make in India, Digital India, and the "Atma-nirbhara drive" throughout the nation gains another component from the national logistics policy.

Digital Logistics Industry Overview

The Digital Logistics Market is fragmented due to the presence of a large number of players which cater to various types of organizations, such as SMEs to Large Enterprises. Some key players in the market are IBM Corporation, Advantech Corporation, and Samsung Electronics Co. Ltd., among others. Some key developments in the market are:

- November 2023, Suttons International and LogChain have started a digitalization partnership. This collaboration, coming from LogChain's recent success in facilitating the world's first fully digitalized cross-border shipment, symbolizes a mutual commitment to bolstering digital transparency and scalability in the logistics sector. Suttons International is integrating its platform as a pivotal component in its digital transformation journey. The platform's adoption underscores a significant step in Suttons' commitment to spearheading digital innovation within the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence Of Digital Technology

- 5.1.2 Growth In E-Commerce Industry And Emergence Of Multichannel Distribution Networks

- 5.1.3 Growing Adoption Of Cloud Based Applications

- 5.2 Market Restraints

- 5.2.1 Lack of ICT Infrastructure and Data Security Concerns

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Inventory Management

- 6.1.2 Warehouse Management System (WMS)

- 6.1.3 Fleet Management

- 6.1.4 Other Types

- 6.2 End-user Vertical

- 6.2.1 Automotive

- 6.2.2 Pharmaceutical / Life Sciences

- 6.2.3 Retail

- 6.2.4 Food and Beverage

- 6.2.5 Oil and Gas

- 6.2.6 Other End-user Verticals

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Advantech Corporation

- 7.1.3 Oracle Corporation

- 7.1.4 Samsung Electronics Co. Ltd

- 7.1.5 DigiLogistics Technology Ltd

- 7.1.6 Hexaware Technologies Limited

- 7.1.7 Tech Mahindra Limited

- 7.1.8 JDA Software Pvt Ltd

- 7.1.9 UTI Worldwide Inc.(DSV Group)

- 7.1.10 SAP SE

- 7.1.11 Manhattan Associates Inc.

- 7.1.12 HighJump Software Inc.

- 7.1.13 Vinculum Group

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219