|

市場調查報告書

商品編碼

1444682

乳酸:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Lactic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

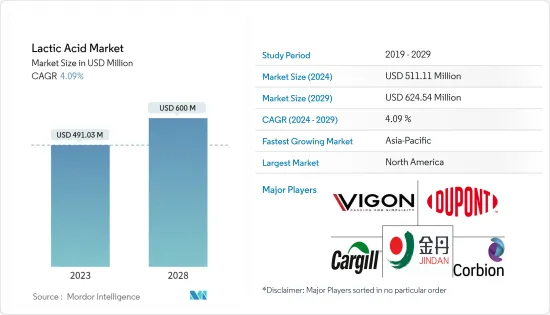

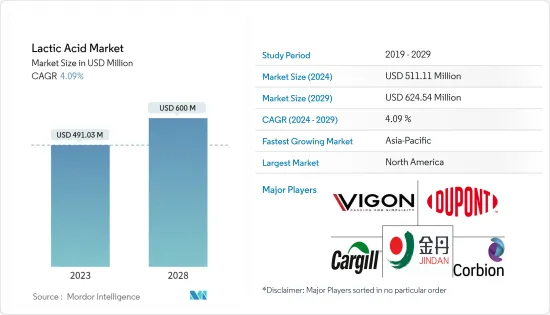

2024年乳酸市場規模預計為5.1111億美元,預計到2029年將達到6.2454億美元,在預測期內(2024-2029年)年複合成長率為4.09%成長。

根據其純度和用途,乳酸有不同的等級。預計在預測期內,乳酸在藥品、食品和飲料各種最終用途領域的使用將增加對該產品的需求,特別是在亞太地區等新興地區。乳酸的這些不同的功能特性和根據國際規則的監管核准是乳酸市場的主要驅動力。

PLA 是一種生物分解性的聚合物和可堆肥的熱塑性塑膠,由發酵過程中產生的乳酸等可再生資源製成。 PLA 主要由乳酸製成。美國食品藥物管理局已宣布該化學品為 GRAS。這意味著該化學品在食品業具有巨大的市場潛力。也可由化學合成或發酵法製得。

由於人們越來越喜歡即食食品,需要發酵過程的加工食品在發酵過程中往往含有乳酸。乳酸廣泛用於發酵飲料,如飲用型優格和湯匙式優格,越來越受到消費者的歡迎。這項因素鼓勵製造商將乳酸和乳酸衍生成分涵蓋乳製品食品和飲料中。這主要是由於乳酸在各種乳製品中具有賦予質地和增強風味的特性。因此,乳酸在世界各地的乳製品中被廣泛使用。

乳酸菌市場趨勢

食品酸味劑需求量大

乳酸因其多種功能特性而成為食品和飲料產品中的重要成分。乳酸在食品和飲料領域的廣泛應用以及食品酸味劑提供的各種功能優勢正在推動市場發展。食品和飲料行業的穩步擴張正在推動該行業的發展。隨著亞太地區消費行為和經濟發展的演變,該地區正在成為食品和飲料行業前景廣闊的市場,食品酸味劑的使用不斷增加。乳酸也廣泛應用於保鮮產業。它在歐洲、美國、澳大利亞和紐西蘭被允許作為食品添加劑。因此,在各種食品製造過程中增加乳酸的使用可能會增加全球的需求。

亞太地區是成長最快的區域市場

隨著乳酸作為食品添加劑的使用不斷增加,亞太地區對乳酸的需求正在迅速增加。肉類和其他食品應用中對乳酸的需求不斷成長、低成本原料的供應、技術創新以及該地區領先製造公司的大力支持是市場的主要促進因素。乳酸通常用於肉類工業,以減少基於細菌的病原體,保護肉類免受污染。糖蜜、甘蔗、澱粉和其他碳水化合物等製造商原料的低成本使該行業受益匪淺,因為它立即降低了最終產品的成本。在該地區營運的主要公司,例如河南金丹乳酸,正致力於將乳酸作為食品加工的關鍵成分之一。

乳酸菌產業概況

乳酸市場本質上是高度一體化的。市場主要競爭對手有嘉吉、Corbion NV、河南金丹乳酸科技、杜邦內穆爾等。由於大宗商品價格的波動,主要競爭對手更願意投資新產品開發和行銷策略以維持自己的地位。大多數主要企業都投資研發以開發新技術和創新技術。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 起源

- 自然的

- 合成

- 目的

- 肉、家禽、魚

- 飲料

- 糖果零食

- 麵包店

- 水果和蔬菜

- 乳製品

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 西班牙

- 英國

- 德國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Corbion NV

- Henan Jindan Lactic Acid Technology Co. Ltd

- Futerro SA

- DuPont de Nemours Inc.

- VIGON INTERNATIONAL INC.

- Cargill Incorporated

- Cellulac

- Galactic

- Mushashino Chemical

- Danimer Scientific

第7章市場機會與未來趨勢

第8章 關於出版商

The Lactic Acid Market size is estimated at USD 511.11 million in 2024, and is expected to reach USD 624.54 million by 2029, growing at a CAGR of 4.09% during the forecast period (2024-2029).

Lactic acid comes in various grades, depending on its purity and intended use. The use of lactic acid in different end-use sectors, including pharmaceuticals and food and beverages, is expected to boost demand for this product over the forecast period, particularly in emerging regions like Asia-Pacific. These varied functional qualities of lactic acid and regulatory approval by international rules are the primary drivers for the lactic acid market.

PLA is a biodegradable polymer and compostable thermoplastic made from renewable sources such as lactic acid produced through fermentation processes. PLA is chiefly made from lactic acid. The US Food and Drug Administration has declared this chemical GRAS, which means it has significant market potential in the food business. It can also be made through chemical synthesis or fermentation.

With an increasing inclination toward convenience food, processed food that requires fermentation processes tends to include lactic acid in the fermentation process. Lactic acid is widely used in fermented beverages such as drinkable and spoonable yogurts, which are becoming popular among consumers. This factor has encouraged the manufacturers to incorporate lactic acid and derived ingredients in dairy-based food and beverages, mainly due to the texture-imparting and flavor-enhancing nature of lactic acid in various dairy-based products. Hence, lactic acid is extensively used in dairy-based products across the world.

Lactic Acid Market Trends

High Demand for Food Acidulants

Lactic acid is a crucial ingredient in food and beverage products due to its diverse functional qualities. Lactic acid's wide range of applications in the food and beverage sector and the variety of functional benefits offered by food acidulants drive the market. The industry is boosted by solid expansion in the food and beverage sector. With evolving consumer behavior and economic development in Asia-Pacific, the region emerges as a prospective market for the food and beverage industry to increase the use of food acidulants. Lactic acid is also widely used in the preservation industry. It is permitted as a food additive in Europe, the United States, Australia, and New Zealand. Hence, the increasing usage of lactic acid across various food manufacturing processes could possibly increase the demand across the world.

Asia-Pacific is the Fastest-growing Regional Market

With the rising use of lactic acid as a food additive, the demand for lactic acid in Asia-Pacific is rapidly increasing. Increased demand for lactic acid in meat and other foods applications, availability of low-cost raw materials, technological innovations, and strong backing from large manufacturing businesses in the region are the main drivers for the market. Usually, lactic acid is used in the meat-based industry to reduce bacterial-based pathogens, hence keeping the meat safe from contamination. The low cost of raw materials for manufacturers, such as molasses, sugarcane, starch, and other carbohydrates, has significantly benefited the sector as it immediately decreases the final product's cost. Major players operating in the region, such as Henan Jindan Lactic Acid Co. Ltd, are focusing on incorporating lactic acid as one of the key ingredients in food processing.

Lactic Acid Industry Overview

The lactic acid market is highly consolidated in nature. The leading competitors in the market are Cargill Incorporated, Corbion NV, Henan Jindan Lactic Acid Technology Co. Ltd, and DuPont de Nemour Inc. Due to commodity price instability, the big competitors prefer to invest in new product development and marketing strategies to maintain their positions. Most significant firms are investing in R&D to develop new and innovative technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Natural

- 5.1.2 Synthetic

- 5.2 Application

- 5.2.1 Meat, Poultry, and Fish

- 5.2.2 Beverage

- 5.2.3 Confectionery

- 5.2.4 Bakery

- 5.2.5 Fruits and Vegetable

- 5.2.6 Dairy

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Corbion NV

- 6.3.2 Henan Jindan Lactic Acid Technology Co. Ltd

- 6.3.3 Futerro SA

- 6.3.4 DuPont de Nemours Inc.

- 6.3.5 VIGON INTERNATIONAL INC.

- 6.3.6 Cargill Incorporated

- 6.3.7 Cellulac

- 6.3.8 Galactic

- 6.3.9 Mushashino Chemical

- 6.3.10 Danimer Scientific