|

市場調查報告書

商品編碼

1444668

移動式製圖系統:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Mobile Mapping Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

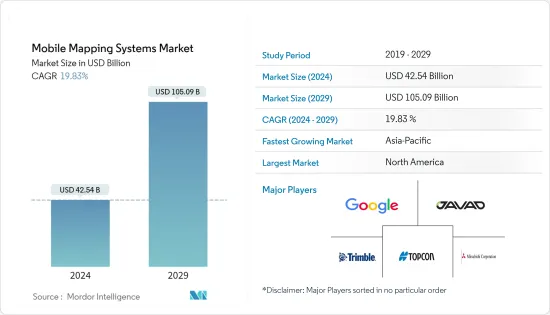

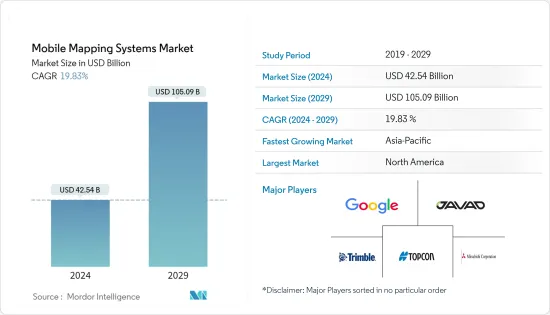

移動式製圖系統市場規模預計到2024年為425.4億美元,預計到2029年將達到1050.9億美元,在預測期內(2024-2029年)成長19.83%,年複合成長率成長。

衛星測繪技術的快速普及以及與智慧型手機和物聯網 (IoT) 連接設備的無縫整合正在推動市場成長。

由於都市化程度的提高以及世界各地政府措施的支持,智慧城市迅速擴張。智慧城市只能存在於 3D 地圖中。用於智慧城市的移動式製圖技術,支援 3D 城市建模、自主導航、交通、災害管理、道路資產數位化和減少污染,透過最佳化資源和維持永續性來提高生活品質。我們的目標智慧型手機和網際網路的使用在管理和存取資料方面發揮了重要作用。

此外,環境監測行動導航地理資訊系統(GIS)擴大用於環境監測。環境研究人員依靠移動式製圖GIS 工具來幫助預測和監測風暴和颶風。美國太空總署資助的生態監測和自然資源管理研究計劃正在推動移動式製圖領域的收益成長。

移動式製圖系統可用於行人導航的室內地圖、自動駕駛車輛的高清 (HD) 地圖、資產和基礎設施管理、航空測量、管道測量、水文測量、疏浚和海洋定位/挖掘作業等應用。它用於各種目的。

按需部署系統的出現已成為移動式製圖市場的轉捩點,因為它們以較低的初始成本(按月/以季度為基礎向用戶申請)提供了高水準的彈性和準確性。本公司提供基於訂閱的模式來滿足對永久用戶許可證的需求。

COVID-19 大流行導致 IT 產業迅速重組,公司紛紛轉向遠距工作。疫情期間,移動式製圖市場大幅成長。一些公司和機構已使用移動式製圖資料進行視覺化和地理空間分析,以限制疾病的傳播。儀表板用於顯示地理空間資料。其中一些儀表板和應用程式近乎即時地接收資料變更。

移動式製圖系統市場趨勢

影像服務領域佔據市場主導地位

- 衛星影像和地理資訊系統使安全和執法機構能夠識別犯罪熱點地圖以及其他趨勢和模式。準確檢測犯罪的空間集中度並及時繪製犯罪地點地圖可以幫助執法機構識別犯罪的空間和時間集中度,為減少犯罪工作提供關鍵資訊。

- 此類圖像有助於提高此應用程式中的分析效率和速度,使分析人員能夠覆蓋其他資料集,例如人口普查人口統計資料以及商店、銀行和學校位置。這有助於安全部門經理了解犯罪的根本原因並制定策略。這些策略包括部署警察並派遣他們處理緊急情況。

- 然而,對先進遙感探測技術的需求日益成長,這些技術可以提供彩色和全色影像處理服務,以及透過資料融合、增強、地理配準、馬賽克以及色彩和灰階平衡來銳化影像的能力。

- 此外,所研究市場的當前發展旨在監測水體。例如,非法捕魚和人口販運問題導致需要發現海洋異常現象。 Nature Ecology & Evolution 的研究人員表示,在某些地區,例如西太平洋和中太平洋,非法捕撈可能佔總捕撈量的 30%。

- 聯合國糧食及農業組織 (FAO) 的統計數據強調了未報告和無管制 (IUU) 捕撈的全球影響。據估計,全球 IUU 捕撈每年捕獲的魚類數量高達 2,600 萬噸(相當於 100 億美元至 230 億美元)。 DigitalGlobe 和 Planet 合作開展了一項此類計劃,以識別非法活動。此夥伴關係旨在偵查非法漁業轉運。

亞太地區成長最快

- 預計亞太市場在預測期內將以顯著的速度擴張。政府在衛星圖像方面的舉措增加以及產品的推出正在吸引國內外公司的投資,推動該地區的市場成長。

- 2022 年 3 月,總部位於澳洲的獨立無人機測繪公司 Emesent 宣布發布其最新的自主無人機 LiDAR 測繪和測量有效載荷 Hovermap ST。 Emesent 的 LiDAR 有效負載使用一種稱為同步定位和構建圖 (SLAM) 的技術。透過這項技術,無人機可以創建地圖並同時在該地圖中定位自己。

- 亞太國家GDP的快速成長推動了大眾交通工具和創新城市計劃等基礎設施現代化項目,增加了對移動式製圖技術的需求。

- 中國銀川是該地區最先進的智慧城市之一,幾乎所有基礎設施都連接到一個系統。例如,銀川智慧城市使用的方達平台結合3D地圖來定位現代地圖中的節點和燈具,並整合了各種其他應用程式。此外,該地區的市場相關人員正在推出創新解決方案。

- 例如,2022 年 6 月,Grab Holdings Limited 宣布推出 GrabMaps。這項新的企業解決方案將使該公司能夠挖掘東南亞每年 10 億美元的地圖和定位服務市場潛力。 GrabMaps 最初是為內部使用而建立的,是為了回應 Grab 對更超當地語系化的解決方案以增強其營運的要求。

- 行動裝置的快速製造顯著降低了掃描器、相機和其他組件的成本,使小型企業和個人更能負擔得起基於位置的服務。

移動式製圖系統產業概況

移動式製圖產業主要參與者的不斷增加預計將加劇預測期內競爭公司之間的敵對行動。現有公司有Google Inc.、Javad GNSS Inc.、三菱公司、Trimble、Topcon Corporation等。大公司在研發業務上投入大量資源,以保護其市場地位並推動創新。高退出障礙、企業集中度不斷提高以及市場滲透率是影響市場競爭的一些關鍵特徵。總體而言,競爭公司之間的敵對強度仍然較高,但這主要是由於研究市場中參與者的強大存在所造成的。

2022 年 9 月,連網卡車服務供應商和北美最大的公私稱重站旁路網路營運商 Drivewyze 宣布與流量分析和互聯車輛連網汽車服務供應商INRIX Did 合作推出即時車內交通警示。賓州收費公路委員會。賓州與俄亥俄州、新澤西州和北卡羅來納州一起為即將到來的交通延誤、擁塞和事故提供聲音和視覺警報。

2022 年 5 月,Hexagon 旗下公司 Leica Geosystems 推出了 Hexagon 旗下 Reality Capture,推出人工智慧、自主工作流程和遠距移動式製圖,適用於資產管理、道路建設、關鍵基礎設施、石油和天然氣以及電力等領域的應用發布移動式製圖系統“Leica Pegasus TRK”。該系統非常適合為自動駕駛車輛創建高清底圖。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對的強度

- 評估 COVID-19 對產業的影響

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 與任何類型的車輛整合

- 市場限制因素

- 購買和實施該系統的成本很高。

第6章市場區隔

- 按用途

- 影像服務

- 航空移動式製圖

- 緊急應變計劃

- 網路應用

- 設施管理

- 衛星

- 按最終用戶產業

- 政府

- 油和氣

- 礦業

- 軍隊

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- Google LLC(Alphabet Inc.)

- Leica Geosystems AG(Hexagon Geosystems)

- Trimble Inc.

- Topcon Corporation

- NovAtel Inc.

- Javad GNSS Inc.

- Teledyne Optech

- Mitsubishi Corporation

- Imajing SAS

- TomTom International BV

- Cyclomedia Technology BV

- INRIX Inc.

第8章投資分析

第9章 未來的機會

The Mobile Mapping Systems Market size is estimated at USD 42.54 billion in 2024, and is expected to reach USD 105.09 billion by 2029, growing at a CAGR of 19.83% during the forecast period (2024-2029).

The rapid acceptance of satellite mapping technology and its seamless integration into smartphones and Internet of Things (IoT)-connected devices are driving the market's growth.

Smart cities rapidly expanded due to increased urbanization and supported government initiatives worldwide. A smart city can only exist with a 3D map. With the support of 3D city modeling, autonomous navigation, traffic, disaster management, digitizing roadway property, and pollution reduction, mobile mapping technology for smart cities aims to improve quality of life by optimizing resources and maintaining sustainability. Smartphone and internet usage played critical roles in data management and access.

Further, mobile navigation geographic information system (GIS) for environmental monitoring is increasingly used in monitoring the environment. Environmental researchers are employing mobile mapping GIS tools to help with storm and hurricane forecasting and monitoring. The NASA-funded research project on ecological monitoring and natural resource management drives revenue growth in the mobile mapping sector.

Mobile mapping systems are used for various applications, including developing indoor maps for pedestrian navigation, high-definition (HD) maps for autonomous vehicles, asset and infrastructure management, ariel surveys, pipeline surveys, hydrographic surveys, dredging, and offshore positioning/drilling operations.

The emergence of on-demand deployment systems is an inflection point in the mobile mapping market, as high levels of flexibility and accuracy at low initial costs are offered (users are charged on a monthly/quarterly basis). Companies offer subscription-based models to counter the need for perpetual user licenses.

The COVID-19 pandemic resulted in a rapid restructuring of the IT industry, with firms shifting to remote labor. During the pandemic, the mobile mapping market grew considerably. Several businesses and agencies used mobile mapping data for visualization and geospatial analytics to restrict the spread of the disease. Dashboards were used to display geospatial data. Some of these dashboards and applications received data changes in near-real time.

Mobile Mapping Systems Market Trends

Imaging Services Segment to Dominate the Market

- Satellite imagery and GIS systems enable security and law enforcement agencies to identify hot spots and other trends and patterns for crime mapping. Accurate detection of spatial concentrations of crime and timely mapping of crime locations help law enforcement identify the concentration of crimes in space and time, thus providing important information for crime reduction efforts.

- Such imagery helps provide efficiency and speed of analysis in this application, allowing analysts to overlay other datasets, such as census demographics and locations of stores, banks, and schools. This helps security department administrators understand the underlying causes of crime and devise strategies. These strategies include allocating police officers and dispatching them to emergencies.

- However, there is an increase in demand for advanced remote sensing techniques, which can provide color and panchromatic image processing services along with the ability to sharpen the image with data fusion, enhancements, georeferencing, mosaicing, and color and grayscale balancing.

- Furthermore, current developments in the market studied aim to monitor water bodies. For instance, the challenge of illegal fishing and trafficking led to the need to find anomalies in the oceans. According to Nature Ecology & Evolution researchers, illegal fishing may constitute up to 30% of the total fisheries in some regions, such as the western and central Pacific oceans.

- The Food and Agriculture Organization of the United Nations (FAO) statistics highlight the global impact of unreported and unregulated (IUU) fishing. Global IUU fishing is estimated to represent up to 26 million metric tons of fish caught annually (equivalent to USD 10 billion-USD 23 billion). DigitalGlobe and Planet collaborated on one such project to identify illicit activities. The partnership aims to spot illegal transshipments of fisheries.

Asia Pacific to Register Fastest Growth

- The market in Asia-Pacific is expected to expand at a significant rate during the forecast period. Increasing government initiatives for satellite imaging are attracting investment from foreign and domestic players, along with product launches, which are driving the market's growth in the region.

- In March 2022, Emesent, an Australia-based independent drone mapping business, announced the release of its latest Hovermap ST autonomous drone LiDAR mapping and surveying payload. Emesent's LiDAR payloads use a technology known as simultaneous localization and mapping (SLAM), in which a drone produces a map while simultaneously localizing itself inside that map.

- The fast GDP expansion in Asia-Pacific countries led to infrastructure modernization programs such as mass public transit networks and innovative city projects, increasing demand for mobile mapping technologies.

- Yinchuan, China, is one of the region's most advanced smart cities, with practically all infrastructure linked into a single system. For instance, the Fonda platform used in Yinchuan smart city combines a 3D map to locate the nodes and lamps in the latest map and integrates various other applications. Moreover, market players in the region are launching innovative solutions.

- For instance, in June 2022, Grab Holdings Limited announced the introduction of GrabMaps. This new enterprise solution enables the firm to capitalize annually on the USD 1.0 billion market potential for mapping and location-based services in Southeast Asia. GrabMaps was first established for internal usage to answer Grab's demand for a more hyperlocal solution to power its operations.

- Rapid mobile device manufacturing has significantly decreased the cost of scanners, cameras, and other components, making location-based services more affordable for SMEs and private individuals.

Mobile Mapping Systems Industry Overview

The growing presence of big players in the mobile mapping industry is expected to intensify competitive rivalry during the forecast period. Incumbents, such as Google Inc., Javad GNSS Inc., Mitsubishi Corporation, Trimble, and Topcon Corporation. Large companies are expending significant resources on R&D operations to protect their position and drive innovation in the market. High barriers to exit, growing levels of firm concentration, and market penetration are some of the significant characteristics influencing the competition in the market. Overall, the intensity of competitive rivalry remains moderately high, mainly driven by the strong presence of players involved in the market studied.

In September 2022, Drivewyze, the connected truck services provider and operator of North America's largest public-private weigh station bypass network, announced real-time, in-cab traffic alerts in collaboration with INRIX, a transportation analytics and connected vehicle services provider, and the Pennsylvania Turnpike Commission. Pennsylvania joins Ohio, New Jersey, and North Carolina in providing in-state alerts that offer audio and visual indicators of upcoming traffic delays, congestion, and incidents.

In May 2022, Leica Geosystems, part of Hexagon, announced the introduction of the reality capture mobile mapping system Leica Pegasus TRK, introducing artificial intelligence, autonomous workflows, and long-range mobile mapping for applications in asset management, road construction, critical infrastructure, oil, gas, and electricity industries. The system is ideal for creating high-definition base maps for autonomous vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Integration with All Kinds of Vehicles

- 5.2 Market Restraints

- 5.2.1 High Cost of System Acquisition and Deployment

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Imaging Services

- 6.1.2 Aerial Mobile Mapping

- 6.1.3 Emergency Response Planning

- 6.1.4 Internet Applications

- 6.1.5 Facility Management

- 6.1.6 Satellite

- 6.2 By End-user Verticals

- 6.2.1 Government

- 6.2.2 Oil and Gas

- 6.2.3 Mining

- 6.2.4 Military

- 6.2.5 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Google LLC (Alphabet Inc.)

- 7.1.2 Leica Geosystems AG (Hexagon Geosystems)

- 7.1.3 Trimble Inc.

- 7.1.4 Topcon Corporation

- 7.1.5 NovAtel Inc.

- 7.1.6 Javad GNSS Inc.

- 7.1.7 Teledyne Optech

- 7.1.8 Mitsubishi Corporation

- 7.1.9 Imajing SAS

- 7.1.10 TomTom International BV

- 7.1.11 Cyclomedia Technology BV

- 7.1.12 INRIX Inc.