|

市場調查報告書

商品編碼

1444663

X 光管 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 年 - 2029 年)X-ray Tube - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

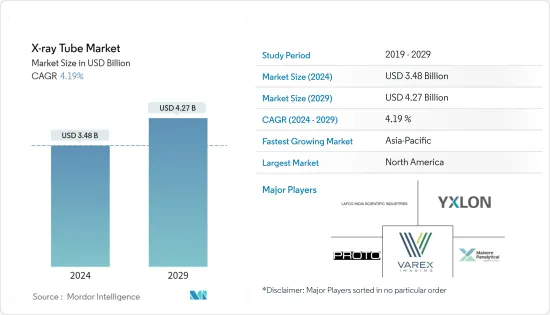

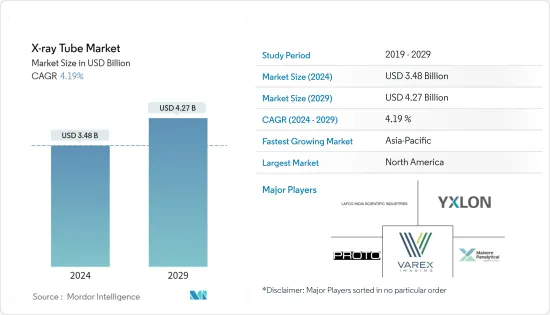

X光管市場規模預計到2024年為34.8億美元,預計到2029年將達到42.7億美元,在預測期內(2024-2029年)CAGR為4.19%。

主要亮點

- X光已在安全、冶金、無損檢測和其他工業應用中得到應用。技術進步是推動所研究市場成長的主要因素之一。在過去的幾十年裡,X光的應用已大大擴展到醫學領域之外。

- 隨著電子創新,這些系統的尺寸已顯著減少。隨著緊湊型系統的出現,X光機現已應用於各個領域,例如機場安全、行李掃描和冶金應用。此外,全球醫療病例和意外傷害的增加正在影響所研究市場的成長。

- 例如,最近,Excillum推出了其最新研發成果—新一代高解析度X光管。 Excillum NanoTube N3 最初有 3 個不同版本,可實現高達 160 kV 的世界最佳解析度。 NanoTube N3 針對先進產業的計量和無損檢測 (NDT) 組件,例如汽車、航空航太、醫療、電子和半導體後端。

- 疫情場景讓醫療保健應用受益匪淺。多個協會和管理機構已在全球範圍內將 CT 和 X 光成像確定為主要檢查方式,以檢查患者是否存在與 COVID-19 相關的症狀。根據西門子 Healthineers 報告,多名研究人員進行的研究發現,X 光檢查對與 COVID-19 相關的肺部陰影的敏感性較低,為 25% 至 69%。

- 在不久的將來,亞太和北美等高需求地區預計將修改其安全法規,從而製定更嚴格的規則和行業標準。這種情況也讓新玩家很難進入市場。因此,嚴格的法規和驗證指南限制了市場的成長。

X 光管市場趨勢

醫療保健產業佔據最大的市場佔有率

- 在醫療領域,需要更小和更短掃描的牙科應用發現使用固定 X 光管進行成像。據 Listerine Professional 稱,口腔狀況是最常見的健康問題,估計影響著全球 39 億人。因此,在牙科領域,對不需要旋轉陽極 X光管的 X光成像的主要需求是由於適合成像目的的固定管。

- 醫療放射設備和技術的許多進步被視為醫療保健行業技術進步和技術採用增加的結果。在過去的幾年中,介入 X 光的重大進步之一是更加關注核心以及提供高品質、高解析度影像而無需相應增加輻射劑量的支援技術。這是西門子 Artis Q、飛利浦 ClarityIQ 技術、Q.zen 技術、GE Healthcare 影像引導系統 (IGS) 和東芝 Infinix Elite 產品線等技術進步背後的關鍵驅動力。

- 由於各種因素,例如對放射診斷測試的日益關注、慢性病負擔的增加以及市場上高效 X光設備的引入等,醫療器械行業每年進行的成像和診斷測試數量都在成長。合併和合併。

- 根據聯合國《世界人口展望》的資料,65歲以上的人口數量正在穩定增加。到2050年,全球60歲及以上人口預計將達到20億,其中80%可能生活在低收入國家和中等收入國家。因此,老年人口的增加以及骨科和心血管手術數量的增加可能會進一步推動 X 光管在醫療應用中的採用。

- X光是使用 X光管產生的,在製藥行業中,這些管子與鎢一起使用,特別是當乳房 X光照相應用需要較軟的 X光時。研究中使用的專用 X光源稱為同步加速器輻射,由使用高強度 X光管的粒子加速器中的輻射過程產生。

北美佔重要佔有率

- 由於久坐的生活方式和不健康的飲食習慣,美國老年人口不斷增加,慢性病發生率也激增。人口普查資料顯示,截至去年7月,美國3.28億人口中,65歲以上人口占16.5%,即5,400萬人。預計到2030年,這一數字將增加至7,400萬人。 85歲以上老年人口成長速度較快。此外,隨著醫療設施的增加,醫療基礎設施的不斷發展預計將推動美國醫用X光管市場的需求。

- 例如,醫療器材公司 EOS Imaging 在美國紐約市特殊外科醫院 (HSS) 安裝了第四個 EOS 系統,為患者提供低劑量全身立體放射影像處於職能位置。

- 此外,光是在美國,超過 30% 的慢性病患者去急診室就診是可以預防的,每年可避免的費用超過 90 億美元。慢性病的增加提高了篩檢技術對於正確、及時的治療和護理的重要性。 X 光在慢性疾病診斷中繼續發揮至關重要的作用,例如外分泌胰臟、肺部、骨骼和腹部疾病。

- 此外,X光管在該地區大量部署用於檢查目的。據美國緝毒局 (DFA) 稱,大部分芬太尼、海洛因和甲基安非他命都是透過西南邊境販運的。它主要透過合法入境口岸走私到美國,即到達海關和邊境保護局 (CBP) 官員腳下的地方。此外,CBP 承認,目前在陸地邊境僅掃描 2% 的私人乘用車和 16% 的商用車輛。

- 機場安檢也是 X 光系統的主要使用者。例如,最近,TSA 向 Analogic 公司授予了價值 1.98 億美元的訂單,為 TSA 檢查站採購中型電腦斷層掃描 X 光系統。

X 光管產業概況

主要參與者的存在決定了該行業的競爭。由於對差異化產品的需求不斷成長,市場可以透過創新獲得永續的競爭優勢。例如,2022 年 1 月,Fortress Technology 推出了一款名為 raptor 的新型 X光管,用於食品包裝。 Raptor X 光檢查並剔除含有金屬、玻璃、木材、橡膠、高密度塑膠、石頭和鈣化骨頭的包裝肉類、起司、冷凍食品和糖果產品。

2022 年 5 月,醫療保健 AI 解決方案提供商 Aidoc 宣布與法國 MedTech 公司 Gleamer 達成協議,專注於在放射學中使用 AI 技術,整合 Gleamer 的 BoneViewsolution 用於 X光。 Gleamer 的 AI BoneViewX光解決方案的加入旨在將 Aidoc 的業務擴展到 X光模式。

2022 年 3 月,佳能醫療系統公司宣布達成協議,收購 Nordisk Rontgen Teknik A/S,這是一家擁有開發和製造診斷 X 光系統先進技術的丹麥公司。透過此次收購,佳能醫療開啟了獲得歐洲先進影像解決方案技術、開發和製造的大門。

2022 年 1 月,Malvern 收購了 CreoptixAG,以加強和擴大其親和力產品。 Creoptix 是一家動力學測量公司,開發和製造分析設備、軟體和消耗品。透過利用 Malvern Panalytical 龐大的客戶群,此次合作呈現出令人興奮的潛力,可以在速度和靈敏度方面快速擴展 Creoptix 的卓越技術。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- 技術簡介

- 介紹

- X光管主要部件

- 信封

- 陰極

- 陽極

- 防護罩

第 5 章:市場動態

- 市場促進因素

- 技術進步

- 對醫療診斷的需求不斷增加

- 市場限制

- 嚴格的法規和驗證指南

第 6 章:市場區隔

- 類型

- 旋轉陽極管

- 固定式 X光管

- 最終用戶產業

- 製造業

- 衛生保健

- 食物

- 航太和國防

- 其他最終用戶產業

- 地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 亞太其他地區

- 世界其他地區

- 北美洲

第 7 章:競爭格局

- 公司簡介

- Varex Imaging Corporation

- YXLON International

- Lafco India Scientific Industries

- Malvern Panalytical Ltd

- Proto Manufacturing

- Oxford Instruments PLC

- General Electric Company

- Koninklijke Philips NV

- Comet Group

- Canon Electron Tubes & Devices Co. Ltd (CANON Inc.)

- Siemens AG

第 8 章:投資分析

第 9 章:市場機會與未來趨勢

The X-ray Tube Market size is estimated at USD 3.48 billion in 2024, and is expected to reach USD 4.27 billion by 2029, growing at a CAGR of 4.19% during the forecast period (2024-2029).

Key Highlights

- X-rays have found applications in security, metallurgy, non-destructive testing, and other industrial applications. Technological advancement is one of the primary factors driving the growth of the market studied. Over the past few decades, the application of X-rays has drastically expanded beyond the field of medicine.

- With electronic innovations, these systems' sizes have significantly decreased. With the availability of compact systems, X-ray machines are now used in various fields, such as airport security, baggage scanning, and metallurgical applications. In addition, increasing medical cases and accidental injuries worldwide are influencing the growth of the market studied.

- For instance, recently, Excillum launched its latest development-a new generation of high-resolution X-ray tubes. The Excillum NanoTube N3, initially available in 3 different versions, enables the world's best resolution up to 160 kV. The NanoTube N3 targets advanced industries' metrology and non-destructive testing (NDT) components, e.g., automotive, aerospace, medical, electronics, and semiconductor back ends.

- The pandemic scenario benefited medical and healthcare applications greatly. Several associations and governing bodies have globally established CT and X-ray imaging as a primary mode of examination to check a patient for the presence of COVID-19-related symptoms. According to Siemens Healthineers, the studies conducted by multiple researchers found that the X-ray examinations had a lower sensitivity for COVID-19-related lung shadowing of 25% to 69%.

- In the near future, the high-demand regions, such as Asia-Pacific and North America, are expected to revise their safety regulations, leading to stricter rules and industrial standards. This scenario also makes it hard for new players to enter the market. Therefore, stringent regulations and validatory guidelines restrain the market's growth.

X-Ray Tube Market Trends

Healthcare Sector Holds the Largest Market Share

- In the medical sector, dental applications that require smaller and shorter scans are found to be using stationary x-ray tubes for imaging. Oral conditions are the most common health issues, affecting an estimated 3.9 billion people worldwide, according to Listerine Professional.Therefore, in the dental sector, the primary demand for x-ray imaging, which does not require rotating anode x-ray tubes, is due to stationary tubes that are suitable for imaging purposes.

- Many advances in medical radiation equipment and techniques have been seen as a result of technological advancements and increased adoption of technology in the healthcare industry.Over the past few years, one of the significant advancements in interventional x-ray has been an increased focus on core and supporting technologies to provide high-quality, high-resolution images without a corresponding increase in radiation dose. This has been a key driver behind technology advancements such as Siemens' Artis Q, Philips' ClarityIQ technology, Q.zen technology, GE Healthcare's Image Guided Systems (IGS), and Toshiba's Infinix Elite product line.

- The medical devices industry is witnessing a growth in the number of imaging and diagnostic tests performed every year owing to various factors, such as an increasing focus on radiological diagnostic tests, rising chronic disease burdens, and the introduction of efficient X-ray devices through market consolidation and mergers.

- The number of people over the age of 65 is steadily increasing, according to UN data from the World Population Prospects.By 2050, the world's population aged 60 years and older is predicted to reach 2 billion, of which 80% may live in low- and middle-income countries. Hence, the rising geriatric population and the increasing number of orthopedic and cardiovascular procedures may further drive the adoption of X-ray tubes in medical applications.

- The x-rays are generated using the x-ray tubes, and in the pharmaceutical industry, these tubes are used with tungsten, especially when softer x-rays are required in mammography applications. The specialized x-ray sources used in the research are known as synchrotron radiation, generated by the radiation process in particle accelerators in which high-magnitude x-ray tubes are used.

North America Accounts for a Significant Share

- The United States is witnessing an increase in the geriatric population as well as a surge in the incidence of chronic diseases because of sedentary lifestyles and unhealthy eating habits. According to census data, as of July last year, 16.5% of the US population of 328 million people, i.e., 54 million, were over the age of 65. It is estimated that by 2030, the number will increase to 74 million. The number of people over the age of 85 is growing even faster. Moreover, rising medical infrastructure developments with the increase in medical facilities are expected to propel the demand for the medical X-ray tube market in America.

- For instance, EOS imaging, a medical device company, has installed its fourth EOS system at the Hospital for Special Surgery (HSS) in New York City, United States, which offers low-dose full-body, stereo-radiographic images of a patient in a functional position.

- Additionally, in the United States alone, over 30% of emergency department visits by the chronically ill are preventable, resulting in avoidable costs of over USD 9 billion each year. The rise in chronic diseases is pushing up the importance of screening techniques for the right and timely treatment and care. X-ray continues to play a vital role in chronic disease diagnosis, like diseases of the exocrine pancreas, lungs, bones, and abdomen.

- Also, the X-ray tube is being deployed significantly in the region for inspection purposes. According to the Drug Enforcement Administration (DFA), most of the fentanyl, heroin, and methamphetamine are trafficked across the southwest border. It is primarily smuggled into the United States through legal ports of entry, i.e., it comes within feet of the Customs and Border Protection (CBP) officer. Additionally, CBP has acknowledged that it currently scans only 2% of all private passenger vehicles and 16% of commercial vehicles at land borders.

- Airport security is also a major user of X-ray systems. For instance, recently, the TSA awarded an order worth USD 198 million to Analogic Corporation for the procurement of mid-sized computed tomography X-ray systems for TSA checkpoints.

X-Ray Tube Industry Overview

The presence of major players governs competitive rivalry in this industry. The market can attain a sustainable competitive advantage through innovation, owing to the growing need for differentiated products. For instance, in January 2022, Fortress Technology launched a new x-ray tube named raptor for food packs. The Raptor X-Ray inspects and rejects packaged meat, cheese, chilled, and confectionery products with metal, glass, wood, rubber, high-density plastic, stone, and calcified bones.

In May 2022, Aidoc, a provider of healthcare AI solutions, announced an agreement with Gleamer, a French MedTech company focused on using AI technology in radiology to integrate Gleamer's BoneViewsolution for X-rays. The onboarding of Gleamer's AI BoneViewX-ray solution aimed to expand Aidoc's venture into the X-ray modality.

In March 2022, Canon Medical Systems Corporation announced that it entered an agreement to acquire Nordisk Rontgen Teknik A/S, a Danish company with advanced technology for developing and manufacturing diagnostic X-ray systems. Through this acquisition, Canon Medical opened up access to European-based technology, development, and manufacturing for advanced imaging solutions.

In January 2022, Malvern acquired CreoptixAG in order to strengthen and expand its affinity offering. Creoptixis a kinetics measuring company that develops and manufactures analytical equipment, software, and consumables. By leveraging Malvern Panalytical'senormous client base, the partnership presents an exciting potential to quickly scale Creoptix'ssuperior technology in terms of speed and sensitivity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.4.1 Introduction

- 4.4.2 Major Components of X-ray Tube

- 4.4.2.1 Envelope

- 4.4.2.2 Cathode

- 4.4.2.3 Anode

- 4.4.2.4 Protective housing

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancements

- 5.1.2 Increasing Demand for Healthcare Diagnostics

- 5.2 Market Restraints

- 5.2.1 Stringent Regulations and Validatory Guidelines

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Rotating Anode Tube

- 6.1.2 Stationary X-Ray Tube

- 6.2 End-user Industry

- 6.2.1 Manufacturing

- 6.2.2 Healthcare

- 6.2.3 Food

- 6.2.4 Aerospace and Defense

- 6.2.5 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Varex Imaging Corporation

- 7.1.2 YXLON International

- 7.1.3 Lafco India Scientific Industries

- 7.1.4 Malvern Panalytical Ltd

- 7.1.5 Proto Manufacturing

- 7.1.6 Oxford Instruments PLC

- 7.1.7 General Electric Company

- 7.1.8 Koninklijke Philips NV

- 7.1.9 Comet Group

- 7.1.10 Canon Electron Tubes & Devices Co. Ltd (CANON Inc.)

- 7.1.11 Siemens AG