|

市場調查報告書

商品編碼

1444646

耐火材料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Refractories - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

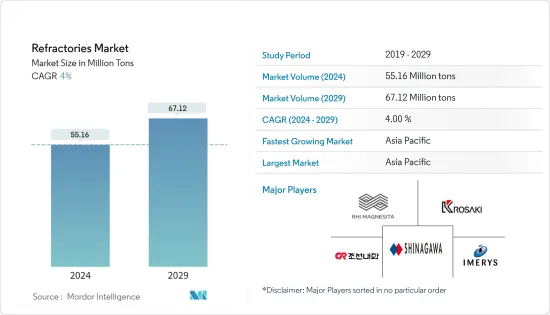

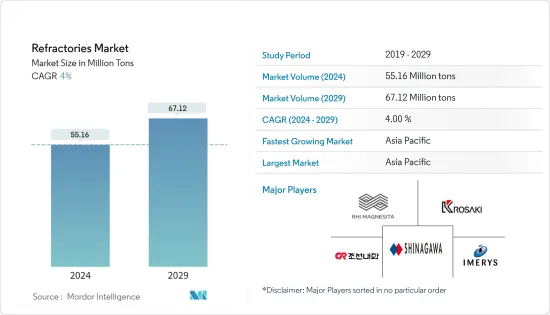

2024年耐火材料市場規模預估為5,516萬噸,預估至2029年將達到6,712萬噸,預測期間(2024-2029年)年複合成長率為4%。

由於COVID-19的影響,許多國家進入封鎖狀態,極大地影響了全球經濟,經濟和工業活動暫時停止。耐火材料市場也對鋼鐵、水泥、能源化工、陶瓷等終端用戶產業的生產和需求產生影響。即使在大流行之後,最終用戶產業仍在成長。這反映了經濟開放後產品需求的增加。

主要亮點

- 從中期來看,推動所研究市場的關鍵因素是新興國家鋼鐵產量的強勁成長以及有色金屬材料產量的增加。耐火材料用於黑色金屬和有色金屬產品的內襯應用。

- 此外,玻璃產業的高需求是推動成長的主要因素。

- 同時,日益增強的環保意識促使世界各地的政府和環境機構制定了耐火材料的使用和處置指南。它可能會阻礙市場成長。

- 印度鋼鐵業的成長潛力預計將為研究市場提供新的機會。

- 亞太地區可能會主導市場並維持最高的年複合成長率。中國、俄羅斯、墨西哥、南非等新興國家正大力投資大型基礎建設計劃,預計將顯著促進鋼鐵業的成長。

耐火材料市場趨勢

鋼鐵業需求增加

- 鋼鐵業是耐火材料的主要終端用戶,約佔市場的70%。這些材料可以承受 260 度C(500 °F) 至 1850 度C(3400 °F) 的高溫,而物理特性不會發生顯著變化。

- 耐火材料在鋼鐵工業的主要應用包括用於生產鋼的爐襯、用於在進一步加工前加熱鋼的爐子以及用於容納和運輸金屬和爐渣的容器,包括用於熱氣體通過的煙道和煙囪。 。實施和其他應用程式。

- 根據世界鋼鐵協會的數據,2023 年 2 月 63 個國家的粗鋼產量為 1.424 億噸。這顯示了全球普遍的需求前景,有助於推動鋼鐵生產活動。

- 2023年2月排名前10位的鋼鐵生產國包括中國(8010萬噸)、印度(10萬噸)、日本(690萬噸)、美國(600萬噸)、俄羅斯(560萬噸)。 。

- 2022年9月,Essar宣布計畫在2025年投資40億美元,在沙烏地阿拉伯建造和試運行一座年產400萬噸的鋼鐵設施。

- 在歐盟,低碳鋼需求持續復甦,經濟信心和投資條件也在改善。然而,與難民危機和英國相關的政治形勢是我們財務狀況面臨的不確定性風險。預計該地區的鋼鐵需求在預測期內將緩慢成長。

- 所有上述因素預計將在預測期內推動全球市場。

亞太地區主導市場

- 在亞太地區,中國是最大的經濟體,也是全球最大的製造業和生產之一。由於原料供應充足,中國在耐火材料市場的消費和生產方面佔據主導地位。

- 中國是世界上最大的鋼鐵生產國。根據世界鋼鐵協會報告,2023年2月中國產量約8,010萬噸,較2022年2月成長5.6%。國內巨大的鋼材需求預示著耐火材料市場的機會。

- 印度國內粗鋼產量預計到2030-31年將達2.55億噸。在2022-23年聯盟預算中,印度政府向鋼鐵部撥款620萬美元。

- 此外,根據「十四五」計畫(2021-2025年),中國設定了約1100吉瓦的燃煤發電裝置目標。因此,網路營運商國家電網和中國電力委員會正在製定在該國開發數百座新燃煤發電廠的計畫。

- 日本鋼鐵聯合會的資料顯示,2022年國內粗鋼產量達8,920萬噸,而2021年為9,630萬噸。

- 總體而言,預計亞太地區耐火材料需求在預測期內將大幅增加。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 耐火材料在鋼鐵工業的繼續使用

- 非鐵金屬產量增加

- 抑制因素

- 中國耐火材料產量下降

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(市場規模(數量))

- 產品類別

- 非黏土耐火材料

- 菱鎂磚(重燒鎂砂、電熔鎂砂、輕燒氧化鎂)

- 氧化Brick

- Brick

- 鉻鐵礦磚

- 其他產品類型(碳化物、矽酸鹽)

- 黏土耐火材料

- 高鋁

- 耐火粘土

- 絕緣

- 非黏土耐火材料

- 最終用戶產業

- 鋼

- 能源和化學品

- 非鐵金屬

- 水泥

- 陶瓷製品

- 玻璃

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率分析

- 主要企業採取的策略

- 公司簡介

- Chosun Refractories

- Harbisonwalker International

- IFGL Refractories Ltd

- Imerys

- Intocast AG

- Krosaki Harima Corporation

- Magnezit Group

- Minerals Technologies Inc.

- Morgan Advanced Materials

- Puyang Refractories Group Co., Ltd

- Refratechnik

- RHI Magnesita GmbH

- Saint-Gobain

- Shinagawa Refractories Co. Ltd

- Vesuvius

第7章市場機會與未來趨勢

- 擴大耐火材料回收的投資與研究

The Refractories Market size is estimated at 55.16 Million tons in 2024, and is expected to reach 67.12 Million tons by 2029, growing at a CAGR of 4% during the forecast period (2024-2029).

Due to COVID-19, numerous countries were in lockdown, significantly affecting the global economy, and economic and industrial activities were temporarily halted. The refractories market also witnessed a repercussion in production and demand from the end-user industries, such as iron and steel, cement, energy and chemicals, ceramics, etc. Although in the post-pandemic period, the end-user industries are growing because of the growing demand for products after economies open up.

Key Highlights

- Over the medium term, the significant factors driving the market studied are the strong growth of iron and steel production in emerging countries and the increased output of non-ferrous materials. The refractories are used for internal lining applications in iron steel and non-ferrous productions.

- Moreover, high demand from the glass industry is the primary factor driving the growth.

- On the flip side, due to increasing environmental awareness, government agencies and environmental agencies worldwide are laying down guidelines regarding the usage and disposal of refractories. It is likely to hinder market growth.

- The growth potential of the Indian steel industry is expected to provide new opportunities for the market studied.

- The Asia-Pacific region will likely dominate the market and register the highest CAGR. Emerging countries like China, Russia, Mexico, and South Africa are investing heavily in large-scale infrastructure projects, which are expected to boost the iron and steel industry's growth significantly.

Refractories Market Trends

Increasing Demand from the Iron and Steel Industry

- The iron and steel industry is the primary end user of refractories, which accounts for around 70% of the market. These materials can withstand high temperatures, ranging from 260°C (500°F) to 1850°C (3400°F), without any significant change in their physical properties.

- The major refractory applications in the iron and steel industry include using internal furnace linings to make iron and steel, in furnaces for heating steel before further processing, in vessels for holding and transporting metal and slag, in the flues or stacks through which hot gases are conducted, and other applications.

- According to the World Steel Association, the production of crude steel for 63 countries in the month of February 2023 was 142.4 million metric tons (Mt). It indicates the demand prospect prevailing worldwide, which is instrumental in driving steel production activities.

- The top 10 steel-producing countries in the month of February 2023 included China (80.1 Mt), India (10 Mt), Japan (6.9 Mt), the United States (6 Mt), Russia (5.6 Mt), and various others.

- In September 2022, Essar announced its plans to invest USD 4 billion in building and commissioning a four-mtpa steel complex in Saudi Arabia by 2025.

- In the European Union, a mild steel demand recovery continues while improving economic sentiment and investment conditions. However, uncertainties in the political landscape related to the refugee crisis and Brexit are some of the risks to the financial situation. The demand for steel in the region is anticipated to grow slowly over the forecast period.

- All the factors above are expected to drive the global market during the forecast period.

Asia-Pacific region to Dominate the Market

- In the Asia-Pacific region, China is the largest economy and one of the world's largest manufacturing and production industries. China dominates the refractories market in terms of consumption and production owing to the abundant supply of raw materials.

- China is the largest producer of steel in the world. As per the World Steel Association report, China produced around 80.1 Mt (million tons) in February 2023, which is up by 5.6% compared to February 2022. This massive demand for steel in the country projects market opportunities for refractories.

- In India, by FY 2030-31, crude steel actual production in the country is forecasted to reach 255 MT. In Union Budget 2022-23, the Indian government allocated USD 6.2 million to the Ministry of Steel.

- Furthermore, China, under its 14th Five-Year Plan (2021-2025), has set coal-power capacity targets to about 1,100 GW. Thus, the network operator State Grid and the China Electricity Council have targeted plans to develop hundreds of new coal-fired power stations in the country.

- As per the data of the Japan Iron and Steel Federation, the crude steel production in the country reached 89.2 million tons in 2022, compared to 96.3 million tons in 2021.

- Overall, refractory demand in the Asia-Pacific region is expected to grow significantly during the forecast period.

Refractories Industry Overview

The refractories market stands to be fragmented in nature. The major players (not in any particular order) include RHI Magnesita GmbH, Chosun Refractories ENG Co., Ltd., Krosaki Harima Corporation, Shinagawa Refractories Co., Ltd., and Imerys.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Continuous Usage of Refractories in the Iron and Steel Industry

- 4.1.2 Increase in the Production of Non-ferrous Metals

- 4.2 Restraints

- 4.2.1 Decreasing Production of Refractories in China

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Non-clay Refractory

- 5.1.1.1 Magnesite Brick (Dead Burned Magnesia, Fused Magnesia, and Caustic Calcined Magnesia)

- 5.1.1.2 Zirconia Brick

- 5.1.1.3 Silica Brick

- 5.1.1.4 Chromite Brick

- 5.1.1.5 Other Product Types (Carbides, Silicates)

- 5.1.2 Clay Refractory

- 5.1.2.1 High Alumina

- 5.1.2.2 Fireclay

- 5.1.2.3 Insulating

- 5.1.1 Non-clay Refractory

- 5.2 End-user Industry

- 5.2.1 Iron and Steel

- 5.2.2 Energy and Chemicals

- 5.2.3 Non-ferrous Metals

- 5.2.4 Cement

- 5.2.5 Ceramic

- 5.2.6 Glass

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chosun Refractories

- 6.4.2 Harbisonwalker International

- 6.4.3 IFGL Refractories Ltd

- 6.4.4 Imerys

- 6.4.5 Intocast AG

- 6.4.6 Krosaki Harima Corporation

- 6.4.7 Magnezit Group

- 6.4.8 Minerals Technologies Inc.

- 6.4.9 Morgan Advanced Materials

- 6.4.10 Puyang Refractories Group Co., Ltd

- 6.4.11 Refratechnik

- 6.4.12 RHI Magnesita GmbH

- 6.4.13 Saint-Gobain

- 6.4.14 Shinagawa Refractories Co. Ltd

- 6.4.15 Vesuvius

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Investments and Research on the Recycling of Refractories