|

市場調查報告書

商品編碼

1444635

潤滑油 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

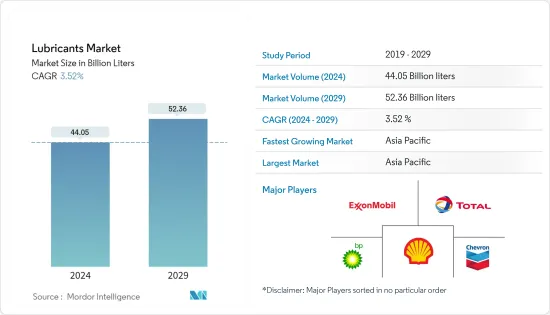

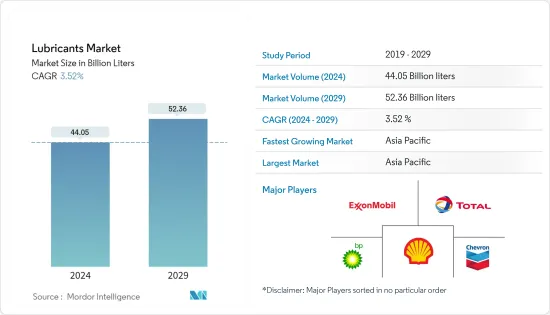

2024年潤滑油市場規模預計為440.5億公升,預計到2029年將達到523.6億公升,在預測期內(2024-2029年)CAGR為3.52%。

COVID-19危機嚴重影響了全球汽車供應產業,大多數地區的機動車輛生產和銷售突然停止。這些停工導致全球數百萬輛汽車的產量損失。在汽車工業中,潤滑油廣泛用於控制引擎的摩擦和磨損,防止引擎生鏽,防止燃燒氣體儲存在油底殼中的機油,以及冷卻活塞。

主要亮點

- 短期內,推動市場研究的一個主要因素是對高性能潤滑劑的需求不斷成長(由於其性能更好和改進,例如降低可燃性、減少齒輪磨損和延長使用壽命)。

- 另一方面,汽車和工業領域換油間隔的增加以及電動車短期內的適度影響預計將阻礙預測期內研究的市場的成長。

- 機油在市場上佔據主導地位,預計在預測期內將成長,因為它被廣泛用於潤滑內燃機。

- 生物潤滑劑的日益突出可能會成為未來的一個機會。

- 亞太地區主導了全球市場,最大的消費來自中國和印度等國家。

潤滑油市場趨勢

汽車和其他運輸領域將主導市場

- 汽車和其他運輸媒介,例如飛機和船舶,是最大的潤滑油市場。

- 引擎設計不斷改進,以提高性能、效率,同時滿足環境排放法規。

- 輕型汽車包括兩輪汽車和客車。機油、齒輪油、變速箱油、潤滑脂和壓縮機油是這些汽車中使用最廣泛的潤滑油。潤滑油在OEM和售後市場中都佔有很大的佔有率。

- 典型的中型卡車包括公用卡車、快遞卡車、包裹運送卡車、救護車、接駁車、校車和休閒車。然而,直列卡車仍然是主要的中型底盤。

- 這些車輛廣泛使用中負荷和高性能潤滑油,因為齒輪、傳動系統和引擎等部件承受高負載和快速摩擦,產生充足的熱量。

- 2022 年前三季度,全球乘用車產量約 5,000 萬輛,較 2021 年同季度成長近 9%。不過,根據統計,這仍較 2019 年疫情前水準減少約 500 萬輛。歐洲汽車製造商協會(ACEA) 報告。

- IEA公佈的資料顯示,2022年全球電動車銷量將超過1,000萬輛,預計2023年銷量將再成長35%,達到1,400萬輛。

- 根據國際機動車輛製造商組織 (OICA) 的數據,2022 年汽車總產量為 85,016,728 輛,而 2021 年為 82,684,788 輛。

- 上述所有因素預計將在預測期內顯著增加市場成長。

亞太地區將主導市場

- 亞太地區主導了全球市場佔有率。隨著中國、印度和日本等國家對風力發電的需求不斷成長以及大型汽車生產基地的建立,該地區的潤滑油使用量正在增加。

- 中國是該地區乃至全球最大的潤滑油消費國,其次是美國。除了汽車和風電之外,化學製造是中國另一個重要的終端用戶產業。

- 來自印度的 20 家汽車製造商,包括塔塔汽車有限公司、鈴木汽車古吉拉特邦、馬恆達、馬恆達、現代和起亞印度私人有限公司。有限公司於 2020 年 2 月被選為獲得生產掛鉤激勵措施 (PLI),作為政府增加本地汽車製造和吸引新投資計劃的一部分。

- 然而,韓國的電動車產業預計將快速成長。政府的目標是到 2030 年將 33% 的車輛電動化,這也推動了電動車產業的成長。為實現這一目標,電動車充電站的數量預計到 2025 年將增加到 15,000 個。

- 預計上述因素將在預測期內增加該地區的潤滑油消費量。

潤滑油產業概況

研究的市場集中在前 10 名參與者。頂級公司正在利用競爭策略和投資來保留和擴大其佔有率。市場上排名前五的參與者是(排名不分先後)埃克森美孚公司、雪佛龍公司、英國石油公司、殼牌公司和道達爾能源公司。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 增加高性能潤滑劑的使用

- 不斷成長的風能產業的需求

- 全球冷鏈市場的拓展

- 限制

- 增加汽車和工業領域的換油間隔

- 電動車 (EV) 對未來的影響不大

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 監理政策分析

第 5 章:市場區隔(市場規模依數量計算)

- 團體

- 第一組

- 第二組

- 第三組

- 第四組

- 第五組

- 基礎油

- 礦物油潤滑油

- 合成潤滑油

- 半合成潤滑油

- 生物性潤滑劑

- 產品類別

- 機油

- 變速箱和液壓油

- 金屬加工液

- 一般工業用油

- 齒輪油

- 潤滑脂

- 工藝油

- 其他產品類型

- 最終用戶產業

- 發電

- 汽車和其他運輸

- 重型設備

- 食品與飲品

- 冶金和金屬加工

- 化學製造

- 其他最終用戶產業(包裝、石油和天然氣)

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 菲律賓

- 印尼

- 馬來西亞

- 泰國

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 土耳其

- 西班牙

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥倫比亞

- 南美洲其他地區

- 中東

- 沙烏地阿拉伯

- 伊朗

- 伊拉克

- 阿拉伯聯合大公國

- 科威特

- 中東其他地區

- 非洲

- 埃及

- 南非

- 奈及利亞

- 阿爾及利亞

- 摩洛哥

- 非洲其他地區

- 亞太

第 6 章:競爭格局

- 併購、合資、合作與協議

- 市佔率(%)**/排名分析

- 領先企業採取的策略

- 公司簡介

- AMSOIL INC.

- BASF SE

- Bharat Petroleum Corporation Limited

- BP plc

- Blaser Swisslube

- Carl Bechem GmbH

- China National Petroleum Corporation (PetroChina)

- China Petrochemical Corporation (Sinopec)

- Chevron Corporation

- Eni SpA

- Exxon Mobil Corporation

- FUCHS

- Gazprom Neft PJSC

- Gulf Oil Corporation Limited

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Ltd

- Illinois Tool Works Inc. (ROCOL)

- ENEOS Corporation

- Kluber Lubrication Munchen GmbH & Co. KG

- LUKOIL

- Motul

- PT Pertamina Lubricants

- Petrobras

- PETROFER CHEMIE HR Fischer GmbH + Co. KG

- Petromin

- Petroliam Nasional Berhad

- Phillips 66 Company

- Repsol

- Shell plc

- SK Lubricants Co. Ltd

- Veedol International Limited

- TotalEnergies

- Valvoline LLC

第 7 章:市場機會與未來趨勢

- 生物潤滑劑的地位日益突出

- 其他機會

The Lubricants Market size is estimated at 44.05 Billion liters in 2024, and is expected to reach 52.36 Billion liters by 2029, growing at a CAGR of 3.52% during the forecast period (2024-2029).

The COVID-19 crisis heavily impacted the global automotive supply industry, as both motor vehicle production and sales suddenly stopped in most regions. These work stoppages led to a loss in the production of millions of vehicles worldwide. In the automobile industry, lubricants are widely used to control friction and wear in the engine, to protect the engine from rusting & engine oil stored in the sump from combustion gases, and to cool the pistons.

Key Highlights

- In the short term, a major factor driving the market studied is the increasing demand for high-performance lubricants (owing to their better and improved properties, such as reduced flammability, reduced gear wear, and increased service life).

- On the flip side, increasing drain intervals in the automotive and industrial sectors and the modest impact of EVs shortly are expected to hinder the growth of the market studied in the forecast period.

- Engine oil dominated the market and is expected to grow during the forecast period, as it is widely used to lubricate internal combustion engines.

- Growing prominence for bio-lubricants is likely to act as an opportunity in the future.

- Asia-Pacific dominated the global market, with the largest consumption coming from the countries such as China and India.

Lubricants Market Trends

Automotive and Other Transportation Segment to Dominate the Market

- Automotive and other transportation media, such as aircraft and marine, are the largest lubricant markets.

- Engine designs were continually improved to enhance performance, increase efficiency, and, at the same time, meet environmental emission regulations.

- Light-duty vehicles include two-wheelers and passenger cars. Engine oils, gear oils, transmission oils, greases, and compressor oils are the most widely used lubricants in these automobiles. Lubricants contain a good share in both the OEM and the aftermarket.

- Typical medium-duty trucks include utility, courier, package delivery trucks, ambulances, shuttle buses, school buses, and recreational vehicles. However, straight trucks continue to be the predominant medium-duty chassis.

- Medium-duty and high-performance lubricants are used extensively in these vehicles, as the components, such as gears, transmission systems, and engines, are subjected to high loads and rapid rubbing, producing ample heat.

- In the first three quarters of 2022, around 50 million passenger cars were manufactured worldwide, up nearly 9% compared to the same quarter in 2021. However, this was still less by around 5 million units from pre-pandemic levels in 2019, as per the European Automobile Manufacturers' Association (ACEA) report.

- As per data published by IEA, more than 10 million electric cars were sold worldwide in 2022, and sales are expected to grow by another 35% in 2023 to reach 14 million.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), the total vehicle units produced in 2022 were 85,016,728 compared to 82,684,788 in 2021.

- All the factors mentioned above are expected to significantly increase the market growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. With the increasing need for wind power and a large automotive production base in countries such as China, India, and Japan, lubricant usage is increasing in the region.

- China is the largest lubricant consumer in the region, and the world, followed by the United States. Besides automotive and wind power, chemical manufacturing is another prominent end-user industry in China.

- 20 carmakers from India, including Tata Motors Ltd, Suzuki Motor Gujarat, Mahindra, Mahindra, Hyundai, and Kia India Pvt. Ltd was selected in February 2020 to receive production-linked incentives (PLI) as part of the government's plan to increase local vehicle manufacturing and attract new investment.

- However, the electric vehicle industry in South Korea is expected to grow at a rapid rate. The EV industry growth is also fueled by the government's aim to electrify 33% of all vehicles by 2030. The number of charging stations for electric vehicles is expected to increase to 15,000 by 2025 to achieve this target.

- The factors above are, in turn, expected to increase lubricant consumption in the region during the forecast period.

Lubricants Industry Overview

The market studied is consolidated among the top 10 players. The top companies are utilizing competitive strategies and investments to retain and expand their shares. The top five players in the market are (not in a particular order) Exxon Mobil Corporation, Chevron Corporation, BP p.l.c., Shell plc, and TotalEnergies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of High-performance Lubricants

- 4.1.2 Demand from the Growing Wind Energy Sector

- 4.1.3 Expansion of the Global Cold Chain Market

- 4.2 Restraints

- 4.2.1 Increasing Drain Intervals in the Automotive and Industrial Sectors

- 4.2.2 Modest Impact of Electric Vehicles (EVs) in the Future

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Group

- 5.1.1 Group I

- 5.1.2 Group II

- 5.1.3 Group III

- 5.1.4 Group IV

- 5.1.5 Group V

- 5.2 Base Stock

- 5.2.1 Mineral Oil Lubricant

- 5.2.2 Synthetic Lubricant

- 5.2.3 Semi-synthetic Lubricant

- 5.2.4 Bio-based Lubricant

- 5.3 Product Type

- 5.3.1 Engine Oil

- 5.3.2 Transmission and Hydraulic Fluid

- 5.3.3 Metalworking Fluid

- 5.3.4 General Industrial Oil

- 5.3.5 Gear Oil

- 5.3.6 Grease

- 5.3.7 Process Oil

- 5.3.8 Other Product Types

- 5.4 End-user Industry

- 5.4.1 Power Generation

- 5.4.2 Automotive and Other Transportation

- 5.4.3 Heavy Equipment

- 5.4.4 Food and Beverage

- 5.4.5 Metallurgy and Metalworking

- 5.4.6 Chemical Manufacturing

- 5.4.7 Other End-user Industries (Packaging, Oil, and Gas)

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Philippines

- 5.5.1.6 Indonesia

- 5.5.1.7 Malaysia

- 5.5.1.8 Thailand

- 5.5.1.9 Vietnam

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Russia

- 5.5.3.6 Turkey

- 5.5.3.7 Spain

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Rest of South America

- 5.5.5 Middle-East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 Iran

- 5.5.5.3 Iraq

- 5.5.5.4 United Arab Emirates

- 5.5.5.5 Kuwait

- 5.5.5.6 Rest of the Middle-East

- 5.5.6 Africa

- 5.5.6.1 Egypt

- 5.5.6.2 South Africa

- 5.5.6.3 Nigeria

- 5.5.6.4 Algeria

- 5.5.6.5 Morocco

- 5.5.6.6 Rest of Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMSOIL INC.

- 6.4.2 BASF SE

- 6.4.3 Bharat Petroleum Corporation Limited

- 6.4.4 BP p.l.c.

- 6.4.5 Blaser Swisslube

- 6.4.6 Carl Bechem GmbH

- 6.4.7 China National Petroleum Corporation (PetroChina)

- 6.4.8 China Petrochemical Corporation (Sinopec)

- 6.4.9 Chevron Corporation

- 6.4.10 Eni SpA

- 6.4.11 Exxon Mobil Corporation

- 6.4.12 FUCHS

- 6.4.13 Gazprom Neft PJSC

- 6.4.14 Gulf Oil Corporation Limited

- 6.4.15 Hindustan Petroleum Corporation Limited

- 6.4.16 Idemitsu Kosan Co. Ltd

- 6.4.17 Indian Oil Corporation Ltd

- 6.4.18 Illinois Tool Works Inc. (ROCOL)

- 6.4.19 ENEOS Corporation

- 6.4.20 Kluber Lubrication Munchen GmbH & Co. KG

- 6.4.21 LUKOIL

- 6.4.22 Motul

- 6.4.23 PT Pertamina Lubricants

- 6.4.24 Petrobras

- 6.4.25 PETROFER CHEMIE H. R. Fischer GmbH + Co. KG

- 6.4.26 Petromin

- 6.4.27 Petroliam Nasional Berhad

- 6.4.28 Phillips 66 Company

- 6.4.29 Repsol

- 6.4.30 Shell plc

- 6.4.31 SK Lubricants Co. Ltd

- 6.4.32 Veedol International Limited

- 6.4.33 TotalEnergies

- 6.4.34 Valvoline LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Prominence for Bio-lubricants

- 7.2 Other Opportunities