|

市場調查報告書

商品編碼

1444622

蛋白酶 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Proteases - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

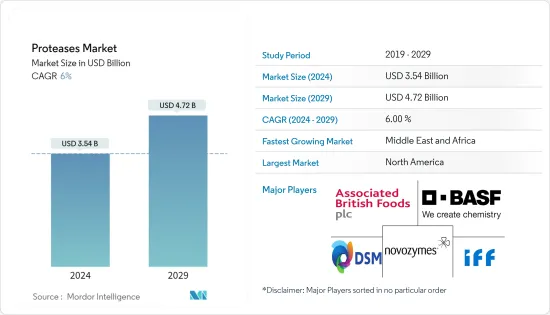

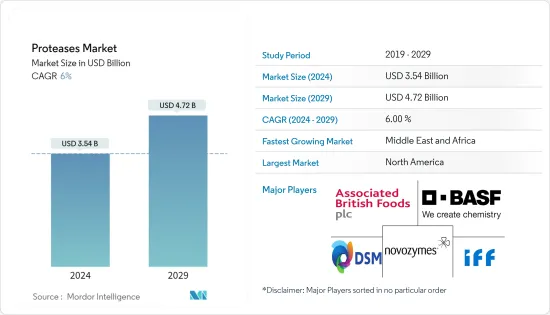

蛋白酶市場規模估計到2024年為 35.4 億美元,預計到2029年將達到 47.2 億美元,在預測期內(2024-2029年)CAGR為 6%。

蛋白酶是一類多樣化的酶,可充當蛋白酶、胜肽酶和醯胺酶,具有廣泛的工業應用,特別是在食品、洗滌劑和製藥領域。研究表明,蛋白酶是一類重要的工業酶,約佔酶市場的 60%和全球酶銷售額的 40%。蛋白酶是重要的工業酶,可分解蛋白質中的肽鍵,並在化學和生物過程中具有多種用途。使用蛋白酶的主要優點之一是它們能夠產生天然產物,在溫和的反應條件下表現出活性,並表現出立體特異性、特異性和生物分解性。該公司推出了創新產品,可縮短反應時間以提高整體產量。蛋白酶對於開發許多快速消費品(FMCG)產品非常重要。市場的主要驅動力是蛋白酶在各行業的多種應用。此外,它們的無毒和非致病性使其對環境友善,進一步推動了市場的發展。

蛋白酶可用於食品工業的三個主要應用:肉製品、烘焙食品和飲料。在肉製品中,蛋白酶用於使肉質嫩化,使其更加柔軟可口,並減少整體加工時間。由於生活方式的改變需要即煮/食用產品,全球加工食品產業經歷顯著成長。預計這將推動預測期內對蛋白酶的需求。此外,微生物蛋白酶因其在代謝活動中的重要作用及其在工業中的廣泛利用而引起了人們的興趣。市面上的蛋白酶都是微生物來源的,因其產量高、耗時少、成本效益高,適合市場上的生物技術應用

蛋白酶市場趨勢

蛋白酶在各行業的應用不斷增加

蛋白酶是在各行業中發揮重要作用的酶,佔酶市場的 60%。它們用於生產洗滌劑、皮革、食品、藥品、紙張和紙漿,以及從照相膠片和生物修復過程中回收銀。紡織品、紙張、飼料、食品、藥物和化學品等日常必需品的製造會產生大量廢棄物,對環境和人類健康有害。因此,蛋白酶的使用對於提高加工效率、減少廢棄物產生和保護自然資源非常重要。因此,世界各地的公司都在尋找替代技術或併購,以滿足年度需求,同時消耗更少的自然資源。

例如,2022年 11月,Novozymes 和 LinusBio 合作在一項臨床試驗中測試新的非侵入性技術,以評估有害化合物的暴露。該計畫將利用 LinusBio 的環境生物動力學平台來繪製由 Novozymes 人類健康部門贊助的益生菌臨床試驗期間有害化合物的暴露情況。此臨床試驗將評估鉛等重金屬和多種環境污染物的暴露情況,是 Novozymes OneHealth 更大臨床計畫的一部分。除了環境效益外,蛋白酶還廣泛應用於食品和飲料產業,以增強食品蛋白質的風味、營養價值、溶解度和消化率。它們用於多種應用,例如釀造、牛奶凝固和肉類工業,其中蛋白酶透過分解肉結構中的微纖維來嫩化肉製品。鹼性蛋白酶可製備具有明確胜肽譜的高營養價值的蛋白質水解產物。

蛋白酶在眾多行業中有多種應用。由於其在減少廢棄物產生、提高加工效率和保護自然資源方面發揮非常重要的作用,預計該市場在未來幾年將顯著成長。

亞太地區是成長最快的市場

印度、中國和韓國是全球加工食品成長最快的市場,使亞太地區成為蛋白酶應用最多產的市場。印度的食品加工業是世界上最大的工業之一,該國的蛋白酶具有巨大的成長潛力。在中國,快速的城市化和收入成長創造了對高價值產品的需求,使中國人的飲食多樣化並增加了對蛋白酶的需求。

韓國加工食品工業發展迅速,消費者更傾向於冷凍加工食品和冷凍肉製品,尤其是脂肪含量高的豬肉。它在全球加工食品市場佔有率排名第十五。韓國食品工業在蛋白酶等食品添加劑的廣泛應用方面也具有更大的潛力。

發展中地區不斷擴大的有組織零售連鎖店進一步增加了對加工肉類產品的需求,使包括蛋白酶在內的肉類嫩化劑受益。在烘焙業中,蛋白酶用於降低麵粉的麵筋,提高麵筋的可塑性,增加麵團體積,提高麵團韌性,縮短麵團成型時間。對高品質、長保存期限、健康烘焙產品(包括麵包、蛋糕、餅乾等)的需求不斷增加,預計將推動蛋白酶領域的成長。

除了食品和烘焙產品外,蛋白酶還廣泛用於洗滌劑和藥品。亞太地區的蛋白酶在這些產業中也呈現出尚未開發的成長潛力。總體而言,亞太地區是蛋白酶的重要市場,預計未來幾年將顯著成長。

蛋白酶產業概況

蛋白酶市場本質上是整合的,頂級參與者佔據主要市場佔有率。該領域的一些主要參與者包括 International Flavors & Fragrances, Inc.、Koninklijke DSM NV、Novozymes AS、BASF SA 和 Associated British Foods plc。這些參與者採取各種策略來保持其在市場中的領先地位並建立強大的品牌形象。這些參與者採取的關鍵策略是併購,這有助於他們鞏固市場地位並擴大產品組合。

產品創新和新產品開發是頂級企業為迎合消費者需求和偏好所採取的重要策略。公司大力投資研發活動,以推出新的和改進的產品,這有助於他們將產品與競爭對手區分開來並擴大客戶群。此外,公司也致力於透過增加新產品線和收購新業務來擴大產品組合。這項策略使公司能夠滿足消費者不斷變化的需求和偏好,並增加其市場佔有率。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第5章 市場細分

- 來源

- 動物

- 胰蛋白酶

- 胃蛋白酶

- 腎素

- 其他動物來源

- 植物

- 木瓜蛋白酶

- 鳳梨蛋白酶

- 其他植物來源(角蛋白酶和無花果蛋白酶)

- 微生物

- 鹼性蛋白酶

- 酸性蛋白酶

- 中性蛋白酶

- 動物

- 應用

- 食品與飲品

- 乳製品

- 烘焙品

- 飲料

- 肉類和家禽

- 嬰幼兒配方奶粉

- 藥品

- 動物飼料

- 其他應用

- 食品與飲品

- 地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 西班牙

- 英國

- 法國

- 德國

- 義大利

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 新加坡

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 中東和非洲其他地區

- 北美洲

第6章 競爭格局

- 最常用的策略

- 市佔率分析

- 公司簡介

- Novus International Inc.

- International Flavors & Fragrances Inc.

- Koninklijke DSM NV

- Biocatalyst Ltd

- Novozymes A/S

- Advanced Enzyme Technologies

- Associated British Foods plc

- Bioseutica BV

- BASF SE

- Kemin Industries Inc.

第7章 市場機會與未來趨勢

The Proteases Market size is estimated at USD 3.54 billion in 2024, and is expected to reach USD 4.72 billion by 2029, growing at a CAGR of 6% during the forecast period (2024-2029).

Proteases are a diverse group of enzymes that act as proteinases, peptidases, and amidases and have a broad range of industrial applications, particularly in the food, detergents, and pharmaceutical sectors. Research has shown that proteases constitute a significant class of industrial enzymes, accounting for approximately 60% of the enzyme market and 40% of all enzyme sales worldwide. Proteases are essential industrial enzymes that break down peptide bonds in proteins and find numerous uses in chemical and biological processes. One of the main advantages of using proteases is their ability to produce natural products, exhibit activity under mild reaction conditions, and exhibit stereospecificity, specificity, and biodegradability. Companies have introduced innovative products that reduce reaction time to enhance overall yield. Proteases are crucial in developing many fast-moving consumer goods (FMCG) products. The market's primary driver is the multiple applications of proteases in various industries. Additionally, their non-toxic and non-pathogenic attributes make them eco-friendly, further boosting the market.

Protease enzymes find use in three primary applications in the food industry: meat products, baked goods, and beverages. In meat products, proteases are used to tenderize the meat, making it softer and palatable and reducing overall processing time. The global processed food industry is experiencing significant growth, driven by changing lifestyles that demand ready-to-cook/eat products. This is expected to drive the demand for proteases during the forecast period. Additionally, microbial proteases have gained interest due to their vital role in metabolic activities and their immense utilization in industries. The proteases available in the market are of microbial origin because of their high yield, less time consumption, and cost-effectiveness, which have made them suitable for biotechnological application in the market

Protease Market Trends

Rising Application of Proteases in Various Industries

Proteases are enzymes that play a significant role in various industries, making up 60% of the enzyme market. They are used in the production of detergent, leather, food, pharmaceuticals, paper, and pulp, as well as in the recovery of silver from photographic films and bioremediation procedures. Manufacturing daily essentials, such as textiles, paper, feed, food, medications, and chemicals, generates a substantial amount of waste, which is harmful to the environment and human health. Thus, the use of proteases has become crucial in increasing processing efficiency while reducing waste production and preserving natural resources. As a result, companies worldwide are searching for alternative technologies or mergers and acquisitions to meet the annual demand while consuming fewer natural resources.

For instance, in November 2022, Novozymes and LinusBio collaborated to test new, non-invasive technology in a clinical trial to assess exposure to harmful compounds. The project will leverage LinusBio's environmental biodynamics platform to map out harmful compound exposure during a clinical trial of probiotics sponsored by Novozymes' human health unit. The clinical trial will assess exposure to heavy metals, such as lead, and a broad range of environmental pollutants and is part of a larger clinical program from Novozymes OneHealth. Apart from environmental benefits, protease enzymes are widely used in the food and beverage industry to enhance food proteins' flavor, nutritional value, solubility, and digestibility. They are utilized in various applications such as brewing, coagulation of milk, and the meat industry, where proteases are used to tenderize meat products by breaking down the microfibre in the meat structure. Alkaline proteases prepare protein hydrolysates of high nutritional value with a well-defined peptide profile.

Protease enzymes have diverse applications in numerous industries. The market is expected to grow significantly in the upcoming years due to its vital role in reducing waste production, improving processing efficiency, and preserving natural resources.

Asia-Pacific is the Fastest-growing Market

India, China, and South Korea are some of the fastest-growing markets for processed foods globally, making the Asia-Pacific region the most productive market for protease enzymes by application. In India, the food processing industry is one of the largest in the world, and the country presents enormous growth potential for proteases. In China, rapid urbanization and income growth create a demand for high-value products, diversifying the Chinese diet and increasing the demand for protease enzymes.

South Korea has a developing processed food industry, where consumers are more inclined toward frozen processed foods and frozen meat products, especially pork meat with high-fat content. It holds the fifteenth largest market share in processed food globally. The South Korean food industry also holds greater potential for wide applications of food additives like proteases.

The expanding organized retail chains in developing regions further augment the demand for processed meat products, benefiting meat tenderizing agents, including protease. In the bakery industry, protease is used to reduce the gluten of flour, improve the plasticity of gluten, increase dough volume, improve dough toughness, and shorten dough forming time. The heightened demand for high-quality, long-shelf-life, healthy bakery products, including bread, cakes, biscuits, and others, is expected to fuel the growth of the protease enzyme segment.

In addition to food and bakery products, protease enzymes are widely used in detergents and pharmaceuticals. The Asia-Pacific region also presents untapped growth potential for protease enzymes in these industries. Overall, the Asia-Pacific region is an important market for protease enzymes and is expected to witness significant growth in the coming years.

Protease Industry Overview

The protease market is consolidated in nature with the top players occupying major market shares. Some of the major players in this sector include International Flavors & Fragrances, Inc., Koninklijke DSM NV, Novozymes AS, BASF SA, and Associated British Foods plc. These players adopt various strategies to maintain their leading position in the market and build a strong brand image. The key strategies these players adopt are mergers and acquisitions, which help them consolidate their market position and expand their product portfolios.

Product innovation and new product developments are essential strategies, top players adopt to cater to consumer demand and preferences. Companies invest heavily in research and development activities to introduce new and improved products, which helps them to differentiate their products from their competitors and expand their customer base. Moreover, companies also focus on expanding their product portfolios by adding new product lines and acquiring new businesses. This strategy enables companies to cater to consumers' evolving needs and preferences and increase their market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Animal

- 5.1.1.1 Trypsin

- 5.1.1.2 Pepsin

- 5.1.1.3 Renin

- 5.1.1.4 Other Animal Sources

- 5.1.2 Plant

- 5.1.2.1 Papain

- 5.1.2.2 Bromelain

- 5.1.2.3 Other Plant Sources (Keratinases and Ficin)

- 5.1.3 Microbial

- 5.1.3.1 Alkaline Protease

- 5.1.3.2 Acid Protease

- 5.1.3.3 Neutral Protease

- 5.1.1 Animal

- 5.2 Application

- 5.2.1 Food and Beverage

- 5.2.1.1 Dairy

- 5.2.1.2 Bakery

- 5.2.1.3 Beverages

- 5.2.1.4 Meat and Poultry

- 5.2.1.5 Infant Formula

- 5.2.2 Pharmaceuticals

- 5.2.3 Animal Feed

- 5.2.4 Other Applications

- 5.2.1 Food and Beverage

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Singapore

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Novus International Inc.

- 6.3.2 International Flavors & Fragrances Inc.

- 6.3.3 Koninklijke DSM NV

- 6.3.4 Biocatalyst Ltd

- 6.3.5 Novozymes A/S

- 6.3.6 Advanced Enzyme Technologies

- 6.3.7 Associated British Foods plc

- 6.3.8 Bioseutica BV

- 6.3.9 BASF SE

- 6.3.10 Kemin Industries Inc.