|

市場調查報告書

商品編碼

1444604

行動化營運服務:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Managed Mobility Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

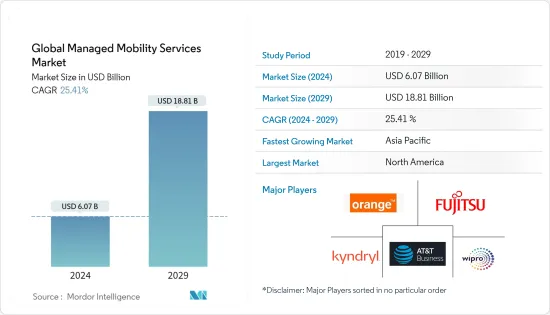

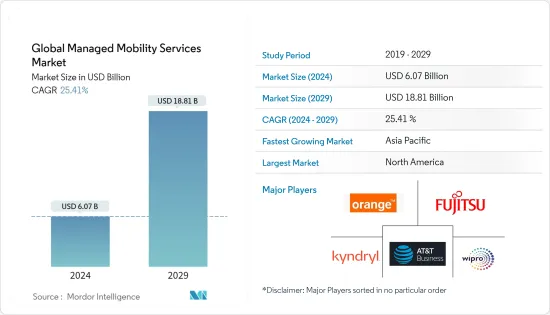

預計2024年全球行動化營運服務市場規模為60.7億美元,預計2029年將達到188.1億美元,在預測期內(2024-2029年)將成長至254.1億美元,年複合成長率為%。

主要亮點

- 行動化營運服務供應商提供的解決方案透過利用專用行動應用程式的解釋內容來處理管理不同裝置平台的複雜性,從而減輕企業 IT 部門的負擔。因此,行動化營運服務透過將行動上班族上班族連接到管理、伺服器和資料庫,可以輕鬆地與他們進行通訊。因此,公司可以克服僅使用 PC 進行商業電子郵件、資料庫和其他公司內容的傳統通訊。

- 此外,行動即服務解決方案透過提供單一合作夥伴來管理整個行動裝置生命週期,簡化了企業負責人複雜的行動裝置技術需求。因此,這些公司正在努力管理行動技術,以便他們的 IT 團隊可以節省資源和時間,並專注於幫助其業務轉型的策略計劃。

- 隨著成熟組織擴大轉向數位連接,至少 50% 的員工現在使用多個設備來執行需要集中管理的業務。因此,隨著新型營運商設備的興起並充斥職場,行動生態系統不斷擴大,對經驗豐富的彩信提供者處理跨組織通訊複雜性的需求也在成長。

- 在全球範圍內,醫生、護士、患者和其他支援人員對行動裝置的使用正在增加。此外,醫療保健最終用戶行業的組織必須遵守有關資料共用和儲存的 HIPAA 法規。預計這些因素將推動醫療保健產業採用行動化營運服務。

- 客戶在投資第三方行動化營運服務時不斷面臨成本可見性挑戰。有些供應商缺乏估計總成本、容量和資源的專業知識,需要增加各個參數來手動得出估計費用。這些挑戰為市場帶來了進一步的弊端。

- 整體而言,COVID-19 疾病對全球行動化營運服務市場的影響好壞參半。雖然由於向遠距工作的轉變,疫情增加了對彩信服務的需求,但它也造成了供應鏈中斷和經濟不確定性,在某些情況下導致投資減少。然而,疫情也加速了全球彩信市場的技術進步,帶來了新的創新解決方案。隨著公司尋求提高效率和適應不斷變化的商業環境的方法,彩信服務市場預計將長期成長。

行動化營運服務市場趨勢

IT 和通訊終端用戶產業佔據重要市場佔有率

- IT 和通訊產業是託管服務的重要市場。由於各種技術的高採用率,企業行動化趨勢多年來已經出現。目前,公司主要專注於商務策略和核心能力,這推動了 BYOD(自帶設備)的使用和採用。這可能會增加對簡化行動服務的需求,並增加對這些行動裝置管理的需求。

- 此外,中國、印度和巴西等新興國家不斷成長的行動用戶群正在推動 BYOD 政策的採用,從而提高業務效率和營運彈性。根據思科的報告,採用 BYOD 政策的公司每年為每位員工平均節省 350 美元。此外,反應式計畫每年可為每位員工節省 1,300 美元。

- 由於政府法規和 COVID-19感染疾病導致的封鎖措施,全球對託管雲端服務的需求不斷增加,進一步擴大了行動化營運服務並迫使企業轉向遠端工作模式。這促使企業採用雲端。使用基本解決方案擴展您的需求。

- 州、地方政府和監管機構規定的網路安全合規性要求也增加了對以安全為重點的託管行動應用服務的需求。此外,隨著用於計算目的的本地專用硬體的減少以及大多數功能變得雲端基礎,隱私和安全問題變得更加嚴重。

- 在管理行動化營運服務中採用物聯網解決方案,連接硬體設備、內建軟體和通訊服務,以提供智慧通訊環境、智慧交通、智慧家庭和智慧醫療保健,預計將在預測期內推動市場發展。

北美在預測期內將維持主要佔有率

- 根據思科年度網路報告,到年終,全球人均設備和連線數量預計將增加3.6個。到 2023 年,在人均設備和連接數量最高的國家中,美國是:平均每人擁有 13.6 台設備和連接的國家預計將繼續位居榜首,其次是韓國和日本。

- 此外,5G在國內的普及也將推動未來物聯網設備的需求。 AT&T、Sprint、T mobile 和 Verizon 等國內行動通訊業者對 5G 部署的關注多年來帶來了重大發展。根據GSMA預計,5G預計在2023年初將達到1億行動連線,到2025年5G連接將超過1.9億,使其成為全國領先的行動網路技術。

- 雲端和數位轉型正在增加資料外洩的總成本。行動平台的使用、廣泛的雲端遷移和物聯網設備正在推高成本。根據 Ponemon Institute 的資料外洩成本研究,全球平均資料外洩損失為 383 萬美元。然而,美國資料外洩的平均成本要高得多,達到 864 萬美元。隨著企業更加關注IT安全,資料外洩的高機率預計將推動託管行動服務市場的發展。

- 由於COVID-19感染疾病造成的工作文化,加拿大行動化營運服務市場進一步增加了投資。例如,2021 年 9 月,MSP Corp Investments Inc. 籌集了 3,500 萬美元的成長資本,用於收購和投資加拿大各地的託管 IT服務供應商(MSP)。主要財務支持者包括 CIBC 和 BDC Capital 的 Growth Equity Partners-Fund II。該公司與全國最好的 MSP 合作並收購,為 MSP 團隊提供技術、資源和業務支援。該公司的主要關注領域包括託管網路服務、行動管理、網路安全和雲端託管。

- 工業 4.0舉措在全球範圍內帶來的數位化趨勢也將推動對工業物聯網的需求。例如,2021 年 5 月,總部位於多倫多的新興企業BehrTech 因其 2020 年物聯網無線連接產品而獲得獎勵。該公司還從聯邦和非營利組織聯合資助計劃中獲得了 300 萬美元的津貼,用於建造工業 4.0 實驗室。

行動化營運服務產業概述

行動化營運服務市場較為分散,主要參與者包括 AT&T Intellectual Property、Fujitsu、Kyndryl Inc.、Wipro 和 Orange SA。市場參與者正在採取合作夥伴關係、協議、創新和收購等策略來增強其服務產品並獲得永續的競爭優勢。

- 2023 年 2 月:Kyndryland 諾基亞擴大全球網路與邊緣運算聯盟。這項為期三年的協議擴展了我們的合作計劃,並加速靈活、可靠和安全的 LTE 和 5G 專用無線連接服務以及工業 4.0 解決方案的部署。此外,Kyndryl 還獲得了最高級別的諾基亞數位自動化雲端 (DAC) 認證地位,是諾基亞的一項策略投資,透過增加其專用資源和熟練的專業人員,隨時為全球客戶提供支援。 Kyndryland 諾基亞在北卡羅來納州羅利開設了合作夥伴創新實驗室。該實驗室將先進的無線連接和邊緣運算與多因素零信任模型相整合,以統一企業的 IT 和 OT。

- 2023 年 3 月:Wipro 正式推出「5G Def-I」平台。這個整合平台使行動市場的公司能夠無縫改造其基礎設施、網路和服務,並在巴塞隆納世界行動通訊大會的專題研討會中首次亮相,以實現連網型企業的目標。 Wipro 的 5G Def-iplatform 基於開放標準構建,提供企業加載現有基礎設施、開發新應用和服務以及響應技術變革所需的雲端原生環境和網路 API,並提供第三方整合。此整合套件將雲端擴充性與 5G 速度和容量相結合。它還包括一個智慧層,用於創建可操作的業務見解。它還包括端點設備的可見性和資料洞察、網路營運商更快的服務實施以及新企業應用程式的更快部署。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代產品的威脅

- 評估 COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 多個產業的 BYOD 採用率增加

- 外包 IT業務的公司

- 市場限制因素

- 缺乏營運控制和成本可見性

第6章市場區隔

- 按功能分類

- 行動裝置管理

- 行動應用程式管理

- 行動安全

- 其他特性

- 按配置

- 雲

- 本地

- 按最終用戶產業

- 資訊科技和電信

- BFSI

- 衛生保健

- 製造業

- 零售

- 教育

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- AT&T Intellectual Property

- Fujitsu

- Kyndryl Inc.

- Wipro

- Orange SA

- Telefonica SA

- Samsung Electronics Co. Ltd

- Hewlett Packard Enterprise

- Vodafone Group PLC

- Microsoft Corporation

- Tech Mahindra

第8章投資分析

第9章市場的未來

The Global Managed Mobility Services Market size is estimated at USD 6.07 billion in 2024, and is expected to reach USD 18.81 billion by 2029, growing at a CAGR of 25.41% during the forecast period (2024-2029).

Key Highlights

- The managed mobility service providers offer solutions that ease the burden on enterprise IT departments by dealing with complex managing of various device platforms, with the help of interpreted content for specialized mobile applications. Therefore, managed mobility services enable easy communication with mobile office workers by connecting them with management, servers, and databases. Thus, it allows enterprises to overcome the traditional communications that involve PC only for business emails, databases, and other corporate content.

- Furthermore, mobility as a service solution simplifies corporate personnel's complex mobile device technology needs by offering a single partner to manage the whole mobile device lifecycle. Thus, these companies take the hassle of managing mobile technology so that IT teams can save resources and time to focus on the strategic initiatives that are helping them to transform their businesses.

- The growing shift of mature organizations toward digital connectivity drives at least 50% of employees to use more than one device for work that demands centralized management. Thus, the rise of new types of carrier devices continues to flood workplaces and expand the mobility ecosystem, driving the need for experienced MMS providers to handle the complexity of communication across organizations.

- The use of mobile devices among doctors, nurses, patients, and other supporting staff has increased worldwide. Moreover, organizations in the healthcare end-user industry must adhere to HIPAA regulations for data sharing and storage. These factors are expected to drive the adoption of managed mobility services in the healthcare industry.

- Customers are still witnessing challenges for cost visibility as they invest in the third-party managed mobility service. Some vendors lack the expertise to estimate the total costs or the capacity or resources in order to add individual parameters to arrive at an estimated cost manually. Such challenges add a drawback to the market.

- Overall, the impact of COVID-19 on the global managed mobility services market has been mixed. While the pandemic has increased demand for MMS services due to the shift toward remote work, it has also caused disruptions to supply chains and economic uncertainties, leading to a decrease in investment in some cases. However, the pandemic has also accelerated technological advancements in the global MMS market, leading to new and innovative solutions. The market for MMS services is expected to grow in the long term as companies look for ways to increase efficiency and adapt to changing business environments.

Managed Mobility Services Market Trends

IT and Telecom End-user Industry Segment Holds Significant Market Share

- The IT and telecom sector is a significant market for managed services. Due to the high rate of various technological adoptions, the enterprise mobility trend has emerged over the years. Today, companies primarily focus on business strategies and core competencies, fueling the utilization and adoption of bring-your-own-device (BYOD). This increases the requirement for streamlined mobility services, likely to boost the demand for managing these mobile devices.

- Furthermore, the growing mobile subscriber base in emerging countries, such as China, India, and Brazil, has been propelling the adoption of BYOD policies, enhancing work efficiency and flexibility in operations. According to a Cisco report, enterprises with a BYOD policy save, on average, USD 350 per year per employee. Moreover, reactive programs can boost these savings to USD 1,300 per year per employee.

- The demand for managed cloud services has increased across the globe due to government regulations and lockdown measures due to the COVID-19 pandemic, further boosting the managed mobility services and forcing businesses to move towards remote working modes, which has led companies to adopt cloud-based solutions to expand their requirements.

- Cybersecurity compliance requirements mandated by the state and local governments and regulatory bodies also drive the need for managed mobility application services to be security-focused. Additionally, as dedicated, on-premise hardware for computing purposes will decrease, and most of the functionality will become cloud-based, privacy and security issues will become more intense.

- Adopting IoT solutions in managed mobility services, which connect hardware devices, embedded software, and communication services, offers smart communication environments, smart transportation, smart homes, and smart healthcare and is expected to drive the market during the forecast period.

North America to Hold Major Share over the Forecast Period

- According to the annual internet report by Cisco, the average number of devices and connections per capita worldwide is anticipated to increase to 3.6 by the end of the year 2023. Among the countries with the highest average per capita devices and connections by 2023, the United States is expected to remain at the top with an average of 13.6 devices and connections per capita, followed by South Korea and Japan.

- Moreover, the 5G penetration in the country also encourages the demand for IoT devices in the future. The focus on deploying 5G by national mobile operators, like AT&T, Sprint, T mobile, and Verizon, has led to significant developments over the years. According to the GSMA, 5G will reach 100 million mobile connections in early 2023 and become the country's leading mobile network technology by 2025, with more than 190 million 5G connections.

- Cloud and digital transformation have increased the total cost of a data breach. The use of mobile platforms, extensive cloud migration, and IoT devices are the drivers increasing the cost. According to the Ponemon Institute's "Cost of Data Breach Study," the global average for a data breach was USD 3.83 million. However, the average data breach cost in the United States was significantly high at USD 8.64 million. The high potential of data breaches is expected to drive the managed mobile services market as enterprises focus more on IT security.

- The Canadian managed mobility services market is witnessing increased investments further driven by the COVID-19 pandemic-induced work culture. For instance, in September 2021, MSP Corp Investments Inc. raised USD 35 million in growth capital to acquire and invest in managed IT services providers (MSPs) across Canada. Major financial backers include CIBC and BDC Capital's Growth Equity Partners - Fund II. The company partners and acquires high-performing MSPs in the country to deliver technology, resources, and business support to empower MSP teams. Key areas of focus of the company include managed network services, mobility management, cybersecurity, and cloud hosting.

- The digital trends brought globally by the Industry 4.0 initiatives also drive the need for industrial IoT. For instance, in May 2021, Toronto-based BehrTech, a startup, was awarded for its wireless connectivity products for the IoT that the company developed in 2020, and the company also received a USD 3 million grant from a joint funding program between the federal government and a non-profit organization to build an Industry 4.0 lab.

Managed Mobility Services Industry Overview

The managed mobility services market is fragmented, with the presence of major players like AT&T Intellectual Property, Fujitsu, Kyndryl Inc., Wipro, and Orange SA. Players in the market are adopting strategies such as partnerships, agreements, innovations, and acquisitions to enhance their service offerings and gain sustainable competitive advantage.

- February 2023: Kyndryland Nokia expanded its global network and edge computing alliance. The three-year agreement extends plans to collaborate on and accelerate the deployment of flexible, dependable, and secure LTE and 5G private wireless connectivity services, as well as Industry 4.0 solutions. Furthermore, Kyndryl increases its strategic investment in Nokia by achieving the highest tier Nokia Digital Automation Cloud (DAC) accreditation status, increasing expert resources and skilled practitioners ready to support customers worldwide. Kyndryland Nokia opened a partner innovation lab in Raleigh, North Carolina. The lab will integrate advanced wireless connectivity and edge computing with a multi-factor zero trust model, converging IT and OT for enterprises.

- March 2023: Wipro officially launched its "5G Def-I" platform. The integrated platform, which enables businesses in the mobility market to transform their infrastructure, networks, and services seamlessly, debuted at the MWC Barcelona panel, realizing the connected enterprise's goals. Wipro's 5G Def-iplatform, built on open standards, offers the cloud-native environment, network APIs, and third-party integrations required for businesses to onboard existing infrastructure, incubate new apps and services, and keep up with technological changes. The integrated suite combines cloud scalability with 5G speed and capacity. It also includes an intelligence layer for creating actionable business insights. It also includes visibility into endpoint devices and data insights, faster service implementation for network operators, and rapid deployment of new enterprise applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of BYOD in Multiple Industries

- 5.1.2 Companies Outsourcing IT Activities

- 5.2 Market Restraints

- 5.2.1 Lack of Control over Operations and Cost Visibility

6 MARKET SEGMENTATION

- 6.1 By Function

- 6.1.1 Mobile Device Management

- 6.1.2 Mobile Application Management

- 6.1.3 Mobile Security

- 6.1.4 Other Functions

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End-user Industry

- 6.3.1 IT and Telecom

- 6.3.2 BFSI

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Retail

- 6.3.6 Education

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T Intellectual Property

- 7.1.2 Fujitsu

- 7.1.3 Kyndryl Inc.

- 7.1.4 Wipro

- 7.1.5 Orange SA

- 7.1.6 Telefonica SA

- 7.1.7 Samsung Electronics Co. Ltd

- 7.1.8 Hewlett Packard Enterprise

- 7.1.9 Vodafone Group PLC

- 7.1.10 Microsoft Corporation

- 7.1.11 Tech Mahindra